Personal Finance Final Exam Review Presentation

advertisement

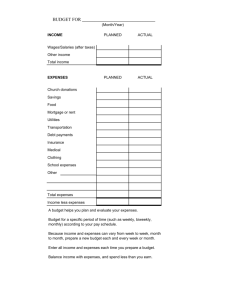

Personal Finance Final Exam Review Money Habit Want Need SMART GOAL SPECIFIC MEASURABLE ATTAINABLE RELEVANT TIME BOUND Goals Short Medium long Up to three months Three months to a year More than a year Parts of a Budget Income Expenses Fixed expenses Variable expenses Periodic or occasional expenses PYF Decide Steps 1. 2. 3. 4. 5. 6. Define your goal Establish your criteria Choose two to three good options Identify the pro’s and cons’ Decide what’s best Evaluate the results 6 steps to a winning plan 1. 2. 3. 4. 5. 6. Decide the time frame for tracking your income and expenses List your income Use your spending log to create categories and predict amounts for each of your expenses Subtract your total expenses from your total income Implement the plan Review and adjust he plan as needed. Stop Drop and Think Do I need this or do I want it? If I don’t need it, why do I want it? Exactly when will I use it? Can I find it for less somewhere else? What will I have to give up or put off by buying this now? credit 5 1. 2. 3. 4. 5. c’s of credit Capital Capacity Character Collateral conditions Triple D Approach to fraud Deter Detect Defend Pay Yourself First What is it, and how does apply to concepts you learned in the 5 booklets…? Items on a Paycheck Name Address Hours worked Rate of pay Payroll deductions Other deductions Payroll taxes Federal income tax State income tax FICA (medicare) Local income tax Investment Options Booklet 4 Savings Account Money Market Deposit Certificate of Deposit US Savings Bond Stock Mutual funds Real estate Collectibles Start your own business Risk tolerance Education options Associates Degree Bachelors Degree Masters Degree Doctorate Degree Benefits at a job Health insurance Vacation time 401K College reimbursement Company discounts Checking Account Parts of a check Name-address Pay to the order of.. Numerical value Writen out value Signature Memo line Bank routing number Your account number Bank Fees Monthly service fee Out of network atm fees Check fees Debit fees Nonsufficient funds Overdraft fees Od transfer fees Deposited item returned fee Stop payment fees Steps to Reconcile a Checking Account Page 21 1. Go through your statement and check off each transaction in your register 2. Jot down any bank fees you didn’t have listed in your register and subtract them from your register balance …see page 21 for the restbooklet 5 …see page 21 for the rest- booklet 5 Bank They sell financial services.. A bank is owned by its investors, and a paid board of directors runs the bank. Credit Union Are not for profit organizations offering the same financial services as banks and are owned by their customers, who are called members. Identify Theft the illegal use of someone else's personal information (as a Social Security number) in order to obtain money or credit 1. 2. 3. 4. 5. 6. 7. How thieves can steal from you? (booklet 5) Don’t trust – verify Keep PINS total under wraps Befriend a shredder Protect your PC Be skeptical of any offers Shop securely Surf safely in public