Chapter 4: Time Value of Money

advertisement

Chapter 4: Time Value of

Money

Objective

Explain the concept of compounding

and discounting and to provide

examples of real life

applications

Copyright, 2000 Prentice Hall ©Author Nick Bagley, bdellaSoft, Inc.

1

Compounding: Future Value of a Lump

Sum

FV PV * (1 i)

n

F V w ith gro w th s fro m -6 % to +6 %

F utu re V a lue o f $1 0 0 0

3 ,5 0 0

6%

3 ,0 0 0

2 ,5 0 0

4%

2 ,0 0 0

1 ,5 0 0

2%

1 ,0 0 0

0%

-2 %

-4 %

-6 %

500

0

0

2

4

6

8

10

12

14

16

18

20

Y ea rs

5

The Frequency of Compounding

Annual Percentage Rate (APR)

Effective Annual Rate (EFF): The

equivalent interest rate, if

compounding were only once a

year.

APR m

1 EFF (1

)

m

10

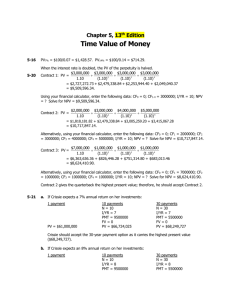

Effective Annual Rates of an APR

of 18%

Annual

Percentage

Rate

18

18

18

18

18

18

Frequency of Annual

Compounding Effective

Rate

1

18.00

2

18.81

4

19.25

12

19.56

52

19.68

365

19.72

11

The Frequency of Compounding

Note that as the frequency of

compounding increases, so does the

annual effective rate

What occurs as the frequency of

compounding rises to infinity?

APR

EFF Lim 1

m

m

m

1 e APR 1

12

The Frequency of Compounding

APR

1 EFF 1

m

1

APR

m

1 EFF

1

m

m

APR m * 1 EFF 1

1

m

13

The Frequency of Compounding

Annual

Effective

Rate

12

12

12

12

12

12

12

Compounding Annual

Frequency

Percentage

Rate

1

12.00

2

11.66

4

11.49

12

11.39

52

11.35

365

11.33

Infinity

11.33

14

Annuities

A level stream of Cash Flows or

Payments

Immediate Annuity: The Cash Flows

start immediately.

Ordinary Annuity: The Cash Flows

start at the end of the current

period.

15

Derivation of PV of Ordinary

Annuity Formula

pmt

pmt

PV

1

2

1 i 1 i

pmt

pmt

pmt

3

n 1

n

1 i

1 i

1 i

16

Derivation of PV of Ordinary

Annuity Formula

1

1

PV pmt *{

1

2

1 i 1 i

1

1

1

}

3

n 1

n

1 i

1 i

1 i

17

PV of Ordinary Annuity Formula

1

pmt *{1

}

n

1 i

PV

i

pmt

1

* 1

n

i 1 i

18

Annuity Formula: PV of Immediate

Annuity

PVimm PVord * (1 i )

pmt

n

*{1 1 i } * (1 i )

i

pmt

1 n

*{(1 i ) 1 i }

i

19

Derivation of FV of Annuity

Formula

pmt

1

(ord. annuity)

PV

* 1

n

i 1 i

FV PV * 1 i (lump sum)

n

pmt

1

n

* 1 i

FV

* 1

n

i 1 i

pmt

n

* 1 i 1

i

20

Perpetual Annuities / Perpetuities

Recall the annuity formula:

pmt

1

PV

* 1

n

i 1 i

• Let n -> infinity with i > 0:

pmt

PV

i

21

Alternative Discounted Cash Flow

Decision Rules

1.

NPV rule: the NPV is the difference

between the present value of all

future cash inflows minus the

present value of all current and

future cash outflows. Accept a

project if its NPV is positive.

22

DCF rules

Example: You have the opportunity to

buy a piece of land for $10,000. You

are sure that 5 years from now it

will be worth $20,000. If you can

earn 8% per year by investing your

money in bank, is this investment in

the land worthwhile?

23

NPV rule solution

20,000

NPV $10,000 $

5

1.08

$10,000 $13,612

$3612 0

24

Alternative Discounted Cash Flow

Decision Rules

2.

FV rule: Invest if the future value

of the investment is larger than

the future value that can be

obtained from the next best

alternative.

25

FV rule solution

FV $10,0001.08

5

$14,693 $20,000

26

Alternative Discounted Cash Flow

Decision Rules

3.

IRR rule: The IRR is the discount

rate at which the NPV is zero.

Invest if the IRR is greater than

the opportunity cost of capital.

27

IRR rule solution

$20,000

$10,000

5

(1 i )

i 14.87% 8%

28

Alternative Discounted Cash Flow

Decision Rules

4.

Choose the investment alternative

with fastest payback.

29

Payback rule solution

$20,000

$10,000

n

1.08

n95

30

Loan Amortization

The process of paying a loan principal

gradually over its term

Example:

$100,000 mortgage loan, APR: 9%,

repaid in 3 annual installments

pm t

1

pmt=?

PV

*

1

n

i

1 i

pmt=$39504.48 100000 pmt * 1 1 3

0.09 1.09

31

Loan Amortization

First Year:

Interest:

(0.09)(100000)=9000

pmt:

39504.48

principal:

30504.48

Outstanding Balance:

69494.52

32

Loan Amortization

Second Year:

Interest: (0.09)(69494.52)=6254.51

pmt:

39504.48

principal:

33250.97

Outstanding Balance:

36243.54

33

Loan Amortization

Third Year:

Interest:(0.09)(36243.54)=3262

pmt:

39504.48

principal:

36244

Outstanding Balance:

0

34

Amortization of Principal

450000.00

Outstanding Balance

400000.00

350000.00

300000.00

250000.00

200000.00

150000.00

100000.00

50000.00

0.00

0

24

48

72

96

120 144 168 192 216 240 264 288 312 336 360

Months

35

Percent of Interest and Principal

100%

90%

80%

Percent

70%

% Interest

60%

50%

40%

% Principal

30%

20%

10%

0%

0

24

48

72

96

120 144 168 192 216 240 264 288 312 336 360

Months

36

Computing NPV in Different Currencies

In any TVM calculation, the cash flows

and the interest rate must be

denominated in the same currency.

41

Inflation and Future Values

Example: At age 20 you save $100

and invest it at a dollar interest rate

of 8% per year, and you do not

take it until age 65. If the inflation

is estimated 5% per year, how

much will you have accumulated in

the account at that time in terms of

real purchasing power?

42

Solution 1:

1 nom. rate(r )

1 real rate( R )

1 Inflation(i )

1 R 1.02857

real FV PV (1 R)

n

real FV $1001.02857

$355

45

43

Solution 2:

nom. FV in 45 years $100 1.08

$3,192

45

price level in 45 years 1.05

8.985

nom.FV $3,192

real FV

FPL

8.985

$355

45

44

Inflation and Present Values

Example: Your daughter is 10 years

old, and you are planning to open

an account to provide for her

college education. Tuition for a year

of college is now $15,000. How

much must you invest now in order

to have enough to pay for her first

year’s tuition 8 years from now, if

you think you can earn a rate of

interest that is 3% more than the

inflation rate of 5%?

45

Solution:

$15,000

PV

$

11

.

841

8

1.03

Wrong:

$15,000

PV

$

8

.

104

8

1.08

46

Inflation and Present Values

Never use a nominal interest rate

when discounting real cash flows or

a real interest rate when

discounting nominal cash flows.

47