Macro Weekly - ABN AMRO Markets

advertisement

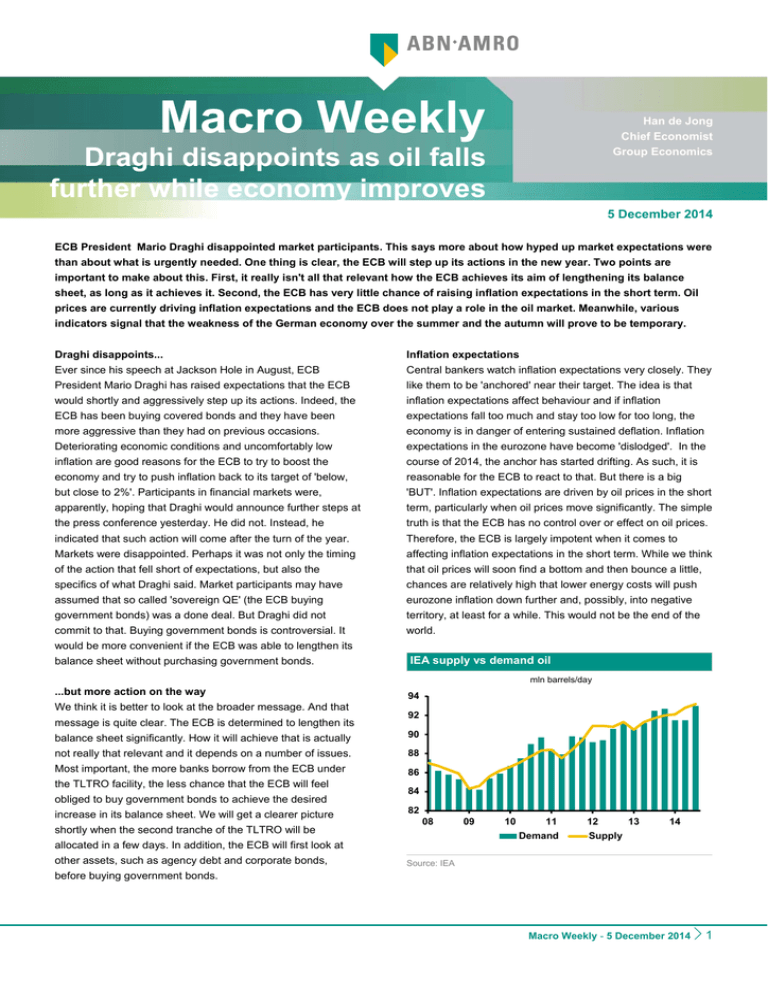

Macro Weekly Han de Jong Chief Economist Group Economics Draghi disappoints as oil falls further while economy improves 5 December 2014 ECB President Mario Draghi disappointed market participants. This says more about how hyped up market expectations were than about what is urgently needed. One thing is clear, the ECB will step up its actions in the new year. Two points are important to make about this. First, it really isn't all that relevant how the ECB achieves its aim of lengthening its balance sheet, as long as it achieves it. Second, the ECB has very little chance of raising inflation expectations in the short term. Oil prices are currently driving inflation expectations and the ECB does not play a role in the oil market. Meanwhile, various indicators signal that the weakness of the German economy over the summer and the autumn will prove to be temporary. Draghi disappoints... Inflation expectations Ever since his speech at Jackson Hole in August, ECB Central bankers watch inflation expectations very closely. They President Mario Draghi has raised expectations that the ECB like them to be 'anchored' near their target. The idea is that would shortly and aggressively step up its actions. Indeed, the inflation expectations affect behaviour and if inflation ECB has been buying covered bonds and they have been expectations fall too much and stay too low for too long, the more aggressive than they had on previous occasions. economy is in danger of entering sustained deflation. Inflation Deteriorating economic conditions and uncomfortably low expectations in the eurozone have become 'dislodged'. In the inflation are good reasons for the ECB to try to boost the course of 2014, the anchor has started drifting. As such, it is economy and try to push inflation back to its target of 'below, reasonable for the ECB to react to that. But there is a big but close to 2%'. Participants in financial markets were, 'BUT'. Inflation expectations are driven by oil prices in the short apparently, hoping that Draghi would announce further steps at term, particularly when oil prices move significantly. The simple the press conference yesterday. He did not. Instead, he truth is that the ECB has no control over or effect on oil prices. indicated that such action will come after the turn of the year. Therefore, the ECB is largely impotent when it comes to Markets were disappointed. Perhaps it was not only the timing affecting inflation expectations in the short term. While we think of the action that fell short of expectations, but also the that oil prices will soon find a bottom and then bounce a little, specifics of what Draghi said. Market participants may have chances are relatively high that lower energy costs will push assumed that so called 'sovereign QE' (the ECB buying eurozone inflation down further and, possibly, into negative government bonds) was a done deal. But Draghi did not territory, at least for a while. This would not be the end of the commit to that. Buying government bonds is controversial. It world. would be more convenient if the ECB was able to lengthen its balance sheet without purchasing government bonds. IEA supply vs demand oil mln barrels/day ...but more action on the way We think it is better to look at the broader message. And that message is quite clear. The ECB is determined to lengthen its 94 92 balance sheet significantly. How it will achieve that is actually 90 not really that relevant and it depends on a number of issues. 88 Most important, the more banks borrow from the ECB under 86 the TLTRO facility, the less chance that the ECB will feel obliged to buy government bonds to achieve the desired increase in its balance sheet. We will get a clearer picture shortly when the second tranche of the TLTRO will be 84 82 08 09 10 11 Demand 12 13 14 Supply allocated in a few days. In addition, the ECB will first look at other assets, such as agency debt and corporate bonds, Source: IEA before buying government bonds. Macro Weekly - 5 December 2014 1 Falling oil: good or bad? Fed’s end of year forecast. Both indicators suggest that the Mr Draghi talked a lot about oil prices in his recent press economy is making fast progress towards maximum conference. The message is not entirely clear, at least, not to employment. The labour market is now showing tighter me. In the past, the ECB, and the Bundesbank before that, conditions which should spur wage growth. have always played down the relevance for monetary policy of swings in oil prices and their impact on headline inflation. And Germany: Business confidence in construction it is important to determine what causes the decline in oil prices. If lower demand for oil (resulting, for example, from a recession) is the main driver, then slumping oil prices are a index 60 symptom of an economic problem. The situation is different if higher oil production is the main cause. We believe that the 50 current decline in oil prices is more caused by the supply side of the oil market than the demand side. That is an important reason for us to see the decline in oil prices mainly as a 40 tailwind for the global economy and for oil importers in particular, obviously. The eurozone economy will benefit and growth is likely to pick up in the months and quarters ahead. The ECB is too pessimistic on growth 30 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 Jul-14 Source: Bloomberg The ECB has lowered its GDP growth and inflation forecasts for 2015 and 2016. The downgrade of its growth forecast for Germany: Business confidence in retail 2015, from 1.6% to 1.0% was particularly large. We think the index ECB is now far too pessimistic. It looks to us as though the revision was largely driven by disappointing data over the 60 summer. We have argued that the weakness would be temporary as the economy will increasingly enjoy tailwinds from lower oil prices, lower borrowing costs, the decline in the 55 euro, less austerity and the healing of the credit channel. In addition, we have argued that the weakness over the summer was partly the result of an inventory correction in the industrial 50 sector globally. Such corrections are temporary by definition. Recent data encouraging Recent economic data is consistent with our more optimistic view. Eurozone retail sales recovered a little in October from a sharp drop in September. More importantly, German factory orders were strong in October and significantly ahead of expectations, following a couple of months of weakness. The picture emerging from various sectoral confidence indices is also positive. Confidence in the German retail sector and in German construction rose significantly in November, the second consecutive material improvement. The strengthening 45 Jan-12 in three years. Underutilisation in the labour market is gradually diminishing. The November nonfarm payrolls report (+321K) showed that employers ramped up hiring. The unemployment rate was unchanged at 5.8% which is below the Jan-13 Jul-13 Jan-14 Jul-14 Source: Bloomberg Taking stock Our views on these issues can be summarised in the following bullet points: • The ECB will expand its balance sheet more • The market is obsessed with the question of whether or aggressively in the new year not the ECB will buy government bonds, but that is not so of confidence is cancelling out weakness in previous months. The US labour market report delivered its strongest job growth Jul-12 relevant as long as the ECB lengthens its balance sheet. • The ECB will, if possible, avoid, but certainly delay buying government bonds, because such purchases are controversial. In any event, government bonds will not be at the top of the ECB's shopping list when the 'sales' start after Christmas. Macro Weekly 2 • Should the ECB fail to lengthen its balance sheet without buying government bonds, they will not hesitate (too long) to enter that market. • The ECB is worried over inflation expectations, but has • Eurozone headline inflation may fall into negative territory very little influence over them in the short term. in the months ahead. This is not the beginning of a sustained period of painful deflation. • Recent data suggests that the weakness in the eurozone seen over the summer and the autumn will be temporary • The slump in oil prices is largely driven by higher oil production and is therefore a significant tailwind for the global economy in 2015, and for the eurozone in particular Find out more about Group Economics at: http://insights.abnamro.nl/en/category/economy/ This document has been prepared by ABN AMRO. It is solely intended to provide financial and general information on economics. The information in this document is strictly proprietary and is being supplied to you solely for your information. It may not (in whole or in part) be reproduced, distributed or passed to a third party or used for any other purposes than stated above. This document is informative in nature and does not constitute an offer of securities to the public, nor a solicitation to make such an offer. No reliance may be placed for any purposes whatsoever on the information, opinions, forecasts and assumptions contained in the document or on its completeness, accuracy or fairness. No representation or warranty, express or implied, is given by or on behalf of ABN AMRO, or any of its directors, officers, agents, affiliates, group companies, or employees as to the accuracy or completeness of the information contained in this document and no liability is accepted for any loss, arising, directly or indirectly, from any use of such information. The views and opinions expressed herein may be subject to change at any given time and ABN AMRO is under no obligation to update the information contained in this document after the date thereof. Before investing in any product of ABN AMRO Bank N.V., you should obtain information on various financial and other risks and any possible restrictions that you and your investments activities may encounter under applicable laws and regulations. If, after reading this document, you consider investing in a product, you are advised to discuss such an investment with your relationship manager or personal advisor and check whether the relevant product –considering the risks involved- is appropriate within your investment activities. The value of your investments may fluctuate. Past performance is no guarantee for future returns. ABN AMRO reserves the right to make amendments to this material. © Copyright 2014 ABN AMRO Bank N.V. and affiliated companies ("ABN AMRO"). Macro Weekly 3 Main economic/financial forecasts GDP grow th (%) 2013 2014e 2015e 2016e +3M +12M 2015e 2016e 2.2 2.3 3.8 3.0 United States 0.23 0.24 0.8 1.4 1.4 3.1 -0.4 0.9 1.5 1.9 Eurozone 0.08 0.08 0.0 0.0 0.0 0.0 Japan 1.5 0.5 1.1 1.6 Japan 0.18 0.18 0.2 0.2 0.2 0.2 United Kingdom 1.7 3.0 2.8 2.6 United Kingdom 0.55 0.55 0.6 1.2 1.2 2.2 China 27/11/2014 04/12/2014 2016e United States Eurozone 3M interbank rate 27/11/2014 04/12/2014 7.7 7.5 7.0 7.0 World Inflation (%) 3.2 2013 3.2 2014e 3.8 2015e 3.9 2016e +3M +12M 2015e United States 1.5 1.7 1.6 2.2 US Treasury 2.25 2.24 2.8 3.0 3.0 3.5 Eurozone 1.3 0.5 0.9 1.5 German Bund 0.71 0.77 1.1 1.3 1.3 1.6 10Y interest rate Japan 0.3 2.7 1.7 2.0 Euro sw ap rate 0.91 0.99 1.3 1.5 1.5 1.8 United Kingdom 2.6 1.4 1.1 1.9 Japanese gov. bonds 0.43 0.41 0.6 0.7 0.7 1.0 China UK gilts 1.92 1.99 2.4 2.7 2.7 3.2 27/11/2014 04/12/2014 2.6 2.0 2.5 2.9 World Key policy rate 4.0 04/12/2014 3.8 +3M 3.8 2015e 3.8 2016e +3M +12M 2015e 2016e Federal Reserve 0.25 0.50 1.00 3.00 EUR/USD 1.25 1.24 1.20 1.15 1.15 1.00 European Central Bank 0.05 0.05 0.05 0.05 USD/JPY 117.7 119.8 120 125 125 135 Bank of Japan 0.10 0.10 0.10 0.10 GBP/USD 1.57 1.57 1.46 1.47 1.47 1.33 Currencies Bank of England 0.50 0.50 1.00 2.00 EUR/GBP 0.79 0.79 0.82 0.78 0.78 0.75 People's Bank of China 5.60 5.10 5.10 5.10 USD/CNY 6.14 6.15 6.20 6.25 6.17 6.25 Source: Thomson Reuters Datastream, ABN AMRO Group Economics. Day Date Time Country Monday Monday Monday Monday Monday Monday Monday 08/12/2014 08/12/2014 08/12/2014 08/12/2014 08/12/2014 08/12/2014 08/12/2014 00:50:00 00:50:00 06:00:00 08:00:00 09:15:00 18:30 JP JP JP DE CH CN US Tuesday Tuesday Tuesday Tuesday Tuesday Tuesday Tuesday 09/12/2014 09/12/2014 09/12/2014 09/12/2014 09/12/2014 09/12/2014 09/12/2014 01:01:00 07:45:00 08:45:00 10:30:00 13:30:00 16:00:00 16:00:00 Wednesday Wednesday Wednesday Wednesday Wednesday Wednesday Wednesday Wednesday Wednesday 10/12/2014 10/12/2014 10/12/2014 10/12/2014 10/12/2014 10/12/2014 10/12/2014 10/12/2014 10/12/2014 Thursday Thursday Thursday Thursday Thursday Thursday Thursday Thursday Thursday Thursday Thursday Friday Friday Friday Friday Friday Friday Friday Friday Key Economic Indicators and Events Period Latest outcome Consensus GDP - % qoq BOP Current account - JPY bn Economy Watchers Survey - index Industrial production - % mom CPI - % yoy Trade balance - USD bn Fed's Lockhart speaks on Monetary Policy in Atlanta 3Q F Oct Nov Oct Nov Nov -0.4 963.0 44.0 1.4 0.0 45.4 -0.1 432.0 GB CH FR GB US US GB BRC Retail sales - % yoy Unemployment - % Trade balance - EUR mln Manufacturing production - % mom NFIB small business optimisme - index US Job Openings by Industry NIESR GDP estimate - % qoq Nov Nov Oct Oct Nov Oct Nov 0.0 3.2 -4715.0 0.4 96.1 4735.0 0.7 02:30:00 09:00:00 10:00:00 10:30:00 10:30:00 21:00:00 15/12/2014 15/12/2014 15/12/2014 CN ZA NO GB GB NZ CN CN CN CPI - % yoy CPI - % yoy CPI - % yoy Trade balance Non-EU - GDP mln Trade balance - GDP mln Policy rate - % M2 money growth - % yoy New yuan loans - RMB bn Aggregate financing - RMB bn Nov Nov Nov Oct Oct Dec 11 Nov Nov Nov 1.6 5.9 2.5 -4048.0 -2838.0 3.5 12.6 548.3 662.7 11/12/2014 11/12/2014 11/12/2014 11/12/2014 11/12/2014 12/11/2014 11/12/2014 11/12/2014 11/12/2014 11/12/2014 11/12/2014 00:50:00 01:01:00 08:00:00 09:30:00 10:00:00 11:15:00 14:30:00 16:00:00 22:30:00 JP GB DE CH NO EZ US US NZ KR RU Machinery orders private sector - % mom RICS house price balance - % CPI - % yoy Policy rate - % Policy rate - % ECB TLTRO allotment (EUR bn) Retail sales - % mom Business inventories - % mom PMI manufacturing - index Policy rate - % GDP - % yoy Oct Nov Nov F Dec 11 Dec 11 2.9 20.0 0.6 0.0 1.5 -1.4 18.0 0.6 0.0 Nov Oct Nov Dec 11 3Q P 0.3 0.3 59.3 2.0 0.7 0.3 0.2 12/12/2014 12/12/2014 12/12/2014 12/12/2014 12/12/2014 12/12/2014 12/12/2014 12/12/2014 05:30:00 06:30:00 06:30:00 06:30:00 11:00:00 13:00:00 13:00:00 15:55:00 JP CN CN CN EC IN IN US Industrial production - % mom Fixed investments - % yoy Retail sales - % yoy Industrial production - % yoy Industrial production - % mom Industrial production - % yoy CPI - % yoy Univ. of Michigan cons. confidence - index Oct F Nov Nov Nov Oct Oct Nov Dec P 0.2 15.9 11.5 7.7 0.6 2.5 5.5 88.8 0.1 ABN AMRO 0.5 44.5 0.3 96.2 96 1.6 -2566.7 3.5 12.5 650.0 890.0 3.5 0.0 1.5 0.3 1.9 0.7 15.8 11.6 7.5 0.1 89.2 89.5 Source: Bloomberg, Reuters, ABN AMRO Group Economics (we provide own forecasts only for selected k ey variables and events) Macro Weekly 4