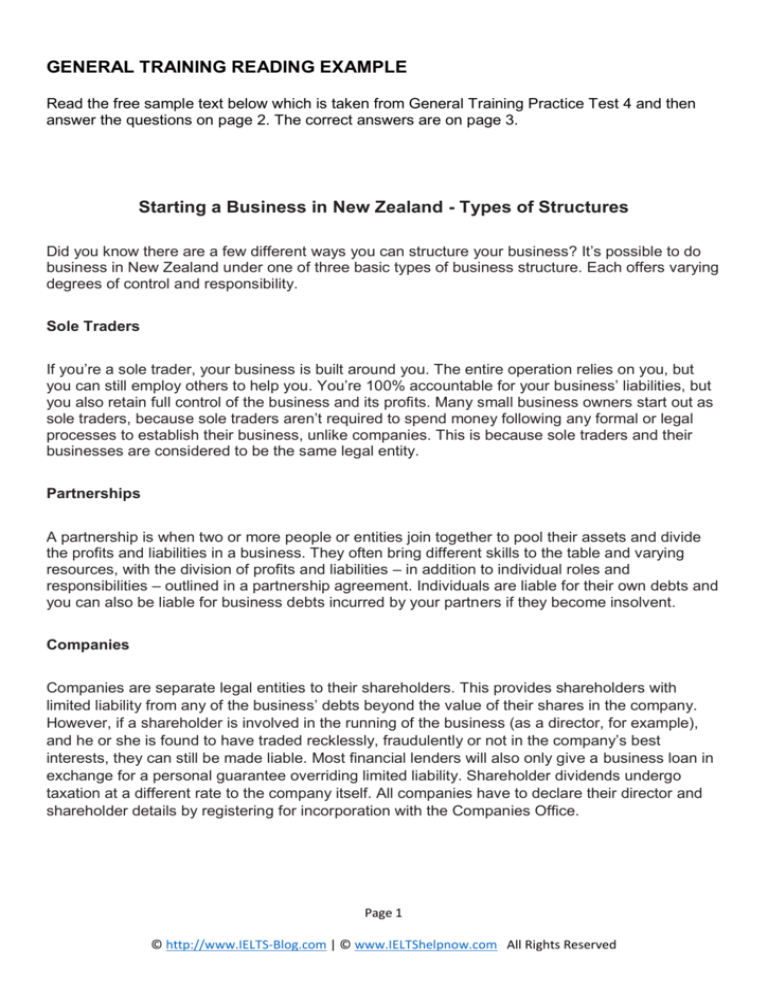

GENERAL TRAINING READING EXAMPLE

Read the free sample text below which is taken from General Training Practice Test 4 and then

answer the questions on page 2. The correct answers are on page 3.

Starting a Business in New Zealand - Types of Structures

Did you know there are a few different ways you can structure your business? It’s possible to do

business in New Zealand under one of three basic types of business structure. Each offers varying

degrees of control and responsibility.

Sole Traders

If you’re a sole trader, your business is built around you. The entire operation relies on you, but

you can still employ others to help you. You’re 100% accountable for your business’ liabilities, but

you also retain full control of the business and its profits. Many small business owners start out as

sole traders, because sole traders aren’t required to spend money following any formal or legal

processes to establish their business, unlike companies. This is because sole traders and their

businesses are considered to be the same legal entity.

Partnerships

A partnership is when two or more people or entities join together to pool their assets and divide

the profits and liabilities in a business. They often bring different skills to the table and varying

resources, with the division of profits and liabilities – in addition to individual roles and

responsibilities – outlined in a partnership agreement. Individuals are liable for their own debts and

you can also be liable for business debts incurred by your partners if they become insolvent.

Companies

Companies are separate legal entities to their shareholders. This provides shareholders with

limited liability from any of the business’ debts beyond the value of their shares in the company.

However, if a shareholder is involved in the running of the business (as a director, for example),

and he or she is found to have traded recklessly, fraudulently or not in the company’s best

interests, they can still be made liable. Most financial lenders will also only give a business loan in

exchange for a personal guarantee overriding limited liability. Shareholder dividends undergo

taxation at a different rate to the company itself. All companies have to declare their director and

shareholder details by registering for incorporation with the Companies Office.

Page 1

© http://www.IELTS-Blog.com | © www.IELTShelpnow.com All Rights Reserved

Questions 21 – 27

Do the following statements agree with the information given in the text?

In boxes 21 – 27 on your answer sheet write:

TRUE

if the statement agrees with the information

FALSE

if the statement contradicts the information

NOT GIVEN

if there is no information on this

21

All company expenses can only be paid at the end of every three months.

22

Employees can claim for food when staying at a hotel on company business.

23

Employees can only claim for using their car when the company cars are not available.

24

Employees cannot claim back any money on their personal cell phone contract, even

when they use it for company purposes.

25

Employees can claim some money back on their own home Internet connection if they

use it sometimes for work purposes.

26

Employees cannot claim taxi expenses for their customers when entertaining.

27

No expenses can be paid without production of the relevant receipt.

Page 2

© http://www.IELTS-Blog.com | © www.IELTShelpnow.com All Rights Reserved

ANSWERS

21.

FALSE

22.

TRUE

23.

NOT GIVEN

24.

TRUE

25.

TRUE

26.

NOT GIVEN

27.

FALSE

Need more practice? Visit the websites below for more IELTS practice tests, complete with

audio and answers:

http://www.IELTS-Blog.com

http://www.ieltshelpnow.com

Page 3

© http://www.IELTS-Blog.com | © www.IELTShelpnow.com All Rights Reserved