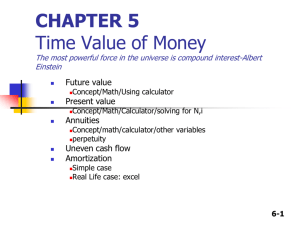

Chapter 6 Time Value of Money

advertisement

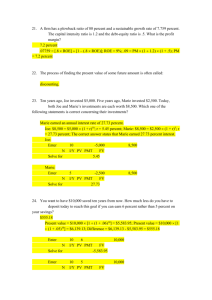

CHAPTER 5 Time Value of Money The most powerful force in the universe is compound interest-Albert Einstein Future value Concept/Math/Using calculator Present value Concept/Math/Calculator/solving for N,i Annuities Concept/math/calculator/other variables perpetuity Uneven cash flow Amortization Simple case Real Life case: excel 6-1 What is the future value (FV) of an initial $100 after 3 years, if I/YR = 10%? FV: The amount to which a cash flow or series of cash flows will grow over a give period of time when compounded at a given interest rate. Finding the FV of a cash flow or series of cash flows when compound interest is applied is called compounding. FV can be solved by using the arithmetic, financial calculator, and spreadsheet methods. 0 1 2 3 10% 100 FV = ? 6-2 Solving for FV: The arithmetic method After 1 year: FV1 = PV ( 1 + i ) = $100 (1.10) = $110.00 After 2 years: 2 2 FV2 = PV ( 1 + i ) = $100 (1.10) =$121.00 After 3 years: 3 3 FV3 = PV ( 1 + i ) = $100 (1.10) =$133.10 After n years (general case): n FVn = PV ( 1 + i ) n PV= FVn /( 1 + i ) 6-3 Solving for FV: The calculator method Calculator settings Solves the general FV equation. Requires 4 inputs into calculator, and will solve for the fifth. (Set to P/YR = 1 and END mode.) INPUTS OUTPUT 3 10 -100 0 N I/YR PV PMT FV 133.10 6-4 What is the present value (PV) of $100 due in 3 years, if I/YR = 10%? PV: The value today of a future cash flow or series of cash flows Finding the PV of a cash flow or series of cash flows when compound interest is applied is called discounting (the reverse of compounding). 0 1 2 3 10% PV = ? 100 6-5 Solving for PV: The arithmetic method Solve the general FV equation for PV: PV = FVn / ( 1 + i )n PV = FV3 / ( 1 + i )3 = $100 / ( 1.10 )3 = $75.13 6-6 Solving for PV: The calculator method Solves the general FV equation for PV. Exactly like solving for FV, except we have different input information and are solving for a different variable. INPUTS OUTPUT 3 10 N I/YR PV 0 100 PMT FV -75.13 6-7 Solving for N: If interest is 20% per year, how long before your savings double? Solves the general FV equation for N. Same as previous problems, but now solving for N. INPUTS N OUTPUT 20 -1 0 2 I/YR PV PMT FV 3.8 6-8 Solving for I: What interest rate would cause $100 to grow to $125.97 in 3 years? Solves the general FV equation for I. INPUTS 3 N OUTPUT I/YR -100 0 125.97 PV PMT FV 8 6-9 Annuity: A series of payments of an equal amount at fixed intervals for a specified number of periods Ordinary Annuity 0 i% 1 2 3 PMT PMT PMT 6-10 Solving for FV of annuity: 3-year ordinary annuity of $100 at 10% Timeline and formula: Using calculator INPUTS OUTPUT 3 10 0 -100 N I/YR PV PMT FV 331 6-11 Solving for PV: 3-year ordinary annuity of $100 at 10% $100 payments still occur at the end of each period, but now there is no FV. INPUTS OUTPUT 3 10 N I/YR PV 100 0 PMT FV -248.69 6-12 Application of annuity Suppose you are 60, expect to live for another 20 years. What is the present value of an annuity with a annual payment of $100,000, assuming a 8% annual interest rate? Saving for retirement Computing PMT, I, and N Combining annuity with lump sum 6-13 Perpetuity Perpetuity: A stream of equal payments expected to continue forever PV of Perpetuity = PMT/I 6-14 What is the PV of this uneven cash flow stream? 0 1 2 3 4 100 300 300 -50 10% 90.91 247.93 225.39 -34.15 530.08 = PV 6-15 Using calculator (quick guide p13) CF mode Clear previous work: 2nd+CLR WORK Two major steps Input CF and frequency Press NPV, input I, arrow down,then CPT Note: consecutive cash flows of the same amount can be entered as one cash flow with frequency higher than one Example: Quick guide page 13 6-16 Solving for PV: Uneven cash flow stream Input cash flows in the calculator’s “CFLO” register: CF0 CF1 CF2 CF3 CF4 = = = = = 0 100 300 300 -50 press NPV, Enter I/YR = 10, arrow down, press CPT to get NPV = $530.09. (Here NPV = PV.) 6-17 Loan amortization Amortization tables are widely used for home mortgages, auto loans, business loans, retirement plans, etc. Financial calculators and spreadsheets are great for setting up amortization tables. EXAMPLE: Construct an amortization schedule for a $1,000, 10% annual rate loan with 3 equal payments. 6-18 Step 1: Find the required annual payment All input information is already given, just remember that the FV = 0 because the reason for amortizing the loan and making payments is to retire the loan. INPUTS OUTPUT 3 10 -1000 N I/YR PV 0 PMT FV 402.11 6-19 Step 2: Find the interest paid in Year 1 The borrower will owe interest upon the initial balance at the end of the first year. Interest to be paid in the first year can be found by multiplying the beginning balance by the interest rate. INTt = Beg balt (i) INT1 = $1,000 (0.10) = $100 6-20 Step 3: Find the principal repaid in Year 1 If a payment of $402.11 was made at the end of the first year and $100 was paid toward interest, the remaining value must represent the amount of principal repaid. PRIN= PMT – INT = $402.11 - $100 = $302.11 6-21 Step 4: Find the ending balance after Year 1 To find the balance at the end of the period, subtract the amount paid toward principal from the beginning balance. END BAL = BEG BAL – PRIN = $1,000 - $302.11 = $697.89 6-22 Constructing an amortization table: Repeat steps 1 – 4 until end of loan Year BEG BAL PMT INT PRIN END BAL $302 $698 1 $1,000 $402 $100 2 698 402 70 332 366 3 366 402 37 366 0 1,206.34 206.34 1,000 - TOTAL Interest paid declines with each payment as the balance declines. What are the tax implications of this? 6-23 Illustrating an amortized payment: Where does the money go? $ 402.11 Interest 302.11 Principal Payments 0 1 2 Constant payments. Declining interest payments. Declining balance. 3 6-24 Power of compounding The most powerful force in universe: Compounding Compare total return at Low rate, inflation rate, stock market return rate and high rate Short vs. Long horizon 6-25 Power of compounding Investing is not a hit-and-run. Investing for the long run! Time has value and time is on your side. The snow ball effect Long slope Steeper slope Consistent slope 6-26 Using TV table (optional) FV of Lump Sum PV of Lump Sum FV of annuity PV of annuity 6-27