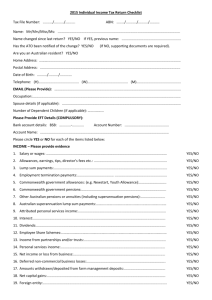

tax questionniare 2006-2007

advertisement

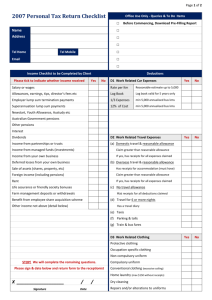

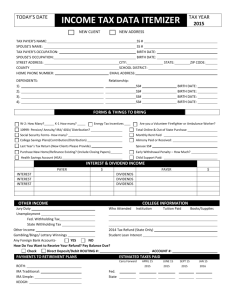

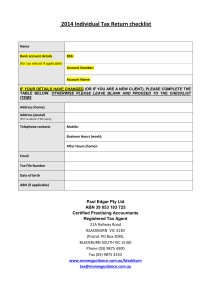

Fax: 02 9388 0077 info@crestfinancial.com.au TAX QUESTIONNIARE 2006-2007 Tax File Number: __________________________ ABN: ____________________________________ Name: Mr/Mrs/Ms/Miss _______________________________________________________ Residential Address: _______________________________________________________ Date of Birth: _______/_________/_________ Telephone : Work/Home ________________________________ Mobile __________________ Email: _________________________________________________________ Occupation: _________________________________________________________ Spouse Details: _________________________________________________________ (N/A if not applicable) Number of Dependants: _________________________________________________________ Please circle YES or NO for each of the items listed below: A tax consultant will go through this in detail during consultation. Fax: 02 9388 0077 info@crestfinancial.com.au INCOME 1. Salary or Wages Yes No 2. Allowances, earnings, tips, director’s fees etc Yes No 3. Lump sum payments Yes No 4. Eligible termination payments Yes No 5. Commonwealth of Australia government allowances like Newstart, youth allowance And Austudy payment 6. Commonwealth of Australia Government pensions and allowances Yes No 7. Other Australian pensions or annuities (including superannuation pensions) Yes No 8. Interest Yes No 9. Dividends Yes No 10. Income from partnerships and/or trusts Yes No 11. Net capital gains Yes No 12. Foreign source income (including foreign pensions) and foreign assets or property Yes No 13. Rental / Investment Property Yes No 14. Bonuses from a life assurance or friendly society policy Yes No 15. Other income (please specify) ___________________________________________________________________________ Yes No Yes No Fax: 02 9388 0077 info@crestfinancial.com.au Are you claiming the following deductions: D1. Work-related car expenses: Yes/No/ Need Advice Cents per kilometer method (max 5,000 kms) Yes No Log book method Yes No One –third actual expenses method Yes No 12% of actual cost method Yes No D2. Other work-related travel expenses: Yes/No/ Need Advice Employee domestic travel with reasonable allowance Yes No ____________________________________________________________________________ ____________________________________________________________________________ ____________________________________________________________________________ ____________________________________________________________________________ ____________________________________________________________________________ ____________________________________________________________________________ D3. Work-related uniform : Yes/No/ Need Advice Yes No Protective Clothing Yes No Occupation-specific clothing Yes No Compulsory uniform Yes No Laundry of uniform (up to $150 without receipts) Yes No Dry cleaning Yes No Other claims – mending/repairs, etc (please specify) Yes No ____________________________________________________________________________ ____________________________________________________________________________ ____________________________________________________________________________ ____________________________________________________________________________ ____________________________________________________________________________ ____________________________________________________________________________ ____________________________________________________________________________ ____________________________________________________________________________ ____________________________________________________________________________ D4. Work-related self-education expenses : Yes/No/ Need Advice Course taken at educational institution Union fees Yes No Course fees Yes No Book, stationary ___________________________________________________________________________ Depreciation Yes No Seminars Yes No Travel Yes No Yes No Other (please specify) ____________________________________________________________________________ ____________________________________________________________________________ ____________________________________________________________________________ D5. Other work-related expenses : Yes/No/ Need Advice Home office expenses Yes No Computer & Software Yes No Telephone/mobile Yes No Tools and equipment Yes No Subscription and union fees Yes No Journals/periodicals Yes No Depreciation of equipment Yes No sun protection products (i.e. sunscreen and sunglasses) Yes No Seminars and courses not at an education institution course fees Yes No travel Yes No other (please specify) Yes No ____________________________________________________________________________ Any other work deductions (please specify) Yes No ____________________________________________________________________________ D6. Low value pool deduction Yes No D7. Interest and dividend deductions Yes No D8. Gifts or donations Yes No D9. Deductible amount of undeducted purchase price Yes No D10. Cost of managing tax affairs Yes No D15. Other deductions (sickness income protection insurance, ATO interest etc) Yes No Tax offsets/rebates T1 Do you have a dependent spouse (without dependent child or student), a childhousekeeper or a housekeeper? These tax offsets may not be available where the taxpayer is eligible to claim FTB Part B. Yes No Family Tax benefit (FTB) Yes No Did you have care of a dependent child in 2006 Yes No Did you or your spouse receive FTB through the Family Assistance Office in 2005? T2 Are you a senior Australian? Male 65/Female 63 Yes No T3 Are you a pensioner Yes No T4 Superannuation pension/ETP annuity Yes No T5 Did you have private health insurance in 2006 Yes No T6 Did you have to pay for approved child care fees between 1/7/2004 to 30/06/2005 Yes No T7 Baby Bonus - Was your child born between 01/07/2001 & 01/07/2004 Yes No T9 Did you live in a remote zone or serve overseas with the defence force in 2005 Yes No T10 Did you have net medical expenses over $1,500? Yes No T11 Did you maintain a parent, spouse’s parent or invalid relative? Yes No T12 Landcare and water facility tax offset Yes No T13 Are you a mature age worker with net income from working of less than $58,000? Yes No T14 Entrepreneurs Tax offset available to a sole trader who elects STS or a person who received a distribution from a trust or partnership that was in STS with a group turnover of $75,000 or less Yes No Fax: 02 9388 0077 info@crestfinancial.com.au Tax Consultant please check 1. Medicare reduction based on family income 2. Medicare Surcharge based on Family Income 3. HECS Liability & Supp Loan 4. Tax Implications if the tax payer is a minor 5. If tax payer ceased full time education during the year 6. If the tax payer became a resident or ceased to be a resident for tax purposes during the year. 7. If PSI Legislation applies to the tax payer in business 8. Check if the client qualifies for Super Contribution from the Government.