Macro Weekly When Yanis met Wolfgang

advertisement

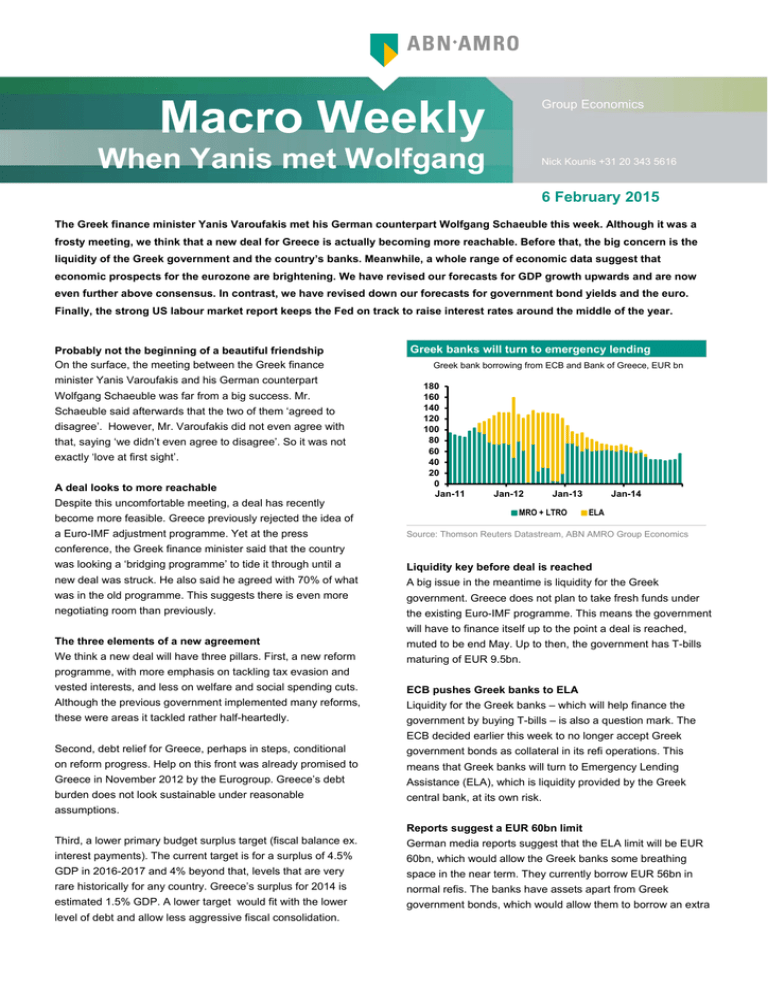

Group Economics Macro Weekly When Yanis met Wolfgang Nick Kounis +31 20 343 5616 6 February 2015 The Greek finance minister Yanis Varoufakis met his German counterpart Wolfgang Schaeuble this week. Although it was a frosty meeting, we think that a new deal for Greece is actually becoming more reachable. Before that, the big concern is the liquidity of the Greek government and the country’s banks. Meanwhile, a whole range of economic data suggest that economic prospects for the eurozone are brightening. We have revised our forecasts for GDP growth upwards and are now even further above consensus. In contrast, we have revised down our forecasts for government bond yields and the euro. Finally, the strong US labour market report keeps the Fed on track to raise interest rates around the middle of the year. Probably not the beginning of a beautiful friendship On the surface, the meeting between the Greek finance minister Yanis Varoufakis and his German counterpart Wolfgang Schaeuble was far from a big success. Mr. Schaeuble said afterwards that the two of them ‘agreed to disagree’. However, Mr. Varoufakis did not even agree with that, saying ‘we didn’t even agree to disagree’. So it was not exactly ‘love at first sight’. A deal looks to more reachable Despite this uncomfortable meeting, a deal has recently become more feasible. Greece previously rejected the idea of a Euro-IMF adjustment programme. Yet at the press Greek banks will turn to emergency lending Greek bank borrowing from ECB and Bank of Greece, EUR bn 180 160 140 120 100 80 60 40 20 0 Jan-11 Jan-12 Jan-13 MRO + LTRO Jan-14 ELA Source: Thomson Reuters Datastream, ABN AMRO Group Economics conference, the Greek finance minister said that the country was looking a ‘bridging programme’ to tide it through until a Liquidity key before deal is reached new deal was struck. He also said he agreed with 70% of what A big issue in the meantime is liquidity for the Greek was in the old programme. This suggests there is even more government. Greece does not plan to take fresh funds under negotiating room than previously. the existing Euro-IMF programme. This means the government will have to finance itself up to the point a deal is reached, The three elements of a new agreement muted to be end May. Up to then, the government has T-bills We think a new deal will have three pillars. First, a new reform maturing of EUR 9.5bn. programme, with more emphasis on tackling tax evasion and vested interests, and less on welfare and social spending cuts. ECB pushes Greek banks to ELA Although the previous government implemented many reforms, Liquidity for the Greek banks – which will help finance the these were areas it tackled rather half-heartedly. government by buying T-bills – is also a question mark. The ECB decided earlier this week to no longer accept Greek Second, debt relief for Greece, perhaps in steps, conditional government bonds as collateral in its refi operations. This on reform progress. Help on this front was already promised to means that Greek banks will turn to Emergency Lending Greece in November 2012 by the Eurogroup. Greece’s debt Assistance (ELA), which is liquidity provided by the Greek burden does not look sustainable under reasonable central bank, at its own risk. assumptions. Reports suggest a EUR 60bn limit Third, a lower primary budget surplus target (fiscal balance ex. German media reports suggest that the ELA limit will be EUR interest payments). The current target is for a surplus of 4.5% 60bn, which would allow the Greek banks some breathing GDP in 2016-2017 and 4% beyond that, levels that are very space in the near term. They currently borrow EUR 56bn in rare historically for any country. Greece’s surplus for 2014 is normal refis. The banks have assets apart from Greek estimated 1.5% GDP. A lower target would fit with the lower government bonds, which would allow them to borrow an extra level of debt and allow less aggressive fiscal consolidation. 2 Macro Weekly - When Yanis met Wolfgang - 6 February 2015 EUR 20bn in regular operations (so EUR 80bn total by 0.9% qoq. Meanwhile, car registrations were up by 2.1% borrowing). They need the space given that there is significant qoq last quarter, a sign that other areas of consumer demand deposit withdrawal underway, while they will also may be are also doing well. pressured to finance the government. However, the situation is clearly fragile and cannot go on in this manner for a long This is not what a deflationary spiral is meant to look like period. This is why the oil-driven falls in consumer prices can be seen as ‘good deflation’. Falling prices – driven by the collapse in oil Governing Council can block, but hurdle is high prices – are giving consumer spending a lift. This appears to The ECB’s Governing Council can restrict ELA to the Greek contradict worries about a deflationary spiral, which would be banks if it judges that it interferes with the ‘objectives and tasks characterised by falling prices leading to consumers cutting of the Eurosystem’. However, the Council would need a two- back spending. thirds majority to block ELA. In addition, it would be a very big step as it would throw Greece’s financial system and economy Labour market improving, German industry on the up into chaos, potentially increasing the risk of a euro exit. Given The fall in oil prices should be seen as a tax cut and a rather this, we think most Governing Council members would keep big one at that. It will provide support to consumer spending for liquidity provision available until there is a clarity in terms of the a number of months, but then the effects will fade. For a political negotiations. sustained recovery, the labour market needs to improve. Fortunately, there are signs this is happening. The composite Europe’s consumers get boost from oil jobs PMI rose to 51 in January from 50.8 in December, the Retail sales, % yoy highest since July and before that September 2011. Job growth is still slow, but is heading in the right direction. 4.0 3.0 2.0 1.0 0.0 -1.0 -2.0 -3.0 -4.0 -5.0 To top off the good news, German factory orders jumped in December. This is a volatile series, but both orders and output accelerated for Q4 as a whole. Capital goods orders led the way, suggesting that investment should also firm going forward. 04 06 08 10 12 14 US labour continues going strong The US economy has been performing strongly over recent Source: Thomson Reuters Datastream, ABN AMRO Group Economics quarters and this is very visible in the labour market. Nonfarm payrolls rose by 257K in January after an upwardly revised We have revised our eurozone growth forecast upwards 329K jump in December. The 3-month average for job growth Despite the risks in Greece, we have become more optimistic is at its highest since 1997! Disappearing labour market slack on the outlook for the eurozone economy. We have revised our is starting to push up wage growth. Average hourly earnings GDP forecasts to reflect lower oil prices, the decline in the euro accelerated to 2.2% yoy in January from 1.9% in December. and the general easing of financial conditions brought about by the ECB’s QE programme. We now see GDP growing by 1.6% Fed on track to raise interest rates this year this year and 2.2% next (previously: 1.5 and 1.9% The labour market report confirms that the Fed is on track to respectively). raise interest rates in the coming months. We think that the move will likely be in June of this year. A lot now hangs on Although the revision for the annual average for this year is core inflation, which was weak in December. A January only slight, this disguises a more significant revision to the rebound (data are out later this month) would confirm that the quarterly profile. If we are right the relatively downbeat Fed will start to normalise its policy rates in the Summer. consensus will be surprised positively. Government bond yields revised lower Eurozone data point to brighter economic outlook We have made revisions to our interest rate and currency Reports out of the eurozone this week suggested that the forecasts. Given the upward revisions in our eurozone economic recovery is building some momentum. Annual retail economic growth forecasts, it is perhaps surprising that our sales growth rose to 2.8% in December, the highest since revisions for bond yields are going in the opposite direction. March 2007. In the fourth quarter alone, retail sales were up We now expect 10y Bund yields to end the year close to 3 Macro Weekly - When Yanis met Wolfgang - 6 February 2015 current levels at 0.4%, rather than 1% previously. However, we Easier monetary policy around the world, ongoing strong US think that on 3-month horizon, the yield will fall further, to reach demand and lower oil prices are good reasons to expect firmer just 10bp. global growth in the months ahead. Acute scarcity due to ECB and weak supply US employment growth going strong The ECB’s large scale government bond purchases, in Nonfarm payrolls, 3-month moving average, 000s mom combination with low net supply of core bonds, will create a situation of acute scarcity (our Euro Sovereign Playbook 2015: ‘Acute scarcity of AAA bonds’ published today contains more on this subject). This situation will also continue to dampen US 10y Treasury yields, which will look increasingly attractive. Our end of year forecast is now 2.1%, down from 2.7% previously, implying a more modest rise, even given Fed rate hikes. 600 400 200 0 -200 -400 -600 EUR/USD set to fall further We also expect the EUR/USD to fall even further. We see it at 1.05 at year-end and 0.95 at the end of next year (previously: -800 91 93 95 97 99 01 03 05 07 09 11 13 15 Source: Thomson Reuters Datastream, ABN AMRO Group Economics 1.10 and 1.00 respectively). A gradual rise in Fed policy rates this year will contrast sharply to aggressive ECB balance sheet expansion. The lessons from the US experience, is that the currency falls during QE as well as in anticipation of the programme. Global monetary easing cycle continues The US aside, most major central banks around the world remain in full monetary easing mode. The Reserve Bank of Australia cut its cash rate target to 2.25% from 2.5%. The correction in commodity prices over the last few months is still hurting the economy, and the central bank is taking steps to underpin the non-mining sectors. The People’s Bank of China to cut its reserve requirement ratio (RRR) for the country’s commercial banks by 50bp. This further loosening in liquidity conditions reflects that the authorities continue to take modest easing steps to keep the economy on the path of a soft landing. We expect further easing going forward in the shape of interest rate cuts. Our base scenario is that China’s economy slows to 7% this year, compared to 7.4% last year. Find out more about Group Economics at: http://insights.abnamro.nl/en/category/economy/ This document has been prepared by ABN AMRO. It is solely intended to provide financial and general information on economics. The information in this document is strictly proprietary and is being supplied to you solely for your information. It may not (in whole or in part) be reproduced, distributed or passed to a third party or used for any other purposes than stated above. This document is informative in nature and does not constitute an offer of securities to the public, nor a solicitation to make such an offer. No reliance may be placed for any purposes whatsoever on the information, opinions, forecasts and assumptions contained in the document or on its completeness, accuracy or fairness. No representation or warranty, express or implied, is given by or on behalf of ABN AMRO, or any of its directors, officers, agents, affiliates, group companies, or employees as to the accuracy or completeness of the information contained in this document and no liability is accepted for any loss, arising, directly or indirectly, from any use of such information. The views and opinions expressed herein may be subject to change at any given time and ABN AMRO is under no obligation to update the information contained in this document after the date thereof. Before investing in any product of ABN AMRO Bank N.V., you should obtain information on various financial and other risks and any possible restrictions that you and your investments activities may encounter under applicable laws and regulations. If, after reading this document, you consider investing in a product, you are advised to discuss such an investment with your relationship manager or personal advisor and check whether the relevant product –considering the risks involved- is appropriate within your investment activities. The value of your investments may fluctuate. Past performance is no guarantee for future returns. ABN AMRO reserves the right to make amendments to this material. © Copyright 2015 ABN AMRO Bank N.V. and affiliated companies ("ABN AMRO"). 2 Macro Weekly - When Yanis met Wolfgang - 6 February 2015 Main economic/financial forecasts GDP grow th (%) 2013 2014e 2015e 2016e +3M +12M 2015e 2.4 2.4 3.8 3.0 United States 0.25 0.26 0.4 1.4 1.4 3.0 -0.4 0.9 1.6 2.2 Eurozone 0.05 0.06 0.05 0.05 0.05 0.05 Japan 1.6 0.4 1.6 1.2 Japan 0.17 0.17 0.2 0.2 0.2 0.2 United Kingdom 1.7 2.6 2.8 2.6 United Kingdom 0.56 0.56 0.6 1.2 1.2 2.2 China 29/01/2015 05/02/2015 United States Eurozone 3M interbank rate 29/01/2015 05/02/2015 2016e 7.7 7.4 7.0 7.0 World Inflation (%) 3.2 2013 3.2 2014e 3.5 2015e 3.8 2016e +3M +12M 2015e 2016e United States 1.5 1.6 1.0 1.8 US Treasury 1.76 1.82 1.8 2.1 2.1 2.9 Eurozone 1.3 0.5 0.2 1.5 German Bund 0.36 0.38 0.2 0.4 0.4 1.0 Japan 0.3 2.8 1.0 1.4 Euro sw ap rate 0.74 0.71 0.6 0.9 0.9 1.3 United Kingdom 2.6 1.5 1.1 1.9 Japanese gov. bonds 0.29 0.36 0.5 0.7 0.7 1.0 China 2.6 2.0 2.0 2.5 UK gilts 1.42 1.55 1.5 2.4 2.7 3.2 World Key policy rate 4.3 05/02/2015 4.0 +3M 3.5 2015e 3.6 2016e 29/01/2015 05/02/2015 +3M +12M 2015e 2016e Federal Reserve 0.25 0.25 1.00 3.00 EUR/USD 1.13 1.14 1.12 1.05 1.05 0.95 European Central Bank 0.05 0.05 0.05 0.05 USD/JPY 118.3 117.5 122 130 130 140 Bank of Japan 0.10 0.10 0.10 0.10 GBP/USD 1.51 1.53 1.47 1.40 1.40 1.36 Bank of England 0.50 0.50 1.00 2.00 EUR/GBP 0.75 0.75 0.76 0.75 0.75 0.70 People's Bank of China 5.60 5.35 5.10 5.10 USD/CNY 6.25 6.25 6.23 6.27 6.27 6.35 10Y interest rate Currencies Source: Thomson Reuters Datastream, ABN AMRO Group Economics. KEY MACRO EVENTS Day Date Sunday Sunday 08/02/2015 08/02/2015 Monday Monday 09/02/2015 09/02/2015 Tuesday Tuesday Tuesday Tuesday Tuesday Tuesday Tuesday Tuesday Tuesday Time Country Key Economic Indicators and Events Period Latest outcome Consensus CN CN Exports - % yoy Imports - % yoy Jan Jan 9.7 -2.4 5.7 -3.2 00:50:00 07:00:00 JP JP BOP Current account - JPY bn Economy Watchers Survey - index Dec Jan 433.0 45.2 354.8 10/02/2015 10/02/2015 10/02/2015 10/02/2015 10/02/2015 10/02/2015 10/02/2015 10/02/2015 10/02/2015 01:01:00 02:30:00 09:15:00 10:00:00 15:00:00 16:00:00 15/02/2015 15/02/2015 15/02/2015 GB CN CH NO US US CN CN CN BRC Retail sales - % yoy CPI - % yoy CPI - % yoy CPI - % yoy NFIB small business optimisme - index US Job Openings by Industry M2 money growth - % yoy New yuan loans - CNY bn Aggregate financing - CNY bn Jan Jan Jan Jan Jan Dec Jan Jan Jan -0.4 1.5 -0.3 2.4 100.4 4972 12.2 697.3 1694.5 0.7 1.0 -0.6 Wednesday 11/02/2015 10:00:00 NO GDP - % qoq 4Q 0.5 Thursday Thursday Thursday Thursday Thursday Thursday Thursday Thursday 12/02/2015 12/02/2015 12/02/2015 12/02/2015 12/02/2015 12/02/2015 12/02/2015 12/02/2015 00:50:00 01:01:00 08:00:00 09:30:00 09:30:00 11:00:00 14:30:00 16:00:00 JP GB DE NL SE EC US US Machinery orders private sector - % mom RICS house price balance - % CPI - % yoy CPI - % yoy Policy rate - % Industrial production - % mom Retail sales - % mom Business inventories - % mom Dec Jan Jan F Jan Feb 12 Dec Jan Dec 1.3 11 -0.3 0.7 0.0 0.2 -0.9 0.2 Friday Friday Friday Friday Friday 13/02/2015 13/02/2015 13/02/2015 13/02/2015 13/02/2015 07:30:00 08:00:00 09:30:00 11:00:00 16:00:00 FR DE NL EC US GDP - % qoq GDP - % qoq GDP - % qoq GDP - % qoq Univ. of Michigan cons. confidence - index 4Q P 4Q P 4Q P 4Q A Feb P 0.3 0.1 0.1 0.2 98.1 ABN AMRO 101.5 12.1 1350.0 2050.0 2.1 10 -0.3 0.0 0.3 -0.2 0.1 0.2 0.2 98.4 0.5 0.0 -0.3 0.1 0.4 0.4 0.3 98.5 Source: Bloomberg, Reuters, ABN AMRO Group Economics (we provide own forecasts only for selected k ey variables and events) If you would like to receive this calendar by email on Friday, please send a message to abn.amro.group.economics@nl.abnamro.com