KAF First Fund Fact Sheet - June 2014

advertisement

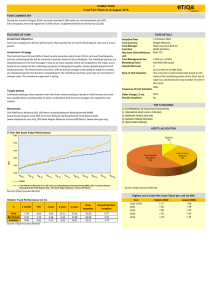

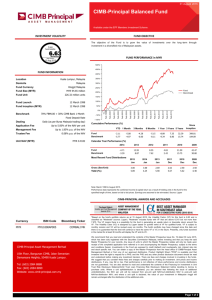

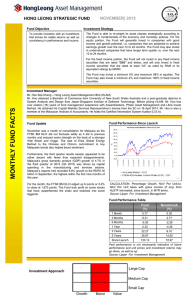

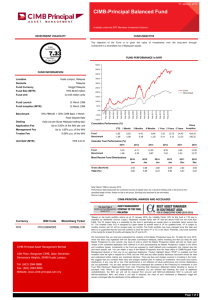

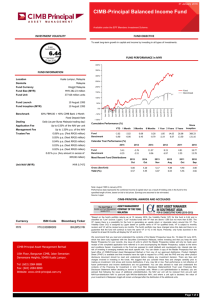

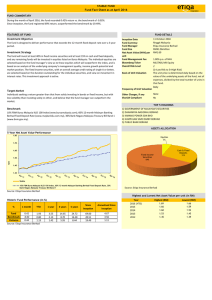

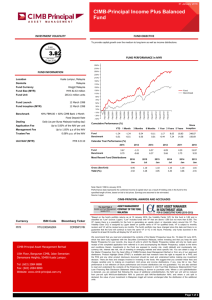

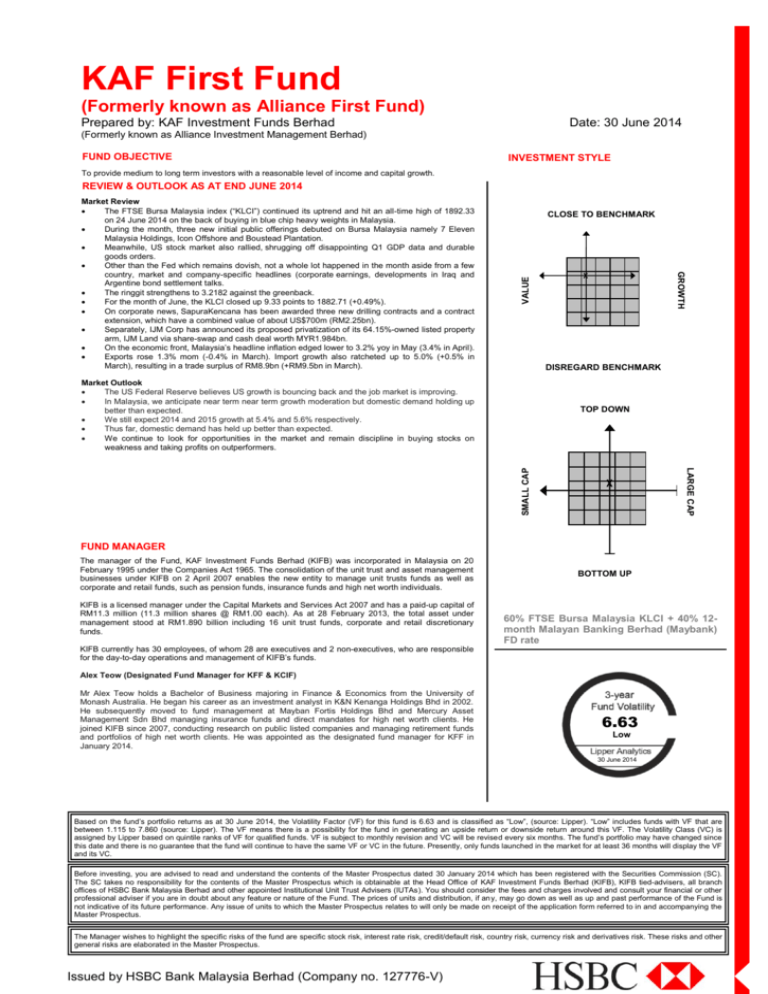

KAF First Fund (Formerly known as Alliance First Fund) Prepared by: KAF Investment Funds Berhad Date: 30 June 2014 (Formerly known as Alliance Investment Management Berhad) FUND OBJECTIVE INVESTMENT STYLE To provide medium to long term investors with a reasonable level of income and capital growth. REVIEW & OUTLOOK AS AT END JUNE 2014 VALUE CLOSE TO BENCHMARK GROWTH Market Review The FTSE Bursa Malaysia index (“KLCI”) continued its uptrend and hit an all-time high of 1892.33 on 24 June 2014 on the back of buying in blue chip heavy weights in Malaysia. During the month, three new initial public offerings debuted on Bursa Malaysia namely 7 Eleven Malaysia Holdings, Icon Offshore and Boustead Plantation. Meanwhile, US stock market also rallied, shrugging off disappointing Q1 GDP data and durable goods orders. Other than the Fed which remains dovish, not a whole lot happened in the month aside from a few country, market and company-specific headlines (corporate earnings, developments in Iraq and Argentine bond settlement talks. The ringgit strengthens to 3.2182 against the greenback. For the month of June, the KLCI closed up 9.33 points to 1882.71 (+0.49%). On corporate news, SapuraKencana has been awarded three new drilling contracts and a contract extension, which have a combined value of about US$700m (RM2.25bn). Separately, IJM Corp has announced its proposed privatization of its 64.15%-owned listed property arm, IJM Land via share-swap and cash deal worth MYR1.984bn. On the economic front, Malaysia’s headline inflation edged lower to 3.2% yoy in May (3.4% in April). Exports rose 1.3% mom (-0.4% in March). Import growth also ratcheted up to 5.0% (+0.5% in March), resulting in a trade surplus of RM8.9bn (+RM9.5bn in March). X DISREGARD BENCHMARK Market Outlook The US Federal Reserve believes US growth is bouncing back and the job market is improving. In Malaysia, we anticipate near term near term growth moderation but domestic demand holding up better than expected. We still expect 2014 and 2015 growth at 5.4% and 5.6% respectively. Thus far, domestic demand has held up better than expected. We continue to look for opportunities in the market and remain discipline in buying stocks on weakness and taking profits on outperformers. LARGE CAP SMALL CAP TOP DOWN X FUND MANAGER The manager of the Fund, KAF Investment Funds Berhad (KIFB) was incorporated in Malaysia on 20 February 1995 under the Companies Act 1965. The consolidation of the unit trust and asset management businesses under KIFB on 2 April 2007 enables the new entity to manage unit trusts funds as well as corporate and retail funds, such as pension funds, insurance funds and high net worth individuals. KIFB is a licensed manager under the Capital Markets and Services Act 2007 and has a paid-up capital of RM11.3 million (11.3 million shares @ RM1.00 each). As at 28 February 2013, the total asset under management stood at RM1.890 billion including 16 unit trust funds, corporate and retail discretionary funds. BOTTOM UP 60% FTSE Bursa Malaysia KLCI + 40% 12month Malayan Banking Berhad (Maybank) FD rate KIFB currently has 30 employees, of whom 28 are executives and 2 non-executives, who are responsible for the day-to-day operations and management of KIFB’s funds. Alex Teow (Designated Fund Manager for KFF & KCIF) Mr Alex Teow holds a Bachelor of Business majoring in Finance & Economics from the University of Monash Australia. He began his career as an investment analyst in K&N Kenanga Holdings Bhd in 2002. He subsequently moved to fund management at Mayban Fortis Holdings Bhd and Mercury Asset Management Sdn Bhd managing insurance funds and direct mandates for high net worth clients. He joined KIFB since 2007, conducting research on public listed companies and managing retirement funds and portfolios of high net worth clients. He was appointed as the designated fund manager for KFF in January 2014. 6.63 Low 30 June 2014 Based on the fund’s portfolio returns as at 30 June 2014, the Volatility Factor (VF) for this fund is 6.63 and is classified as “Low”, (source: Lipper). “Low” includes funds with VF that are between 1.115 to 7.860 (source: Lipper). The VF means there is a possibility for the fund in generating an upside return or downside return around this VF. The Volatility Class (VC) is assigned by Lipper based on quintile ranks of VF for qualified funds. VF is subject to monthly revision and VC will be revised every six months. The fund’s portfolio may have changed since this date and there is no guarantee that the fund will continue to have the same VF or VC in the future. Presently, only funds launched in the market for at least 36 months will display the VF and its VC. Before investing, you are advised to read and understand the contents of the Master Prospectus dated 30 January 2014 which has been registered with the Securities Commission (SC). The SC takes no responsibility for the contents of the Master Prospectus which is obtainable at the Head Office of KAF Investment Funds Berhad (KIFB), KIFB tied-advisers, all branch offices of HSBC Bank Malaysia Berhad and other appointed Institutional Unit Trust Advisers (IUTAs). You should consider the fees and charges involved and consult your financial or other professional adviser if you are in doubt about any feature or nature of the Fund. The prices of units and distribution, if any, may go down as well as up and past performance of the Fund is not indicative of its future performance. Any issue of units to which the Master Prospectus relates to will only be made on receipt of the application form referred to in and accompanying the Master Prospectus. The Manager wishes to highlight the specific risks of the fund are specific stock risk, interest rate risk, credit/default risk, country risk, currency risk and derivatives risk. These risks and other general risks are elaborated in the Master Prospectus. INTERNAL Issued by HSBC Bank Malaysia Berhad (Company no. 127776-V) FUND INFORMATION Launch Date 16 January 1996 Fund Category (as per S&P, Micropal or Lipper) Fund Type Balanced Income and Growth Fund Size (RM) RM39.649 million Launch Price RM1.00 RM1,000 Initial Investment Subsequent Investment CHART 1: HISTORICAL PRICE OF FUND SINCE INCEPTION N/A Annual Management Fee RM100 Maximum up to 6.50% of net asset value (NAV) per unit 1.50% of NAV Exit Fee Nil Annual Expense Ratio as at 30/06/2014 1.7257% Yes Subject to specific stock risk, interest rate risk, credit/default risk, currency risk, country risk and derivatives risk Sales Charge EPF Investment Scheme Special Risk NAV line chart (based on NAV-to-NAV, Dividend re-invested) CHART 2: PERFORMANCE OF FUND SINCE INCEPTION RISK AS AT END 30/06/2014 175.03% **3-year Annualised Volatility 6.69 **3-year Annualised Sharpe Ratio 0.491 HSBC Risk Classification 3 105.92% **3-YEAR VOLATILITY AND SHARPE RATIO FIGURES ARE BASED ON BID PRICES, ADJUSTED FOR DIVIDENDS RE-INVESTED AND IN MYR. FUND’S NAV AS AT END 30/06/2014 52-Week High RM0.5931 52-Week Low RM0.5210 TRAILING RETURNS 3-MTH Absolute Returns To-Date (%) 6-MTH N/A Annualised Returns To-Date (%) -0.28 1-YR 2-YR 3-YR 5-YR N/A N/A -0.18 3.40 N/A N/A N/A 5.34 N/A 9.20 The Fund vs Benchmark (Line Chart) since inception SECTOR ALLOCATION* AS AT 30/06/2014 PERFORMANCE FIGURES ARE BASED ON BID-TO-BID PRICES, DIVIDENDS RE-INVESTED IN MYR. CALENDAR YEAR RETURNS 2010 2011 2012 2013 YTD KAF First Fund (%) 15.36 -0.44 8.51 Benchmark (%) 12.76 1.83 7.47 11.82 7.62 0.85 0.72 PERFORMANCE FIGURES ARE BASED ON BID-TO-BID PRICES, DIVIDENDS RE-INVESTED IN MYR. TOP 10 HOLDINGS AS AT END 30/06/2014 % OF FUND Woori Bond - 30/9/2014 12.63% MTN Hyundai - 23/2/2017 12.61% 12.56% KMCOB Bond - 14/12/16 10.04% 8.93% Malayan Banking Bhd YTL Power International Bhd Tenaga Nasional Bhd 6.05% 5.74% Axiata Group Bhd 3.94% Zhulian Corporation Bhd 3.55% WCT Holdings Bhd No. of stock holdings 30 SOURCE: KIFB/Lipper, as at 30 June 2014 INTERNAL *As percentage of NAV. Asset exposure is subject to change on a daily basis. Source: KAF Investment Funds Bhd COUNTRY ALLOCATION Nil