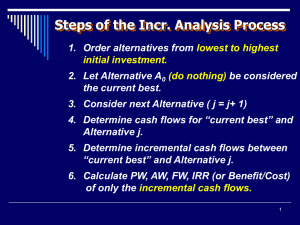

Incremental Analysis

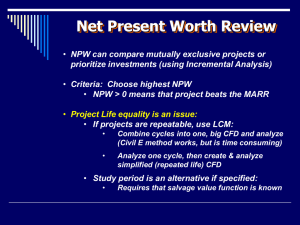

advertisement

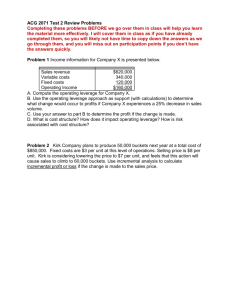

Incremental Analysis Ismu Kusumanto Pengertian Incremental analysis is used to find the impact of changes in costs or revenues, given a specific potential scenario. Decisions involving incremental analysis include the following: Sell or process further: Sell or process further issues often arise in industries which refine raw materials. The key question is whether the incremental revenues from a more highly refined product will at least offset the increased costs associated with additional processing Pengertian Make or buy: Should we make a component ourselves or farm out the work to someone else? Qualitative considerations may or may not override quantitative issues. For example, we may be able to subcontract work more economically than we can do it ourselves, but if the contractor is unable to maintain the necessary level of quality or meet delivery schedules, subcontracting may not be worthwhile. The impact of quality and/or delivery problems may not be quantifiable, thus making the whole business a judgment call. Pengertian Changes in production and/or technology: Modifications in production processes or acquisition of new machinery typically entail adjustments in costs. New machinery or a revised process may enhance efficiency in the use of labor and/or material. It is clearly important to know whether the improvements offset whatever incremental costs may be associated with the changes. Types of Incremental Analysis A number of different types of decisions involve incremental analysis. The more common types of decisions are whether to: 1) Accept an order at a special price. 2) Make or buy. 3) Sell or process further. 4) Retain or replace equipment. 5) Eliminate an unprofitable business segment. 6) Allocate limited resources. MANAGEMENT’S DECISION MAKING PROCESS Considers both financial and nonfinancial information Financial information Revenues and costs Overall profitability Nonfinancial information Effect of decision on employee turnover Environment Overall image of company Comparing Mutually Exclusive Alternatives Based on IRR • Issue: Can we rank the mutually exclusive projects by the magnitude of its IRR? n A1 A2 0 -$1,000 -$5,000 1 $2,000 $7,000 IRR 100% > 40% $818 < $1,364 PW (10%) Who Got More Pay Raise? Bill Hillary 10% Contemporary Engineering Economics, 5% Can’t Compare without Knowing Their Base Salaries Bill Hillary Base Salary $50,000 $200,000 Pay Raise (%) 10% 5% Pay Raise ($) $5,000 $10,000 For the same reason, we can’t compare mutually exclusive projects based on the magnitude of its IRR. We need to know the size of investment and its timing of when to occur. Incremental Investment n 0 1 ROR PW(10%) Project A1 -$1,000 $2,000 100% $818 Project A2 -$5,000 $7,000 40% $1,364 Incremental Investment (A2 – A1) -$4,000 $5,000 25% $546 • Assuming a MARR of 10%, you can always earn that rate from other investment source, i.e., $4,400 at the end of one year for $4,000 investment. • By investing the additional $4,000 in A2, you would make additional $5,000, which is equivalent to earning at the rate of 25%. Therefore, the incremental investment in A2 is justified. Incremental Analysis (Procedure) Step 1: Step 2: Step 3: Compute the cash flow for the difference between the projects (A,B) by subtracting the cash flow of the lower investment cost project (A) from that of the higher investment cost project (B). Compute the IRR on this incremental investment (IRRB-A ). Accept the investment B if and only if IRR B-A > MARR NOTE: Make sure that both IRRA and IRRB are greater than MARR. Example 7.10 - Incremental Rate of Return n 0 1 2 3 IRR B1 B2 -$3,000 -$12,000 1,350 4,200 1,800 6,225 1,500 6,330 25% 17.43% B2 - B1 -$9,000 2,850 4,425 4,830 15% Given MARR = 10%, which project is a better choice? Since IRRB2-B1=15% > 10%, and also IRRB2 > 10%, select B2. IRR on Increment Investment: Three Alternatives n 0 D1 D2 D3 -$2,000 -$1,000 -$3,000 1 1,500 800 1,500 2 1,000 500 2,000 3 800 500 1,000 IRR 34.37% 40.76% 24.81% Step 1: Examine the IRR for each project to eliminate any project that fails to meet the MARR. Step 2: Compare D1 and D2 in pairs. IRRD1-D2=27.61% > 15%, so select D1. D1 becomes the current best. Step 3: Compare D1 and D3. IRRD3-D1= 8.8% < 15%, so select D1 again. Here, we conclude that D1 is the best alternative. For example, assume the ABC Company is planning to expand its productive capacity. The plan consists of purchasing a new machine for $50,000 and disposing of the old machine without receiving anything for it. The new machine has a five-year life. The old machine has a five-year remaining life and a book value of $12,500. The new machine will reduce variable operating costs from $35,000 per year to $20,000 per year. Annual sales and other operating costs are shown below: At first glance, it appears that the new machine provides an increase in net income of $7500 per year. The book value of the present machine, however, is a sunk cost and is irrelevant in this decision. Furthermore, sales and fixed costs such as insurance and taxes are also irrelevant since they do not differ between the two alternatives being considered. Eliminating all the irrelevant costs leaves us with only the incremental costs, as follows: Savings in variable costs $15,000 Less: Increase in fixed costs 7,500 Net annual cash savings arising from the new machine $ 7,500 Practice Problem You are considering four types of engineering designs. The project lasts 10 years with the following estimated cash flows. The interest rate (MARR) is 15%. Which of the four is more attractive? Project A B C D Initial cost $150 $220 $300 $340 Revenues/ Year $115 $125 $160 $185 Expenses/ Year $70 $65 $60 $80 27.32 24.13 31.11 28.33 IRR (%) Example 7.13 Incremental Analysis for Cost-Only Projects Items CMS Option FMS Option Annual O&M costs: Annual labor cost $1,169,600 $707,200 832,320 598,400 3,150,000 1,950,000 Annual tooling cost 470,000 300,000 Annual inventory cost 141,000 31,500 Annual income taxes 1,650,000 1,917,000 Total annual costs $7,412,920 $5,504,100 Investment $4,500,000 $12,500,000 $500,000 $1,000,000 Annual material cost Annual overhead cost Net salvage value Incremental Cash Flow (FMS – CMS) n CMS Option FMS Option Incremental (FMS-CMS) 0 -$4,500,000 -$12,500,000 -$8,000,000 1 -7,412,920 -5,504,100 1,908,820 2 -7,412,920 -5,504,100 1,908,820 3 -7,412,920 -5,504,100 1,908,820 4 -7,412,920 -5,504,100 1,908,820 5 -7,412,920 -5,504,100 1,908,820 6 -7,412,920 -5,504,100 Salvage + $500,000 + $1,000,000 $2,408,820 Solution: PW (i) FMS CMS $8,000,000 $1,908,820( P / A, i,5) $2,408,820( P / F, i,6) 0 IRRFMS CMS 12.43% 15%, select CMS. Example 7.14 IRR Analysis for Projects with Different Lives MARR = 15% The incremental cash flows (Model B – Model A) result in a nonsimple and mixed investment. RICB–A = 50.68% > 15% Select Model B Summary Rate of return (ROR) is the interest rate earned on unrecovered project balances such that an investment’s cash receipts make the terminal project balance equal to zero. Rate of return is an intuitively familiar and understandable measure of project profitability that many managers prefer to NPW or other equivalence measures. Mathematically we can determine the rate of return for a given project cash flow series by locating an interest rate that equates the net present worth of its cash flows to zero. This break-even interest rate is denoted by the symbol i*. Internal rate of return (IRR) is another term for ROR that stresses the fact that we are concerned with the interest earned on the portion of the project that is internally invested, not those portions that are released by (borrowed from) the project. To apply rate of return analysis correctly, we need to classify an investment into either a simple or a nonsimple investment. A simple investment is defined as one in which the initial cash flows are negative and only one sign change occurs in the net cash flow, whereas a nonsimple investment is one for which more than one sign change occurs in the net cash flow series. Multiple i*s occur only in nonsimple investments. However, not all nonsimple investments will have multiple i*s either. For a pure investment, the solving rate of return (i*) is the rate of return internal to the project; so the decision rule is: If IRR > MARR, accept the project. If IRR = MARR, remain indifferent. If IRR < MARR, reject the project. IRR analysis yields results consistent with NPW and other equivalence methods. For a mixed investment, we need to calculate the true IRR, or known as the “return on invested capital.” However, if your objective is simply to make an accept or reject decision, it is recommended that either the NPW or AE analysis be used to make an accept/reject decision. To compare mutually exclusive alternatives by the IRR analysis, the incremental analysis must be adopted.