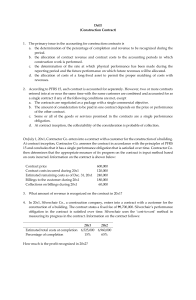

Completed-Contract Method Exercise handout

advertisement

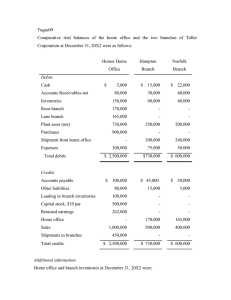

Completed-Contract Method Exercise Hardhat Construction Company has a contract starting July 20x1 to construct a $4,500,000 bridge that the company expects to complete in October 20x3. The following costs were determined at the end of each year during construction: 20x1 Costs to date 20x2 20x3 $1,000,000 $2,916,000 $4,050,000 Estimated cost to complete Progress billings during the year Cash Collected during the year Unknown Unknown None $900,000 $2,400,000 $1,200,000 750,000 1,750,000 2,000,000 a. The appropriate method to account for this contract is ___________________________. Why? b. The total profit earned on the contract is $______________________. c. The amount of profit that should be recognized each year is: 1. 20x1 $_______________________ 2. 20x2 $_______________________ 3. 20x3 $_______________________ d. The inventory account balance (Construction in Progress) would include which of the following? Cost Incurred Only or Cost Incurred plus Profit Recognized to Date e. Determine the following year-end account balances for 20x1 and 20x2. For 20x3, determine the account balances at the end of the contract, closing them out when the contract is completed. 20x1 20x2 20x3 Construction in process Billings on long-term contracts f. Asset (liability (at year-end) None ============ ============ Accounts receivable balance (at year-end) None ============ ============ Make the journal entries each year to record the cost incurred, billings, cash collections, and to recognize profit (loss), if any. Construct T accounts to see if the balances each year-end correspond to the above.