Supplemental Income and Loss

advertisement

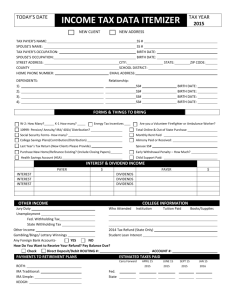

TAX ORGANIZER-2013 Email address:_________________________________ Phone #:_________________________________ Address:_________________________________ _________________________________ _________________________________________________________________________________________ Last Name First Name Initial _________________________________________________________________________________________ Social Security # D.O.B. Occupation _________________________________________________________________________________________ Spouse Last Name First Name Initial _________________________________________________________________________________________ Social Security # D.O.B. Occupation Did your name or address change last year?___________ Did your marital status change last year?_____________ Financial Institution for electronic deposit - refund: _______________________________________________ Is this a checking account or savings account ________? Account number: Routing number: _______________________________ 2. DEPENDENTS – You are claiming: ____________________________ Name (Last, First, MI) _________________ SS# _______________ D.O.B. _________________ Childcare/Tuition Exp. ____________________________ Name (Last, First, MI) _________________ SS# _______________ D.O.B. _________________ Childcare/Tuition Exp. ____________________________ Name (Last, First, MI) _________________ SS# _______________ D.O.B. _________________ Childcare/TuitionExp. 3. ESTIMATED TAX PAYMENTS/REFUND-OTHER TAXES PAID Did you receive a state refund last year? ___________How much was it?______________________________ Quarterly Estimated Tax Payments (Self Employed) - Please provide check copies. Federal_______________ 04/15/13 __________________ 06/15/13 _________________ 09/15/13 ____________________ 01/15/14 State_________________ 04/15/13 __________________ 06/15/13 _________________ 09/15/13 ____________________ 01/15/14 Other Taxes: _____________________________ Real Estate Tax-Primary Residence _____________________ Other Personal R.E. Tax _____________________________ Registration Owner Tax-Vehicles 4. OWN A FOREIGN COUNTRY BANK ACCOUNT? ________ (yes) _______ (no) Page 1 5. INCOME SOURCES: PLEASE PROVIDE W-2 INCOME-PLEASE PROVIDE ALL W-2 AND 1099 MISC. STATEMENTS INTEREST INCOME-PLEASE PROVIDE ALL 1099-INT STATEMENTS DIVIDEND INCOME-PLEASE PROVIDE ALL 1099-DIV STATEMENTS CAPITAL GAIN INCOME-PLEASE PROVIDE ALL 1099-B AND 1099-S STATEMENTS DEBT FORGIVENESS-PLEASE PROVIDE ALL 1099-A AND 1099-C STATEMENTS BUSINESS INCOME-PLEASE PROVIDE ALL K-1 STATEMENTS SSI-INCLUDE SOCIAL SECURITY STATEMENTS. 6. MEDICAL EXPENSES: Do not include any amounts reimbursed through FSA/HSA. Premiums Paid Directly by You_________________________ Dental _____________________________ Co-Pays ______________________________________ Vision _____________________________ Long Term Care Premium (You)___________________ Labs, X-Rays ________________________ Long Term Care Premium (Spouse)_________________ Prescriptions _________________________ Medical Mileage ________________________________ Amount contributed by you to your HSA: Family $ __________________ Single $ _______________ Amount contributed by your employer to your HSA: $ __________________ a) Do you currently have health insurance? Y/N ____ Coverage was in place for how many months? ________ b) Is it employer sponsored?______ c) Individual coverage? ______ Family coverage? ______ d) Are you receiving a tax credit/subsidy for your health insurance? ______ 7. INTEREST PAID BY YOU: (Provide 1098) Did you refinance? ______ What did you use the money for? ________________________________________ __________________________________ Mortgage Int. on Primary Residence _____________________________________ Interest on Other Non-Business Properties __________________________________ 2nd Mortgage/Heloc _____________________________________ Points Paid to Refinance 8. CHARITABLE CONTRIBUTIONS ALL CASH AND NON-CASH DONATIONS OF ANY SIZE MUST HAVE A SIGNED, DATED RECEIPT OR CANCELLED CHECK. Attach a separate piece of paper for non-cash donations including dates of donation, who items were donated to, the value at the time of donation, and how you determined value. For all cash donations over $250, please provide the receipt letter from charity. NON-CASH CONTRIBUTIONS: 1)____________________ Organization _________ Amount 3)__________________ Organization _______ Amount 2)___________________ Organization _________ Amount 4)__________________ Organization _______ Amount Page 2 CASH CONTRIBUTIONS: 1)___________________ Organization ________ Amount 4)____________________ Organization _______ Amount 2)___________________ Organization ________ Amount 5)____________________ Organization _______ Amount 3)___________________ Organization _______ _ Amount 6)____________________ Organization _______ Amount Total Volunteering Mileage______________ 9. MISCELLANEOUS DEDUCTIONS & EMPLOYEE EXPENSES ________________ Tax Preparer Fees __________________ Safe Deposit Fee ________________ Certain Legal Fees ____________________ Student Loan Interest ________________ Union Dues __________________ Professional Dues/Fees ________________ Subscriptions _____________________ Tools/Shoes ________________ Uniforms/Upkeep __________________ Continuing Education ________________ Job Hunting Expenses _____________________ Other 10. CHILD/DEPENDENT CARE EXPENSE ___________________ Provider Name _________________ SS#/TIN ___________________________________ Address ___________ Amount ___________________ Provider Name _________________ SS#/TIN __________________________________ Address ___________ Amount 11. COLLEGE EXPENSES: (Provide 1098-T) College expenses paid to a college/university: you, spouse, and dependents. _________________________ Student’s Name _________________________________ Name/State of Institution _______________ Yr. In School __________________________ Qualified Tuition/Fees __________________________________ Room/Board _______________ Supplies __________________________ Student’s Name __________________________________ Name/State of Institution _______________ Yr. In School __________________________ Qualified Tuition/Fees __________________________________ Room/Board _______________ Supplies 12. Total Contributions to the Colorado Scholars Choice 529 Plan: $________________ Page 3 13. IRA CONTRIBUTIONS YOU SPOUSE Do you wish to make an additional contribution for 2013? Roth _______________ __________________ ____________________ Traditional _______________ __________________ ____________________ SEP _______________ __________________ ____________________ 14. Do you or your spouse wish to designate $3 to the Presidential Campaign Fund? You ______ Spouse ______ 15. Qualified Educator Expenses: ________________ 16. Early Withdrawal Penalties: ________________ 17. ENERGY CREDITS: Qualifying windows, doors, roofing materials, and insulation. Solar, wind, or geothermal systems. Property: _______________________________________________________________ (provide receipt(s)). Amount of credit previously taken? __________________________________________ Page 4 17. SELF EMPLOYED INDIVIDUALS ONLY _________________________________ 1099 Misc. Self Employed Income __________________________________________ Self Employed Income not reported on 1099 Vehicle Information: ___________ _________________ Yr/Make/Model Date Placed in Service ____________ ____________________ _____________ Total Miles/Yr. Total Business Miles/Yr. Commuting Miles/Yr. Do you have a written mileage record? __________ Was vehicle available for personal use?___________ Is another vehicle available for personal use? _________ Parking Fees/Tolls___________________ Property Tax on vehicle _____________________________ ____________________ Legal/Professional Fees _______________ Subscriptions _______________ Gifts _____________________ * Meals/Entertainment ____________________ Office Supplies _______________ Commissions Pd. _____________ Equip. Purchase _____________________ Equip. Purchase Date(s) _____________________ Prior Yrs. Depreciation __________ Dues _____________ Internet Service _______________ Cell Phone/Pgr. ___________ ______________ Liab. Ins. Pd Wages/Contractors ___________ Advertising _____________ Continuing Ed _______________ Office Rent ___________ Utilities ___________ Airfare _____________ Food-Travel _______________ Hotel-Travel ____________________________ Transportation-Travel ___________ Tools ______________ Postage/Shipping __________________ Repairs/Maintenance ____________________________ Supplies/Other _____________________ Self Employed Health Ins. _____________________ Bank Charges ______________ Phone ____________________________ Cost Of Goods Sold/Inventory Office in the Home Expenses: Employees & Self Employed __________________ Square Footage/Home __________________ Square Footage/Office ______________ Cost of Home _____________________ Cost of Land __________________ Improvements __________________ Utilities/year ______________ Repairs _____________________ Mortgage Interest/Rent _____________________________ Home Maintenance Expense _____________________ Real Estate Taxes _______________________ Home Owners Insurance Would you like to use the optional method for home office deduction of $5/square foot of office space? Yes _______ No _______ Whichever is best _______. Page 5 Supplemental Income and Loss 18. Rental Real Estate & Royalties Location Address: A)_______________________________________ _________________________________________ B)________________________________________ __________________________________________ C)________________________________________ __________________________________________ Rent Income: Rents received Property A ____________ Property B ____________ Property C ____________ Expenses: Advertising ____________ ____________ ____________ Auto/Travel ____________ ____________ ____________ Cleaning/Maintenance ____________ ____________ ____________ Commissions ____________ ____________ ____________ Insurance ____________ ____________ ____________ Legal/Professional Fees ____________ ____________ ____________ Management Fees ____________ ____________ ____________ Mortgage Interest paid ____________ ____________ ____________ Other Interest ____________ ____________ ____________ Repairs ____________ ____________ ____________ Supplies ____________ ____________ ____________ Taxes ____________ ____________ ____________ Utilities ____________ ____________ ____________ Other (list) _______________ ____________ ____________ ____________ _______________ ____________ ____________ ____________ _______________ ____________ ____________ ____________ *Purchase Date: ____________ ____________ ____________ *Total Cost on date placed in service ____________ ____________ ____________ *Provide if new property/or new to us. Page 6