PPT for Eurozone Crisis - The University of Nottingham Ningbo China

advertisement

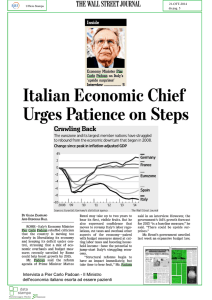

欧洲债务危机: 原因,解决方法及对中国的影响 Eurozone Crisis: Origin, Solutions and Impact on China Michele Geraci (杰拉奇) Head of China Program - Global Policy Institute Senior Research Fellow and Adjunct Professor of Finance -Zhejiang University Visiting Assistant Professor of Finance – University of Nottingham, Ningbo 1 Global Policy Institute Personal Introduction • Head of China – Global Policy Institute, London • Senior Research Fellow and Adjunct Professor of Finance – Zhejiang University • Visiting Assistant Professor of Finance – Nottingham University • Electronic Engineering – Graduate degree, University of Palermo (University College London) • Master in Business Administration (MBA) - Massachusetts Institute of Technology, Sloan School of Management 2 Global Policy Institute Personal Introduction • Merrill Lynch Investment Banking – Associate • Donaldson, Lufkin and Jenrette – Vice President, Head of Latin America and Co-Head of Europe Telecom Research • Bank of America – Director, Co-Head of Europe Telecoms • Pali Capital – Managing Director, Head of Europe Telecoms • Schroders Asset Management – Head of European Media, Telecom 3 Global Policy Institute Agenda • • • • • Introduction to the EU and the Eurozone Reasons for the current crisis Impact on China Recent Events Q&A 4 Global Policy Institute Other Data 5 Global Policy Institute Other Data 6 Global Policy Institute 7 Global Policy Institute 8 Global Policy Institute 9 Global Policy Institute 10 Global Policy Institute Other Data 11 Global Policy Institute Europe:brief history • • • • • • 1945 - End of WWII 1952 – Treaty of Paris signed (France, Italy, Holland, Belgium and Germany): European Community formally established 1958 – Treaty of Rome signed 1973 – England joins 1992:Treaty of Maastricht – path to Eurozone 2012:27 countries are part of the EU。 12 Global Policy Institute Message 1: Not Long after the end of WWI, Europe had been re-united Global Policy Institute 13 EU System • • • • • Free flow of goods and services Tax-free trade area Free flow of people No custom, no need for ID card (ex Schengen) All citizens from any of the 27 countries enjoys same rights and befenits Message2: EU basically looks as if it was a single country Global Policy Institute 14 Eurzozone:’99 First Stage 15 Global Policy Institute Eurozone ‘01: Greece joins 16 Global Policy Institute Eurozone ‘12: 17 countries 17 Global Policy Institute Convergence Criteria:趋同标准 • If a country wants to join the Eurozone, it must fulfill certain conditions • 如果一个国家想加入欧元区,他就必须满 足几个条件。 18 Global Policy Institute Convergence Criteria:趋同标准 • Inflation Rate (通货膨胀): <1.5% higher than av. of best three other countries • Government Deficit/GDP (政府赤字) <3% • Government Debt/GDP (政府债务与GDP比率)<60% • Interest Rates (利息率)< 2% more than three lowest countries 19 Global Policy Institute Inflation 奥地利 比利时 2003 2004 2005 Inflation 2006 2007 2008 2009 2010 2011 芬兰 法国 德国 希腊 爱尔兰 意大利 卢森堡 马耳他 荷兰 葡萄牙 斯洛伐克 斯洛文尼亚 西班牙 1.3% 1.5% 4.0% 1.4% 1.3% 2.2% 1.0% 3.4% 4.0% 2.8% 2.5% 1.9% 2.2% 3.3% 8.4% 5.7% 3.1% 2.0% 1.9% 1.9% 3.0% 0.1% 2.3% 1.8% 3.0% 2.3% 2.2% 3.2% 2.7% 1.4% 2.5% 7.5% 3.7% 3.1% 2.1% 2.5% 2.0% 4.1% 0.8% 1.9% 1.9% 3.5% 2.1% 2.2% 3.8% 2.5% 1.5% 2.1% 2.8% 2.5% 3.4% 1.7% 2.3% 2.3% 4.5% 1.3% 1.9% 1.8% 3.3% 2.7% 2.2% 3.0% 2.6% 1.7% 3.0% 4.3% 2.5% 3.6% 2.2% 1.8% 2.2% 6.7% 1.6% 1.6% 2.3% 3.0% 2.8% 2.1% 2.7% 0.7% 1.6% 2.4% 1.9% 3.8% 2.8% 3.2% 4.5% 4.4% 10.6% 3.9% 3.2% 2.8% 4.2% 3.1% 3.5% 4.1% 4.7% 2.2% 2.7% 3.9% 5.5% 4.1% 0.4% 0.0% 0.2% 0.2% 1.6% 0.1% 0.2% 1.4% -1.7% 0.7% 0.0% 1.8% 1.0% -0.9% 0.9% 0.9% -0.2% 1.7% 2.3% 2.6% 2.7% 1.7% 1.7% 1.1% 4.7% -1.6% 1.7% 2.8% 2.0% 0.9% 1.4% 0.7% 2.1% 2.0% 3.6% 3.5% 3.5% 5.1% 3.3% 2.3% 2.5% 3.1% Smallest Second Smallest Third Smalles 1.0% 1.3% 1.3% 0.1% 1.4% 1.8% 0.8% 1.5% 1.9% 1.3% 1.7% 1.7% 0.7% 1.6% 1.6% 2.2% 2.7% 2.8% -1.7% -0.9% -0.2% -1.6% 0.7% 0.9% 2.1% 2.3% 2.4% Average 1.2% 1.1% 1.4% 1.5% 1.3% 2.5% -0.9% 0.0% 2.3% 条件 (Average +1.5%) 2.7% 2.6% 2.9% 3.0% 20 2.8% 4.0% 0.6% 塞浦路斯 爱沙尼亚 2.9% 3.7% 2.4% 2.5% 3.6% 4.1% 2.1% 3.1% Austria Belgium Cyprus Estonia Finland France Germany Greece Ireland Italy Luxembourg Malta Netherlands Portugal Slovakia Slovenia Spain Global Policy Institute 1.5% 3.8% Inflation Inflation 奥地利 比利时 塞浦路斯 爱沙尼亚 芬兰 法国 德国 希腊 爱尔兰 意大利 卢森堡 马耳他 荷兰 葡萄牙 斯洛伐克 斯洛文尼亚 西班牙 条件 2003 2004 2005 2006 2007 2008 2009 2010 2011 1.3% 1.5% 4.0% 1.4% 1.3% 2.2% 1.0% 3.4% 2.0% 1.9% 1.9% 3.0% 0.1% 2.3% 1.8% 3.0% 2.1% 2.5% 2.0% 4.1% 0.8% 1.9% 1.9% 3.5% 1.7% 2.3% 2.3% 4.5% 1.3% 1.9% 1.8% 3.3% 2.2% 1.8% 2.2% 6.7% 1.6% 1.6% 2.3% 3.0% 3.2% 4.5% 4.4% 10.6% 3.9% 3.2% 2.8% 4.2% 0.4% 0.0% 0.2% 0.2% 1.6% 0.1% 0.2% 1.4% 1.7% 2.3% 2.6% 2.7% 1.7% 1.7% 1.1% 4.7% 4.0% 2.8% 2.5% 1.9% 2.2% 3.3% 8.4% 5.7% 3.1% 2.3% 2.2% 3.2% 2.7% 1.4% 2.5% 7.5% 3.7% 3.1% 2.1% 2.2% 3.8% 2.5% 1.5% 2.1% 2.8% 2.5% 3.4% 2.7% 2.2% 3.0% 2.6% 1.7% 3.0% 4.3% 2.5% 3.6% 2.8% 2.1% 2.7% 0.7% 1.6% 2.4% 1.9% 3.8% 2.8% 3.1% 3.5% 4.1% 4.7% 2.2% 2.7% 3.9% 5.5% 4.1% -1.7% 0.7% 0.0% 1.8% 1.0% -0.9% 0.9% 0.9% -0.2% -1.6% 1.7% 2.8% 2.0% 0.9% 1.4% 0.7% 2.1% 2.0% 2.7% 2.6% 2.9% 3.0% 2.8% 4.0% 0.6% 1.5% 21 3.6% Austria 3.5% Belgium 3.5% Cyprus 5.1% Estonia 3.3% Finland 2.3% France 2.5% Germany 3.1% Greece Ireland 2.9% Italy 3.7% Luxembourg 2.4% Malta 2.5% Netherlands 3.6% Portugal 4.1% Slovakia 2.1% Slovenia 3.1% Spain 3.8% Global Policy Institute Government Deficit 财政赤字 22 Global Policy Institute Government Deficit 0.0% 0.4% -2.2% -0.1% 5.1% -1.5% -3.1% -4.5% 0.9% -3.1% 6.1% -6.4% -0.2% -4.3% -6.5% -4.0% -0.5% -1.9% -3% -0.7% -0.1% -4.4% 0.3% 4.1% -3.1% -3.8% -4.8% -0.4% -3.1% 2.1% -5.8% -2.1% -2.9% -8.2% -2.4% -0.2% -2.6% -3% -1.5% -0.1% -6.6% 1.7% 2.6% -4.1% -4.2% -5.6% 0.4% -3.6% 0.5% -9.2% -3.1% -3.0% -2.8% -2.7% -0.3% -3.1% -3% -4.4% -0.3% -4.1% 1.6% 2.5% -3.6% -3.8% -7.5% 1.4% -3.5% -1.1% -4.7% -1.7% -3.4% -2.4% -2.3% -0.1% -2.9% -3% -1.7% -2.7% -2.4% 1.6% 2.8% -2.9% -3.3% -5.2% 1.7% -4.4% 0.0% -2.9% -0.3% -5.9% -2.8% -1.5% 1.3% -2.5% -3% 23 -1.5% 0.1% -1.2% 2.5% 4.1% -2.3% -1.6% -5.7% 2.9% -3.4% 1.4% -2.8% 0.5% -4.1% -3.2% -1.4% 2.4% -1.3% -3% 2009 2008 2007 2006 2005 2004 2003 2002 2001 奥地利 比利时 塞浦路斯 爱沙尼亚 芬兰 法国 德国 希腊 爱尔兰 意大利 卢森堡 马耳他 荷兰 葡萄牙 斯洛伐克 斯洛文尼亚 西班牙 欧元区 条约的条件 -0.9% -0.3% 3.5% 2.4% 5.3% -2.7% 0.2% -6.5% 0.1% -1.6% 3.7% -2.4% 0.2% -3.1% -1.8% 0.0% 1.9% -0.7% -3% -0.9% -1.3% 0.9% -2.9% 4.3% -3.3% -0.1% -9.8% -7.3% -2.7% 3.0% -4.6% 0.5% -3.6% -2.1% -1.9% -4.5% -2.1% -3% -4.1% -5.8% -6.1% -2.0% -2.5% -7.5% -3.2% -15.8% -14.2% -5.4% -0.9% -3.7% -5.6% -10.1% -8.0% -6.1% -11.2% -6.4% -3% 2010 -4.4% -4.1% -5.3% 0.2% -2.5% -7.1% -4.3% -10.6% -31.3% -4.6% -1.1% -3.6% -5.1% -9.8% -7.7% -5.8% -9.3% -6.2% -3% Austria Belgium Cyprus Estonia Finland France Germany Greece Ireland Italy Luxembourg Malta Netherlands Portugal Slovakia Slovenia Spain Euro17 Criteria Global Policy Institute Government Deficit 2001 奥地利 比利时 塞浦路斯 爱沙尼亚 芬兰 法国 德国 希腊 爱尔兰 意大利 卢森堡 马耳他 荷兰 葡萄牙 斯洛伐克 斯洛文尼亚 西班牙 欧元区 条约的条件 2002 0.0% 0.4% -2.2% -0.1% 5.1% -1.5% -3.1% -4.5% 0.9% -3.1% 6.1% -6.4% -0.2% -4.3% -6.5% -4.0% -0.5% -1.9% -3% 2003 -0.7% -0.1% -4.4% 0.3% 4.1% -3.1% -3.8% -4.8% -0.4% -3.1% 2.1% -5.8% -2.1% -2.9% -8.2% -2.4% -0.2% -2.6% -3% 2004 -1.5% -0.1% -6.6% 1.7% 2.6% -4.1% -4.2% -5.6% 0.4% -3.6% 0.5% -9.2% -3.1% -3.0% -2.8% -2.7% -0.3% -3.1% -3% 2005 -4.4% -0.3% -4.1% 1.6% 2.5% -3.6% -3.8% -7.5% 1.4% -3.5% -1.1% -4.7% -1.7% -3.4% -2.4% -2.3% -0.1% -2.9% -3% 2006 -1.7% -2.7% -2.4% 1.6% 2.8% -2.9% -3.3% -5.2% 1.7% -4.4% 0.0% -2.9% -0.3% -5.9% -2.8% -1.5% 1.3% -2.5% -3% 2007 -1.5% 0.1% -1.2% 2.5% 4.1% -2.3% -1.6% -5.7% 2.9% -3.4% 1.4% -2.8% 0.5% -4.1% -3.2% -1.4% 2.4% -1.3% -3% 2008 -0.9% -0.3% 3.5% 2.4% 5.3% -2.7% 0.2% -6.5% 0.1% -1.6% 3.7% -2.4% 0.2% -3.1% -1.8% 0.0% 1.9% -0.7% -3% 2009 -0.9% -1.3% 0.9% -2.9% 4.3% -3.3% -0.1% -9.8% -7.3% -2.7% 3.0% -4.6% 0.5% -3.6% -2.1% -1.9% -4.5% -2.1% -3% -4.1% -5.8% -6.1% -2.0% -2.5% -7.5% -3.2% -15.8% -14.2% -5.4% -0.9% -3.7% -5.6% -10.1% -8.0% -6.1% -11.2% -6.4% -3% 2010 -4.4% -4.1% -5.3% 0.2% -2.5% -7.1% -4.3% -10.6% -31.3% -4.6% -1.1% -3.6% -5.1% -9.8% -7.7% -5.8% -9.3% -6.2% -3% Austria Belgium Cyprus Estonia Finland France Germany Greece Ireland Italy Luxembourg Malta Netherlands Portugal Slovakia Slovenia Spain Euro17 Criteria GRE, ITA, POR Global Policy Institute almost always24exceed criteria Debt/GDP Spain: RE bubble four countries “always”exceededGlobal criteria Policy Institute 25 Debt/GDP Attention:France and Germany are not too ‘in Global Policy Institute 26 good shape, either Debt/GDP Eurozone and EU members performance: UK??? 27 Global Policy Institute Interest Rates 28 Global Policy Institute Convergence Criteria:met or not? • Inflation:in 2010, 12 countries did not meet criteria! • Gov’t Deficit:in ’09 and ‘10,15 countries did not meet criteria! • Debt/GDP: Greece and Italy ratio always above: EU average always above criteria! Message 3: Eurozone:basically, never met, almost never, at least Global Policy Institute 29 Why Greece so serious? Message 4:“reciprocal help”: Global Policy Institute 30 this concept is now in doubt Crisis: Soft reasons • 27 countries • 27 electoral democracies,54 different points of view! • Culture, history, technology, language, custom, food,economic structure,social structure, etc..not at all the same! Message 5:Unification process not easy 31 Global Policy Institute Crisis“hard”reasons • • • • • • • • Relaxed lending practices Excessive investment Risk assessment not proper Global Imbalances Improper fiscal policies Socialise losses Contagion Problems Single Currency!!! 32 Global Policy Institute Trade Imbalance, leading to protectionism Reaganomics Benefits to Chinese exports Financing US consumption 33 Accumulation of FX Reserves Purchase of US bonds Global Policy Institute Crisis:3 examples • Ireland • Greece • Italy Excessive Inv,Real Estate Civil Servants and salaries loss of competiveness,low efficiency ratios 34 Global Policy Institute Reasons for the crisis We must acknowledge that Europe faces two distinct problems: Sovereign Debt crisis and Eurozone Crisis • The first one is due to individual countries bad fiscal policies • The second is due to structural problems。 Message 6:Debt crisis and Eurozone crisis areInstitute two Global Policy 35 Conditions for monetary area 1. 2. 3. 4. Relax the mandate of the ECB 财政整合 – Fiscal Integration Fully implement people’s mobility (Dakota) 。。。??? 36 Global Policy Institute Possible Solutions 1. Generally, Central banks look after inflation and economic growth: a balanced mandate, but.. 2. ECB’s only responsibility is price stability (CPI): – Unrealistic goal (17 countries) – ECB is not concerned with stimulating growth 3. AND, even worse, When you have debt you should push inflation up, but that is not what the ECB does 37 Global Policy Institute Possible Solutions 2. Eurozone has no fiscal integration – currently, each country look after its own budget – What about China and the US? – A German tax envoy goes to Greece to collect taxes and decides to spend the money in Berlin – Can people accept this? 38 Global Policy Institute Possible Solutions 3. Realize full people mobility – – – – Easy in theory, not in practice Language, culture, society, political systems What about China and the US? Dakota can be emptied, but Belgium? 39 Global Policy Institute Possible Solutions 4. Break up of the EURO! – Or, reduce the scope – Re-introduce individual currencies – Every country can choose its own monetary policy (print money) – Can depreciate currency,stimulate exports (Short term is fine) – Painful in the short term , but successful in the long term PIIGS can leave, or Germany can leave EUROzone 40 Global Policy Institute Possible Solutions Message 7:Sacrifice the Euro to Save the European Union 41 Global Policy Institute 欧元区已经解体了 42 Global Policy Institute Impact on China • The Chinese economy, as a whole, is becoming less dependent on exports…apparently • This year, there maybe a trade deficit Therefore… A slowing demand from Europe for Chinese goods is not going to have a big impact on Chinese economy – True? 43 Global Policy Institute Key points on the RMB • Countries have sovereign right to set it exchange rate as they wish (US, Italy, UK) • No one knows the real value of the RMB • The impact of a possible revaluation of RMB on US exports in far from clear, • But, impact on China can be negative 44 Global Policy Institute Plaza Accord and US$ devaluation 45 Global Policy Institute Impact on China 46 Global Policy Institute Impact on China 47 Global Policy Institute Impact on China • China should come to the rescue of Europe • Not for charity, but to protect it’s own interest • Chinese policy makers may underestimate this problem Message 8:Chinese policy makers must pay closer Global Policy Institute attention 48 Summary 1 Not Long after the end of WWI, Europe had been re-united 2 EU basically looks as if it was a single country 3 Eurozone:basically, never met, almost never, at least 4 “reciprocal help”:this concept is now in doubt 5 Unification process not easy 6 Debt crisis and Eurozone crisis are two different things 7 Sacrifice the Euro to Save the European Union 8 Chinese policy makers must pay closer attention 最近的时间 • 2011 年10月份:欧盟高峰会:新的财政条 约 • 2012年三月份:希腊新的纾困 • 2012年四月份:法国大选 50 Global Policy Institute