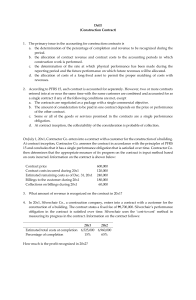

Assignment 2, Question 6

advertisement

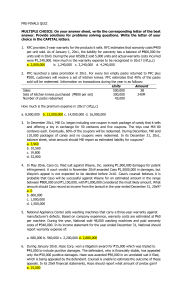

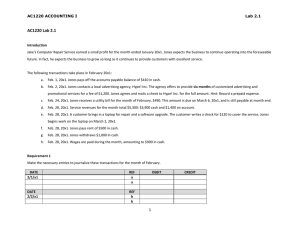

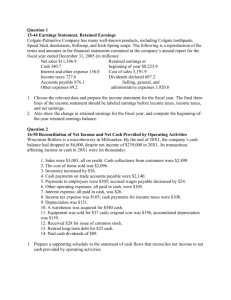

COURSE UPDATE FA4: Financial Accounting: Consolidation and Advanced Issues Assignment 2, Question 6 For distribution to lecturers, markers, tutors and students Assignment 2, Question 6 Question 6 assignment 2 session 4 should read as follows (deletions crossed over and additions in bold): Question 6 (13 marks) The following information is available about Haika’s Emporium Inc. (HEI) at December 31, 20X1: Net income before tax for 20X1 is $8,000,000. At December 31, 20X0, accrued pension cost, a non-current liability, was $1,200,000 and at December 31, 20X1, accrued pension cost was $1,500,000. In 20X1, pension expense was $400,000 $500,000 while cash contributions to the pension fund amounted to $200,000. Pension expense is not deductible on the tax return. Only cash contributions are tax deductible in the year they are paid to the pension trustee. At December 31, 20X0, the machinery account had a tax basis of $1,500,000 and a carrying value of $2,000,000. For 20X1, HEI claimed CCA of $400,000 and depreciation was $500,000. All other assets were acquired via operating leases. In August 20X1, HEI received $200,000 dividends from an investment in shares of the Bank of Nova Scotia. Dividends received by Canadian corporations from other taxable Canadian corporations are never taxable in the hands of the receiving corporation. A three-year casualty insurance policy was acquired for $90,000 at the beginning of 20X1. The cost is tax deductible in 20X1 when the cash was paid for the three-year policy. By December 31, 20X1, the prepaid insurance account had a carrying value of $60,000 and a tax basis of zero. The tax rate for 20X1 is 45%. However, in September of 20X1 the government decreased the tax rate to 40% effective for 20X2. There were no transactions with deferred tax implications other than those discussed above. Required a. (9 marks) Compute current tax expense, taxes payable, and deferred tax amounts for HEI for 20X1 using the method recommended by IFRS. Show all calculations. (Hint: taxable income is $7,740,000.) b. (2 marks) FA4-11-CU17-ALL (Session 4-Assignment 2- Question 6) Issued by CGA-Canada Page 1 of 2 May 17, 2012 COURSE UPDATE Prepare the journal entry to record tax payable and deferred income tax for the year ended December 31, 20X1. c. (2 marks) Indicate the amounts that would be shown on the statement of financial position of HEI as at December 31, 20X1. FA4-11-CU17-ALL (Session 4-Assignment 2- Question 6) Issued by CGA-Canada Page 2 of 2 May 17, 2012