Euro Watch Five Big Questions on Greece

advertisement

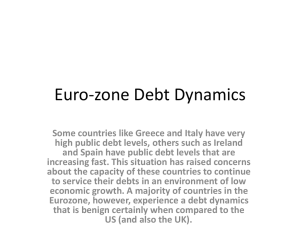

Group Economics Euro Watch Macro & Financial Markets Research Five Big Questions on Greece Nick Kounis, + 31 20 343 5616 26 January 2015 Greece is heading for a Syriza-led coalition government following yesterday’s elections We ask five big questions on the outlook for Greece and its future in the eurozone Our base case is that Greece will reach a deal with the EU/Troika, but it might be a bumpy ride 1. What will the new government look like? 2. Will Greece remain in the eurozone? A coalition government is already in place. The left wing Syriza Yes most likely. Opinion polls report that the vast majority of party, led by Alexis Tsipras, will form a government with the Greeks want to stay in the euro. In addition, Greece has made right wing Independent Greeks party, led by Panos a lot of progress with reforms, fiscal consolidation and wage Kammenos. He has already pledged to support a Syriza adjustment. It would be odd to throw it all away now. government in a confidence vote in parliament on 5 February. Meanwhile, other eurozone countries also have an interest in keeping the club together. There is strong political The Syriza party came very close to an absolute majority, but commitment, and the symbolism of a country leaving could be ultimately was two seats short of the 151 needed in the 300 damaging. Although risks are lower than a few years ago, seat parliament. The Independent Greeks won 13 seats. there may still be a significant economic and financial fall-out from a country leaving. So Greece is likely to stay. However, it The formation of a coalition government has gone amazingly depends on Greece reaching a deal with other eurozone quickly, but it is unclear whether the parties already have the member states and the Troika. outlines of any kind of programme. Syriza and Independent Greeks are from two different ends of the spectrum. As Syriza Greece’s debt burden is large economist Yanis Varoufakis – tipped to be finance minister – Government debt, % GDP told Bloomberg ‘in terms of social issues, foreign affairs, civil 200 liberties, we are chalk and cheese’. 160 So what do the parties have in common? They are both anti- 120 austerity and pro debt reduction. So these two issues look 80 likely to be at the heart of the agreement. 40 0 Table: Official sector exposure to Greece (EUR bn) ECB* EFSF/bilateral loans IMF Total AT 2.0 5.8 0.3 8.0 BE 2.5 7.2 0.6 10.3 GR IT PT IE 2013 BE EZ FR ES AT DE NL 2014 FI 60% Source: European Commission, ABN AMRO Group Economics FI 1.2 3.7 0.2 5.1 FR 14.1 42.0 1.5 57.7 DE 17.9 55.3 2.0 75.2 IT 12.2 36.8 1.1 50.2 in the sand relates to Greece getting debt relief. An outright IE 1.2 0.9 0.2 2.2 debt write off will obviously be politically difficult as it will be NL 4.0 11.8 0.7 16.5 unpopular in other eurozone states. However, significant debt PT 1.7 1.4 0.1 3.2 relief could be provided by further lengthening maturities and ES 8.8 25.0 0.6 34.3 freezing interest payments. Indeed, the Eurogroup already rest** Total 1.7 4.8 0.2 6.7 committed to do this once Greece had a primary surplus in a 67.3 194.7 7.6 269.6 Sources: ECB, national central banks, EFSF, IMF, Ministries of Finance, ABN AMRO Group Economics (due to rounding figures may not add up) * Contains bonds purchases under the Securities Market Programme as well as net MRO and LTRO borrowing ** Includes Cyprus, Estonia, Luxembourg, Malta, Slovakia and Slovenia 3. Will the new government be able to reach a deal with the eurozone? Yes, but it might be a bumpy ride. On the side of Syriza, its line statement on Greece in November 2012. On the side of other eurozone member states and the Troika, their line in the sand relates to Greece remaining on the path of reform and maintaining its primary budget in balance or in surplus. Indeed, debt relief could be made conditional on 2 Five Big Questions on Greece – 26 January 2015 actions by the Greek government. While Syriza is less willing Greece’s debt mainly to the official sector than the previous New Democracy – led governing coalition to Holdings of Greek debt cut welfare spending, it will be more willing to fight tax evasion and go after vested interests. In any case, there looks to be sufficient room for negotiation. EU/EFSF In the meantime, there me be a lot of uncertainty and it could IMF well be a bumpy ride as both sides play a ‘game of chicken’ ECB/NCB during the negotiations. Greece’s current bailout extension Private ends in February, while the country has significant bond redemption in July and August. 4. Will there be contagion? Source: IMF, EU, ABN AMRO Group Economics No, we do not expect significant contagion during this period of uncertainty in Greece, as would have been the case in the past. This reflects that the watershed moment during the euro European banks’ exposure to Greece crisis came in July 2012. ECB President Mario Draghi EUR bn famously announced that the central bank was willing to do 140 ‘whatever it takes’ to save the eurozone. It committed to buy 120 unlimited amounts of the sovereign bonds of trouble states as 100 long as they stuck to EUR-IMF conditionality. This sovereign 80 safety net makes contagion to other peripheral countries less 60 likely. 40 20 0 In addition, the eurozone banking system has less direct 11Q1 exposures to Greece. Exposure to the public sector had Public sector already been cut in 2012 because of the restructuring of outstanding government bonds. However, since then the 12Q1 Banks 13Q1 14Q1 Non-bank private sector Source: BIS, ABN Amro Group Economics exposure to the non-financial sector also declined. 5. So a Greek euro exit is no longer a big deal? We would not go that far. The fall-out looks likely to be less than in the past, but it could still be very damaging. It could create worries about the sustainability of the eurozone. The euro would be seen less as an internal single currency area and more as a fixed exchange rate regime with high barriers to exit and entry. In addition, the OMT programme has never been tested. The truth is we just do not know. We do not have recent historical experiences of countries leaving a monetary union. It does not seem like a risk worth taking lightly. Find out more about Group Economics at: https://insights.abnamro.nl/en/ This document has been prepared by ABN AMRO. It is solely intended to provide financial and general information on economics. The information in this document is strictly proprietary and is being supplied to you solely for your information. It may not (in whole or in part) be reproduced, distributed or passed to a third party or used for any other purposes than stated above. This document is informative in nature and does not constitute an offer of securities to the public, nor a solicitation to make such an offer. No reliance may be placed for any purposes whatsoever on the information, opinions, forecasts and assumptions contained in the document or on its completeness, accuracy or fairness. No representation or warranty, express or implied, is given by or on behalf of ABN AMRO, or any of its directors, officers, agents, affiliates, group companies, or employees as to the accuracy or completeness of the information contained in this document and no liability is accepted for any loss, arising, directly or indirectly, from any use of such information. The views and opinions expressed herein may be subject to change at any given time and ABN AMRO is under no obligation to update the information contained in this document after the date thereof. Before investing in any product of ABN AMRO Bank N.V., you should obtain information on various financial and other risks and any possible restrictions that you and your investments activities may encounter under applicable laws and regulations. If, after reading this document, you consider investing in a product, you are advised to discuss such an investment with your relationship manager or personal advisor and check whether the relevant product –considering the risks involved- is appropriate within your investment activities. The value of your investments may fluctuate. Past performance is no guarantee for future returns. ABN AMRO reserves the right to make amendments to this material. © Copyright 2015 ABN AMRO Bank N.V. and affiliated companies ("ABN AMRO").