141205 US Employment.docx

advertisement

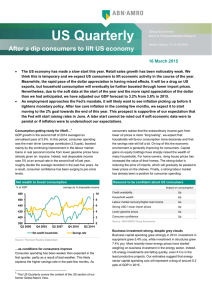

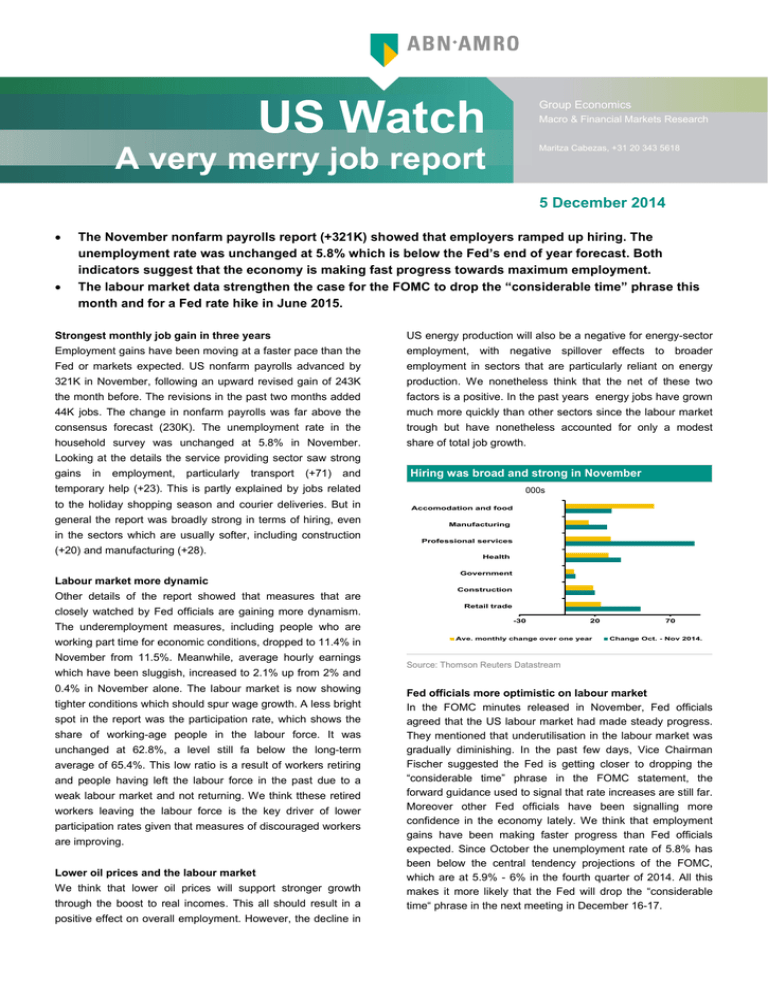

US Watch Group Economics Macro & Financial Markets Research Maritza Cabezas, +31 20 343 5618 A very merry job report 5 December 2014 • • The November nonfarm payrolls report (+321K) showed that employers ramped up hiring. The unemployment rate was unchanged at 5.8% which is below the Fed’s end of year forecast. Both indicators suggest that the economy is making fast progress towards maximum employment. The labour market data strengthen the case for the FOMC to drop the “considerable time” phrase this month and for a Fed rate hike in June 2015. Strongest monthly job gain in three years US energy production will also be a negative for energy-sector Employment gains have been moving at a faster pace than the employment, with negative spillover effects to broader Fed or markets expected. US nonfarm payrolls advanced by employment in sectors that are particularly reliant on energy 321K in November, following an upward revised gain of 243K production. We nonetheless think that the net of these two the month before. The revisions in the past two months added factors is a positive. In the past years energy jobs have grown 44K jobs. The change in nonfarm payrolls was far above the much more quickly than other sectors since the labour market consensus forecast (230K). The unemployment rate in the trough but have nonetheless accounted for only a modest household survey was unchanged at 5.8% in November. share of total job growth. Looking at the details the service providing sector saw strong gains in employment, particularly transport (+71) and Hiring was broad and strong in November temporary help (+23). This is partly explained by jobs related to the holiday shopping season and courier deliveries. But in general the report was broadly strong in terms of hiring, even in the sectors which are usually softer, including construction (+20) and manufacturing (+28). 000s Accomodation and food Manufacturing Professional services Health Government Labour market more dynamic Other details of the report showed that measures that are closely watched by Fed officials are gaining more dynamism. The underemployment measures, including people who are working part time for economic conditions, dropped to 11.4% in November from 11.5%. Meanwhile, average hourly earnings which have been sluggish, increased to 2.1% up from 2% and 0.4% in November alone. The labour market is now showing tighter conditions which should spur wage growth. A less bright spot in the report was the participation rate, which shows the share of working-age people in the labour force. It was unchanged at 62.8%, a level still fa below the long-term average of 65.4%. This low ratio is a result of workers retiring and people having left the labour force in the past due to a weak labour market and not returning. We think tthese retired workers leaving the labour force is the key driver of lower participation rates given that measures of discouraged workers are improving. Lower oil prices and the labour market We think that lower oil prices will support stronger growth through the boost to real incomes. This all should result in a positive effect on overall employment. However, the decline in Construction Retail trade -30 20 Ave. monthly change over one year 70 Change Oct. - Nov 2014. Source: Thomson Reuters Datastream Fed officials more optimistic on labour market In the FOMC minutes released in November, Fed officials agreed that the US labour market had made steady progress. They mentioned that underutilisation in the labour market was gradually diminishing. In the past few days, Vice Chairman Fischer suggested the Fed is getting closer to dropping the “considerable time” phrase in the FOMC statement, the forward guidance used to signal that rate increases are still far. Moreover other Fed officials have been signalling more confidence in the economy lately. We think that employment gains have been making faster progress than Fed officials expected. Since October the unemployment rate of 5.8% has been below the central tendency projections of the FOMC, which are at 5.9% - 6% in the fourth quarter of 2014. All this makes it more likely that the Fed will drop the “considerable time“ phrase in the next meeting in December 16-17. 2 A very merry job report – 5 December 2014 Find out more about Group Economics at: https://insights.abnamro.nl/en/ This document has been prepared by ABN AMRO. It is solely intended to provide financial and general information on economics.The information in this document is strictly proprietary and is being supplied to you solely for your information. It may not (in whole or in part) be reproduced, distributed or passed to a third party or used for any other purposes than stated above. This document is informative in nature and does not constitute an offer of securities to the public, nor a solicitation to make such an offer. No reliance may be placed for any purposes whatsoever on the information, opinions, forecasts and assumptions contained in the document or on its completeness, accuracy or fairness. No representation or warranty, express or implied, is given by or on behalf of ABN AMRO, or any of its directors, officers, agents, affiliates, group companies, or employees as to the accuracy or completeness of the information contained in this document and no liability is accepted for any loss, arising, directly or indirectly, from any use of such n i formation. The views and opinions expressed herein may be subject to change at any given time and ABN AMRO is under no obligation to update the information contained in this document after the date thereof. Before investing in any product of ABN AMRO Bank N.V., you should obtain information on various financial and other risks andany possible restrictions that you and your investments activities may encounter under applicable laws and regulations. If, after reading this document, you consider investing in a product, you are advised to discuss such an investment with your relationship manager or personal advisor and check whether the relevant product –considering the risks involved- is appropriate within your investment activities. The value of your investments may fluctuate. Past performance is no guarantee for future returns. ABN AMRO reserves the right to make amendments to this material. © Copyright 2014 ABN AMRO Bank N.V. and affiliated companies ("ABN AMRO").