CIMB-Principal Balanced Fund

advertisement

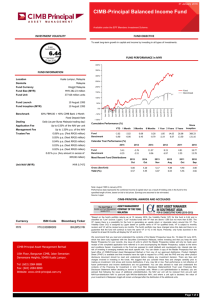

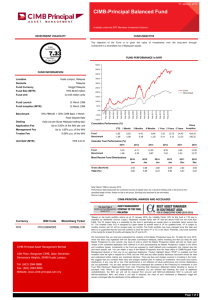

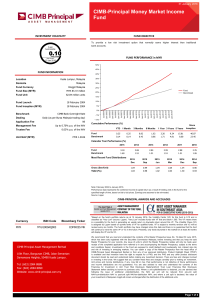

31 August 2015 CIMB-Principal Balanced Fund A S S E T MA N A GE ME N T Available under the EPF Members Investment Scheme. INVESTMENT VOLATILITY FUND OBJECTIVE The objective of the Fund is to grow the value of investments over the long -term through investment in a diversified mix of Malaysian assets. 3-year Fund Volatlity 6.63 Moderate FUND PERFORMANCE in MYR Lipper Analytcs 15 Aug 2015 500% 450% FUND INFORMATION 400% Location Kuala Lumpur, Malaysia 350% Domicile Malaysia 300% Ringgit Malaysia 250% Dealing Application Fee Management Fee Daily (as per Bursa Malaysia trading day) Up to 5.00% of the NAV per unit 0.08% p.a. of the NAV MYR 0.4182 Unit NAV (MYR) Feb-2015 Feb-2014 Feb-2013 Feb-2012 Feb-2011 Cumulative Performance (%) YTD 1 Month Up to 1.85% p.a. of the NAV Trustee Fee Feb-2010 - 50% - 100% Feb-2009 Fixed Deposit Rate Feb-2008 0% 70% FBM100 + 30% CIMB Bank 1-Month Feb-2007 50% Feb-2006 12 March 1998 Feb-2005 Fund Inception (MYR) Feb-2004 100% Feb-2003 12 March 1998 Feb-2002 150% Fund Launch Benchmark Fund Benchmark 200% Feb-2001 226.32 million units Fund Unit Feb-2000 MYR 94.65 million Fund Size (MYR) Feb-1999 Fund Currency Fund Benchmark -2.11 -5.77 3 Months 6 Months -4.28 -6.00 -5.15 -8.11 -5.08 -4.97 1 Year 3 Years 5 Years -8.89 -9.34 7.35 0.80 Since Inception 32.39 15.74 399.81 184.09 Calendar Year Performance (%) Fund Benchmark 2014 2013 2012 2011 2010 2009 -4.71 -3.39 12.95 8.87 8.55 7.62 4.65 2.43 21.09 15.75 42.47 30.80 Most Recent Fund Distributions Gross (Sen/Unit) Yield (%) 2015 Jan 2014 Jan 2013 Jan 2011 Dec 2010 Dec 2009 Dec 3.00 5.89 3.00 6.24 2.69 5.90 2.62 5.67 2.50 5.62 2.50 6.40 Note: March 1998 to August 2015. Performance data represents the combined income & capital return as a result of holding units in the fund for the specified length of time, based on bid to bid prices. Earnings are assumed to be reinvested. Source: Lipper CIMB-PRINCIPAL AWARDS AND ACCOLADES Currency MYR ISIN Code Bloomberg Ticker MYU1000AP005 COMBALI MK CIMB-Principal Asset Management Berhad 10th Floor, Bangunan CIMB, Jalan Semantan Damansara Heights, 50490 Kuala Lumpur. Tel: (603) 2084 8888 Fax: (603) 2084 8899 Website: www.cimb-principal.com.my ^Based on the fund's portfolio returns as at 15 August 2015, the Volatility Factor (VF) for this fund is 6.63 and is classified as "Moderate" (source: Lipper). "Moderate" includes funds with VF that are above 6.310 but not more than 7.975. The VF means there is a possibility for the fund in generating an upside return or downside return around this VF. The Volatility Class (VC) is assigned by Lipper based on quintile ranks of VF for qualified funds. VF is subject to monthly revision and VC will be revised every six months. The fund's portfolio may have changed since this date and there is no guarantee that the fund will continue to have the same VF or VC in the future. Presently, only funds launched in the market for at least 36 months will display the VF and its VC. We recommend that you read and understand the contents of the Master Prospectus Issue No. 19 dated 30 June 2015, which has been duly registered with the Securities Commission Malaysia, before investing and that you keep the said Master Prospectus for your records. Any issue of units to which the Master Prospectus relates will only be made upon receipt of the completed application form referred to in and accompanying the Master Prospectus, subject to the terms and conditions therein. Investments in the Fund are exposed to credit (default) and counterparty risk, interest rate risk and stock specific risk. You can obtain a copy of the Master Prospectus from the head office of CIMB-Principal Asset Management Berhad or from any of our approved distributors. Product Highlight Sheet ("PHS") is available and that investors have the right to request for a PHS; and the PHS and any other product disclosure document should be read and understood before making any investment decision. There are fees and charges involved in investing in the funds. We suggest that you consider these fees and charges carefully prior to making an investment. Unit prices and income distributions, if any, may fall or rise. Past performance is not reflective of future performance and income distributions are not guaranteed. You are also advised to read and understand the contents of the Financing for Investment in Unit Trust Risk Disclosure Statement/Unit Trust Loan Financing Risk Disclosure Statement before deciding to borrow to purchase units. Where a unit split/distribution is declared, you are advised that following the issue of additional units/distribution, the NAV per unit will be reduced from pre-unit split NAV/cum-distribution NAV to post-unit split NAV/ex-distribution NAV; and where a unit split is declared, the value of your investment in Malaysian ringgit will remain unchanged after the distribution of the additional units. Page 1 of 2 31 August 2015 CIMB-Principal Balanced Fund A S S E T MA N A GE ME N T Available under the EPF Members Investment Scheme. FUND MANAGER'S REPORT PORTFOLIO ANALYSIS The Fund lost 5.08% in August 2015, underperforming the benchmark by 11 basis points ("bps"). On a year-to-date ("YTD") basis, the fund is down 2.11%, outperforming the benchmark by 366 bps. During the month, equities outperformed while fixed income underperformed. In terms of stock holdings, the equities performance was partly driven by its overweight position in Westports Holdings and underweight position in Sime Darby. For fixed income, the main contributors were from the banking and ports related bonds in the Fund. ASSET ALLOCATION Equities (Local) 60.83% Bond/Sukuk 35.20% Cash 3.97% 100.00% Total We expect corporate earnings to be downgraded post results season, as the recent second quarter of 2015 ("2Q15") earnings continued to disappoint. Market continues to be very narrow and lacks positive catalysts. Healthy earnings growth is essential for the market to move up from here. Earnings per share ("EPS") growth is 0% and 9.5% for 2015 and 2016 respectively, with corresponding price-earnings ratio ("PER") of 16.1 times and 14.7 times. Despite the sharp correction, the FTSE Bursa Malaysia Kuala Lumpur Composite Index ("FBMKLCI") continues to look fair for 2016. SECTOR BREAKDOWN We favour stocks which show strong growth despite being in a low growth environment. We like Exporters, Ports and Utilities. We remain underweighted in Oil & Gas, Plantations, Telcos and Financials. For fixed income, we aim to be fully invested with concentration on selective repriced corporate bonds from the primary and secondary market with higher yields for better yield enhancement. Bond/Sukuk 35.20% Trading / Services 20.93% Finance 14.14% Industrials 9.99% IPC 4.95% Construction 3.64% Technology 3.20% Consumer 2.19% Properties 1.10% Plantations 0.69% Cash 3.97% 100.00% Total RISK STATISTICS TOP HOLDINGS Beta 1.11 1 Public Bank Bhd - Local Malaysia 5.50% Information Ratio 0.77 2 HSBC Bank Malaysia Bhd Malaysia 5.31% 3 Nur Power Sdn Bhd Malaysia 5.25% 4 Malayan Banking Bhd Malaysia 4.80% 5 Tenaga Nasional Bhd Malaysia 4.72% 6 Krung Thai Bank PCL Malaysia 2.63% 7 Digi.com Bhd Malaysia 2.55% 8 CIMB Group Hldgs Bhd Malaysia 2.50% 9 Jimah Energy Ventures Malaysia 2.49% Sharpe Ratio -0.10 3 years monthly data 10 Time Dotcom Bhd Total Malaysia 2.40% 38.15% Page 2 of 2