Reporting and Interpreting

Liabilities

Chapter 09

Part 2 – Long-Term Liabilities and Present Value

Techniques

McGraw-Hill/Irwin

Copyright © 2011 by The McGraw-Hill Companies, Inc. All rights reserved.

Long-Term Liabilities

Creditors often require the borrower to pledge

specific assets as security for the long-term

liability.

Maturity = 1 year or less

Maturity > 1 year

Current

Liabilities

Noncurrent

Liabilities

Long-Term Notes Payable and Bonds

Relatively small debt needs

can be filled from single

sources.

Banks

Insurance

Companies

Pension

Plans

Long-Term Notes Payable and Bonds

Significant debt needs are

often filled by issuing bonds to

the public.

Bonds

Cash

Present Value Concepts

$1,000 invested

today at 10%.

In 1 year it will

be worth

$1,100.

In 5 years it will

be worth

$1,610!

Money can grow over time, because it can

earn interest.

Present Value Concepts

The growth is a mathematical function of

four variables:

1. The value today (present value).

2. The value in the future (future value).

3. The interest rate.

4. The time period.

Present Value of a Single Amount

The present value of a single amount is the

worth to you today of receiving that amount

some time in the future.

Present

Value

Future

Value

Interest compounding periods

Today

Future

Calculating the Present Value of a

Single Amount

• Need:

1. The Appropriate Interest Rate (i) Use these to

determine the PVF$

2. The number of periods (n)

3. Future Value you wish to determine its

present value

• Multiply the PVF$ (Present Value Factor of a $)

times the future value

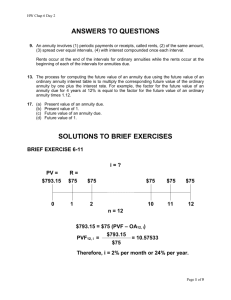

Calculating the PVF$ and PVFA

Present Value Factor for a single amount

PVF$ = 1/(1 + i)^n

Present Value Factor for An Annuity Formula

PVFA = (1-PVF$)/i

Present Value of a Single Amount

How much do we need to invest today at 10%

interest, compounded annually, if we need

$1,331 in three years?

a. $1,000.00

The required future amount is $1,331.

b. $ 990.00

i = 10% & n = 3 years

c. $ 751.30

Using the present value of a single amount

d. $ 970.00

table, the factor is .7513.

$1,331 × .7513 = $1,000 (rounded)

Present Values of an Annuity

An annuity is a series of

consecutive equal periodic

payments.

Today

Present Values of an Annuity

What is the value today of a series of

payments to be received or paid out in the

future?

Payment 1

Present

Value

Today

Payment 2

Interest compounding periods

Payment 3

Calculating the Present Value of an

Annuity

• Need:

1. The Appropriate Interest Rate (i)

2. The number of periods (n)

3. Annual payment

Use these to

determine the PVFA

• Multiply the PVFA (Present Value Factor of an

Annuity) times the annual payment

Calculating the PVF$ and PVFA

Present Value Factor for a single amount

PVF$ = 1/(1 + i)^n

Present Value Factor for An Annuity Formula

PVFA = (1-PVF$)/i

Present Values of an Annuity

What is the present value of receiving $1,000 each

year for three years at an interest rate of 10%,

compounded annually?

a. $3,000.00

b. $2,910.00

The consecutive equal payment amount is

$1,000.

c. $2,700.00

i = 10% & n = 3 years

d. $2,486.90

Using the present value of an annuity

table, the factor is 2.4869.

$1,000 × 2.4869 = $2,486.90

Try AP9-6 (page 500-501)