US labour market rebounds

advertisement

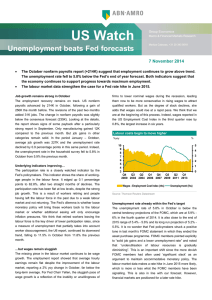

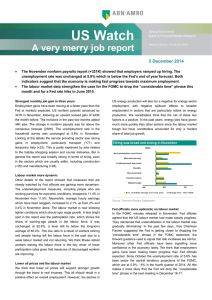

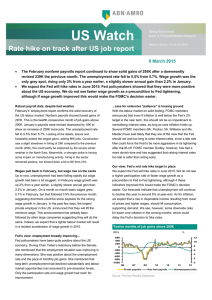

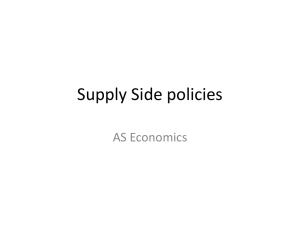

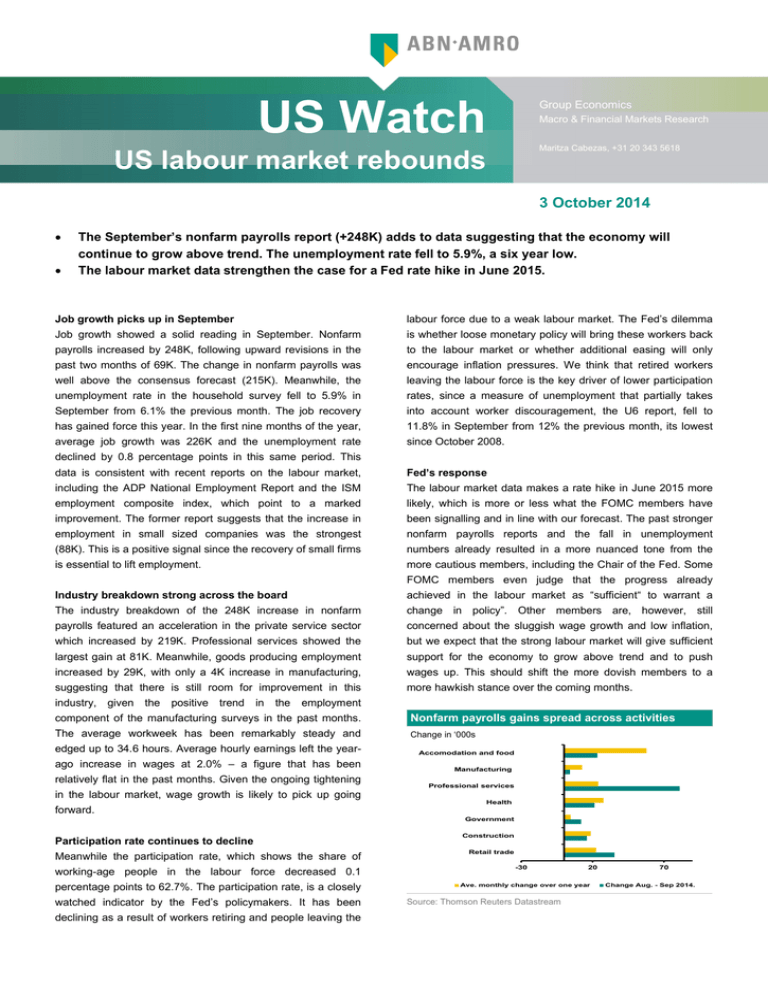

US Watch Group Economics Macro & Financial Markets Research Maritza Cabezas, +31 20 343 5618 US labour market rebounds 3 October 2014 • • The September’s nonfarm payrolls report (+248K) adds to data suggesting that the economy will continue to grow above trend. The unemployment rate fell to 5.9%, a six year low. The labour market data strengthen the case for a Fed rate hike in June 2015. Job growth picks up in September labour force due to a weak labour market. The Fed’s dilemma Job growth showed a solid reading in September. Nonfarm is whether loose monetary policy will bring these workers back payrolls increased by 248K, following upward revisions in the to the labour market or whether additional easing will only past two months of 69K. The change in nonfarm payrolls was encourage inflation pressures. We think that retired workers well above the consensus forecast (215K). Meanwhile, the leaving the labour force is the key driver of lower participation unemployment rate in the household survey fell to 5.9% in rates, since a measure of unemployment that partially takes September from 6.1% the previous month. The job recovery into account worker discouragement, the U6 report, fell to has gained force this year. In the first nine months of the year, 11.8% in September from 12% the previous month, its lowest average job growth was 226K and the unemployment rate since October 2008. declined by 0.8 percentage points in this same period. This data is consistent with recent reports on the labour market, Fed’s response including the ADP National Employment Report and the ISM The labour market data makes a rate hike in June 2015 more employment composite index, which point to a marked likely, which is more or less what the FOMC members have improvement. The former report suggests that the increase in been signalling and in line with our forecast. The past stronger employment in small sized companies was the strongest nonfarm payrolls reports and the fall in unemployment (88K). This is a positive signal since the recovery of small firms numbers already resulted in a more nuanced tone from the is essential to lift employment. more cautious members, including the Chair of the Fed. Some FOMC members even judge that the progress already Industry breakdown strong across the board achieved in the labour market as “sufficient“ to warrant a The industry breakdown of the 248K increase in nonfarm change in policy”. Other members are, however, still payrolls featured an acceleration in the private service sector concerned about the sluggish wage growth and low inflation, which increased by 219K. Professional services showed the but we expect that the strong labour market will give sufficient largest gain at 81K. Meanwhile, goods producing employment support for the economy to grow above trend and to push increased by 29K, with only a 4K increase in manufacturing, wages up. This should shift the more dovish members to a suggesting that there is still room for improvement in this more hawkish stance over the coming months. industry, given the positive trend in the employment component of the manufacturing surveys in the past months. Nonfarm payrolls gains spread across activities The average workweek has been remarkably steady and Change in ‘000s edged up to 34.6 hours. Average hourly earnings left the yearago increase in wages at 2.0% – a figure that has been relatively flat in the past months. Given the ongoing tightening Accomodation and food Manufacturing Professional services in the labour market, wage growth is likely to pick up going Health forward. Government Participation rate continues to decline Meanwhile the participation rate, which shows the share of working-age people in the labour force decreased 0.1 percentage points to 62.7%. The participation rate, is a closely watched indicator by the Fed’s policymakers. It has been declining as a result of workers retiring and people leaving the Construction Retail trade -30 20 Ave. monthly change over one year Source: Thomson Reuters Datastream 70 Change Aug. - Sep 2014. 2 US labour market rebounds – 3 October 2014 Find out more about Group Economics at: https://insights.abnamro.nl/en/ This document has been prepared by ABN AMRO. It is solely intended to provide financial and general information on economics. The information in this document is strictly proprietary and is being supplied to you solely for your information. It may not (in whole or in part) be reproduced, distributed or passed to a third party or used for any other purposes than stated above. This document is informative in nature and does not constitute an offer of securities to the public, nor a solicitation to make such an offer. No reliance may be placed for any purposes whatsoever on the information, opinions, forecasts and assumptions contained in the document or on its completeness, accuracy or fairness. No representation or warranty, express or implied, is given by or on behalf of ABN AMRO, or any of its directors, officers, agents, affiliates, group companies, or employees as to the accuracy or completeness of the information contained in this document and no liability is accepted for any loss, arising, directly or indirectly, from any use of such n i formation. The views and opinions expressed herein may be subject to change at any given time and ABN AMRO is under no obligation to update the information contained in this document after the date thereof. Before investing in any product of ABN AMRO Bank N.V., you should obtain information on various financial and other risks and any possible restrictions that you and your investments activities may encounter under applicable laws and regulations. If, after reading this document, you consider investing in a product, you are advised to discuss such an investment with your relationship manager or personal advisor and check whether the relevant product –considering the risks involved- is appropriate within your investment activities. The value of your investments may fluctuate. Past performance is no guarantee for future returns. ABN AMRO reserves the right to make amendments to this material. © Copyright 2014 ABN AMRO Bank N.V. and affiliated companies ("ABN AMRO").