finance

advertisement

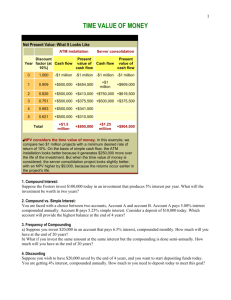

Engineering is $$$ A dollar today is worth more than a dollar tomorrow: Compound Interest P0 = principal 0 time units into the future (i.e., today) Pn = principal n time units into the future Pn P0 1 r n where r is the annual interest rate A Dutchman Peter Inuit bought Manhattan from the Canarsie Indians for $23 in 1626. Who got robbed. . .? Assuming funds were invested at 6% compounded monthly since 1626. The investment today would be worth $23*(1+.06/12)(12*(2010-1626)) = $220 *109 A dollar today is worth more than a dollar tomorrow: Present Value: P0 Pn 1 r where r is the annual interest rate US treasury bills sold at “discount”, so that when the bill matures, you receive face value. If you buy a one-year $10,000 bill with an interest rate of 3%, how much should you expect to pay for it? n A dollar today is worth more than a dollar tomorrow: Effective Interest: 1 n Pn r 1 P0 Invest $10,000 in company stock. Ten years later, you sell the stock for $20,000. What was your effective annual rate of return? Compound interest—different forms Interest compounded once per year Interest compounded q times per year Pn P0 1 r n r Pn P0 1 q nq Interest compounded continuously nq r Pn P0 lim1 P0 e rn q q DJIA 1900-2010 Lease vs. Buy? Example: Honda Pilot EX AWD price = $33,595 (Chicago, 2006 figures) Purchase with 20% down and a 36 month loan @6.75% down payment monthly payment spent after 36 mo residual value total cost = $ 6,719 = $ 825 = $36,419 = $23,701 = $12,718 Lease for 36 months down payment monthly payment spent after 36 mo residual value total cost = $ 2,000 = $ 359 = $14,565 = $0 = $14,565 Annuities: Equal payments paid (or received) over n time periods Future value of an annuity: Pn P[(1 r )n1 (1 r )n2 (1 r )1 ] where Pn = the value of the annuity after n payments of P Multiply both sides by (1+r) to obtain Pn (1 r) P[(1 r)n (1 r)n1 (1 r)0 ] Subtract the first equation from the second to obtain [(1 r ) n 1] Pn P r Annuity example: Each year for 20 years you deposit $1000 into an annuity at an interest rate of 5%. What will be its value in 20 years? [(1.05) 20 1] An $1000* $33065 .05 Annuity example: You win $1M in a lottery which pays you in 20 annual installments of $50K? What’s it worth $$ today, i.e., what is its present value? Assume 5% interest. [(1 r ) n 1] Pn P r but, So, Pn P0 1 r n [(1 r ) n 1] 1.0520 1 P0 P $50K $623K n 20 r (1 r ) .05* (1.05) Opportunity Cost The opportunity cost of a decision is based on what must be given up (the next best alternative) as a result of the decision. Any decision that involves a choice between two or more options has an opportunity cost. Applications of Opportunity Cost The concept of opportunity cost has a wide range of applications including: Consumer choice Production possibilities Cost of capital Time management Career choice Analysis of comparative advantage Payback Period The length of time required to recover the cost of an investment. Shorter paybacks are better investments. Problems with this metric: 1. It ignores any benefits that occur after the payback period and, therefore, does not measure profitability. 2. It ignores the time value of money.