Fin 3322: Cashman

advertisement

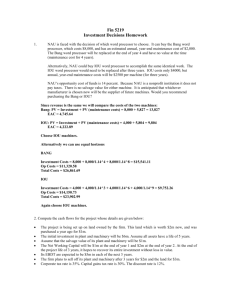

Fin 3322: Cashman Investment Decisions My Big Example 2 1 Your R&D department has come up with a innovative product. Your firm had spent $2m as R&D expenses for this project. You are now wondering whether this product introduction will increase shareholder wealth? Investment of $6.0m is required immediately and another $4.0m is required at the end of year 1. The factory can start manufacturing only after this second investment is made. Assume all assets have a life of 5 years, and depreciation starts after manufacturing begins. You expect to sell 1m units in the first year of production, 1.5m units in the next four years. You plan to sell the factory after that and you expect it to fetch $1m. Selling price is expected to be $10/unit in the first year of goods sold and is expected to increase at 5% p.a. Cost of goods sold is $6/unit in the first year of production and is expected to increase at 4% p.a. Assume the level of net working capital to be $1.0m in the first year of production. Afterwards, it will increase by $1.0m each year. In the last year, the firm will be able to liquidate its entire NWC without loss in value. Assume corporate income tax rate to be 35% and capital gains tax rate of 20%. This project requires a discount rate of 10%. Yr 0 Investment -R&D - Equipment Net Working Capital Profit-Loss Account Quantity Selling Price growth (%) Selling Price - $/unit Sales ($m) COGS growth (%) COGS - $/unit COGS ($m) EBDT ($m) Book Depreciation ($m) EBT ($m) Tax ($m) Net Income ($m) Corporate Tax Calculation Tax Depreciation (%) Tax Depreciation ($m) EBT (for tax purpose) Corporate Tax ($m) Capital Gains Tax Calculation Proceeds from sale of assets Book Value of Assets ($m) Profit on sale of asset Capital Gains Tax Summary of Cash Flows Investment Change in Net Working Capital Net Income Book Depreciation Proceeds from sale of assets Capital Gains Tax Net Cash Flow NPV 0.00 6.00 Yr 1 Yr 2 Yr 3 Yr 4 Yr 5 Yr 6 0.00 10.00 1.00 2.00 3.00 4.00 0.00 1.00 1.50 5% 10.50 15.75 4% 6.24 9.36 6.39 1.80 4.59 1.12 3.47 1.50 5% 11.03 16.54 4% 6.49 9.73 6.80 1.80 5.00 1.71 3.29 1.50 5% 11.58 17.36 4% 6.75 10.12 7.24 1.80 5.44 2.13 3.31 1.50 5% 12.16 18.23 4% 7.02 10.53 7.70 1.80 5.90 2.29 3.61 10.00 10.00 6.00 6.00 4.00 1.80 2.20 0.70 1.50 20.0% 32.0% 19.2% 11.52% 11.52% 2.00 3.20 1.92 1.15 1.15 2.00 3.19 4.88 6.09 6.55 0.70 1.12 1.71 2.13 2.29 6.00 10.00 1.00 0.58 0.42 0.08 8.00 4.80 2.88 1.73 (1.00) 1.50 1.80 (1.00) 3.47 1.80 (1.00) 3.29 1.80 (1.00) 3.31 1.80 4.00 3.61 1.80 1.00 (0.08) 2.30 4.27 4.09 4.11 10.33 (6.00) (4.00) (6.00) (4.00) 6.65 2. A project is expected to create operating cash flows of $22,500 a year for three years. The initial cost of the fixed assets is $50,000. These assets will be worthless at the end of the project. An additional $3,000 of net working capital will be required throughout the life of the project. What is the project’s net present value if the required rate of return is 10%? Time CF Change in Net Working Cap PV SUM 3. 0 -50,000 1 22,500 2 22,500 3 22,500 -3,000.00 -53,000.00 20,454.55 18,595.04 3,000.00 19,158.53 5,208.11 Walks Softly, Inc. sells customized shoes. Currently, it sells 10,000 pairs of shoes annually at an average price of $68 a pair. It is considering adding a lowerpriced line of shoes which sell for $49 a pair. Walks Softly estimates it can sell 5,000 pairs of the lower-priced shoes but will sell 1,000 less pairs of the higherpriced shoes by doing so. What is the amount of the sales that should be used when evaluating the addition of the lower-priced shoes? The new line will generate gross sales of 49 * 5,000 = $245,000 But the new line will lower sales of the higher end line by 68 * 1,000 = $68,000 The amount sales to consider when considering the lower-priced shoes is: $245,000 - $68,000 = $177,000 4 Two machines, A and B, which perform the same functions, have the following costs and lives. Type Machine A Machine B PV Costs Life $6000 5 $8000 7 Which machine would you choose? The two machines are mutually exclusive and the cost of capital is 15%. Machine A N 5 I/Y 15% PV $6,000 PMT ? FV 0 Machine B 7 15% $8,000 ? 0 EAC $1,922.88 $1,789.89 Chose Machine A 5. Ernie’s Electrical is evaluating a project which will increase sales by $50,000 and costs by $30,000. The project will cost $150,000 and be depreciated straight-line to a zero book value over the 10 year life of the project. The applicable tax rate is 34%. What is the operating cash flow for this project? Depreciation per year = 150,000/10 = 15,000 (Sales – Costs – Depreciation) * (1-tax) + Dep = OCP (50,000 – 30,000 - 15,000) * (1-0.34) + 15,000 = $18,300 6. Your factory must buy one of the following two machines to produce bowling balls. The Abfab machine will cost $40,000 and produce net cash flows of $10,000 per year for the next 3 years. The BetterBall machine will cost $50,000 and produce net cash flows of $8,000 per year for the next 4 years. Assume that whichever machine is purchased, you will replace it with an identical machine going forward. Which machine should you choose, and why? The appropriate discount rate is 6%. First find NPV Abfab N I/Y PV PMT FV 3 6% ? 10,000 0 BetterBall 4 6% ? 8,000 0 PV 26,730.12 27,720.84 NPV -13,270 -22,279 Abfab N I/Y PV PMT FV 3 6% -13,270 ? 0 BetterBall 4 6% -22,279 ? 0 PMT 4,964 Find EAC 6,429 Accept Abfab it has the lower EAC – smallest reduction to firm value 7. Sean Co has decided to enter the mask making business. Sean Co can either purchase the Halloween 5000, or the Mardi Gras Madness. Both machines can produce 1,000,000 masks a year, which can be sold at $25 per mask. The Halloween 5000 costs $150,000, will last for 5 years, and requires $95,000 to operate per year. The Mardi Gras Madness costs $75,000, will last 3 years, and requires $65,000 to operate per year. Which machine should Sean Co purchase? The discount rate is 9%. PV of Op Halloween 5000 N= 5, I/Y= 9, PV= ?, PMT= 95,000, FV=0: PV=369,516.87 Total PV = 150,000 + 369,516.87 = 519,516.87 EAC of Halloween 5000 N= 5, I/Y= 9, PV= 519,516.87, PMT= ???, FV=0: PMT=133,563.87 PV of Op Mardi Gras Madness N=3, I/Y=9, PV= ???, PMT=65,000, FV=0:: PV = 164,534.15 Total PV = 75,000 + 164,534.15 = 239,534.15 EAC of Halloween 5000 N=3, I/Y=9, PV= 239,534.15, PMT=???, FV=0:: PMT= 94,629.11 Buy the Mardi Gras Madness, it has a lower EAC