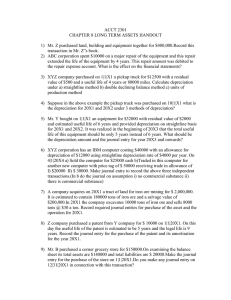

Drill (Construction Contract) 1. The primary issue in the accounting for construction contracts is a. the determination of the percentage of completion and revenue to be recognized during the period. b. the allocation of contract revenue and contract costs to the accounting periods in which construction work is performed. c. the determination of the rate at which physical performance has been made during the reporting period and the future performance on which future revenues will be allocated. d. the allocation of costs of a long-lived asset to permit the proper matching of costs with revenues. 2. According to PFRS 15, each contract is accounted for separately. However, two or more contracts entered into at or near the same time with the same customer are combined and accounted for as a single contract if any of the following conditions are met, except a. The contracts are negotiated as a package with a single commercial objective. b. The amount of consideration to be paid in one contract depends on the price or performance of the other contract. c. Some or all of the goods or services promised in the contracts are a single performance obligation. d. At contract inception, the collectability of the consideration is probable of collection. On July 1, 20x1, Contractor Co. enters into a contract with a customer for the construction of a building. At contract inception, Contractor Co. assesses the contract in accordance with the principles of PFRS 15 and concludes that it has a single performance obligation that is satisfied over time. Contractor Co. then determines that the appropriate measure of its progress on the contract is input method based on costs incurred. Information on the contract is shown below: Contract price Contract costs incurred during 20x1 Estimated remaining costs as of Dec. 31, 20x1 Billings to the customer during 20x1 Collections on billings during 20x1 600,000 120,000 240,000 180,000 60,000 3. What amount of revenue is recognized on the contract in 20x1? 4. In 20x1, Silverchair Co., a construction company, enters into a contract with a customer for the construction of a building. The contract states a fixed fee of ₱8,700,000. Silverchair’s performance obligation in the contract is satisfied over time. Silverchair uses the ‘cost-to-cost’ method in measuring its progress in the contract. Information on the contract follows: Estimated total costs at completion Percentage of completion 20x1 6,525,000 15% How much is the profit recognized in 20x2? 20x2 6,960,000 65% Use the following information for the next two questions: In 20x1, Gorgeous Too Co. enters into a fixed-price construction contract with a customer. At contract inception, Gorgeous Too Co. assesses its performance obligations in the contract and concludes that it has a single performance obligation that is satisfied over time. Gorgeous Too Co. determines that the measure of progress that best depicts its performance on the contract is input method based on costs incurred. Information on the contract follows: Cumulative contract costs incurred Cumulative profits recognized Progress billings Collections on progress billings 20x1 2,250,000 750,000 2,400,000 2,000,000 20x2 4,800,000 1,200,000 3,600,000 4,000,000 The contract is completed in 20x2. 5. What amount of revenue is recognized in 20x2? 6. How much is the transaction price in the contract? Use the following information for the next two questions: In 20x1, ABC Co. was contracted to build a railroad. The contract price is equal to the construction costs incurred plus 20% thereof. However, if the project is completed within 4 years, ABC will receive an additional payment of ₱200,000. Information on the project is shown below: Costs incurred to date Estimated costs to complete 20x1 2,400,000 3,600,000 20x2 4,575,000 1,525,000 20x3 6,125,000 125,000 In 20x1 and 20x2, it was not highly probable that the project will be completed on time. However, in 20x3, ABC assessed that project will be completed earlier than originally expected and thus it is now highly probable that the incentive payment will be received. 7. How much revenue is recognized on the contract in 20x3? 8. How much profit is recognized on the contract in 20x3?