compound interest

advertisement

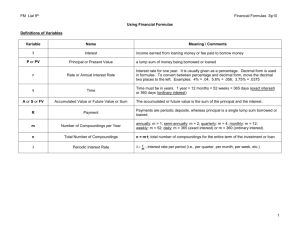

Finance Workshop Friday, March 26, 2010 3:15pm – 4:15pm PS – A103 Anthony D’Alesandro Audience • Students seeking help with finance problems are primarily taking MAT142. • Remember MAT142 students are not math/science majors. They have trouble/fear of formulas. • The MAT142 students need to be reminded on how to correctly input formulas into a calculator. The order of operations needs to stressed. • Some MAT117 and MAT170 students use one or two finance formulas when solving exponential equations. Simple Interest • When you deposit money into a savings at a bank you expect the bank to pay you for the privilege of saving your money with them. This extra money is called interest. • Interest is also paid by a borrower to a lender for the privilege of using money. • The simple interest I on a principal (present value) P at an annual interest rate r for t years is I = Prt. • The balance or future value F is given by F = P + I = P + Prt = P(1 + rt). • Note interest is money, interest rate is a percentage. • Note future value is also known as accumulated value and may use the letter A in the formulas. Add-on Interest • Add – on interest is a way of calculating interest used by car dealerships, appliance stores, furniture stores etc. • The lender computes the simple interest on the loan amount and adds that on to the loan amount so that the interest is distributed equally over each payment. • Webwork Example: Katie buys a three-year old Civic from a car dealer for $8000. She puts $400 down and finances the rest through the dealer at 16% add-on interest. If she agrees to make 48 monthly payments, find out the size of each payment. Solution: F = P(1 + rt) = 7600(1+.16*4) = $12,464 monthly payment is F/48 = $259.67 • Remember time is in years thus 48 months is 4 years. Also ther can be fractional years 10 months is 10/12 years, 180 days is 180/365 years. Credit Card Finance Charge • Everyone who has a credit card knows that if they do not pay-off their balance each month they will be assessed a monthly finance charge. How is this computed??? • Credit card companies use the average daily balance. The lender charges interest for the actual number of days an amount was owed on the bill. • Let’s look at John F. Brown’s credit card statement. The APR is 21%. • He’s carrying a balance of $287.84. • On June 12 he got an oil change and for his car. This cost $45.60. • He made a payment of $150 on June 18. • He then got gasoline for $20 on June 22. • Then he got some PS-2 games for $78.50 on July 3. • The period for this credit card is from June 10 to July 9; 30 days. Table summarizing credit card activity Days Time period Daily Balance June 10 – June 11 2 $287.84 $287.84 June 12 – June 17 6 $287.84 + $45.60 $333.44 June 18 – June 21 4 $333.44 – $150.00 $183.44 June 22 – July 2 11 $183.44 + $20.00 $203.44 July 3 – July 9 7 $203.44 + $78.50 $281.94 Finance Charge Calculations • Avg. Daily Balance = [2(287.84)+6(333.44)+4(183.44)+11(203.44)+7(281. 94)]/(2 + 6 + 4 + 11 + 7) ADB = 7521.50/30 = $250.72 • Instead of using the annual percentage rate (APR), we use the daily percentage rate for this account which is .21/365. Also the time will be measured in days hence t = 30. Use the simple interest formula to compute the finance charge. • Finance charge = 250.72 x (.21/365) x 30 = $4.33 • The new balance on John’s credit card will be $281.94 + $4.33 = $286.27 Compound Interest • Re-investing your interest income from an investment makes your money grow faster over time! This is what compound interest does. • Compound interest uses the same information as simple interest, but what is new is the frequency of compounding n. • n=1 annually, n=2 semi-annually, n=4 quarterly, n=12 monthly, n=52 weekly, n=365 daily. • If P represents the present value, r the annual interest rate, t the time in years, and n the frequency of compounding, then the future value is given by the formula: F = P( 1 + r/n)nt • NOTE: some textbooks use i instead of r/n. Students will just blindly use the formula and assume that i is the same as r. They do not realize that i is the periodic interest rate, not the annual interest rate. • MAT117 and MAT170 students use the compound interest formula as an application for solving exponential equations. Compound Interest - Webwork • When Mike was born his grandparents deposited $6000 into a special account for Mike's college education earning 6½% interest compounded daily. a. How much will be in the account when Mike is eighteen? SOLUTION: F = 6000(1 + .065/365)(365*18) = $19,329.94. b. On becoming eighteen, Mike arranges for the monthly interest to be sent to him, how much would be received each 30-day month? SOLUTION: Now the answer to part a. becomes the present value in part b. The time is now 30/365 years. Interest = F – P. F = 19329.94(1 + .065/365)(365*30/365) = $19,433.48. Interest = F – P = $19,433.48 – $19,329.94 = $103.54 Annual Yield • To compare different savings plans, you need to have a common basis for making the comparisons. • The annual yield of a compound interest investment is the simple interest rate that has the same future value the compound rate would have in one year. • The formula for yield is y = (1 + r/n)n – 1. • Find the annual yield for an investment that has an annual interest rate of 8.4% compounded monthly. • ANSWER: y = (1 + .084/12)12 – 1 • y = (1.007)12 – 1 = 0.087310661 = 8.73% Continuously compounded interest and yield • These formulas may be used in MAT117 or MAT170, not likely encountered in MAT142. • What would happen if we let the frequency of compounding get very large. That is we would compound not just every hour, or every minute or every second but for every millisecond! • What happens is that the expression (1 +r/n)nt goes to ert. This e is the famous Euler number. It’s value is the irrational number 2.7182818 … • The future value formula is F = Pert. • The annual yield for continuously compounded interest is y = er – 1. • Given a principal of $32,000 we will invest the money in an account that has 5.2% annual interest compounded continuously for 3 years. What is the future value? • ANSWER: F = 32000e(.052)(3) = $37,402.44 • What is the yield for this investment? • ANSWER: y = e.052 – 1 = 0.05337 = 5.34% Annuities • Let’s say you want to save money to go on a vacation, or you want to save money now for your baby’s college education. • A strategy for saving a little bit of money in the present and having a big payoff in the future is called an annuity. • An annuity is an account in which equal regular payments are made. • There are two basic questions with annuities: – Determine how much money will accumulate over time given that equal payments are made. – Determine what periodic payments will be necessary to obtain a specific amount in a given time period. • ORDINARY ANNUITY F pmt 1 nr nt 1 r n • ANNUITY DUE – receives one more period of compounding than the ordinary annuity so the formula is r nt F pmt 1 n r n 1 1 nr Annuities - Webwork • John recently set up a TDA (tax-deferred annuity) to save for his retirement. He arranged to have $350 taken out of each of his monthly checks; it will earn 12½% interest. He just had his thirty-ninth birthday, and his ordinary annuity comes to term when he is sixty-five. a. Find the future value of the account. SOLUTION: Assume an ordinary annuity. F 350 1 0 . 125 12 * 26 12 1 $ 818 ,510 . 00 0 . 125 12 b. Find John's total contribution to the account. SOLUTION: Total contribution = number of payments x payment Total contribution = n x t x pmt = 12 x 26 x 350 = $109,200.00 c. Find the total interest earned on the account. SOLUTION: Interest = Future Value – Total contribution Interest = F – n x t x pmt = $818,510.00 - $109,200.00 = $709,310.00 Sinking Fund • A sinking fund is when we know the future value of the annuity and we wish to compute the monthly payment. • For an ordinary unity this formula is pmt F r n 1 nr nt 1 • For an annuity due the formula is pmt F r n 1 1 r n r n nt 1 • A company establishes a sinking fund to pay off a debt of $140000 due in 10 years. The sinking fund will earn 11% compounded weekly. Find the amount of the weekly deposits into the fund. pmt 140000 0 . 11 52 1 0 . 11 52 *10 52 1 $ 148 . 03 Amortized Loans • The word amortize comes from the Latin word admoritz which means “bring to death”. • What we are saying is that we want to bring the debt to death! More gently it is retiring the debt. • The important factors related to an amortized loan are the principal, annual interest rate, the length of the loan and the monthly payment. • Types of problems we use this formula for are car loans, mortgages. • The monthly payment formula is basically derived from the equation future value of annuity = future value of loan amount. • Let P be present value or full amount of loan, r is the annual interest rate, t is the length of the loan and PMT is the monthly payment. PMT P r 12 [( 1 1 r 12 ) 12 t r 12 t 12 1] Mortgage Patty puts 20% down on a $280000 home and finances the balance through a 30 year mortgage at 6.9% compounded monthly. a) How much is financed? SOLUTION: actual amount – down payment = $280,000 – 0.20x280,000 = $224,000 b) What are Patty's monthly payments? PMT 224000 [( 1 0 . 069 12 0 . 069 12 1 ) 12 * 30 0 . 069 12 12 *30 1] $ 1, 475 . 26 c) How much will she pay in interest? SOLUTION: payment x 12 x 30 – amount financed 1475.26 x 12 x 30 – 224000 = $307,093.60 d) If she decided to sell the home after 7 years, how much would she still owe on the loan? SOLUTION: Compute the future value of compound interest on $224,000 for seven years. Next compute the future value of an ordinary annuity with monthly payment of $1,475.26. Lastly take the difference of the two future values. F 224000 1 0 . 069 12 * 7 12 $ 362 , 586 . 40 F 1475 . 26 1 0 . 069 12 12 *7 1 $ 158 , 735 . 20 0 . 069 12 Amount remaining is $362,586.40 – $158,735.20 = $203,851.20 e) If the house is worth $336,813 in 7 years, how much equity does she have? Equity is Value of home – amount owed on mortgage = $336,813 – $203,851.20 = $132,961.80. Amortized Loan Schedule • • • • • • • • • • • • Chart the history of an amortized loan of $1000 for three months at 12% interest, with a monthly payment of $340. When the 1st payment is made 1/12 of a year has gone by, so the interest is $1000 x .12 x 1/12 = $10. The payment first goes toward paying the interest, then the rest is applied to the unpaid balance. The net payment is $340 - $10 = $330. The new balance is $1000 - $330 = $670. Now we calculate the interest on the remaining balance. $670 x .12 x 1/12 = $6.70. The net payment is $340 - $6.70 = $333.30. The new balance is $670 - $333.30 = $336.70. Once again we calculate the interest on the remaining balance. $336.70 x .12 x 1/12 = $3.37. Thus the last payment has to cover the interest and the remaining balance. This is $3.37 + $336.70 = $340.07. Thus the last payment is $340.07 Payment Interest $340.00 $340.00 $340.07 $10.00 $6.70 $3.37 Net Payment New Balance $330.00 $333.30 $336.70 $670.00 $336.70 $0.00