Math Review Sheet plus Solutions

advertisement

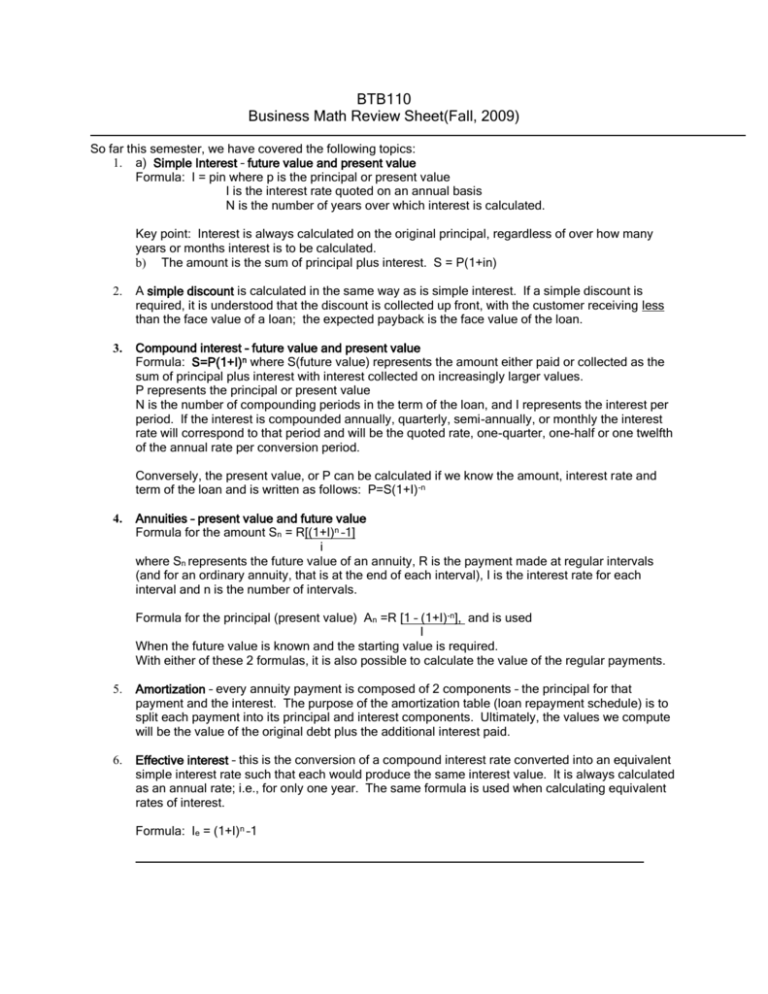

BTB110 Business Math Review Sheet(Fall, 2009) So far this semester, we have covered the following topics: 1. a) Simple Interest – future value and present value Formula: I = pin where p is the principal or present value I is the interest rate quoted on an annual basis N is the number of years over which interest is calculated. Key point: Interest is always calculated on the original principal, regardless of over how many years or months interest is to be calculated. b) The amount is the sum of principal plus interest. S = P(1+in) 2. A simple discount is calculated in the same way as is simple interest. If a simple discount is required, it is understood that the discount is collected up front, with the customer receiving less than the face value of a loan; the expected payback is the face value of the loan. 3. Compound interest – future value and present value Formula: S=P(1+I)n where S(future value) represents the amount either paid or collected as the sum of principal plus interest with interest collected on increasingly larger values. P represents the principal or present value N is the number of compounding periods in the term of the loan, and I represents the interest per period. If the interest is compounded annually, quarterly, semi-annually, or monthly the interest rate will correspond to that period and will be the quoted rate, one-quarter, one-half or one twelfth of the annual rate per conversion period. Conversely, the present value, or P can be calculated if we know the amount, interest rate and term of the loan and is written as follows: P=S(1+I)-n 4. Annuities – present value and future value Formula for the amount Sn = R[(1+I)n –1] i where Sn represents the future value of an annuity, R is the payment made at regular intervals (and for an ordinary annuity, that is at the end of each interval), I is the interest rate for each interval and n is the number of intervals. Formula for the principal (present value) An =R [1 – (1+I)-n], and is used I When the future value is known and the starting value is required. With either of these 2 formulas, it is also possible to calculate the value of the regular payments. 5. Amortization – every annuity payment is composed of 2 components – the principal for that payment and the interest. The purpose of the amortization table (loan repayment schedule) is to split each payment into its principal and interest components. Ultimately, the values we compute will be the value of the original debt plus the additional interest paid. 6. Effective interest – this is the conversion of a compound interest rate converted into an equivalent simple interest rate such that each would produce the same interest value. It is always calculated as an annual rate; i.e., for only one year. The same formula is used when calculating equivalent rates of interest. Formula: Ie = (1+I)n –1 Sample Problems 1.A loan of $6500 is to be settled by 4 equal payments due today, and one year, 2 years, and 3 years from now respectively. Determine the size of the equal payments if money is worth 10% and the agreed focal date is today. X x x x Now =$6500 1 2 3 We know then $6500 value is in today’s dollars, and that all four payments must be equal, one of which is to be made today. We therefore need to know the present value of the other three payments. Solve for the present value of the payments using simple interest. $6500 = x + x + (1+ 10%*1) x + (1+10%*2) x (1+10%*3) 6500*(1.716) = 1.716x + 1.56x + 1.43x +1.32x 11,154 = 6.026x X = $1850.98 2.Adam borrowed $5000 at 10% compounded semi-annually. He repaid $2000 after 2 years and $2500 after 3 years. How much will he owe after 5 years? Because this is a compound interest problem, the rate we will use is 10%/2 = 5%. The number of times interest is calculated is 2 years*2 = 4; 3years*2 = 6, 5 years *2 = 10.Because we know the value of the debt at the outset, we deal with the present value of the payouts. $5000 = 2500 (1+5%)-4 +2000(1+5%)-6 + x(1+5%)-10 = 2500 (.8227) +2000(.7462) + X(.6139) =2056.75 + 1492.40 + .6139X $1450.85 = .6139X X = $2363.33 $5000 $5000 2 $2500 3 5 $2000 x 3.Olga deposited $800 in an investment certificate paying 9% compounded semi-annually. On the same day, her sister, Ursula, deposited $600 in an account paying 7% semi-annually. To the nearest day, when will the future value of Olga’s investment be equal to twice the value of Ursula’s investment? Do not solve this problem 4.You won $100,000 in a lottery and you would like to set some of that sum aside for ten years. After 10 years, you would like to receive $2400 at the end of every three months for eight years. How much of your winnings must you set aside if interest is 5.5% compounded quarterly? x Compound interest problem (FV) I = 5.5% comp. quarterly i = 5.5%/4 = .013875 n = 10 yrs. *4 = 40 Annuity Problem (PV) 10 n = 8 yrs. *-4 = -32 If you are reading this problem for comprehension, the situation is this: You have money on deposit that will accumulate to a set amount after 10 years – P+I. Over the next 8 years, the money will be withdrawn in equal installments and at equal intervals. Essentially, the size of the account after earning compound interest for 10 years represents the value that was withdrawn over eight years. They are equal. P(1+.013875)40 = R [1 – (1.013875)-32] .013875 = 2400(.3605/.013875) = 2400*25.98 = $62,356.47 ($61,677.63 using only calculator) P = 62,356.47/1.7353 = $35,934.12 ($35,542.76 using only calculator) Note that you will get greater precision with more decimal places. 5.What deposit must be made at the end of each quarter for 15 years to accumulate to $20,000 at 6% compounded quarterly? Problem wants the future value of an annuity. Sn = R [ (1+1.5%)60 –1]/1.5% 20,000 = R[96.21] R= $207.87 6.A debt of $30,000 with interest of 12% compounded quarterly is to be repaid by equal payments at the end of each quarter for seven years. Compute the size of the quarterly payments, and lay out the amortization schedule for 3 quarters. I =12% compounded quarterly 12/4 = 3% N = 7 years * 4times/yr = 28 An = $30,000=PV of debt R=? R = $1598.80 (using business calculator) $30,000 = R [1-(1.03)-28 /.03] = R[.4371/.03] = R*18.76 R = $1599.15 doing the calculations Payment # Amt. Paid Interest Pd. I = .02 Principal Repaid 0 1 2 3 1599.15 1599.15 1599.15 600 870.03 848.15 999.15 729.12 751.00 Outstanding Princ.Balance 30,000 29,000.85 28,271.73 27520.73 If the answers I show vary from yours somewhat, it is due to the lack of precision that comes from rounding.