RM - CIMB Wealth Advisors

31 January 2016

CIMB-Principal Money Market Income

Fund

A S S E T M A N A G E M E N T

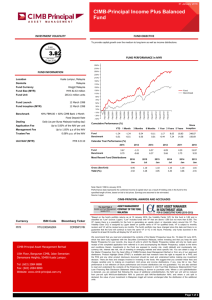

INVESTMENT VOLATILITY FUND OBJECTIVE

To provide a low risk investment option that normally earns higher interest than traditional bank accounts.

3-year

Fund Volatlity

0.10

Very Low

Lipper Analytcs

15 Jan 2016

Location

Domicile

Fund Currency

Fund Size (MYR)

Fund Unit

FUND INFORMATION

Kuala Lumpur, Malaysia

Malaysia

Ringgit Malaysia

MYR 83.72 million

82.84 million units

Fund Launch

Fund Inception (MYR)

18 February 2004

18 February 2004

Benchmark

Dealing

Application Fee

Management Fee

Trustee Fee

Unit NAV (MYR)

CIMB Bank Overnight Rate

Daily (as per Bursa Malaysia trading day)

Nil

Up to 0.70% p.a. of the NAV

0.03% p.a. of the NAV

MYR 1.0106

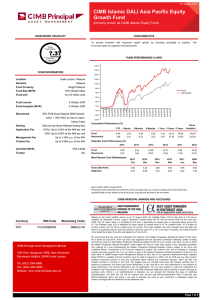

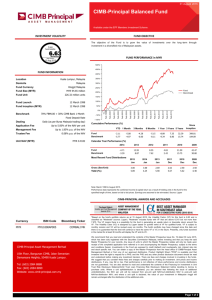

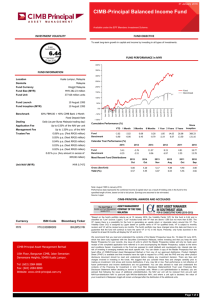

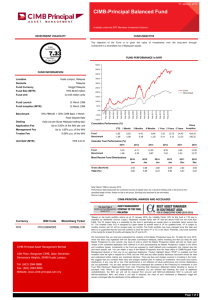

FUND PERFORMANCE in MYR

50%

45%

40%

35%

30%

25%

20%

15%

10%

5%

0%

Fund

Benchmark

- 5%

- 10%

Cumulative Performance (%)

YTD 1 Month

Gross (Sen/Unit)

Yield (%)

3 Months 6 Months

1.04

1.03

0.99

0.98

1 Year 3 Years 5 Years

Fund

Benchmark

0.25

0.14

Calendar Year Performance (%)

2015

0.25

0.14

Fund

Benchmark

3.18

1.69

Most Recent Fund Distributions

2014

2015

Dec

3.06

1.51

0.82

0.43

2015

Sep

1.62

0.86

2013

2.84

1.51

2015

Jun

3.20

1.71

2012

2.95

1.51

1.04

1.02

9.34

4.81

2015

Mar

1.08

1.06

15.81

8.00

2011

2.88

1.51

2014

Dec

1.34

1.30

Since

Inception

40.87

23.45

2010

2.76

1.26

2014

Sep

0.96

0.93

Note: February 2004 to January 2016.

Performance data represents the combined income & capital return as a result of holding units in the fund for the specified length of time, based on bid to bid prices. Earnings are assumed to be reinvested.

Source: Lipper

CIMB-PRINCIPAL AWARDS AND ACCOLADES

Currency

MYR

ISIN Code

MYU1000AQ003

Bloomberg Ticker

COMXCES MK

CIMB-Principal Asset Management Berhad

10th Floor, Bangunan CIMB, Jalan Semantan

Damansara Heights, 50490 Kuala Lumpur.

Tel: (603) 2084 8888

Fax: (603) 2084 8899

Website: www.cimb-principal.com.my

^Based on the fund's portfolio returns as at 15 January 2016, the Volatility Factor (VF) for this fund is 0.10 and is classified as "Very Low" (source: Lipper). "Very Low" includes funds with VF that are below 1.395. The VF means there is a possibility for the fund in generating an upside return or downside return around this VF. The Volatility Class (VC) is assigned by Lipper based on quintile ranks of VF for qualified funds. VF is subject to monthly revision and VC will be revised every six months. The fund's portfolio may have changed since this date and there is no guarantee that the fund will continue to have the same VF or VC in the future. Presently, only funds launched in the market for at least 36 months will display the VF and its VC.

We recommend that you read and understand the contents of the Master Prospectus Issue No. 19 dated 30 June 2015, which has been duly registered with the Securities Commission Malaysia, before investing and that you keep the said

Master Prospectus for your records. Any issue of units to which the Master Prospectus relates will only be made upon receipt of the completed application form referred to in and accompanying the Master Prospectus, subject to the terms and conditions therein. Investments in the Fund are exposed to credit (default) and counterparty risk, interest rate risk and risk of investing in emerging markets. You can obtain a copy of the Master Prospectus from the head office of

CIMB-Principal Asset Management Berhad or from any of our approved distributors. Product Highlight Sheet ("PHS") is available and that investors have the right to request for a PHS; and the PHS and any other product disclosure document should be read and understood before making any investment decision. There are fees and charges involved in investing in the funds. We suggest that you consider these fees and charges carefully prior to making an investment.

Unit prices and income distributions, if any, may fall or rise. Past performance is not reflective of future performance and income distributions are not guaranteed. You are also advised to read and understand the contents of the

Financing for Investment in Unit Trust Risk Disclosure Statement/Unit Trust Loan Financing Risk Disclosure

Statement before deciding to borrow to purchase units. Where a unit split/distribution is declared, you are advised that following the issue of additional units/distribution, the NAV per unit will be reduced from pre-unit split

NAV/cum-distribution NAV to post-unit split NAV/ex-distribution NAV; and where a unit split is declared, the value of your investment in Malaysian ringgit will remain unchanged after the distribution of the additional units.

Page 1 of 2

31 January 2016

CIMB-Principal Money Market Income

Fund

A S S E T M A N A G E M E N T

FUND MANAGER'S REPORT

The Fund’s performance for the month of January 2016 was 0.25%, compared to the benchmark CIMB Bank

Overnight Rate of 0.14%.

During the first Monetary Policy Committee (“MPC”) meeting of the year, Bank Negara Malaysia ("BNM") left the Overnight Policy Rate (“OPR”) unchanged at 3.25% as expected but cut the Statutory Reserve Requirement

(“SRR”) by 50 basis points ("bps") to 3.50% in a surprising move to boost liquidity. BNM reiterated that the stance of monetary policy remains accommodative and supportive of economic activity. Assessment on the global and domestic economy has turned more cautious as BNM highlighted increased downside risks to domestic growth outlook. BNM believes that recovery in the advanced economies has not been as strong as earlier expected and that growth in emerging economies has slowed. This is more dovish than the previous statement citing moderate growth in the global economy and positive growth in the Asia region.

On the inflation front, Consumer Price Index (“CPI”) inched up to 2.7% year-on-year ("YoY") in December from 2.6% YoY in November 2015. Malaysia's inflation rate rose at a faster than expected pace in December

2015 on the back of higher prices for prices of food & beverages, tobacco & alcoholic beverages, healthcare and furnishing & household equipment but was partly mitigated by a further drop in transport costs due to falling energy prices.

Overall, we aim to stay fully invested in quality short term bonds and extend the portfolio duration for yield enhancement.

Fixed Income

Cash

Total

Fixed Income

Cash

PORTFOLIO ANALYSIS

ASSET ALLOCATION

SECTOR BREAKDOWN

77.69%

22.31%

100.00%

77.69%

22.31%

Beta

Information Ratio

Sharpe Ratio

Total

RISK STATISTICS

1.61

16.46

-3.37

3 years monthly data

1 Bank Muamalat Malaysia

2 CIMB Islamic Bank

3 Orix Leasing Malaysia Bhd

4 Lumut Maritime Terminal SdnBhd

5 Gulf Investment Corp

6 Prominic Bhd

7 Bank Pembangunan Malaysia Bhd

8 Perbadanan Kemajuan N.Selangor

9 Alliance Bank M Bhd

10 Sepangar Bay Power Corp

Total

TOP HOLDINGS

Malaysia

Malaysia

Malaysia

Malaysia

Malaysia

Malaysia

Malaysia

Malaysia

Malaysia

Malaysia

100.00%

A3 15.60%

AA+ 11.95%

P1 11.83%

A1 6.20%

AAA 6.00%

AA3 5.99%

MA-1 5.91%

P1 5.84%

A2 3.59%

AA1 2.39%

75.30%

Page 2 of 2