Macro Weekly Mario delivers…now to Athens

advertisement

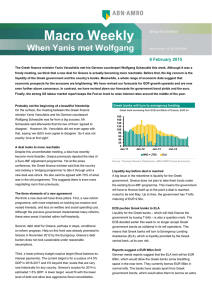

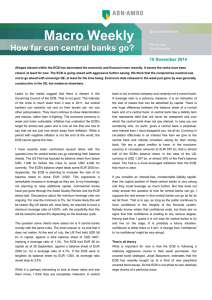

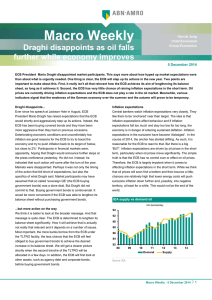

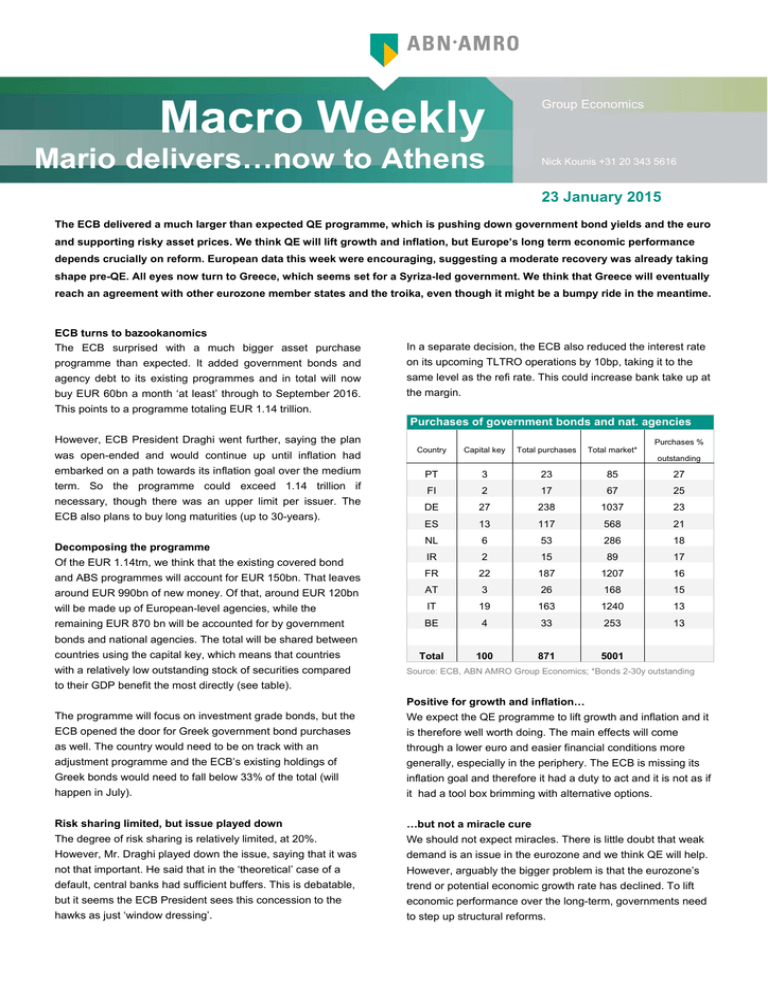

Group Economics Macro Weekly Mario delivers…now to Athens Nick Kounis +31 20 343 5616 23 January 2015 The ECB delivered a much larger than expected QE programme, which is pushing down government bond yields and the euro and supporting risky asset prices. We think QE will lift growth and inflation, but Europe’s long term economic performance depends crucially on reform. European data this week were encouraging, suggesting a moderate recovery was already taking shape pre-QE. All eyes now turn to Greece, which seems set for a Syriza-led government. We think that Greece will eventually reach an agreement with other eurozone member states and the troika, even though it might be a bumpy ride in the meantime. ECB turns to bazookanomics The ECB surprised with a much bigger asset purchase In a separate decision, the ECB also reduced the interest rate programme than expected. It added government bonds and on its upcoming TLTRO operations by 10bp, taking it to the agency debt to its existing programmes and in total will now same level as the refi rate. This could increase bank take up at buy EUR 60bn a month ‘at least’ through to September 2016. the margin. This points to a programme totaling EUR 1.14 trillion. Purchases of government bonds and nat. agencies However, ECB President Draghi went further, saying the plan was open-ended and would continue up until inflation had embarked on a path towards its inflation goal over the medium Purchases % Country Capital key Total purchases Total market* outstanding PT 3 23 85 27 FI 2 17 67 25 DE 27 238 1037 23 ES 13 117 568 21 NL 6 53 286 18 IR 2 15 89 17 and ABS programmes will account for EUR 150bn. That leaves FR 22 187 1207 16 around EUR 990bn of new money. Of that, around EUR 120bn AT 3 26 168 15 will be made up of European-level agencies, while the IT 19 163 1240 13 remaining EUR 870 bn will be accounted for by government BE 4 33 253 13 100 871 5001 term. So the programme could exceed 1.14 trillion if necessary, though there was an upper limit per issuer. The ECB also plans to buy long maturities (up to 30-years). Decomposing the programme Of the EUR 1.14trn, we think that the existing covered bond bonds and national agencies. The total will be shared between countries using the capital key, which means that countries with a relatively low outstanding stock of securities compared Total Source: ECB, ABN AMRO Group Economics; *Bonds 2-30y outstanding to their GDP benefit the most directly (see table). Positive for growth and inflation… The programme will focus on investment grade bonds, but the We expect the QE programme to lift growth and inflation and it ECB opened the door for Greek government bond purchases is therefore well worth doing. The main effects will come as well. The country would need to be on track with an through a lower euro and easier financial conditions more adjustment programme and the ECB’s existing holdings of generally, especially in the periphery. The ECB is missing its Greek bonds would need to fall below 33% of the total (will inflation goal and therefore it had a duty to act and it is not as if happen in July). it had a tool box brimming with alternative options. Risk sharing limited, but issue played down …but not a miracle cure The degree of risk sharing is relatively limited, at 20%. We should not expect miracles. There is little doubt that weak However, Mr. Draghi played down the issue, saying that it was demand is an issue in the eurozone and we think QE will help. not that important. He said that in the ‘theoretical’ case of a However, arguably the bigger problem is that the eurozone’s default, central banks had sufficient buffers. This is debatable, trend or potential economic growth rate has declined. To lift but it seems the ECB President sees this concession to the economic performance over the long-term, governments need hawks as just ‘window dressing’. to step up structural reforms. 2 Macro Weekly - Mario delivers…now to Athens - 23 January 2015 Markets rally on announcement, with risky assets leading Eurozone surveys improved in December the way, while euro slumps Meanwhile, Germany’s ZEW economic sentiment indicator European government bond yields fell sharply following the jumped from 34.9 in December 2014 to 48.4 in January 2015, announcement, led by the periphery, while equity prices reaching its highest level since February 2014 and rising surged. In addition, the euro fell significantly. It is typical that further above its long-term average value of around 24. risky assets do well and the currency slumps on the back of Furthermore, the eurozone composite PMI rose to 52.2 from QE. This is exactly the experience we saw during the various 51.4 in December, the highest level since August of last year. phases of QE in the US. Indeed, we expect risk premium The fall in the euro (on QE expectations) and lower oil prices compression and euro weakness to continue going forward. appear to be having a positive effect. High quality bonds also supported on demand-supply China’s gradual slowdown imbalance Outside of the eurozone, the main economic data came out of What is less normal is that safe government bonds (for China. China’s GDP rose by 7.3% in Q4, the same rate as in instance Germany and the Netherlands) have also continued Q3. This left annual growth at 7.4% in 2014, almost exactly in to rally, with yields falling to new historical lows. In the US line with the government’s target of 7.5%. The monthly data for yields rose sharply following the QE announcement, as retail sales and industrial production showed growth edging up investors expected an economic recovery and as money in December. The overall trend looks to be one of ongoing flowed to higher yielding assets. The stark difference in gradual slowdown and we expect the authorities to ease policy behaviour of core yields in the eurozone likely reflects that further to ensure this remains the case. The authorities will these markets are shrinking. Therefore ECB purchases could likely set the target for 2015 growth at 7%. lead to an acute demand-supply imbalance. This means that there are now significant downside risks to our forecast of Greek election has raised worries of euro exit modestly rising core yields later this year. With the ECB behind us, another big event in the calendar looms, with the Greek elections on Sunday. The polls suggest Stronger loan demand points to eurozone recovery that Syriza will be the largest party. It may not get an overall Loan demand, balance majority, but it should be able to form a coalition government % qoq 2 with the smaller Potami party. This prospect has caused some 50 1 concern (though at time of writing there was no visible effect 0 0 100 stronger demand on markets glowing on the ECB euphoria). The worry is that a Syriza government would unilaterally default on its debt and -50 -1 refuse to stick to any of its obligations, which would lead to an -100 -2 eventual Greek euro exit. weaker demand -150 -3 03 04 05 06 07 08 09 10 11 12 13 14 15 Cons. credit and other lending (lhs) Overall corporate (lhs) House purchase (lhs) GDP (rhs, % qoq) Greece likely to remain in the eurozone Nevertheless, we think it is likely that Greece will remain in the eurozone. Syriza has already significantly toned down its Source: ECB, ABN AMRO Group Economics stance on many issues, and will likely be more constructive in government than its rhetoric suggests. Opinion polls report that Europe’s moderate recovery pre-QE the vast majority of Greeks want to stay in the euro. In Meanwhile, we had a set of encouraging eurozone data. The addition, Greece has made a lot of progress with reforms, ECB’s latest Bank Lending Survey painted a positive picture. It fiscal consolidation and wage adjustment. It would be odd to signalled a eurozone economic recovery going forward. Banks throw it all away now. Meanwhile, other eurozone countries eased lending conditions at a faster pace, while demand for loans continued to improve across loan categories. The improvement in corporate loan demand – driven by rising investment intentions – was particularly encouraging. Stronger loan demand is consistent with firming economic growth in coming quarters (see chart above). also have an interest in keeping the club together. Although risks are lower than a few years ago, there may still be a major fall-out from a country leaving. 3 Macro Weekly - Mario delivers…now to Athens - 23 January 2015 Greece’s unsustainable debt European banks’ exposure to Greece A key Syriza aim if it does come into government is to get debt EUR bn relief. The German government says Greece must meet its 140 obligations. However, there cannot be anyone in the German 120 government or elsewhere that judges that Greece’s debt 100 burden is sustainable. Greece will very likely not be able to meet its obligations. Sooner or later it will need debt relief. 80 60 40 20 A deal is possible Most of Greece’s debt (around 80%) is to the official sector, with the largest share (around 60% of total debt) to Eurozone 0 11Q1 12Q1 Public sector Banks 13Q1 14Q1 Non-bank private sector member states either via bilateral loans or via the EFSF. So a debt write-off would need to involve other member states. An Source: BIS, ABN Amro Group Economics outright debt write off will obviously be politically difficult as it will be unpopular in other eurozone states. However, Greece’s debt mainly to the official sector significant debt relief could be provided by further lengthening Holdings of Greek debt maturities and freezing interest payments. Indeed, the Eurogroup already committed to do this in a statement on Greece in November 2012. EU/EFSF Debt relief could be made conditional on actions by the Greek IMF government. While Syriza is less willing than the previous New ECB/NCB Democracy–led governing coalition to cut welfare spending, it Private will be more willing to fight tax evasion and go after vested interests. In any case, there looks to be sufficient room for negotiation. Source: IMF, EU, ABN AMRO Group Economics Uncertainty will not go away Although we expect a solution, this does not mean it will be smooth. Negotiations might be tough and there may be a lot of pre-positioning by the different actors in public. Tough talk could lead to nervousness. So we may well be in for a period of uncertainty as far as Greece is concerned. Still, we do not expect any significant contagion. Find out more about Group Economics at: http://insights.abnamro.nl/en/category/economy/ This document has been prepared by ABN AMRO. It is solely intended to provide financial and general information on economics. The information in this document is strictly proprietary and is being supplied to you solely for your information. It may not (in whole or in part) be reproduced, distributed or passed to a third party or used for any other purposes than stated above. This document is informative in nature and does not constitute an offer of securities to the public, nor a solicitation to make such an offer. No reliance may be placed for any purposes whatsoever on the information, opinions, forecasts and assumptions contained in the document or on its completeness, accuracy or fairness. No representation or warranty, express or implied, is given by or on behalf of ABN AMRO, or any of its directors, officers, agents, affiliates, group companies, or employees as to the accuracy or completeness of the information contained in this document and no liability is accepted for any loss, arising, directly or indirectly, from any use of such information. The views and opinions expressed herein may be subject to change at any given time and ABN AMRO is under no obligation to update the information contained in this document after the date thereof. Before investing in any product of ABN AMRO Bank N.V., you should obtain information on various financial and other risks and any possible restrictions that you and your investments activities may encounter under applicable laws and regulations. If, after reading this document, you consider investing in a product, you are advised to discuss such an investment with your relationship manager or personal advisor and check whether the relevant product –considering the risks involved- is appropriate within your investment activities. The value of your investments may fluctuate. Past performance is no guarantee for future returns. ABN AMRO reserves the right to make amendments to this material. © Copyright 2015 ABN AMRO Bank N.V. and affiliated companies ("ABN AMRO"). 2 Macro Weekly - Mario delivers…now to Athens - 23 January 2015 Main economic/financial forecasts GDP grow th (%) 2013 2014e 2015e 2016e +3M +12M 2015e 2.2 2.3 3.8 3.0 United States 0.25 0.26 0.4 1.4 1.4 3.1 -0.4 0.9 1.5 1.9 Eurozone 0.07 0.06 0.1 0.1 0.1 0.1 Japan 1.6 0.4 1.6 1.2 Japan 0.18 0.17 0.2 0.2 0.2 0.2 United Kingdom 1.7 3.0 2.8 2.6 United Kingdom 0.56 0.56 0.6 1.2 1.2 2.2 China 15/01/2015 22/01/2015 United States Eurozone 3M interbank rate 15/01/2015 22/01/2015 2016e 7.7 7.4 7.0 7.0 World Inflation (%) 3.2 2013 3.2 2014e 3.7 2015e 3.9 2016e +3M +12M 2015e 2016e United States 1.5 1.6 1.0 1.8 US Treasury 1.73 1.87 2.1 2.7 2.7 3.4 Eurozone 1.3 0.5 0.2 1.5 German Bund 0.48 0.45 0.5 1.0 1.0 1.5 Japan 0.3 2.4 1.0 1.4 Euro sw ap rate 0.70 0.75 0.7 1.2 1.2 1.7 United Kingdom 2.6 1.5 1.1 1.9 Japanese gov. bonds 0.25 0.32 0.5 0.7 0.7 1.0 China 2.6 2.0 2.0 2.5 UK gilts 1.51 1.52 1.5 2.4 2.7 3.2 World Key policy rate 4.4 22/01/2015 4.0 +3M 3.7 2015e 3.8 2016e 15/01/2015 22/01/2015 +3M +12M 2015e 2016e Federal Reserve 0.25 0.25 1.00 3.00 EUR/USD 1.16 1.14 1.17 1.10 1.10 1.00 European Central Bank 0.05 0.05 0.05 0.05 USD/JPY 116.2 118.5 122 130 130 140 Bank of Japan 0.10 0.10 0.10 0.10 GBP/USD 1.52 1.51 1.44 1.41 1.41 1.33 Bank of England 0.50 0.50 1.00 2.00 EUR/GBP 0.76 0.76 0.81 0.78 0.78 0.75 People's Bank of China 5.60 5.35 5.10 5.10 USD/CNY 6.19 6.21 6.20 6.25 6.25 6.30 10Y interest rate Currencies Source: Thomson Reuters Datastream, ABN AMRO Group Economics. KEY MACRO EVENTS Day Date Time Country Monday Monday Monday Monday 26/01/2015 26/01/2015 26/01/2015 26/01/2015 00:50:00 09:30:00 10:00:00 10:30:00 JP NL DE GB Tuesday Tuesday Tuesday Tuesday Tuesday 27/01/2015 27/01/2015 27/01/2015 27/01/2015 27/01/2015 10:30:00 14:30:00 15:00:00 16:00:00 16:00:00 Wednesday Wednesday Wednesday Wednesday Wednesday 28/01/2015 28/01/2015 28/01/2015 28/01/2015 28/01/2015 Thursday Thursday Thursday Thursday Thursday Thursday Thursday Thursday Thursday Friday Friday Friday Friday Friday Friday Friday Friday Friday Friday Friday Friday Friday Key Economic Indicators and Events Period Latest outcome Consensus Merchandise trade exports - % yoy Producer confidence manufacturing - index Ifo - business climate - index BBA mortgage approvals - units Dec Jan Jan Dec 4.9 3.4 105.5 36717 11.2 GB US US US US GDP - % qoq New durable goods orders - % mom S&P/Case Shiller house price index New homes sold - % mom Conference Board cons. confidence - index 4Q A Dec Nov Dec Jan 01:30:00 20:00:00 21:00:00 22:45:00 AU US NZ NZ GB CPI - % yoy Policy rate - % Policy rate - % Trade balance - NZD mln Nationwide house prices - % mom 29/01/2015 29/01/2015 29/01/2015 29/01/2015 29/01/2015 29/01/2015 29/01/2015 29/01/2015 29/01/2015 09:55:00 09:55:00 10:00:00 11:00:00 12:00:00 14:00:00 16:00:00 20:00:00 DE DE EC EC GB DE US MX ZA 30/01/2015 30/01/2015 30/01/2015 30/01/2015 30/01/2015 30/01/2015 30/01/2015 30/01/2015 30/01/2015 30/01/2015 30/01/2015 30/01/2015 30/01/2015 00:30:00 00:30:00 00:50:00 01:05:00 10:30:00 11:00:00 11:00:00 11:00:00 14:30:00 14:30:00 15:00:00 15:45:00 16:00:00 JP JP JP GB GB EC EC EC CA US BE US US ABN AMRO 106.2 3.5 106.5 0.7 -1 0.8 -1.6 92.6 0.6 0.4 0.7 2.6 95.2 0.6 0.8 2.6 95.5 4Q Jan 28 Jan 29 Dec Jan 2.3 0.3 3.5 -453 0.2 1.8 0.3 3.5 0.3 3.5 Unemployment - % Unemployment change - thousands M3 growth - % yoy Economic sentiment monitor - index CBI retail sales - balance (%) CPI - % yoy Pending home sales - % mom Policy rate - % Policy rate - % Jan Jan Dec Jan Jan Jan P Dec Jan 29 Jan 29 6.5 -27 3.1 100.7 61 0.2 0.8 3.0 5.8 6.5 -6.5 3.3 101.4 102.0 -0.1 0.5 -0.2 0.5 CPI - % yoy Unemployment - % Industrial production - % mom GfK Consumer confidence - index BoE mortgage approvals - thousands Core inflation - % yoy CPI - % yoy Unemployment - % GDP - % yoy GDP - % qoq annualised GDP - % qoq Chicago Fed - business confidence - index Univ. of Michigan cons. confidence - index Dec Dec Dec P Jan Dec Jan A Jan Dec Nov 4Q A 4Q P Jan Jan F 2.4 3.5 -0.5 -4 59.0 0.7 -0.2 11.5 2.3 5.0 0.3 58.8 98.2 2.3 3.5 1.4 -3 59.0 0.7 -0.4 11.5 0.7 -0.5 3.1 3.0 58.0 98.5 58.0 98.5 Source: Bloomberg, Reuters, ABN AMRO Group Economics (we provide own forecasts only for selected k ey variables and events) If you would like to receive this calendar by email on Friday, please send a message to abn.amro.group.economics@nl.abnamro.com