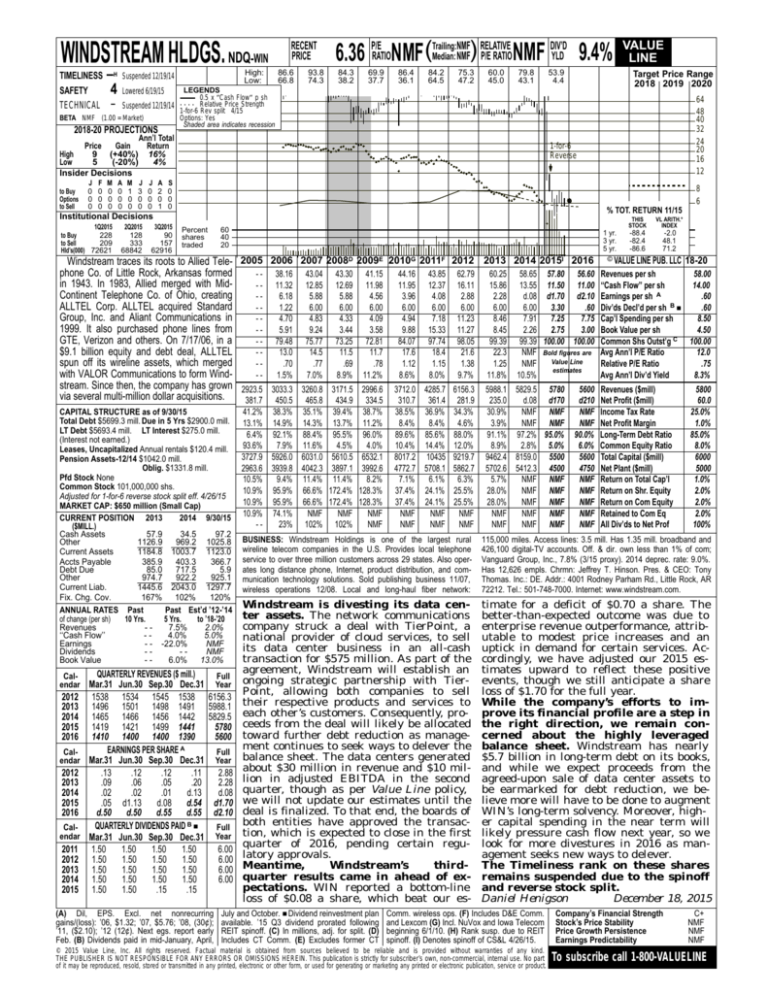

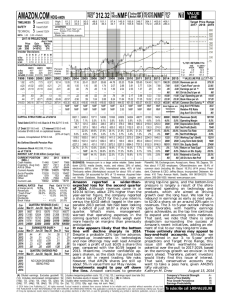

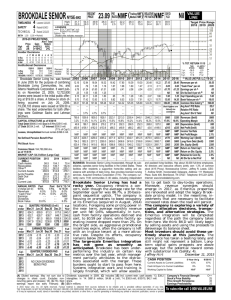

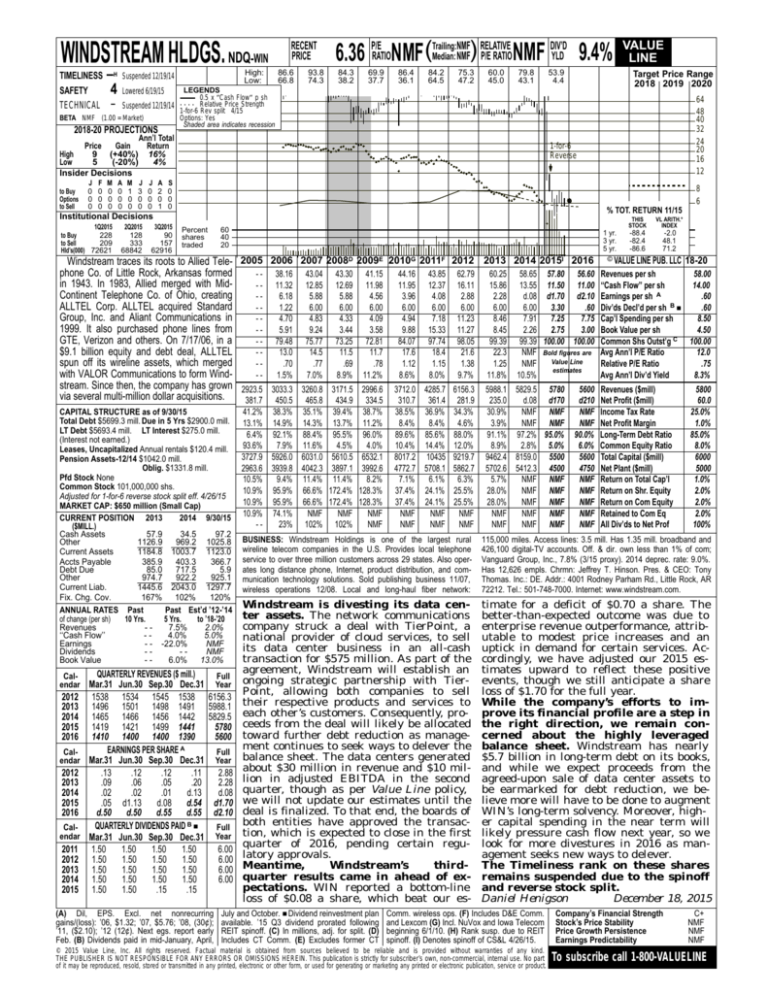

WINDSTREAM HLDGS. NDQ-WIN

TIMELINESS

SAFETY

TECHNICAL

–H

4

–

High:

Low:

Suspended 12/19/14

RECENT

PRICE

86.6

66.8

93.8

74.3

NMF RELATIVE

DIV’D

Median: NMF) P/E RATIO NMF YLD 9.4%

6.36 P/ERATIONMF(Trailing:

84.3

38.2

69.9

37.7

86.4

36.1

84.2

64.5

75.3

47.2

60.0

45.0

79.8

43.1

LEGENDS

0.5 x ″Cash Flow″ p sh

Suspended 12/19/14 . . . . Relative Price Strength

1-for-6 Rev split 4/15

BETA NMF (1.00 = Market)

Options: Yes

Shaded area indicates recession

53.9

4.4

VALUE

LINE

Target Price Range

2018 2019 2020

Lowered 6/19/15

I

64

48

40

32

24

20

16

12

2018-20 PROJECTIONS

Ann’l Total

Price

Gain

Return

High

9 (+40%) 16%

Low

5

(-20%)

4%

Insider Decisions

to Buy

Options

to Sell

J

0

0

0

F

0

0

0

M

0

0

0

A

0

0

0

M

1

0

0

J

3

0

0

J

0

0

0

A

2

0

1

1-for-6

Reverse

S

0

0

0

8

6

% TOT. RETURN 11/15

Institutional Decisions

1Q2015

228

to Buy

to Sell

209

Hld’s(000) 72621

2Q2015

128

333

68842

3Q2015

90

157

62916

Percent

shares

traded

60

40

20

1 yr.

3 yr.

5 yr.

Windstream traces its roots to Allied Tele- 2005 2006 2007 2008D 2009E 2010G 2011F 2012 2013 2014 2015I 2016

phone Co. of Little Rock, Arkansas formed

- - 38.16 43.04 43.30 41.15

44.16 43.85 62.79

60.25 58.65 57.80 56.60

in 1943. In 1983, Allied merged with Mid- - 11.32 12.85 12.69 11.98

11.95 12.37 16.11

15.86 13.55 11.50 11.00

Continent Telephone Co. of Ohio, creating

-6.18

5.88

5.88

4.56

3.96

4.08

2.88

2.28

d.08 d1.70 d2.10

ALLTEL Corp. ALLTEL acquired Standard

-1.22

6.00

6.00

6.00

6.00

6.00

6.00

6.00

6.00

3.30

.60

Group, Inc. and Aliant Communications in

-4.70

4.83

4.33

4.09

4.94

7.18 11.23

8.46

7.91

7.25

7.75

1999. It also purchased phone lines from

-5.91

9.24

3.44

3.58

9.88 15.33 11.27

8.45

2.26

2.75

3.00

GTE, Verizon and others. On 7/17/06, in a

- - 79.48 75.77 73.25 72.81

84.07 97.74 98.05

99.39 99.39 100.00 100.00

$9.1 billion equity and debt deal, ALLTEL

-13.0

14.5

11.5

11.7

17.6

18.4

21.6

22.3

NMF Bold figures are

Value Line

spun off its wireline assets, which merged

-.70

.77

.69

.78

1.12

1.15

1.38

1.25

NMF

estimates

with VALOR Communications to form Wind-1.5%

7.0%

8.9% 11.2%

8.6%

8.0% 9.7% 11.8% 10.5%

stream. Since then, the company has grown 2923.5 3033.3 3260.8 3171.5 2996.6 3712.0 4285.7 6156.3 5988.1 5829.5 5780 5600

via several multi-million dollar acquisitions.

381.7 450.5 465.8 434.9 334.5

310.7 361.4 281.9

235.0

d.08 d170

d210

CAPITAL STRUCTURE as of 9/30/15

Total Debt $5699.3 mill. Due in 5 Yrs $2900.0 mill.

LT Debt $5693.4 mill. LT Interest $275.0 mill.

(Interest not earned.)

Leases, Uncapitalized Annual rentals $120.4 mill.

Pension Assets-12/14 $1042.0 mill.

Oblig. $1331.8 mill.

Pfd Stock None

Common Stock 101,000,000 shs.

Adjusted for 1-for-6 reverse stock split eff. 4/26/15

MARKET CAP: $650 million (Small Cap)

CURRENT POSITION 2013

2014 9/30/15

($MILL.)

Cash Assets

57.9

34.5

97.2

Other

1126.9

969.2 1025.8

Current Assets

1184.8 1003.7 1123.0

Accts Payable

385.9

403.3

366.7

Debt Due

85.0

717.5

5.9

Other

974.7

922.2

925.1

Current Liab.

1445.6 2043.0 1297.7

Fix. Chg. Cov.

167% 102%

120%

ANNUAL RATES Past

Past Est’d ’12-’14

of change (per sh)

10 Yrs.

5 Yrs.

to ’18-’20

Revenues

-7.5%

2.0%

‘‘Cash Flow’’

-4.0%

5.0%

Earnings

- - -22.0%

NMF

Dividends

--NMF

Book Value

-6.0% 13.0%

QUARTERLY REVENUES ($ mill.)

Mar.31 Jun.30 Sep.30 Dec.31

2012 1538 1534 1545 1538

2013 1496 1501 1498 1491

2014 1465 1466 1456 1442

2015 1419 1421 1499 1441

2016 1410 1400 1400 1390

EARNINGS PER SHARE A

Calendar Mar.31 Jun.30 Sep.30 Dec.31

2012

.13

.12

.12

.11

2013

.09

.06

.05

.20

2014

.02

.02

.01

d.13

2015

.05 d1.13

d.08 d.54

2016

d.50 d.50 d.55 d.55

QUARTERLY DIVIDENDS PAID B ■

Calendar Mar.31 Jun.30 Sep.30 Dec.31

2011 1.50

1.50

1.50

1.50

2012 1.50

1.50

1.50

1.50

2013 1.50

1.50

1.50

1.50

2014 1.50

1.50

1.50

1.50

2015 1.50

1.50

.15

.15

Calendar

Full

Year

6156.3

5988.1

5829.5

5780

5600

Full

Year

2.88

2.28

d.08

d1.70

d2.10

(A) Dil, EPS. Excl. net nonrecurring

gains/(loss): ’06, $1.32; ’07, $5.76; ’08, (30¢);

’11, ($2.10); ’12 (12¢). Next egs. report early

Feb. (B) Dividends paid in mid-January, April,

Full

Year

6.00

6.00

6.00

6.00

41.2% 38.3% 35.1% 39.4% 38.7%

13.1% 14.9% 14.3% 13.7% 11.2%

6.4% 92.1% 88.4% 95.5% 96.0%

93.6%

7.9% 11.6%

4.5%

4.0%

3727.9 5926.0 6031.0 5610.5 6532.1

2963.6 3939.8 4042.3 3897.1 3992.6

10.5%

9.4% 11.4% 11.4%

8.2%

10.9% 95.9% 66.6% 172.4% 128.3%

10.9% 95.9% 66.6% 172.4% 128.3%

10.9% 74.1%

NMF

NMF

NMF

-23% 102% 102%

NMF

38.5% 36.9% 34.3%

8.4%

8.4% 4.6%

89.6% 85.6% 88.0%

10.4% 14.4% 12.0%

8017.2 10435 9219.7

4772.7 5708.1 5862.7

7.1%

6.1% 6.3%

37.4% 24.1% 25.5%

37.4% 24.1% 25.5%

NMF

NMF NMF

NMF

NMF NMF

30.9%

NMF NMF

3.9%

NMF NMF

91.1% 97.2% 95.0%

8.9%

2.8% 5.0%

9462.4 8159.0 5500

5702.6 5412.3 4500

5.7%

NMF NMF

28.0%

NMF NMF

28.0%

NMF NMF

NMF

NMF NMF

NMF

NMF NMF

NMF

NMF

90.0%

6.0%

5600

4750

NMF

NMF

NMF

NMF

NMF

THIS

STOCK

VL ARITH.*

INDEX

-88.4

-82.4

-86.6

-2.0

48.1

71.2

© VALUE LINE PUB. LLC

18-20

Revenues per sh

‘‘Cash Flow’’ per sh

Earnings per sh A

Div’ds Decl’d per sh B ■

Cap’l Spending per sh

Book Value per sh

Common Shs Outst’g C

Avg Ann’l P/E Ratio

Relative P/E Ratio

Avg Ann’l Div’d Yield

58.00

14.00

.60

.60

8.50

4.50

100.00

12.0

.75

8.3%

Revenues ($mill)

Net Profit ($mill)

Income Tax Rate

Net Profit Margin

Long-Term Debt Ratio

Common Equity Ratio

Total Capital ($mill)

Net Plant ($mill)

Return on Total Cap’l

Return on Shr. Equity

Return on Com Equity

Retained to Com Eq

All Div’ds to Net Prof

5800

60.0

25.0%

1.0%

85.0%

8.0%

6000

5000

1.0%

2.0%

2.0%

2.0%

100%

BUSINESS: Windstream Holdings is one of the largest rural

wireline telecom companies in the U.S. Provides local telephone

service to over three million customers across 29 states. Also operates long distance phone, Internet, product distribution, and communication technology solutions. Sold publishing business 11/07,

wireless operations 12/08. Local and long-haul fiber network:

115,000 miles. Access lines: 3.5 mill. Has 1.35 mill. broadband and

426,100 digital-TV accounts. Off. & dir. own less than 1% of com;

Vanguard Group, Inc., 7.8% (3/15 proxy). 2014 deprec. rate: 9.0%.

Has 12,626 empls. Chrmn: Jeffrey T. Hinson. Pres. & CEO: Tony

Thomas. Inc.: DE. Addr.: 4001 Rodney Parham Rd., Little Rock, AR

72212. Tel.: 501-748-7000. Internet: www.windstream.com.

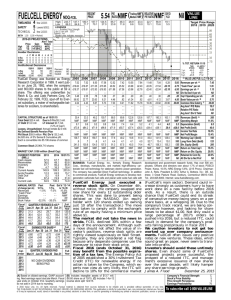

Windstream is divesting its data center assets. The network communications

company struck a deal with TierPoint, a

national provider of cloud services, to sell

its data center business in an all-cash

transaction for $575 million. As part of the

agreement, Windstream will establish an

ongoing strategic partnership with TierPoint, allowing both companies to sell

their respective products and services to

each other’s customers. Consequently, proceeds from the deal will likely be allocated

toward further debt reduction as management continues to seek ways to delever the

balance sheet. The data centers generated

about $30 million in revenue and $10 million in adjusted EBITDA in the second

quarter, though as per Value Line policy,

we will not update our estimates until the

deal is finalized. To that end, the boards of

both entities have approved the transaction, which is expected to close in the first

quarter of 2016, pending certain regulatory approvals.

Meantime,

Windstream’s

thirdquarter results came in ahead of expectations. WIN reported a bottom-line

loss of $0.08 a share, which beat our es-

timate for a deficit of $0.70 a share. The

better-than-expected outcome was due to

enterprise revenue outperformance, attributable to modest price increases and an

uptick in demand for certain services. Accordingly, we have adjusted our 2015 estimates upward to reflect these positive

events, though we still anticipate a share

loss of $1.70 for the full year.

While the company’s efforts to improve its financial profile are a step in

the right direction, we remain concerned about the highly leveraged

balance sheet. Windstream has nearly

$5.7 billion in long-term debt on its books,

and while we expect proceeds from the

agreed-upon sale of data center assets to

be earmarked for debt reduction, we believe more will have to be done to augment

WIN’s long-term solvency. Moreover, higher capital spending in the near term will

likely pressure cash flow next year, so we

look for more divestures in 2016 as management seeks new ways to delever.

The Timeliness rank on these shares

remains suspended due to the spinoff

and reverse stock split.

Daniel Henigson

December 18, 2015

July and October. ■ Dividend reinvestment plan

available. ’15 Q3 dividend prorated following

REIT spinoff. (C) In millions, adj. for split. (D)

Includes CT Comm. (E) Excludes former CT

Comm. wireless ops. (F) Includes D&E Comm.

and Lexcom (G) Incl. NuVox and Iowa Telecom

beginning 6/1/10. (H) Rank susp. due to REIT

spinoff. (I) Denotes spinoff of CS&L 4/26/15.

© 2015 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

Company’s Financial Strength

Stock’s Price Stability

Price Growth Persistence

Earnings Predictability

C+

NMF

NMF

NMF

To subscribe call 1-800-VALUELINE