2015 Income Tax Itemizer

advertisement

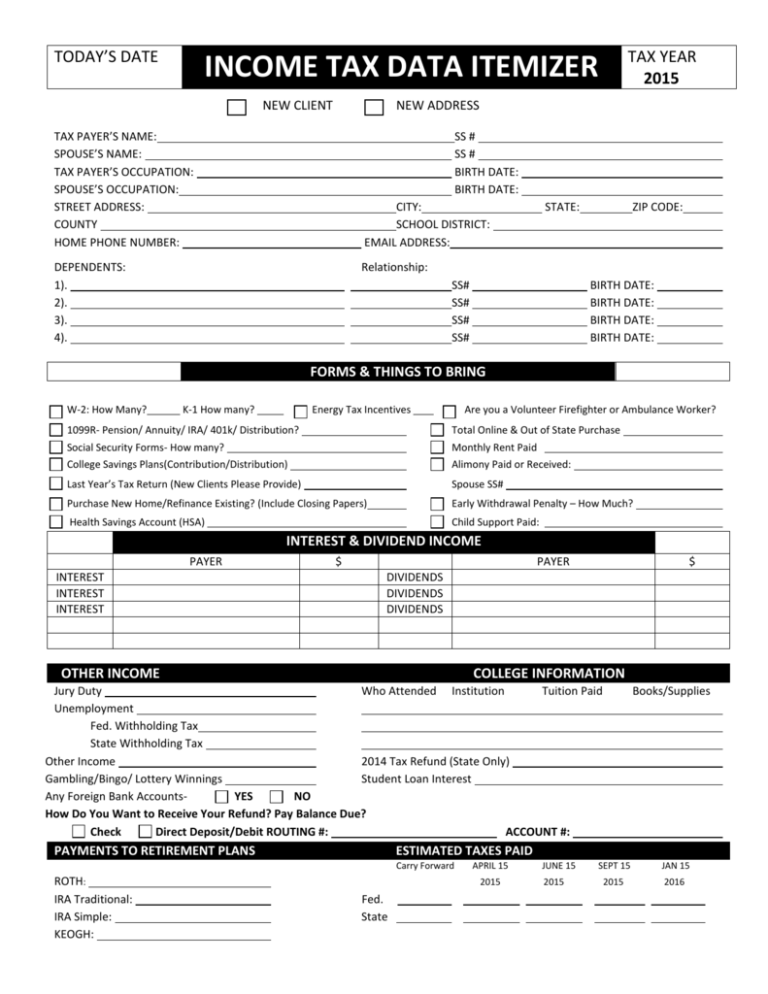

TODAY’S DATE TAX YEAR 2015 INCOME TAX DATA ITEMIZER NEW CLIENT NEW ADDRESS TAX PAYER’S NAME: SPOUSE’S NAME: TAX PAYER’S OCCUPATION: SPOUSE’S OCCUPATION: STREET ADDRESS: COUNTY HOME PHONE NUMBER: SS # SS # BIRTH DATE: BIRTH DATE: CITY: SCHOOL DISTRICT: EMAIL ADDRESS: DEPENDENTS: 1). 2). 3). 4). STATE: ZIP CODE: Relationship: SS# SS# SS# SS# BIRTH DATE: BIRTH DATE: BIRTH DATE: BIRTH DATE: FORMS & THINGS TO BRING W-2: How Many? K-1 How many? Energy Tax Incentives Are you a Volunteer Firefighter or Ambulance Worker? 1099R- Pension/ Annuity/ IRA/ 401k/ Distribution? Total Online & Out of State Purchase Social Security Forms- How many? Monthly Rent Paid College Savings Plans(Contribution/Distribution) Alimony Paid or Received: Last Year’s Tax Return (New Clients Please Provide) Spouse SS# Purchase New Home/Refinance Existing? (Include Closing Papers) Early Withdrawal Penalty – How Much? Health Savings Account (HSA) Child Support Paid: INTEREST & DIVIDEND INCOME PAYER INTEREST INTEREST INTEREST $ PAYER $ DIVIDENDS DIVIDENDS DIVIDENDS OTHER INCOME COLLEGE INFORMATION Jury Duty Who Attended Institution Tuition Paid Unemployment Fed. Withholding Tax State Withholding Tax Other Income 2014 Tax Refund (State Only) Gambling/Bingo/ Lottery Winnings Student Loan Interest Any Foreign Bank AccountsYES NO How Do You Want to Receive Your Refund? Pay Balance Due? Check Direct Deposit/Debit ROUTING #: ACCOUNT #: PAYMENTS TO RETIREMENT PLANS ESTIMATED TAXES PAID Carry Forward ROTH: IRA Traditional: IRA Simple: KEOGH: Books/Supplies APRIL 15 JUNE 15 2015 Fed. State 2015 . . . . SEPT 15 JAN 15 2015 2016 . . . . SALE OF STOCK OF OTHER PROPERTY DATE BOUGHT DATE SOLD DESCRIPTION MEDICAL EXPENSES COST PRICE CONTRIBUTIONS (DO NOT INCLUDE EXPENSES THAT WERE REIMBURSED OR PRE-TAX) Self employed Health Insurance Medical Insurance/Medicare Please Bring to Tax Appt. 1095A 1095B 1095C Long-term Care Insurance Medical Equipment Prescriptions (Include Co-Pay) Eyeglasses/Contacts Doctors (Include Co-Pay) Dentist Hospital and Ambulance Smoking & Weight Loss Medical Expense Nursing Home Medical Auto Miles ( ) @ .23 = Other Medical Expenses Church, Synagogue, Temple, Mosque Charitable Mileage ( ) x .14 = Other Organizations United Way Heart & Lung Assoc. Cancer & MS Boy & Girl Scouts Goodwill or VETS Salvation Army MISCELLANEOUS DEDUCTIONS TAXES PAID School City County Property Tax Freeze Credit Rebate NYS Income Taxes Paid With 2014 Return Mortgage Tax NYS Sales Tax- Large SALE PRICE Work Related -Internet Expenses Work Related Cell Phone Union Dues Job Search Expenses Work-related Tools Professional Organization Legal & Accounting Professional Fees Work Related Auto Miles ( ) x .575 = Work Related Parking & Tolls Professional Journals & Books Work Related Supplies Work Related Education Home Office-Work Related Uniform Expenses Upkeep of Uniforms Safe Deposit Boxes Moving Expenses Investment Fees/IRA Custodial Fee Gambling Losses Casualty/Theft Losses Amount of Employer Reimbursement Property Taxes _________________ INTEREST EXPENSES # 1 Mortgage Interest 1098 # 2 Mortgage Interest 1098 # 3 Home Equity line Interest 1098 Personal Mortgage Insurance (PMI) Private Mortgage Paid Name & Address SS# Investment Interest Mortgage Points Boat/RV/Camper Interest _________________ (________________) CHILD CARE EXPENSES CHILD’S NAME NAME OF CARE GIVER ADDRESS OF CARE GIVER Do You Contribute To a Employer Provided Child Care Plan Yes No SS# Or PROVIDER ID AMOUNT PAID TO CARE GIVER 1/16