Perusahaan Sekuritas

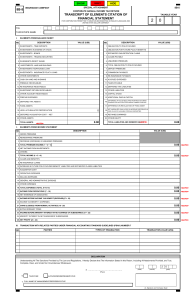

advertisement

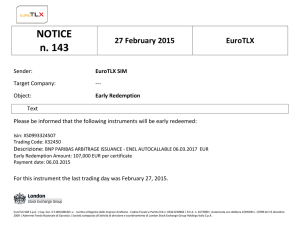

Industri Jasa Keuangan: Perusahaan Sekuritas dan Bank Investasi Budi Purwanto PENGANTAR Bank-based Economy Consequences When a country’s financial system relies heavily on banks, systematic vulnerabilities increase “ This leads one to wonder how severe East Asia’s problems would have been during the past eighteen months had those economies not relied so heavily on banks as their means of financial intermediation. Had a functioning capital market existed, the outcome might well have been far more benign. “ Alan Greenspan, “ Lessons from the Global Crisis “, 1999 Sistem dan Lembaga Keuangan Dana dipasokkan melalui tabungan atau investasi lain Pemasok Dana Perorangan Perusahaan Pemerintah Dana dipasokkan melalui investasi langsung Lembaga Keuangan Bank Komersial Perusahaan Asuransi dan Dana Pensiun PerusahaanInvestasi dll Investasi dibuat atas nama pemasok Pasar Keuangan Pasar Uang Pasar Modal Bursa Outer the Counter Dana disediakan melalui pinjaman, penempatan, dsb Pengguna Dana Perorangan Perusahaan Pemerintah Dana disediakan malalui penawaran umum, dsb Struktur Pendanaan Sektor Swasta Awal dari Sebuah Krisis : sekitar 70% lebih sumber pendanaan sektor swasta di negara berkembang bergantung pada pendanaan perbankan (1997). 2 1 5 Equities, % 50 51 Bonds, % 5 7 16 18 16 76 77 77 5 8 18 42 51 8 12 16 29 87 25 70 44 Bank loans, % 55 48 58 ut h So Th ai lan d Ko re a na Ch i IN DO NE SI A an Ja p Si ng ap or e ala ys ia M an Ta iw on g Ho ng k Un i te d St at es 25 Sumber: Bank of International Settlement, International Monetary Funds, International Finance Corporation, International Federation of Stock Exchange (FIBV), World Bank Sumber Dana Internal Sumber Dana Laba Operasi Jangka Pendek Bank Utang Jangka Panjang Eksternal Ekuitas Pasar Uang Permanen Pasar Modal Go Public Kesempatan Berinvestasi • Pasar Modal – Saham dan obligasi – Diterbitkan oleh emiten melalui bank investasi – Diperdagangkan melalui perusahaan-perusahaan sekuritas • Reksa Dana – – – – Diversifikasi investasi melalui pemaketan aset keuangan Dikelola oleh Manajer Investasi yang profesional Dana investasi yang dibutuhkan relative kecil Pemegang unit penyertaan dapat melakukan penjualan kembali kepada MI Pelaku di Pasar Modal Bursa Efek, Perusahaan Efek, Penasihat Investasi Bank Kustodian Wali Amanat, Pofesi Penunjang Pasar Modal Wakil Penjamin Emisi Efek, Wakil Perantara Pedagang Efek, Wakil Manajer Investasi Emiten & Perusahaan Publik PERUSAHAAN SEKURITAS DAN BANK INVESTASI Pokok Bahasan Activities of securities firms and investment banks Size, structure and composition Balance sheets and recent trends Regulation of securities firms and investment banks Global issues Kegiatan Usaha Underwrite securities. Going public Market making. [Indonesia tidak] Advising. M&A, restructurings Kegiatan Kunci Investing Investment banking Activities related to underwriting and distributing new issues of debt and equity. Market making Trading Position trading, pure arbitrage, risk arbitrage, program trading Kegiatan Kunci Cash management Assisting with mergers and acquisitions Back-office and service functions. Neraca Key assets: Long positions in securities and commodities. Reverse repurchase agreements. Key liabilities: Repurchase agreements major source of funds. Securities and commodities sold short. Broker call loans from banks Capital levels much lower than levels in banks Kecenderungan Decline in trading volume and brokerage commissions Decline in underwriting activities Recovery in activity and profitability Kecenderungan Increases in holdings of fixed-income trading greater interest rate and sovereign risk exposure Pretax profits soared curtailed by economic slowdown Regulasi Primary regulator: Bapepam-LK. Day-to-day trading practices regulated by the BEI. Kepustakaan Siamat, Dahlan. 2004. Manajemen Lembaga Keuangan. Lembaga Penerbit Fakultas Ekonomi Universitas Indonesia. Saunders, A., Cornett M.M. 2006. Financial Institution Management. McGraw-Hill International. Kasmir. 2002. Manajemen Perbankan. Jakarta: Divisi Buku Perguruan Tinggi PT RajaGrafindo Persada. Kuncoro, M & Suhardjono. 2002. Manajemen Perbankan: Teori dan Aplikasi. BPFE Yogyakarta. Riyadi, S. 2004. Banking Assets Liability Management. Penerbitan FE-UI Gandapradja, P. 2004. Dasar dan Prinsip Pengawasan Bank. Penerbit PT Gramedia Utama. LAMPIRAN