141026 - ECB assessment of banks

advertisement

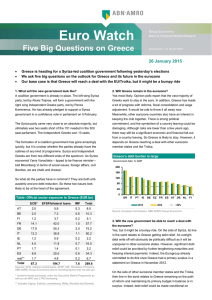

Euro Watch Bank tests a key milestone Group Economics Macro & Financial Markets Research Nick Kounis + 31 20 343 5616 Joost Beaumont 26 October 2014 • • • • The results of the ECB’s comprehensive assessment of the banking sector are very encouraging… …it represents a more rigorous test compared to past ones in the eurozone as well as the US… …in addition most of the capital raising has already been done and the rest looks manageable We see the exercise as a key milestone in the eurozone economy’s recovery process Comprehensive assessment relatively tough be filled within two weeks. These shortfalls will need to be The ECB’s comprehensive assessment of 130 banks was covered in 6 months (where these were identified in the relatively tough and hence represents a credible barometer of AQR/baseline scenario) or 9 months (for those identified in the the health of the eurozone banking system. The review adverse stress test scenario). consisted of an asset quality review (AQR), which assessed whether bank assets were valued correctly. The AQR showed A key milestone in Europe’s recovery process that as of the end-2013, banks’ assets needed to be adjusted Overall, we see the ECB’s comprehensive assessment of by EUR 48bn, while non-performing exposures increased by banks as being a key milestone in the eurozone economy’s EUR 136bn. Furthermore, a stress test was conducted recovery process. This does not mean that the banking sector assessing the impact of bank balance sheets under an is now somehow magically transformed. It is still adapting to a adverse scenario, in which banks were required to maintain a post-crisis world. In addition, a recovery in bank lending will minimum CT1 ratio of 5.5%. In this scenario, which assumed a depend on a recovery in the demand for loans. However, there 3-year collapse of GDP of 6.6%, banks’ aggregate capital was are a number of important positives. The assessment was reduced by EUR 216 bn, while risk-weighted assets increased relatively tough, most of the capital short-falls have already by EUR 860bn. This led to a decrease in the CET1 ratio for the been closed, and the rest look manageable from a macro or median participating bank to 8.3% in 2016 from 12.4%. This country perspective. This means that the banking sector is now four percentage point decrease was almost double the one extremely well-capitalised and the exercise has also provided seen under the EBA exercise in 2011 (2.1%). It also compares transparency. favourably to this year’s stress test in the US (2.9%). Meanwhile, the assessment is being supplemented by a range Much of the capital shortfall has already been plugged of other measures by the ECB, including ABS and covered The results of the assessment showed that 25 banks failed the bond purchases, and the TLTROs. Furthermore, recent test. The total capital shortfall was EUR 24.6bn, but banks evidence on the ground points to improvement. The ECB’s have already filled EUR18.6bn of the gap, leaving only 12 Bank Lending Survey has shown over recent quarters that banks that still need to raise EUR 9.5bn of new capital. demand for loans is recovering, while banks are easing their Overall, during 2014, around EUR 40 bn of net capital was lending conditions. We think that the ECB’s measures and a raised by banks. As not all banks that raised capital had a moderate recovery in the economy mean that these trends will shortfall, the initial shortfall was offset by around EUR 15bn. continue, leading to a gradual improvement in bank lending. Greece and Italy prominent in country breakdown Evidence from banking crises in other countries suggest that Turning to the country breakdown, the biggest short-falls credible intervention to clean-up bank balance sheets and relative to the banking system’s risk-weighted assets were in recapitalise the system tends to be a watershed in the healing Cyprus (around 6%) and Greece (around 4%). They were process from the financial crisis. The US experience in 2009 followed at some distance by Portugal, Italy, Slovenia, Ireland, was a classic example of this. It took the eurozone a number of Austria and Belgium (all less than 1%). In terms of absolute attempts to get it right, but it seems it is finally there. amounts, the lion’s share of the initial capital shortfall was in Italy (EUR 9.7bn) and Greece (EUR 8.7bn). Following the capital raising, Italian and Greek banks account for around two-thirds of the gap (around EUR 3bn in each case), while the rest is spread between the other countries. In cases where there is a remaining shortfall, banks are requested to take remedial actions and submit capital plans of how shortfalls will 2 Bank tests a key milestone - 24 September 2014 Find out more about Group Economics at: https://insights.abnamro.nl/en/ This document has been prepared by ABN AMRO. It is solely intended to provide financial and general information on economics. The information in this document is strictly proprietary andis being supplied to you solely for your information. It may not (in whole or in part) be reproduced, distributed or passed to a third party or used for any other purposes than stated above. This document is informative in nature and does not constitute an offer of securities to the public, nor a solicitation to make such an offer. No reliance may be placed for any purposes whatsoever on the information, opinions, forecasts and assumptions contained in the document or on its completeness, accuracy or fairness. No representation or warranty, express or implied, is given by or on behalf of ABN AMRO, or any of its directors, officers, agents, affiliates, group companies, or employees as to the accuracy or completeness of the information contained in this document and no liability is accepted for any loss, arising, directly or indirectly, from any use of such n i formation. The views and opinions expressed herein may be subject to change at any given time and ABN AMRO is under no obligation to update the information contained in this document after the date thereof. Before investing in any product of ABN AMRO Bank N.V., you should obtain information on various financial and other risks and any possible restrictions that you and your investments activities may encounter under applicable laws and regulations. If, after reading this document, you consider investing in a product, you are advised to discuss such an investment with your relationship manager or personal advisor and check whether the relevant product –considering the risks involved- is appropriate within your investment activities. The value of your investments may fluctuate. Past performance is no guarantee for future returns. ABN AMRO reserves the right to make amendments to this material. © Copyright 2014 ABN AMRO Bank N.V. and affiliated companies ("ABN AMRO").