Money Management Strategies

advertisement

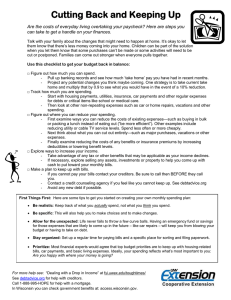

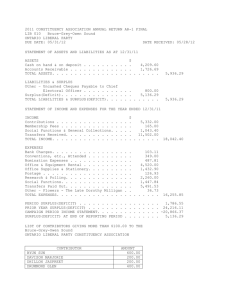

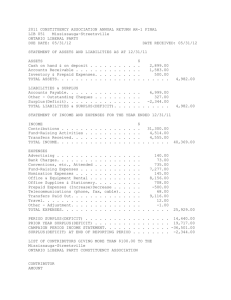

Money Management Strategies CHAPTER 5 Organizing Financial Records CHAPTER 5 SECTION 1 What financial documents should you keep and organize? What are some ways to organize these documents? Money Management • Day-to-day financial activities necessary to get the most from your money. • Money trade-offs Financial Documents • First step in effective money management is to organize your financial documents. • Benefits: o o o o o Financial status Pay your bills on time Tax reports Future planning Investing decisions Storing Financial Documents 1. Locate your documents and sort them into categories such as payroll stubs, savings account, checking account, bills, etc. 2. Label and file each document 3. Maintain filing discipline Safe-Deposit Box • A small, secure storage compartment that you can rent at a bank. #1 Personal Financial Statements CHAPTER 5 SECTION 2 Personal Balance Sheet • Allows you to have a complete look at your financial situation. • Step 1: Determine Assets • Step 2: Determine Liabilities • Step 3: Calculate Net Worth • Step 4: Evaluate Financial Situation Pg. 127 in text Determine Assets • • • • Liquid Assets Real Estate Assets Personal Possessions Investment Assets Liquid Assets • Cash and items that can quickly be converted to cash. • $800 in a savings account and $72 in cash o Your liquid assets are worth $872 Determine Liabilities • Current (short term debt) - paid within one year • Long-term – Debts that require a longer term of repayment • Insolvency – the inability to pay debt when it’s due #2 Cash Flow CHAPTER 5 SECTION 2 Cash Flow Statement • Movement of cash in and out of your wallet and/or bank account. • Step 1: Record your income • Step 2: Record your expenses • Step 3: Calculate your net cash flow • Pg. 131 - chart The next slide lists several types of accounts. Categorize each account as belonging to the personal balance sheet or cash flow statement. 1. Take-home pay 2. Transportation 3. Checking Account Balance 4. Groceries 5. Credit Card Balance 6. Investment income 7. Student Loan Payment 8. Mortgage #3 Your Financial Position CHAPTER 5 SECTION 2 What is your net worth? • Deficit – spend more than you earn • Loans make up for deficit – increases liabilities • Surplus – spend less than you earn • Increases net worth • Invest – pay off debts – etc. #4 Preparing a Budget CHAPTER 5 SECTION 3 Budget • A plan for spending and investing your money to meet your wants and needs. • • • • • • Step 1: Set your financial goals Step 2: Estimate your income Step 3: Budget for unexpected expenses Step 4: Budget for fixed expenses Step 5: Budget for variable expenses Step 6: Record spending Budget Variance • The difference between the budget and the actual amount spent. Increasing Your Savings CHAPTER 5 SECTION 3 Increasing Your Savings • Essential component – open a savings account • PAY YOURSELF FIRST! • PAYROLL SAVINGS DEDUCTION • SPENDING LESS TO SAVE