Chapter 12 - Washington State University

advertisement

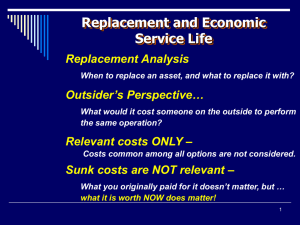

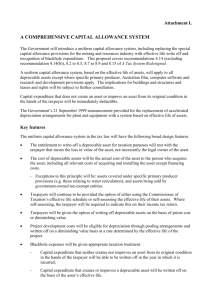

Estimating Cash Flows on Capital Budgeting Projects Chapter 12 Fin 325, Section 04 - Spring 2010 Washington State University 1 Introduction Firms often face capital budgeting decisions: when a potential project arises, a firm needs to decide to carry on or forgo the project. Estimating project cash flows pro forma analysis: - “what is this project’s impact on the firm’s cash flows if we go forward?” 2 Sample Project (a game development company) Computer Game Price = $39.99 Projected unit sales: Year Unit Sales 1 15,000 2 27,000 3 5,000 Variable cost per game = $4.25 Fixed costs per year = $150,000 Startup costs: Software duplicating machine costing $75,000 Shipping and installation costs of $2,000 3 Duplicating machine will be depreciated straight-line to $5,000 over the life of the project We expect to be able to sell the machine for $2,000 after we are done with it The new game will cut into sales of an older game currently on the market The old game will lose sales of 2,000 units per year throughout the life of the new game Old game sells for $19.99 and has variable costs of $3.50 per unit 4 Game development costs for the new game totaled $150,000 Net Working Capital requirements at the beginning of each year will be 10% of the projected sales during the coming year The marginal tax rate is 34 percent The appropriate discount rate for projects of this risk is 15 percent 5 Guiding Principles for Cash Flow Estimation We are interested in incremental cash flows Cash flow changes that we expect as a result of accepting the project Some incremental cash flows are not obvious Opportunity costs Sunk costs Substitutionary and Complementary effects 6 • Opportunity costs Example: if we did not use an existing resource for our project, it could have been used to generate cash flows for another project, so our project must be charged for those foregone cash flows E.g. Existing machinery • Sunk costs If a firm has already paid an expense or is obligated to pay one in the future regardless of whether the project is undertaken, it is a sunk cost and should never be considered in the project cash flows E.g. Development costs 7 • Substitutionary Effects • New project causes reduction in both sales and variable costs of existing projects • Complementary Effects • New project causes increases in both sales and variable costs of existing projects • If a new project will reduce or increase cash flows for existing products or services then those changes are incremental to the project and should be included in the project cash flows 8 Total Project Cash Flow We will use Free Cash Flow as our measure of the cash flow available from a project FCF OperatingCash Flow - Investmentin OperatingCapital [EBIT- T axes Depreciation] - [Gross fixed assets Net operatingworkingcapital] Since we are considering potential projects, the inputs are estimates rather than actual historical numbers 9 Calculating Depreciation The depreciable basis for real property is calculated as: Cost + sales tax + freight charges + installation and testing For our project: Purchase price $75,00 0 Shipping and installation $2,000 Total depreciable basis $77,00 0 10 Since initially we are assuming straight-line depreciation for our project: Depreciation BeginningBook Value - Ending Book Value Depreciable Life = ($77,000 - $5,000) / 3 = $24,000 per year 11 Calculating Operating Cash Flow OCF = EBIT – Taxes + Depreciation It is useful to use a pro-forma income statement approach to calculate operating cash flow. 12 Calculating the Change in Gross Fixed Assets For most projects we need to calculate the change in gross fixed assets at the beginning of the project (time 0) and at the end of the project At the beginning of the project the change in gross fixed assets equals the asset’s depreciable basis For our project: $77,000 13 At the end of the project: We need to consider the tax consequences of the sale of the asset If we sell the asset for more than its book value we have a gain on the sale If we sell the asset for less than book value we have a loss on the sale After-Tax Cash Flow (ATCF) ATCF = Book Value + (Market Value – Book Value) x (1 – TC) In our example: ATCF = 5,000 + (2,000 – 5,000) x (1-.34) = $3,020 14 Calculating Changes in Net Working Capital For some projects we might assume that NWC increases at time zero (resulting in a negative cash flow) and decreases at the end of the project (resulting in a positive cash flow) For our project, NWC changes each year 15 Bringing it All Together 16 Accelerated Depreciation Our FCF calculation used a simplistic assumption about depreciation Straight Line In reality, firms want to use accelerated depreciation More of the depreciation expense occurs earlier in the asset’s life, lowering taxes and increasing cash flow 17 The IRS allows businesses to use the Modified Accelerated Cost Recovery System (MACRS) to depreciate assets Incorporates the half-year convention Uses the double-declining balance depreciation method The ultimate accelerated depreciation method would be to expense it immediately IRS Section 179 deduction allows this for assets up to $108,000 Geared toward small businesses 18 Differing Asset Lives If we decide to go ahead with a project, but we have to choose between two alternative assets, each with a different life, we can use the Equivalent Annual Cost (EAC) method to make the choice Find the sum of the present values of the cash flows for one iteration of asset A and asset B 2. Treat each sum as the present value of an annuity with life equal to the life of the respective asset, and solve for each asset’s payment 3. Choose the asset with the least negative EAC 1. 19 EAC Example Suppose that your company has won a bid for a new project—painting highway signs for the local highway department. Based on past experience, you’re pretty sure that your company will have the contract for the foreseeable future, and now you have to decide whether to use machine A or machine B to paint the signs: machine A costs $20,000, lasts five years, and will generate annual after-tax net expenses of $2,500. Machine B costs $12,000, lasts three years, and will have after-tax net expenses of $3,500 per year. Assume that, in either case, each machine will simply be junked at the end of its useful life, and the firm faces a cost of capital of 12 percent. Which machine should you choose? 20 EAC Example - Solution One iteration of each machine will consist of the sets of cash flows shown below: The sum of the PVs of machine A’s cash flows The sum of the PVs of machine B’s cash flows 21 EAC Example - Solution 1. Treating A as the present value of a 5-period annuity, setting i to 12 percent, and solving for payment will yield a payment of −$8,048, which is machine A’s EAC. 2. Treating B as the present value of a three-period annuity, setting i to 12 percent, and solving for payment will yield a payment of −$8,496, which is machine B’s EAC. 3. Since machine A’s EAC is less negative than machine B’s, your firm should choose machine A. 22