CIMB Islamic DALI Asia Pacific Equity Growth Fund - CIMB

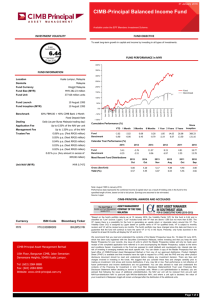

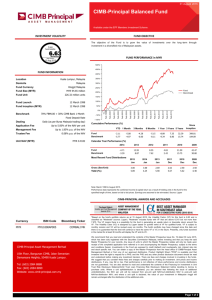

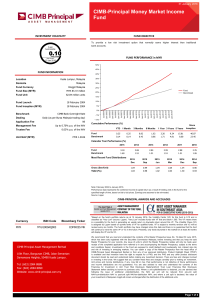

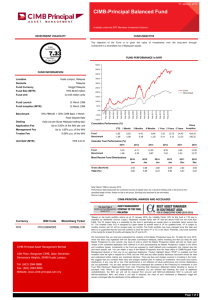

advertisement

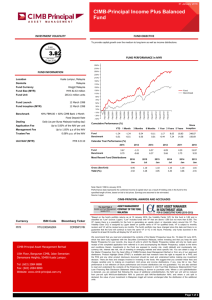

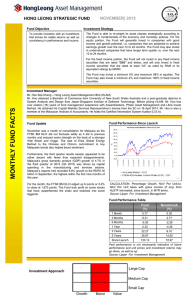

31 August 2016 CIMB Islamic DALI Asia Pacific Equity Growth Fund A S S E T MA N A GE ME N T (formerly known as CIMB Islamic Equity Fund) INVESTMENT VOLATILITY FUND OBJECTIVE To provide investors with long-term capital growth by investing principally in equities. Fund also seeks to outperform the benchmark. 3-year Fund Volatlity 7.37 Moderate The FUND PERFORMANCE in MYR Lipper Analytcs 15 Aug 2016 190% 170% FUND INFORMATION 150% Location Kuala Lumpur, Malaysia 130% Domicile Malaysia 110% Ringgit Malaysia Fund Currency Fund Size (MYR) MYR 346.88 million Fund Unit 411.54 million units 90% Fund Benchmark 70% Islamic Index Dealing Application Fee Daily (as per Bursa Malaysia trading day) YTD 1 Month Management Fee Up to 1.50% p.a. of the NAV Fund Benchmark Trustee Fee Up to 0.06% p.a. of the NAV Calendar Year Performance (%) MYR 0.8428 Unit NAV (MYR) NIL Trustee Feb-2016 Aug-2016 Feb-2015 Aug-2015 Feb-2014 Aug-2014 Feb-2013 Aug-2013 Feb-2012 Aug-2012 Feb-2011 Aug-2011 Feb-2010 - 50% Cumulative Performance (%) IUTAs: Up to 6.50% of the NAV per unit CWA: Up to 6.50% of the NAV per unit Aug-2010 - 30% Feb-2009 Index + 70% MSCI AC Asia ex Japan Aug-2009 30% FTSE Bursa Malaysia EMAS Shariah Feb-2008 - 10% Benchmark Aug-2008 10% Feb-2007 8 October 2004 Aug-2007 Fund Inception (MYR) Feb-2006 30% Aug-2006 8 October 2004 Feb-2005 Fund Launch Aug-2005 50% Fund Benchmark -0.94 1.86 Yield (%) 6 Months 4.96 6.21 6.62 9.32 1.24 2.19 1 Year 3 Years 5 Years 3.18 7.87 21.61 17.10 Since Inception 49.45 34.53 176.87 116.34 2015 2014 2013 2012 2011 2010 9.99 5.07 3.54 1.66 13.48 10.22 14.72 11.56 -5.82 -7.78 10.30 12.25 Most Recent Fund Distributions Gross (Sen/Unit) 3 Months 2015 Oct 2014 Nov 2012 Nov 2012 Mar 2011 Jun 2009 Sep 5.40 6.34 5.35 6.04 4.60 5.92 4.50 6.03 4.94 6.18 4.00 7.39 Note: October 2004 to August 2016. Performance data represents the combined income & capital return as a result of holding units in the fund for the specified length of time, based on bid to bid prices. Earnings are assumed to be reinvested. CIMB-PRINCIPAL AWARDS AND ACCOLADES Currency MYR ISIN Code Bloomberg Ticker MYU1000BD009 SBBIKLS MK CIMB-Principal Asset Management Berhad 10th Floor, Bangunan CIMB, Jalan Semantan Damansara Heights, 50490 Kuala Lumpur. Tel: (603) 2084 8888 Fax: (603) 2084 8899 Website: www.cimb-principal.com.my ^Based on the fund's portfolio returns as at 15 August 2016, the Volatility Factor (VF) for this fund is 7.37 and is classified as "Moderate" (source: Lipper). "Moderate" includes funds with VF that are above 6.455 but not more than 8.405. The VF means there is a possibility for the fund in generating an upside return or downside return around this VF. The Volatility Class (VC) is assigned by Lipper based on quintile ranks of VF for qualified funds. VF is subject to monthly revision and VC will be revised every six months. The fund's portfolio may have changed since this date and there is no guarantee that the fund will continue to have the same VF or VC in the future. Presently, only funds launched in the market for at least 36 months will display the VF and its VC. We recommend that you read and understand the contents of the Master Prospectus (Shariah-Compliant Funds) Issue No. 9 dated 30 June 2016, which has been duly registered with the Securities Commission Malaysia, before investing and that you keep the said Master Prospectus (Shariah-Compliant Funds) for your records. Any issue of units to which the Master Prospectus (Shariah-Compliant Funds) relates will only be made upon receipt of the completed application form referred to in and accompanying the Master Prospectus (Shariah-Compliant Funds), subject to the terms and conditions therein. Investments in the Fund are exposed to country risk, currency risk, risk of investing in emerging markets and stock specific risk. You can obtain a copy of the Master Prospectus (Shariah-Compliant Funds) from the head office of CIMB-Principal Asset Management Berhad or from any of our approved distributors.Product Highlight Sheet ("PHS") is available and that investors have the right to request for a PHS; and the PHS and any other product disclosure document should be read and understood before making any investment decision. There are fees and charges involved in investing in the funds. We suggest that you consider these fees and charges carefully prior to making an investment. Unit prices and income distributions, if any, may fall or rise. Past performance is not reflective of future performance and income distributions are not guaranteed. You are also advised to read and understand the contents of the Financing for Investment in Unit Trust Risk Disclosure Statement before deciding to obtain financing to purchase units. Where a unit split/distribution is declared, you are advised that following the issue of additional units/distribution, the NAV per unit will be reduced from pre-unit split NAV/cum-distribution NAV to post-unit split NAV/ex-distribution NAV; and where a unit split is declared, the value of your investment in Malaysian ringgit will remain unchanged after the distribution of the additional units. Page 1 of 2 31 August 2016 CIMB Islamic DALI Asia Pacific Equity Growth Fund A S S E T MA N A GE ME N T (formerly known as CIMB Islamic Equity Fund) FUND MANAGER'S REPORT PORTFOLIO ANALYSIS The Fund posted a 1.24% return in August 2016, underperforming the benchmark by 0.95%. By sector, the fund's underperformance was driven by the consumer services, property and telecommunication sectors. By country, regional markets underperformed while Malaysia outperformed. Year-to-Date, the fund has shed 0.94%, underperforming the benchmark by 2.80%. ASSET ALLOCATION Shariah-compliant Equities (Foreign) 65.62% Shariah-compliant Equities (Local) 26.69% Cash 7.69% 100.00% Total The Shariah Asian equity universe rose 2.86% in August, with outstanding performances from China and Thailand. Foreign fund inflows were more selective compared to previous months, with several markets seeing slight net outflows. Equity markets in Asia continue to be supported by central bank easing. Real rates remain generally positive across the region, with inflation continuing to ease across most countries. Meantime, earnings revision seem to be stabilizing with some selective upgrades. Valuations are reasonable at 12X P/E. In August, the FBM Emas Shariah Index (FBMS) rose 1.90% to close at 12,430.50. Our market view and strategy are still intact. We continue to expect sluggish growth, low inflation and easy central banks policies to support growth. As valuations are rich and near the top end of the range, we believe that markets will trade range-bound with a slight upward bias. Going forward, we will watch for: 1) Earnings growth stabilisation 2) Pre-election budget and 3) Progress of GLC restructuring efforts SECTOR BREAKDOWN On the regional front, we look to buy on dips. As we head into 2H16, we see positive local factors favoring Asia markets balanced against risks from global macroeconomics. Our preference is balanced between ASEAN including India and North Asia. We intend to generate alpha via stock selection and investments into growth opportunities like e-commerce and electric vehicles. On the domestic front, we still see opportunities in the Malaysian GLC restructuring theme in the medium term in the plantation, property and services sectors. In a slow growth environment, we continue to like high dividend yielders. W COUNTRY ALLOCATION Consumer 19.32% Hong Kong 26.96% Trading / Services 15.76% Malaysia 26.69% Telecommunications 10.61% India 10.26% Technology 10.19% South Korea 10.16% Oil & Gas 7.03% Indonesia 4.98% Financials 6.03% China 4.64% Industrials 5.76% Philippines 3.42% Basic Materials 2.94% Singapore 3.38% Utilities 2.88% United States 1.82% Plantations 2.85% Cash 7.69% Construction 2.64% Health Care 2.09% IPC 2.08% Mutual Fund 1.47% Finance 0.38% Properties 0.28% Cash 7.69% Total 100.00% 100.00% Total TOP HOLDINGS RISK STATISTICS 1 Tencent Hldg Ltd Hong Kong 9.34% 2 Tenaga Nasional Bhd Malaysia 4.64% 3 Techtronic Industries Co Hong Kong 3.44% 4 LG Chem Ltd South Korea 2.94% 5 Telekomunikasi TBK PT Indonesia 2.81% 6 Singapore Telecommunications Singapore 2.68% Beta 0.82 7 CNOOC Ltd Hong Kong 2.43% Information Ratio 0.25 8 China Telecom Corp Ltd China 2.19% Sharpe Ratio 0.44 9 Maruti Suzuki India Ltd India 2.17% Hong Kong 2.14% 3 years monthly data 10 Link REIT Total 34.78% Page 2 of 2