HERE - The William and Irene Beck Charitable Trust

advertisement

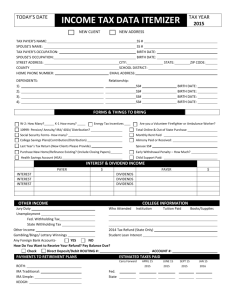

QuickTime™ and a decompressor are needed to see this picture. Photo by Bill Beck FREQUENTLY ASKED QUESTIONS ABOUT PERSONAL FINANCE BILL BECK FREQUENTLY ASKED QUESTIONS ABOUT PERSONAL FINANCE Written by Bill Beck Edited by Irene Beck 2010 All advice and information is from the writer’s perspective. FREQUENTLY ASKED QUESTIONS ABOUT PERSONAL FINANCE 1. How important is it to make and keep a budget? 2. What kind of emergency reserves should I set aside? Where to keep them? 3. Credit & Debit Cards: Which is best for you? 4. What are the advantages/disadvantages of using ATMs? 5. What is a smart approach to Getting a Car: New or Used Leasing or Owning? Financing a Loan? 6. When is renting better than buying a home? 7. Is it better to pre-pay on my mortgage rather than invest discretionary money? 8. How much debt is safe to have? 9. Where should I put any money above my budget and emergency reserves? 10. What is “Laddering” CDs? 11.What do I need to know about a 401(k)? 403(b)? IRA? 12.How much money can I expect to spend in raising a child? 13. Is it OK to co-sign with someone else? 14. What about taking on a second home? 15. What about getting a time-share? 16. Should I pick my own stocks? 17. How to choose a financial consultant? 18. What kinds of mutual funds should I consider? 19. What are the different types of bonds? 20. In my 30s & 40s, what types of insurance should I get? 21. Do I need a safe deposit box? How to get and use one? 22. When do I need to have an attorney? 23. When do I need to have an accountant? 24. What to do with a substantial inheritance? 1. How important is it to make and keep a budget? Making and keeping to a budget is key to managing your money. It is vital to know where and how you are spending your money. Budgeting is probably the most important part of saving. When you see where your money is going, you can make decisions about what doesn’t need to be spent. This helps you prioritize among your needs vs. wants. Live within your means. Don’t spend more than you’re making. One way to determine what you’re spending is to write down every time that you spend your money for a month. When you review this, you will probably see items that cost more than you really want to spend over the coming year. For instance, many people enjoy a Starbucks latte coffee each morning. But at $3.50/day, that amounts to more than $1,000/ year. Seeing that, you can decide if that truly is a need or a want that could be minimized. After making a budget, use it as a guide. It is not written in stone. For instance, review it every month. With these regular reviews, you can catch areas where you over-spent before they get out-of-hand. Or you can re-adjust your budget to accommodate a category for unanticipated expenses. 2. What kind of emergency reserves should I set aside? Where to keep them? To protect yourself, you should try to set aside funds for unanticipated emergencies. Usually, you should plan on saving 3- 5 months of your living expenses. In tougher economic times when unemployment is higher than usual and it’s harder to find a job, consider that you might need 5-9 months of your living expenses. Put that money where you won’t pay a penalty if you need to withdraw it in an emergency. For instance, don’t put it into a CD or a mutual fund. Instead, choose a bank money market or savings account that gives you interest, no matter how small it might be. Make sure that there are no penalties for withdrawal. 3. Credit & Debit Cards: Which is best for you? CREDIT CARDS Consider choosing: Visa or MasterCard—widely used, standard fees The card with the lowest ongoing interest rate The card with a low annual fee (but the card with the lowest interest rate will probably save you more) Don’t let perks be a factor in choosing a credit card, unless you pay off your card each month. DEBIT CARDS A debit card allows you to use your own money without carrying cash. It is like a checking account in that it draws down money you already have in that account. It also allows you to transfer money from a savings account to a checking account to avoid an over-draft. Unlike using a credit card, there are no interest payments involved. Keep in mind that a stolen debit card could mean an unauthorized, unlimited drain on your checking account. The banks usually will not be responsible for this. On the other hand, the banks and credit card companies usually will be responsible for this kind of liability. 4. What are the advantages/disadvantages of using ATMs? ATMs can be advantageous when you need cash in a hurry or when banks are closed. You can also deposit checks and cash. Some people use ATMs unnecessarily. For instance, --to check their account balance more frequently than needed; --to limit their impulse spending. One of the biggest disadvantages to using ATMS could be the fee that you’re charged for every activity. The state of Illinois has the highest fee rate in the U.S. 5. What is a smart approach to Getting a Car: New or Used? Leasing or Owning? Financing a Loan? NEW vs. USED The first decision to make is whether to buy a new or used car. This will be determined largely by what you can afford. Combine your anticipated expenses: the down payment and monthly payments on a car loan. Other considerations: maintenance, repairs, and cost of insurance (liability insurance is required in Illinois). Keep in mind that a new car may have fewer of these costs than a used car. Negotiating when buying a car. The sticker price is negotiable, not firm. Consider using Kelly’s Blue Book or Edmunds Car Buying Guide to find the dealer’s cost for the car. Selling a car at that sticker price already gives the dealer a very large profit. So you can negotiate to a lower price and the dealer will still make a profit. LEASING vs. OWNING Leasing a car is another option but be aware that you do not own it. It is similar to renting vs. buying. FINANCING a LOAN First go to a bank to find out the rate of a car loan. Then go to the dealer and find out what his rate is before making your decision. 6. When is renting better than buying a home? RENTING vs. BUYING A HOME If you don’t plan on staying in a home or location, renting is the better option. Think about buying a house only if you plan to live in it at least 5 years. Think about buying a condo only if you plan to live in it at least 7-10 years. Real estate prices fluctuate, like anything else. It’s important to stay where you buy for this long-term commitment so you don’t lose your money when you sell. A mortgage payment may be cheaper than your rent, which is another consideration. Make sure to count the tax deduction you can take each year on your mortgage when determining these figures. Down Payment The more you put down on a down payment, the less your monthly mortgage payment will be and the less interest you will be paying through the years. For instance, a 15-year mortgage will cost you far less in interest expenses than a 30year mortgage. However, the monthly payments will be higher on the 15-year mortgage than the 30-year mortgage. 7. Is it better to pre-pay on my mortgage rather than invest discretionary money? Whether you choose to put your money into savings or pre-paying your mortgage might depend on the state of the national economy. In bad economic times, consider pre-paying your mortgage. In this case, you likely cannot get an investment with a higher return than you can get from paying down your mortgage. For example, in 2010, when the economy was bad, you could not get more than 1 or 2% in the CD market. Mortgage = tax deduction Having a mortgage provides you with a tax deduction each year on the interest expense. This is unlike using a credit card, where that debt is non-deductible. In addition, your real estate taxes are also tax deductible. 8. How much debt is safe to have? As you make payments from your monthly paycheck, consider these guidelines: No more than approximately 10% should go to pay off credit card debt. No more than approximately 10% should go to pay off student loans. No more than 1/4 – 1/3 should go to rent or to pay off mortgage + real estate taxes, and car expenses. Having all these debts at the same time puts you in a very negative financial situation. Do what you can to bring down any of these expenses as soon as possible. In choosing which debt to reduce first, pick the one that charges the highest annual percentage rate (APR). 9. Where should I put any money above my budget and emergency reserves? Pay down any debt with the highest interest rate, most likely on a credit card Pay down on a car loan. Both of these carry interest expenses that are not tax-deductible. Make regular payments on mortgage and student loans, since those interest rates are likely to be lower than other debt. Start saving with a 401(k), 403(b) or an IRA. These investments can be made before taxes are taken. Consider other investments, such as Mutual Funds, Bonds and CDs. 10. What is Laddering CDs? To assure yourself a steady yield in interest from money you put into Certificates of Deposits (CDs), consider laddering them. For instance, If you have $10,000, place: $2,500 in a 6-month CD, $2,500 in a 12-month CD, $2,500 in a 18-month CD, $2,500 in a 2-year CD. The shorter the term, the smaller the interest rates. On the other hand, the longer the term, the higher the interest rates. When a 6-month CD comes due, roll it over into a 2-year CD if you do not need the cash. Eventually, you will have higher rates on all of them. 11. What do I need to know about a 401(k)? 403(b)? IRA? 401(k) Plans Everyone who is employed should have a corporate savings plan. 401(k) Plans are retirement funds set up by employers in for-profit businesses. Some employers will contribute money in addition to whatever employees save. However, every employee should participate, whether or nor not their employer contributes as well. This is the best way of saving for your retirement. The amount that you set aside for your fund is taken out of your paycheck before federal and state taxes are deducted. Always put the maximum amount in that you can. At minimum, start with 1% of your paycheck rather than nothing. This starts the habit of saving. “If you don’t see it, you don’t miss it” is a widely- held maxim. It is essential to strive toward living within your means. Your 401(k) goes with you, no matter what your job is. If you switch jobs, check to see if you want to leave it there or move it with you. Check with your current and former employers. 403(b) Plans These are similar to 401(k) Plans. 403(b) Plans are retirement funds set up only in non-profit entities, such as charity organizations, schools, hospitals and research institutions. Individual Retirement Account (IRA) If you don’t have a 401(k) or 403(b) where you work, open up an IRA at a bank or brokerage firm. A Roth IRA is best for younger individuals (approx. 50 yrs. or under). In this account, you put money in after taxes and can take it out tax-free between the ages of 591/2 and 701/2. Treat your IRA investment objective as if it were a 401(k). 12. How much money can I expect to spend in raising a child? The U.S. Department of Labor reports regularly on the average costs of raising a child from birth to age 18 (excluding any tuition). For instance, A dual parent family with income before taxes of $39,100-$65,800 will spend $170,460 per child. 13. Is it OK to co-sign with someone else? Co-signing is signing your name with another person on a debt or to secure a loan. This usually is asked for when the first person does not have adequate proof of good credit to pay off the debt or secure the loan. Never co-sign unless you are able and willing to accept the other person’s obligation if s/he reneges on paying it. Co-signing is not the same as Joint Tenancy. Signing your name with another person in Joint Tenancy means that you are co-owners of a property. 14. What about taking on a second home? Unless you plan to live for an extended time at this residence, (3-4 months per year) it might not be the best of investments. The expenses will be same type as those you pay for your primary home. If you have a substantial amount of money that you don’t need for anything else, you might consider it. 15. What about getting a time-share? Buying a time-share is not one of the better investments you can make. However, if you do decide to buy a time-share, consider purchasing it on the secondary market (this could be an owner wanting to sell). This might be 2025% cheaper than buying it directly from the time-share company. 16. Should I pick my own stocks? Unless you have a lot of time to do your own research on individual companies, stay with mutual funds. Treat the investment objectives similar to those you have with your 401(k) for retirement or other future needs. 17. How to choose a Financial Consultant? First, you must clarify what your financial needs are, such as: Do I want help in determining my long-term financial goals? Do I want to develop a long-term financial plan? Or do I have specific needs, like buying a Mutual Fund or Bonds? To choose a Financial Consultant (FC), consider seeking a referral from someone you trust who is already satisfied with his/her FC. However, if you don’t feel comfortable with that person or advice, it is important to seek another FC. Please keep in mind that FCs work on a commission basis. So they might try to sell products or services that are high in commission but do not serve you well. 18. What kinds of Mutual Funds should I consider? Consider investing in Mutual Funds only when you have money for long-term investing, (money that you will not need to use for other purposes for at least 3-5 years.) When you are younger, you can afford to take more risk than when you are older since you will have more years to earn money to recoup lost assets before retiring. You can choose mutual funds by yourself. Additionally, your 401(k) or 403(b) Plan might have some suggestions. On the other hand, you might work with a financial consultant. In either case, look for “no-loads”, if possible. This means that there are no commission charges on a purchase. Mutual Funds are identified by what they invest in. Consider choosing among 5 different categories, such as: 1. 2. 3. 4. 5. Large Caps Mid Caps Small Caps International Growth Real Estate Investment Trusts (REITS) 19. What are the different types of Bonds? U.S. Government Bonds. These are the safest of all Bonds and are the highest quality, rated AAA. The interest on U.S. Government Bonds is tax exempt from State income tax. Corporate Bonds. From the highest quality rating (AAA), Bonds decline in safety as the ratings drop to AA, A, BBB, BB, B, etc. Any Bond that has a rating of BB or less is considered a Junk Bond and is a high risk. The interest on Corporate Bonds is taxable on both Federal and State income taxes. Municipal Bonds. These are issued by state and local governments. From the highest quality rating (AAA), Municipal Bonds decline in safety as the ratings drop to AA, A, BBB, BB, B, etc. Any Bond that has a rating of BB or less is considered a Junk Bond and is a high risk. The interest on Municipal Bonds is tax exempt from Federal income tax. 20. In my 30s & 40s, what types of insurance should I get? There is a variety of insurance policies that you will need depending on your changing life situations, such as: Health Insurance Life Insurance. This should be used for protection in catastrophic situations. To determine the amount of a policy’s benefits, consider Dependents-- Who would be in need of your income if you died? For how long? For example, combine: 1. The estimated cost of raising a child (From birth-18 yrs. w/o tuition expenses) is approximately $170,000. 2. Multiply that amount by the number of your children. 3. Add the unpaid balance on your mortgage 4. The total of #1,2,3 = the amount of life insurance you might consider acquiring. Term Life Insurance vs. Whole Life Insurance— Term insurance might be the wiser choice. It typically costs less. Renter’s Insurance Homeowner’s Insurance Car Insurance. The state of Illinois requires everyone who drives a car to have liability insurance. Pet Insurance 21. Do I need a safe deposit box? How to get and use one? Everyone should have a safe deposit box for important and original documents, such an original birth certificate, marriage certificate and car title. If you are in a couple relationship, the box should have more than one name on it for access. These are available at banks and savings & loan institutions. The annual cost varies by box size, but it is minimal. 22. When do I need to have an attorney? Individuals rely on a lawyer’s advice to understand and secure their legal rights and financial interests. Lawyers typically help clients with estate planning, business negotiations, strategies and transactions. With good legal advice, clients are better prepared to deal with complex laws, rules and regulations. In particular, you might consider using an attorney when making a will. This is important if you have any assets and/or dependents. Attorneys also provide assistance in making legal documents outlining your future health care decisions. Such Advance Directives refer to treatment preferences and the designation of a surrogate decision-maker if you should become unable to make medical decisions on your own behalf. These can include: Living Will. This is a written document that specifies what types of medical treatment are desired should you become incapacitated. Health Care Proxy. This is a legal document in which you would designate another person to make health care decisions if you are incapable of making your own wishes known. Durable Power of Attorney. This document allows a designated individual to make bank transactions, sign Social Security checks, apply for disability, and write personal checks while you are medically incapacitated. 23. When do I need to have an accountant? Use a professional to do your income taxes since laws change every year. If you choose to do your own income taxes, consider using Quicken software. 24. What to do with a substantial inheritance? Don’t make any quick decisions about what to do with your inheritance. When you have given yourself time to think things through, start with paying off debts, particularly credit cards that carry high interest rates. Then focus on a mortgage and other loans. You won’t see an immediate financial benefit but you will be ale to save more money from every paycheck in the future. After this is done, start looking into additional amounts of money to be put into your 401(k) or 403(b) account at work.