Solutions

advertisement

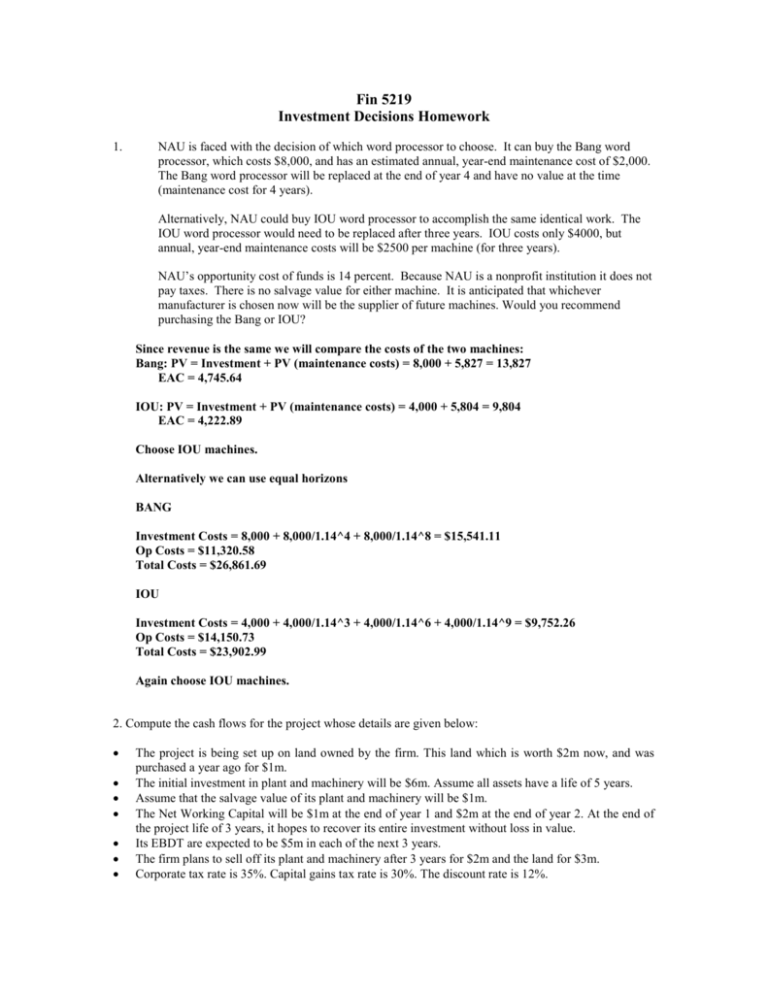

Fin 5219 Investment Decisions Homework 1. NAU is faced with the decision of which word processor to choose. It can buy the Bang word processor, which costs $8,000, and has an estimated annual, year-end maintenance cost of $2,000. The Bang word processor will be replaced at the end of year 4 and have no value at the time (maintenance cost for 4 years). Alternatively, NAU could buy IOU word processor to accomplish the same identical work. The IOU word processor would need to be replaced after three years. IOU costs only $4000, but annual, year-end maintenance costs will be $2500 per machine (for three years). NAU’s opportunity cost of funds is 14 percent. Because NAU is a nonprofit institution it does not pay taxes. There is no salvage value for either machine. It is anticipated that whichever manufacturer is chosen now will be the supplier of future machines. Would you recommend purchasing the Bang or IOU? Since revenue is the same we will compare the costs of the two machines: Bang: PV = Investment + PV (maintenance costs) = 8,000 + 5,827 = 13,827 EAC = 4,745.64 IOU: PV = Investment + PV (maintenance costs) = 4,000 + 5,804 = 9,804 EAC = 4,222.89 Choose IOU machines. Alternatively we can use equal horizons BANG Investment Costs = 8,000 + 8,000/1.14^4 + 8,000/1.14^8 = $15,541.11 Op Costs = $11,320.58 Total Costs = $26,861.69 IOU Investment Costs = 4,000 + 4,000/1.14^3 + 4,000/1.14^6 + 4,000/1.14^9 = $9,752.26 Op Costs = $14,150.73 Total Costs = $23,902.99 Again choose IOU machines. 2. Compute the cash flows for the project whose details are given below: The project is being set up on land owned by the firm. This land which is worth $2m now, and was purchased a year ago for $1m. The initial investment in plant and machinery will be $6m. Assume all assets have a life of 5 years. Assume that the salvage value of its plant and machinery will be $1m. The Net Working Capital will be $1m at the end of year 1 and $2m at the end of year 2. At the end of the project life of 3 years, it hopes to recover its entire investment without loss in value. Its EBDT are expected to be $5m in each of the next 3 years. The firm plans to sell off its plant and machinery after 3 years for $2m and the land for $3m. Corporate tax rate is 35%. Capital gains tax rate is 30%. The discount rate is 12%. Yr 0 Yr 1 Yr 2 Yr 3 1.00 2.00 0.00 EBDT ($m) 5.00 5.00 5.00 Book Depreciation ($m) 1.00 1.00 1.00 EBT ($m) 4.00 4.00 4.00 Tax ($m) 1.33 1.08 1.35 Net Income ($m) 2.67 2.92 2.65 Tax Depreciation (%) 20.00 32.00 19.20 Tax Depreciation ($m) 1.20 1.92 1.15 EBT (for tax purpose) 3.80 3.08 3.85 Tax ($m) 1.33 1.08 1.35 Total Investment 8.00 Plant & M/C 6.00 Land 2.00 Net Working Capital Profit-Loss Account Corporate Tax Calculation Capital Gains Tax Calculation Proceeds from sale of asset - Plant and M/C 2.00 Proceeds from sale of asset - Land 3.00 Tax Book Value of Assets - Plant and M/C 6.00 4.80 2.88 1.73 Tax Book Value of Assets - Land 2.00 Profit on sale of assets 1.27 Capital Gains Tax 0.38 Summary of Cash Flows Investment (8.00) Change in Net Working Capital (1.00) (1.00) 2.00 Net Income 2.67 2.92 2.65 Book Depreciation 1.00 1.00 1.00 Proceeds from sale of asset - Plant and M/C 2.00 Proceeds from sale of asset - Land 3.00 Capital Gains Tax (0.38) Net Cash Flow (8.00) 2.67 2.92 10.27 Present Value (8.00) 2.38 2.33 7.31 4.02 3. You have been asked to evaluate a project with infinite life. Sales and costs are projected to be $1000 and $500 respectively. There is no depreciation and the tax rate is 30%. The real required rate of return is 10%. The inflation rate is 5% and is expected to be 5% forever. Sales and costs will increase at the rate of inflation. If the project costs $3000, what is the NPV? Sales 1,000 Costs 500 Tax 30% rr 10% ri 5% rn = (1.1*1.05)-1 = 15.5% EBT = 1,000-500 = 500, After taxes 500 * (1-0.3) = 350 Perpetual cash flow stream growing at 5% 350 / (0.155-.05) = 3,333.33 - 3,000 NPV = 333.33 4. A project will produce operating cash flows of $45,000 a year for four years. During the life of the project, inventory will be lowered by $30,000 and accounts receivable will increase by $15,000. Accounts payable will decrease by $10,000. The project requires the purchase of equipment at an initial cost of $120,000. The equipment will be depreciated straight-line to a zero book value over the life of the project. The equipment will be salvaged at the end of the project creating a $15,000 after-tax cash flow. At the end of the project, net working capital will return to its normal level. What is the net present value of this project given a required return of 14%? Year Op Cash Change in WorkCap 0 1 45,000 2 45,000 3 45,000 4 45,000 5,000 -5,000 Equip -120,000 15,000 Sum -115,000 PV -115,000 39,473.68 34,626.04 30,373.72 32,564.42 NPV 22,037.86 45,000 45,000 45,000 55,000 5. Marshall’s & Co. purchased a corner lot in Eglon City five years ago at a cost of $640,000. The lot was recently appraised at $810,000. At the time of the purchase, the company spent $50,000 to grade the lot and another $4,000 to build a small building on the lot to house a parking lot attendant who has overseen the use of the lot for daily commuter parking. The company now wants to build a new retail store on the site. The building cost is estimated at $1.5million. What amount should be used as the initial cash flow for this building project? The projected cost of the building plus the opportunity cost of the land 1,500,000 + 810,000 = $2,310,000 6. You own a house that you rent for $1,200 a month. The maintenance expenses on the house average $200 a month. The house cost $89,000 when you purchased it several years ago. A recent appraisal on the house valued it at $250,000. The annual property taxes are $5,000. If you sell the house you will incur $20,000 in expenses. You are deciding whether to sell the house or convert it for your own use as a professional office. What value should you place on this house when analyzing the option of using it as a professional office? The discount rate is 12%. Opportunity costs of selling the house minus the costs associated with the sale 250,000 – 20,000 = $230,000 7. The projects have the following NPVs and project lives. Project NPV Life Project A $5,000 5 years Project B $7,000 7 years If the cost of capital is 10%, which project would you accept? N I/Y PV PMT FV Project A 5 10% $5,000 ? 0 Project B 7 10% $7,000 ? 0 EAR $1,318.99 $1,437.84 Choose Project B 8. OM Construction Company must choose between two types of cranes. Crane A costs $500,000, will last for 5 years, and will require $60,000 in maintenance each year. Crane B costs $750,000 and will last for six years and will require $30,000 in maintenance each year. Maintenance costs for cranes A and B are incurred at the end of each year. The appropriate discount rate is 12% per year. Which machine should OM Construction purchase? Crane A 500,000 Crane B 750,000 5 12% ? 60,000 0 6 12% ? 30,000 0 PV $216,286.57 $123,342.22 Total PV $716,286.57 $873,342.22 N I/Y PV PMT FV Crane A 5 12% 716,286.57 ? 0 Crane B 6 12% 873,342.22 ? 0 PMT/ EAC $198,704.87 $212,419.29 Purchase Op costs N I/Y PV PMT FV EAC Purchase Crane A 9. Kurt’s Kabinets is looking at a project that will require $80,000 in fixed assets and another $20,000 in net working capital. The project is expected to produce sales of $110,000 with associated costs of $50,000. The project has a 4-year life. The company uses straight-line depreciation to a zero book value over the life of the project. The tax rate is 30%. What is the operating cash flow for this project? Depreciation per year = 80,000/4 = 20,000 (Sales – Costs – Depreciation) * (1-tax) + Dep = OCF (110,000 – 50,000 - 20,000) * (1-0.30) + 20,000 = $48,000 10. A project requires an initial investment of $180,000 and is expected to produce a cash flow before taxes of 120,000 per year for two years. [i.e. cash flows will occur at t = 1 and t = 2]. The corporate tax rate is 30%. The assets will be depreciated using MACRS – 3 year schedule: t=1, 33.33%; t = 2: 44.45%; t = 3: 14.81%; t = 4: 7.4%. The company's tax situation is such that it can make use of all applicable tax shields. The opportunity cost of capital is 10%. Assume that the asset can be sold for book value. Calculate the NPV of the project at the end of two years 0 Initial Cost Cash Flows Dep Taxable Income Taxes (30%) Net Income Dep Take Home PV 1 2 -180,000 -180,000 120,000 59,994 60,006 120,000 80,010 39,990 18,002 42,004 59,994 11,997 27,993 80,010 101,998 92,726 Salvage = 180,000 * (1 - 0.3333 – 0.4445) =39,996 PV of Salvage = 33,055 NPV = -180,000 + 92,726 + 89,259 + 33,055 = 35,040 108,003 89,259

![Quiz chpt 10 11 Fall 2009[1]](http://s3.studylib.net/store/data/005849483_1-1498b7684848d5ceeaf2be2a433c27bf-300x300.png)