- Mark E. Moore

advertisement

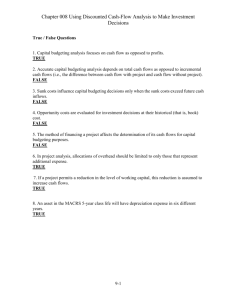

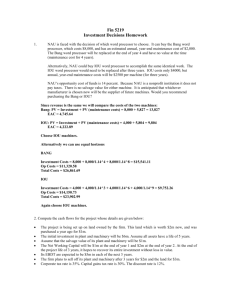

CHAPTER 12 – Practice Problems CASH FLOW ESTIMATION AND RISK ANALYSIS (12-1) Cash flow estimation 1. F I K Answer: b EASY Although it is extremely difficult to make accurate forecasts of the revenues that a project will generate, projects' initial outlays and subsequent costs can be forecasted with great accuracy. This is especially true for large product development projects. a. True b. False (12-1) Relevant cash flows 2. Answer: b EASY Since the focus of capital budgeting is on cash flows rather than on net income, changes in noncash balance sheet accounts such as inventory are not included in a capital budgeting analysis. a. True b. False (12-1) Relevant cash flows 3. F I K F I K Answer: a EASY If an investment project would make use of land which the firm currently owns, the project should be charged with the opportunity cost of the land. a. True b. False (12-2) Depreciation cash flows 4. F I K Answer: a EASY The primary advantage to using accelerated rather than straight-line depreciation is that with accelerated depreciation the present value of the tax savings provided by depreciation will be higher, other things held constant. a. True b. False (12-1) Opportunity costs 5. Answer: a MEDIUM Opportunity costs include those cash inflows that could be generated from assets the firm already owns if those assets are not used for the project being evaluated. a. True b. False (12-1) Sunk costs 6. F I F I Answer: b MEDIUM Suppose Walker Publishing Company is considering bringing out a new finance text whose projected revenues include some revenues that will be taken away from another of Walker's books. The lost sales on the older book are a sunk cost and as such should not be considered in the analysis for the new book. a. True b. False (12-1) Cash flow issues 7. C I Answer: c EASY/MEDIUM Which of the following statements is CORRECT? a. A sunk cost is any cost that must be expended in order to complete a project and bring it into operation. b. A sunk cost is any cost that was expended in the past but can be recovered if the firm decides not to go forward with the project. c. A sunk cost is a cost that was incurred and expensed in the past and cannot be recovered if the firm decides not to go forward with the project. d. Sunk costs were formerly hard to deal with, but once the NPV method came into wide use, it became possible to simply include sunk costs in the cash flows and then calculate the PV. e. A good example of a sunk cost is a situation where Home Depot opens a new store, and that leads to a decline in sales of one of the firm’s existing stores. (12-2) Depreciation C I Answer: a EASY/MEDIUM Which of the following statements is CORRECT? a. Using accelerated depreciation rather than straight line would normally have no effect on a project’s total projected cash flows but it would affect the timing of the cash flows and thus the NPV. b. Under current laws and regulations, corporations must use straightline depreciation for all assets whose lives are 5 years or longer. c. Corporations must use the same depreciation method (e.g., straight line or accelerated) for stockholder reporting and tax purposes. d. Since depreciation is not a cash expense, it has no effect on cash flows and thus no effect on capital budgeting decisions. e. Under accelerated depreciation, higher depreciation charges occur in the early years, and this reduces the early cash flows and thus lowers a project's projected NPV. (12-1) Relevant cash flows 10. EASY Changes in net working capital. Shipping and installation costs. Cannibalization effects. Opportunity costs. Sunk costs that have been expensed for tax purposes. (12-1) Sunk costs 9. Answer: e Which of the following is NOT a relevant cash flow and thus should not be reflected in the analysis of a capital budgeting project? a. b. c. d. e. 8. C I K C I K Answer: c MEDIUM Which of the following factors should be included in the cash flows used to estimate a project’s NPV? a. All costs associated with the project that have been incurred prior to the time the analysis is being conducted. b. Interest on funds borrowed to help finance the project. c. The end-of-project recovery of any working capital required to operate the project. d. Cannibalization effects, but only if those effects increase the project’s projected cash flows. e. Expenditures to date on research and development related to the project, provided those costs have already been expensed for tax purposes. (12-1) Relevant cash flows 11. MEDIUM C I Answer: b MEDIUM Which of the following statements is CORRECT? a. An externality is a situation where a project would have an adverse effect on some other part of the firm’s overall operations. If the project would have a favorable effect on other operations, then this is not an externality. b. An example of an externality is a situation where a bank opens a new office, and that new office causes deposits in the bank’s other offices to increase. c. The NPV method automatically deals correctly with externalities, even if the externalities are not specifically identified, but the IRR method does not. This is another reason to favor the NPV. d. Both the NPV and IRR methods deal correctly with externalities, even if the externalities are not specifically identified. However, the payback method does not. e. Identifying an externality can never lead to an increase in the calculated NPV. (12-2) Annual CF 13. Answer: b When evaluating a new project, firms should include in the projected cash flows all of the following EXCEPT: a. Changes in net working capital attributable to the project. b. Previous expenditures associated with a market test to determine the feasibility of the project, provided those costs have been expensed for tax purposes. c. The value of a building owned by the firm that will be used for this project. d. A decline in the sales of an existing product, provided that decline is directly attributable to this project. e. The salvage value of assets used for the project that will be recovered at the end of the project’s life. (12-1) Externalities 12. C I K C I K Answer: a EASY As assistant to the CFO of Boulder Inc., you must estimate the Year 1 cash flow for a project with the following data. What is the Year 1 cash flow? Sales revenues $13,000 Depreciation $4,000 Other operating costs $6,000 Tax rate 35.0% a. $5,950 b. $6,099 c. $6,251 d. $6,407 e. $6,568 (12-2) Annual CF C I K Answer: d EASY 14. Clemson Software is considering a new project whose data are shown below. The required equipment has a 3-year tax life, after which it will be worthless, and it will be depreciated by the straight-line method over 3 years. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's Year 1 cash flow? Equipment cost (depreciable basis) $65,000 Straight-line depreciation rate 33.333% Sales revenues, each year $60,000 Operating costs (excl. deprec.) $25,000 Tax rate 35.0% a. $28,115 b. $28,836 c. $29,575 d. $30,333 e. $31,092 (12-2) Project NPV C I K Answer: e MEDIUM 15. Temple Corp. is considering a new project whose data are shown below. The equipment that would be used has a 3-year tax life, would be depreciated by the straight-line method over its 3-year life, and would have a zero salvage value. No new working capital would be required. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's NPV? a. b. c. d. e. Risk-adjusted WACC Net investment cost (depreciable basis) Straight-line deprec. rate Sales revenues, each year Operating costs (excl. deprec.), each year Tax rate $15,740 $16,569 $17,441 $18,359 $19,325 10.0% $65,000 33.3333% $65,500 $25,000 35.0% (12-2) Salvage value C I Answer: e MEDIUM 16. Marshall-Miller & Company is considering the purchase of a new machine for $50,000, installed. The machine has a tax life of 5 years, and it can be depreciated according to the following rates. The firm expects to operate the machine for 4 years and then to sell it for $12,500. If the marginal tax rate is 40%, what will the after-tax salvage value be when the machine is sold at the end of Year 4? Year Depreciation Rate 1 0.20 2 0.32 3 0.19 4 0.12 5 0.11 6 0.06 a. $8,878 b. $9,345 c. $9,837 d. $10,355 e. $10,900 (12-2) Project NPV 17. C I K Answer: a HARD Foley Systems is considering a new investment whose data are shown below. The equipment would be depreciated on a straight-line basis over the project's 3-year life, would have a zero salvage value, and would require some additional working capital that would be recovered at the end of the project's life. Revenues and other operating costs are expected to be constant over the project's life. What is the project's NPV? (Hint: Cash flows are constant in Years 1 to 3.) WACC Net investment in fixed assets (basis) Required new working capital Straight-line deprec. rate Sales revenues, each year Operating costs (excl. deprec.), each year Tax rate a. b. c. d. e. 10.0% $75,000 $15,000 33.333% $75,000 $25,000 35.0% $23,852 $25,045 $26,297 $27,612 $28,993 Solutions to Problem 17 7. (12-2) Project NPV Investment in fixed assets WACC = 10% Investment in net working capital Sales revenues - Operating costs (excl. deprec.) Depreciation Rate = 33.333% Operating income (EBIT) - Taxes Rate = 35% After-tax EBIT + Depreciation Cash flow from operations Recovery of working capital Total cash flows NPV $23,852 C I K Answer: a t=0 -$75,000 -$15,000 t=1 t=2 -$90,000 $75,000 25,000 25,000 $25,000 8,750 $16,250 25,000 $41,250 $75,000 25,000 25,000 $25,000 8,750 $16,250 25,000 $41,250 -$90,000 $41,250 $41,250 HARD t=3 $75,000 25,000 25,000 $25,000 8,750 $16,250 25,000 $41,250 15,000 $56,250