seven-up bottling q1 march 2015

advertisement

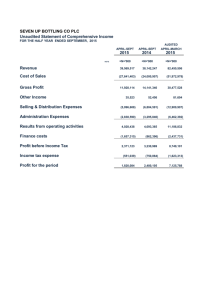

SEVEN UP BOTTLING CO PLC Statement of Comprehensive Income FOR THE FIRST QUATER ENDED 30TH JUNE, 2015 AUDITED NOTE Revenue Cost of Sales Gross Profit Other Income APRIL-JUNE APRIL-JUNE APRIL-MARCH 2015 2014 2015 =N='000 =N='000 =N='000 23,148,054 21,032,956 82,450,506 (15,395,904) (13,400,738) (51,972,978) 7,752,150 7,632,218 30,477,528 13,429 24,610 81,604 Selling & Distribution Expenses (3,205,005) (3,099,449) (12,909,907) Administration Expenses (1,352,835) (1,381,167) (6,462,392) 3,207,739 3,176,212 11,186,832 Results from operating activities Finance costs Profit before Income Tax Income tax expense Profit for the period 1 (759,815) 2,447,924 (489,585) 1,958,339 (471,159) 2,705,052 (541,010) 2,164,042 (2,437,731) 8,749,101 (1,623,313) 7,125,788 SEVEN UP BOTTLING CO PLC STATEMENT OF FINANCIAL POSITION AS AT JUNE, 2015 2015 JUNE ASSETS Non-current At Cost Less: Accumulated Depreciation Property, plant and equipment NOTE INTANGIBLE ASSET At cost Less: Accumulated Depreciation Intangible asset Prepayment Other receivable Non-current asset 2014 JUNE AUDITED 2015 MARCH =N='000 88,165,058 (43,939,946) 44,225,112 =N='000 76,990,340 (36,865,056) 40,125,284 =N='000 86,217,682 (41,777,007) 44,440,675 115,387 (87,431) 27,956 154,784 102,927 107,254 (65,996) 41,257 165,371 131,882 115,129 (87,431) 27,698 58,535 175,663 44,510,779 40,463,795 44,702,571 14,113,936 5,267,930 440,227 3,186,381 10,026,962 2,295,285 370,578 2,296,317 9,568,469 4,421,832 471,195 8,522,772 23,008,475 14,989,142 22,984,268 67,519,254 55,452,937 67,686,839 320,295 299,140 320,295 299,140 320,295 299,140 Retained earnings 25,272,537 18,873,302 23,314,198 Total equity 25,891,972 19,492,737 23,933,633 4,383,469 3,559,173 3,226,788 4,633,484 4,742,522 2,472,898 4,433,469 3,669,295 3,226,789 11,169,430 11,848,903 11,329,553 3,690,637 11,824,279 13,113,544 1,829,390 313,250 8,473,914 13,393,188 1,930,944 4,619,707 11,032,831 15,431,310 1,339,805 Current liabilities 30,457,851 24,111,297 32,423,653 Total Liabilities 41,627,281 35,960,200 43,753,206 Total equity and liabilities 67,519,254 55,452,937 67,686,839 Inventories Trade and other receivables Prepayment Cash and cash equivalent 2 3 4 1 Total Asset EQUITY Share Capital Share Premium Reserves Dividend/SHARE INCREASE LIABILITIES Loans & borrowings Employee benefits Deferred Taxation Non-current liabilities Banks Overdraft Loans & borrowings Trade Creditors and other payables Taxation FAYSAL EL-KHALIL SUNIL SAWHNEY 6 5 SEVEN-UP BOTTLING COMPANY PLC UNAUDITED STATEMENT OF CASH FLOW FOR THE QUARTER ENDED JUNE, 2015 AUDITED Note 2015 JUNE 2014 JUNE 2015 March N'000 N'000 N'000 CASH FLOWS FROM OPERATING ACTIVITIES Profit/(Loss) 1,958,339 2,164,042 7,125,788 489,585 541,010 1,623,313 759,815 471,159 1,961,624 2,162,939 2,033,617 8,520,745 0 6,704 28,139 (39,927) Adjustments for: Income tax expense Finance income Finance cost (22,151) Loss on Forex Depreciation Amortisation of intangible assets (Gain)/Loss on disposals of PPE - - Assets written off - - Employee benefit charge - - 5,370,679 Change in inventories Change in trade and other receivables Change in long term prepayment (4,545,467) 539,513 (23,513) 4,246 (1,860,029) Cash generated from operating activities (1,873,461) Income tax paid Employee benefit paid Net cash flow from operation activities (566,593) (815,130) Change in trade and other payables VAT paid 5,216,532 (568,116) - (4,931) 5,188,768 19,835,583 (372,684) (27,469) 1,862,037 21,297,467 (110,646) (1,485,992) (598,650) (2,210,619) - (2,441,577) 638,052 (209,760) 4,479,471 17,391,096 6,751 4,357 22,151 - - CASH FLOWS FROM INVESTING ACTIVITIES Finance income Proceeds from sale of PPE Acquisition of PPE Acquisition of intangible assets Net cash used in investing activities (1,947,377) - (4,246,867) - (1,940,626) 83,007 (14,461,016) (7,876) (4,242,510) (14,363,734) (475,516) (1,786,572) CASH FLOW FROMS FINANCING ACTIVITIES Interest expense Increase in borrowings Dividend paid Net cash from(used in) financing activities Net increase/ (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year (766,566) 741,448 - (1,359,408) - 594,334 (1,513,088) (25,118) (1,834,924) (4,407,321) (1,597,962) 3,903,065 3,581,029 3,581,029 1,983,067 3,903,065 3,186,381 1,821,141 1,820,726 0 475,176 6,702,046 (313,250) (4,619,707) (504,256) (2,705,326) 322,036 CASH AND CASH EQUIVALENTS ARE ANALYSED INTO: Deposit for imports Cash at bank & in hand Deposit for imports Bank overdrafts (3,690,637) (504,256) 1,983,067 3,903,065 SEVEN-UP BOTTLING COMPANY PLC Notes to the Accounts NOTES UNAUDITED UNAUDITED AUDITED 2015 JUNE 2014 JUNE 2015 MARCH N`000 N`000 658,252 108,248 66 (6,751) 759,815 442,955 32,562 0 (4,357) 471,159 1,662,491 299,133 498,258 (22,151) 2,437,731 4,084,058 183,174 578,509 2,115,117 3,066,104 10,026,962 4,361,887 179,240 813,377 2,094,613 2,119,352 9,568,469 604,989 955,925 87,021 350,420 292,703 2,291,058 502,625 3,037,998 503,620 120,262 257,327 4,421,832 440,227 440,227 370,578 370,578 471,195 471,195 3,737,663 277,531 2,791,446 710,363 5,596,541 13,113,544 3,833,667 318,988 3,643,618 526,659 5,070,256 13,393,188 6,032,530 2,340,515 1,053,597 597,196 5,407,472 15,431,310 11,824,279 11,824,279 8,473,914 8,473,914 11,032,831 11,032,831 NET FINANCE COST INTEREST ON LOANS INTEREST ON OVERDRAFTS FOFEX LOSS FINANCE INCOME INVENTORIES Raw Materials, consumables and non-returnable packaging materials3,903,131 Product in process 379,505 Finished Goods 899,833 Spare Parts 2,025,219 Goods in Transit 6,906,249 14,113,936 Trade debtors and other receivables Trade receivables Advance payment to suppliers-related parties Staff loans and advances Other receivables Amount Due from Registrar Prepayment Current: Short term portion of prepaid rent Trade creditors and other payables Trade payables Amount payable to related parties Other Creditors and accrual Dividend payable Liability for returnable packaging material LOANS AND BORROWINGS Current. Short Term Loan 413,792 3,969,374 556,186 71,251 257,327 5,267,930 0