file pdf - Borsa Italiana

advertisement

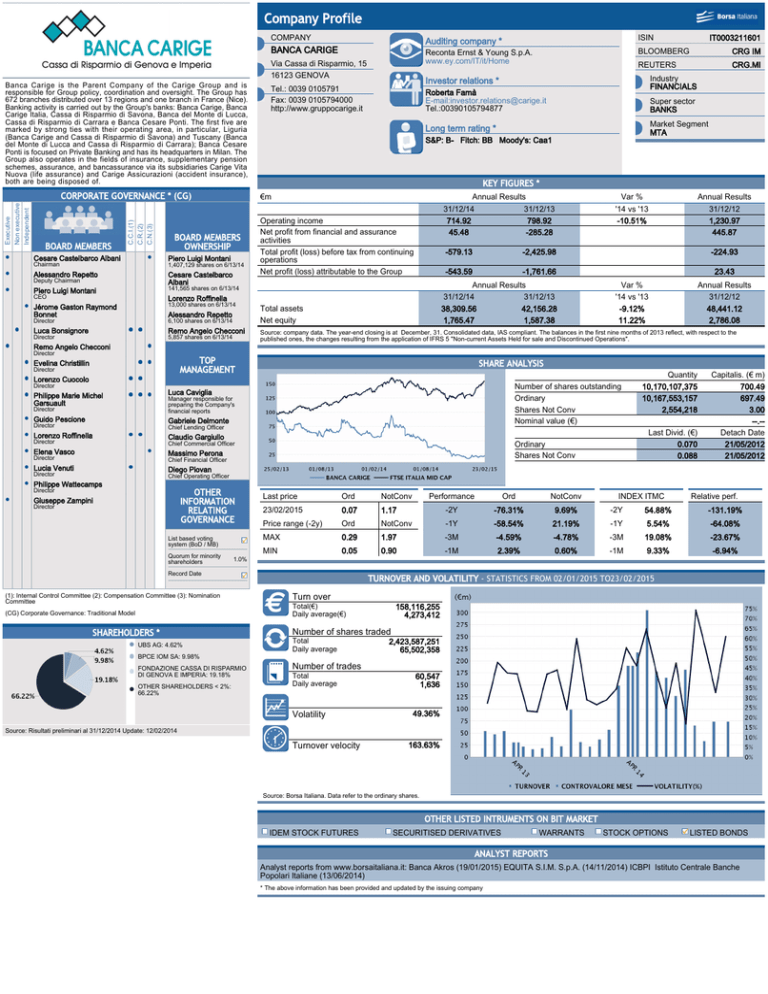

Company Profile COMPANY Auditing company * ISIN BANCA CARIGE Reconta Ernst & Young S.p.A. www.ey.com/IT/it/Home BLOOMBERG CRG IM REUTERS CRG.MI Via Cassa di Risparmio, 15 16123 GENOVA Banca Carige is the Parent Company of the Carige Group and is responsible for Group policy, coordination and oversight. The Group has 672 branches distributed over 13 regions and one branch in France (Nice). Banking activity is carried out by the Group's banks: Banca Carige, Banca Carige Italia, Cassa di Risparmio di Savona, Banca del Monte di Lucca, Cassa di Risparmio di Carrara e Banca Cesare Ponti. The first five are marked by strong ties with their operating area, in particular, Liguria (Banca Carige and Cassa di Risparmio di Savona) and Tuscany (Banca del Monte di Lucca and Cassa di Risparmio di Carrara); Banca Cesare Ponti is focused on Private Banking and has its headquarters in Milan. The Group also operates in the fields of insurance, supplementary pension schemes, assurance, and bancassurance via its subsidiaries Carige Vita Nuova (life assurance) and Carige Assicurazioni (accident insurance), both are being disposed of. BOARD MEMBERS C.C.I.(1) C.R.(2) C.N.(3) Executive Non executive Independent CORPORATE GOVERNANCE * (CG) Cesare Castelbarco Albani Piero Luigi Montani Chairman 1,407,129 shares on 6/13/14 Alessandro Repetto Deputy Chairman Cesare Castelbarco Albani Piero Luigi Montani 141,565 shares on 6/13/14 CEO Lorenzo Roffinella Jérome Gaston Raymond Bonnet 13,000 shares on 6/13/14 Director 6,100 shares on 6/13/14 Alessandro Repetto Luca Bonsignore Remo Angelo Checconi Director Roberta Famà E-mail:investor.relations@carige.it Tel.:00390105794877 5,857 shares on 6/13/14 Super sector BANKS Market Segment MTA Long term rating * S&P: B- Fitch: BB Moody's: Caa1 KEY FIGURES * €m BOARD MEMBERS OWNERSHIP Industry FINANCIALS Investor relations * Tel.: 0039 0105791 Fax: 0039 0105794000 http://www.gruppocarige.it IT0003211601 Annual Results 31/12/14 31/12/13 714.92 798.92 45.48 -285.28 Operating income Net profit from financial and assurance activities Total profit (loss) before tax from continuing operations Net profit (loss) attributable to the Group -579.13 -2,425.98 -543.59 -1,761.66 Annual Results 31/12/14 31/12/13 38,309.56 42,156.28 1,765.47 1,587.38 Total assets Net equity Var % '14 vs '13 -10.51% Annual Results 31/12/12 1,230.97 445.87 -224.93 23.43 Var % '14 vs '13 -9.12% 11.22% Annual Results 31/12/12 48,441.12 2,786.08 Source: company data. The year-end closing is at December, 31. Consolidated data, IAS compliant. The balances in the first nine months of 2013 reflect, with respect to the published ones, the changes resulting from the application of IFRS 5 "Non-current Assets Held for sale and Discontinued Operations". Remo Angelo Checconi Director TOP MANAGEMENT Evelina Christillin Director SHARE ANALYSIS Lorenzo Cuocolo Number of shares outstanding Ordinary Shares Not Conv Nominal value (€) Director Luca Caviglia Philippe Marie Michel Garsuault Director Manager responsible for preparing the Company's financial reports Guido Pescione Gabriele Delmonte Director Chief Lending Officer Lorenzo Roffinella Claudio Gargiullo Director Massimo Perona Director Chief Financial Officer Lucia Venuti Last Divid. (€) 0.070 0.088 Ordinary Shares Not Conv Chief Commercial Officer Elena Vasco Quantity 10,170,107,375 10,167,553,157 2,554,218 Capitalis. (€ m) 700.49 697.49 3.00 --.-Detach Date 21/05/2012 21/05/2012 Diego Piovan Director Chief Operating Officer Philippe Wattecamps Director OTHER INFORMATION RELATING GOVERNANCE Giuseppe Zampini Director List based voting system (BoD / MB) Quorum for minority shareholders Last price Ord NotConv Performance Ord NotConv 23/02/2015 0.07 1.17 -2Y -76.31% 9.69% -2Y INDEX ITMC 54.88% Relative perf. -131.19% Price range (-2y) Ord NotConv -1Y -58.54% 21.19% -1Y 5.54% -64.08% MAX 0.29 1.97 -3M -4.59% -4.78% -3M 19.08% -23.67% MIN 0.05 0.90 -1M 2.39% 0.60% -1M 9.33% -6.94% 1.0% Record Date (1): Internal Control Committee (2): Compensation Committee (3): Nomination Committee (CG) Corporate Governance: Traditional Model SHAREHOLDERS * UBS AG: 4.62% TURNOVER AND VOLATILITY - STATISTICS FROM 02/01/2015 TO23/02/2015 Turn over Total(€) Daily average(€) 158,116,255 4,273,412 Number of shares traded Total Daily average 2,423,587,251 65,502,358 BPCE IOM SA: 9.98% FONDAZIONE CASSA DI RISPARMIO DI GENOVA E IMPERIA: 19.18% OTHER SHAREHOLDERS < 2%: 66.22% Number of trades Total Daily average 60,547 1,636 A Volatility Source: Risultati preliminari al 31/12/2014 Update: 12/02/2014 49.36% A Turnover velocity 163.63% Source: Borsa Italiana. Data refer to the ordinary shares. OTHER LISTED INTRUMENTS ON BIT MARKET IDEM STOCK FUTURES SECURITISED DERIVATIVES WARRANTS STOCK OPTIONS LISTED BONDS ANALYST REPORTS Analyst reports from www.borsaitaliana.it: Banca Akros (19/01/2015) EQUITA S.I.M. S.p.A. (14/11/2014) ICBPI Istituto Centrale Banche Popolari Italiane (13/06/2014) * The above information has been provided and updated by the issuing company