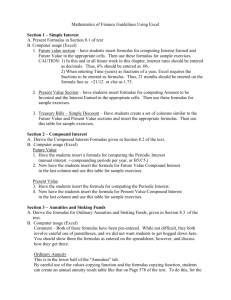

Using Financial Formulas (MS)

advertisement

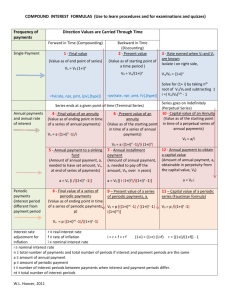

FM Lial 9th Financial Formulas Sp10 Using Financial Formulas Definitions of Variables Variable Name Meaning / Comments I Interest P or PV Principal or Present Value r Rate or Annual Interest Rate Interest rate for one year. It is usually given as a percentage. Decimal form is used in formulas. To convert between percentage and decimal form, move the decimal two places to the left. Examples: 4% = .04; 5.6% = .056; 3.75% = .0375 t Time Time must be in years. 1 year = 12 months = 52 weeks = 365 days (exact interest) or 360 days (ordinary interest) A or S or FV Accumulated Value or Future Value or Sum R Payment m Number of Compoundings per Year n Total Number of Compoundings i Periodic Interest Rate income earned from loaning money or fee paid to borrow money a lump sum of money being borrowed or loaned The accumulated or future value is the sum of the principal and the interest. Payments are periodic deposits, whereas principal is a single lump sum borrowed or loaned. annually: m = 1; semi-annually: m = 2; quarterly: m = 4; monthly: m = 12; weekly: m = 52; daily: m = 365 (exact interest) or m = 360 (ordinary interest) n = m∙t; total number of compoundings for the entire term of the investment or loan i r m ; interest rate per period (i.e., per quarter, per month, per week, etc.) 1 FM Lial 9th Financial Formulas Sp10 Formulas Formula When to Use I = Prt Use to find the simple interest earned on an investment or paid on a loan. Loans with terms of one year or less usually charge simple interest. Simple interest is charged or earned only on the principal and not on past interest. If you know any three of the variables in the formula, you can solve for the fourth. A = P(1 + rt) Use to find the accumulated / future value of a simple interest loan or investment. P A 1 rt Use to find the principal / present value of a simple interest loan or investment. I=A–P r A P1 m mt Use to find the total interest earned on an investment or paid on a loan Use to find the accumulated / future value of an account earning compound interest. The principal is a single lump sum. No periodic payments are made. P(1 i)n Hints To solve for r in the compound interest formula: 1) Divide both sides by P. 2) Take the nth (n = m∙t) root of both sides. 3) Subtract one from both sides. 4) Multiply both sides by m. To solve for t in the compound interest formula: 1) Divide both sides by P. 2) Take the natural log (ln) of both sides. 3) Rewrite the right side by bringing the exponent down in front of the logarithm. 4) Isolate t by dividing both sides by m ln 1 mr . P r A 1 mt m r 1 m A mt r re 1 m m 1 A 1 in A 1 in Use to find the principal / present value of an account earning compound interest. The principal is a single lump sum. No periodic payments are involved. Use to find the effective rate / annual percentage rate (APR) for a given nominal / stated rate. An effective rate is a simple interest rate that will yield the same result as the stated compound interest rate. 2 FM Lial 9th Financial Formulas Sp10 Formula When to Use mt 1 r 1 m 1 in 1 S R R i r m RS r m mt 1 r 1 m S Use to find the future value of an ordinary annuity. With an ordinary annuity, payments are made at the end of each time period. Use to find the payment for the future value of an ordinary annuity. This is also known as a sinking fund payment. A sinking fund is an account set up to receive periodic deposits in order to accumulate a specified amount of money in a specified amount of time. i 1 i 1 n mt 1 1 r 1 m 1 in1 1 S R R R R i r m mt 1 1 r m 1 1 in P R R i r m R P r m i P n mt 1 1 i 1 1 r m Use to find the future value of an annuity due. With an annuity due, payments are made at the beginning of each time period. Use to find the present value of an ordinary annuity. The present value of an annuity is the single lump sum that would produce the same final balance as the annuity. Use this to find the payment for the present value of an ordinary annuity. This is also the formula for finding the payment for an amortized loan. A loan is amortized if both the principal and the interest are paid by a sequence of equal periodic payments. 3