monthly fund performance update pb income plus 2 fund

AIA Bhd.

(790895-D)

MONTHLY FUND PERFORMANCE UPDATE

PB INCOME PLUS 2 FUND

Investment Objective

The Fund seeks growth of capital and income through investment in a diversified portfolio of stocks, bonds and cash by investing in ringgit denominated government and corporate bonds and Malaysian equities.

This Fund will pay a fixed payout of 5 cents per unit per annum for first five

(5) years of which 2.5 cents will be distributed semi-annually. However in the event the income received from the underlying fund is insufficient to support the fixed payout, we have the discretion to liquidate a portion of the Fund’s investment fund in order to meet the fixed payout requirement. Any payout will cause the Net Asset Value (NAV) to be adjusted accordingly and thus unit price will decrease.

In any event, if the NAV of the Fund drops to RM0.70 or lower where it is no longer capable of supporting further payouts, the fixed payout will cease.

However, the fixed payout will resume when the NAV increases above

RM0.70.

After five (5) years, the payout will be made annually if the Fund’s NAV price is above RM1.00. The amount of payout declared, if any, may vary from year to year. The NAV will be adjusted accordingly upon each payout.

Notice: Please refer to the Fund Fact Sheet for more information about the fund.

Fund Details

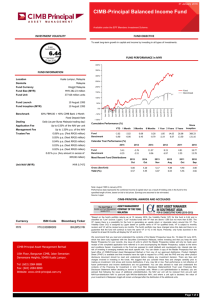

Unit NAV (31 Aug 2015) : RM0.870

Fund Size (31 Aug 2015)

Fund Currency

Fund Inception

Fund Management Charge

Investment Manager

Basis of Unit Valuation

Top Holdings

1 TENAGA NASIONAL BHD

2 MALAYAN BANKING BHD

3 SARAWAK ENERGY BHD

5 YINSON HOLDINGS BHD

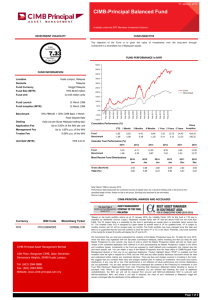

Sector Allocation

Plantation, 4%

Properties, 5%

Finance, 13%

Cash, 7%

: RM92.870 million

: Ringgit Malaysia

: 20 October 2014

Offer Price at Inception : RM0.95

: 1.20% p.a

: AIA Bhd.

: Net Asset Value

Frequency of Unit Valuation : Daily

4 MALAYSIA AIRPORTS CAPITAL BERHAD

Agriculture, Forestry

& Fishing, 2%

Electricity, Gas &

Water, 8%

3.38%

3.28%

3.20%

3.13%

3.12%

Finance, Insurance,

Real Estate &

Business Services,

15%

Govt & Other

Services, 1%

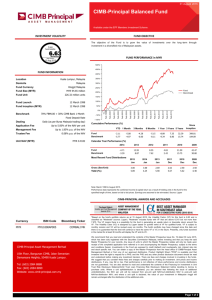

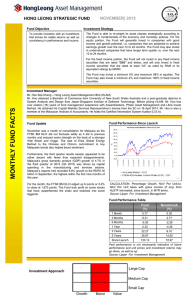

Historical Performance

1.10

1.05

1.00

0.95

0.90

0.85

0.80

%

PB Income Plus 2

Benchmark

Fund^

Weighted Index*

Aug 2015

1 Mth 6 Mths 1-Year 3-Year** 5-Year**

-6.05% -6.53%

-5.48% -8.73%

-

-

-

-

-

-

Excess -0.57% 2.20% - - -

^ Calculation of past performance is based on NAV-to-NAV. This is strictly the performance of the investment fund, and not the returns earned on the actual premiums/contributions paid of the investment-linked product.

* 70% FTSE Bursa Malaysia Top 100 Index (Source: Bursa Malaysia) + 30% RAM Quant MGS All

Index (Source: RAM QuantShop @ www.quantshop.com)

** Performance is on annualized basis.

Notice: Past performance of the fund is not an indication of its future performance.

Market Review

During the month, FBM100 Index plunged 7.22% to end the month at 10,696, underperforming MSCI Asia ex-Japan, which fell 1.23% in MYR term. This is largely driven by political uncertainties and weaker MYR, which fell 9.4% m-o-m against USD to touch the new 17-year high at MYR4.25/USD. In addition, regional markets and Wall Street fell sharply on the back of various concerns stemming out from China such as slower GDP growth and

China may devalue its currency aggressively to gain export competitiveness. Commodity prices also remained weak where brent crude oil prices and crude palm oil (CPO) prices fell below US$50/barrel and MYR2,000/MT respectively in the month. On the corporate front,

IJM Corporation’s outstanding order book hit a record high of about RM7bil, fuelled by new projects secured domestically during FY3/15. Gamuda has been appointed as the Project

Delivery Partner to oversee and realize certain key components in the RM27bil Penang

Transport Master Plan. Westports Holdings has got the Government’s approval to raise the tariffs for containers by 15%, taking effect from 1 September 2015 and another 15% in 2018.

CIMB Group has obtained approval to offer banking services in Vietnam from the State Bank of Vietnam. Hong Leong Bank and its parent, Hong Leong Financial Group will raise up to

RM4.1bil through rights issues by 4Q2015.

Currency depreciation was sparked by the RMB devaluation, weak commodities prices and uncertainty over domestic political environment. The RMB devaluation mooted concern on the Emerging Market growth prospect and Malaysia is not spared. This triggered a broadbased sell-off across the MGS curve, both by onshore and offshore investors with yields headed north by 18 ~ 38bps. Foreign ownership in local MGS gapped down to 47.8% in July

(Jun: 48.5%). The closing levels of benchmark MGS as of end-August were: 3Y at 3.49%

(+18bps); 5Y at 3.91% (+31bps); 7Y at 4.31% (+37bps); 10Y at 4.35% (+28bps); 20Y at

4.72% (+38bps) and 30Y at 5.00% (+24bps). MYR extended its losses subsequent to the month end.

August saw three bond auctions, the reopening of RM3.5bil 5Y MGS, the reopening of

RM3.0b 10Y MGS, as well as the new issuance of RM0.5bil 3.5Y Sukuk Perumahan

Kerajaan. Bidding interest was mixed with bid-to-cover ratios of 1.74x, 2.03x and 4.30x respectively.

On the macro front, 2Q15 GDP growth rate recorded 4.9% yoy (1Q15: 5.6% yoy), exceeded market consensus at 4.5%. Resilient private consumption somewhat mitigated the impact from export slump. Headline in flation rose 3.3% yoy in July, higher than the street’s estimates, in tandem with higher fuel, food and tobacco prices. Exports growth in July surprised on the upside with a rebound to 5% yoy growth, after two months of contraction, seeing support by the weaker MYR. The improvement was buoyed by healthier E&E shipments, palm oil related products, as well as other non-commodity related products.

Corporate papers saw similar trend in yield movements as MGS though the correction was not as steep. Credit spreads tightened amidst thin liquidity in the corporate debt segment.

Primary issuances during the month was higher at RM5.4bil (July: RM2.8bil) due to a shorter working month in July in tandem with the Muslim fasting and Hari Raya month. Notable issuances during the month were RM1.1bil Kuala Lumpur Kepong Berhad, RM1.0bil

Sarawak Energy Berhad, RM2.4bil Genting Malaysia Capital and RM1.0bil West Coast

Expressway, amongst others.

Market Outlook

Infrastructure

Project Company,

3%

Technology, 1%

Trading/Services,

30%

Transport, Storage

In the short run, we expect local equity market to be volatile with downside risk given the weak MYR, low commodity prices, political uncertainties and external headwinds, such as

& Communications,

2% slowdown of global economy. Over the medium term, we are optimistic on the market recovery, supporting by the still-strong economic fundamentals, recovery of oil prices after

OPEC expressed concerns over low oil prices, 1MDB restructuring and recovery of Chinese

Consumer Products,

2% market after implementing monetary policies and measures to support the market.

Industrial Products,

3%

We expect the volatility of the MYR and commodity prices will continue to weigh on the

Malaysian bond market.

Construction, 4%

This document is for informational use only. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units may fall as well as rise. Past performance of the fund is not an indication of its future performance. This is not a pure investment product such as unit trust and please evaluate the options carefully and satisfy that the Investment-Linked Insurance / Takaful plan chosen meets your risk appetite. Please refer to the Fund Fact Sheet for more information about the fund.