Math 125 - Basic Calculus

advertisement

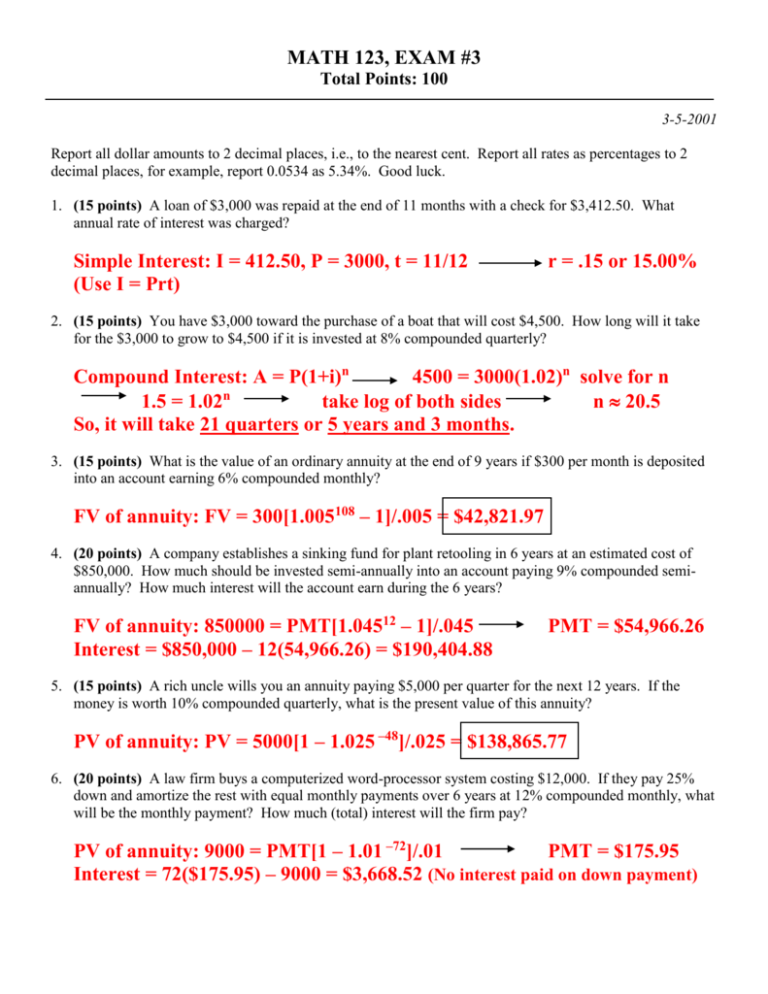

MATH 123, EXAM #3 Total Points: 100 3-5-2001 Report all dollar amounts to 2 decimal places, i.e., to the nearest cent. Report all rates as percentages to 2 decimal places, for example, report 0.0534 as 5.34%. Good luck. 1. (15 points) A loan of $3,000 was repaid at the end of 11 months with a check for $3,412.50. What annual rate of interest was charged? Simple Interest: I = 412.50, P = 3000, t = 11/12 (Use I = Prt) r = .15 or 15.00% 2. (15 points) You have $3,000 toward the purchase of a boat that will cost $4,500. How long will it take for the $3,000 to grow to $4,500 if it is invested at 8% compounded quarterly? Compound Interest: A = P(1+i)n 4500 = 3000(1.02)n solve for n 1.5 = 1.02n take log of both sides n 20.5 So, it will take 21 quarters or 5 years and 3 months. 3. (15 points) What is the value of an ordinary annuity at the end of 9 years if $300 per month is deposited into an account earning 6% compounded monthly? FV of annuity: FV = 300[1.005108 – 1]/.005 = $42,821.97 4. (20 points) A company establishes a sinking fund for plant retooling in 6 years at an estimated cost of $850,000. How much should be invested semi-annually into an account paying 9% compounded semiannually? How much interest will the account earn during the 6 years? FV of annuity: 850000 = PMT[1.04512 – 1]/.045 Interest = $850,000 – 12(54,966.26) = $190,404.88 PMT = $54,966.26 5. (15 points) A rich uncle wills you an annuity paying $5,000 per quarter for the next 12 years. If the money is worth 10% compounded quarterly, what is the present value of this annuity? PV of annuity: PV = 5000[1 – 1.025 –48]/.025 = $138,865.77 6. (20 points) A law firm buys a computerized word-processor system costing $12,000. If they pay 25% down and amortize the rest with equal monthly payments over 6 years at 12% compounded monthly, what will be the monthly payment? How much (total) interest will the firm pay? PV of annuity: 9000 = PMT[1 – 1.01 –72]/.01 PMT = $175.95 Interest = 72($175.95) – 9000 = $3,668.52 (No interest paid on down payment)