YACCT 2301CHAPTER 8 LONG TERM ASSETS HANDOUT.doc

advertisement

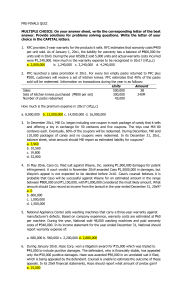

ACCT 2301 CHAPTER 8 LONG TERM ASSETS HANDOUT 1) Mr. Z purchased land, building and equipment together for $400,000.Record this transaction in Mr. Z”s book. 2) ABC corporation spent $10000 on a major repair of the equipment and this repair extended the life of the equipment by 4 years. This repair amount was debited to the repair expense account. What is the effect on the financial statements? 3) XYZ company purchased on 1|1|X1 a pickup truck for $12500 with a residual value of $500 and a useful life of 4 years or 80000 miles. Calculate depreciation under a) straightline method b) double declining balance method c) units of production method 4) Suppose in the above example the pickup truck was purchased on 10|1|X1 what is the depreciation for 20X1 and 20X2 under 3 methods of depreciation? 5) Mr. Y bought on 1|1|X1 an equipment for $32000 with residual value of $2000 and estimated useful life of 6 years and provided depreciation on straightline basis for 20X1 and 20X2. It was realized in the beginning of 20X3 that the total useful life of this equipment should be only 5 years instead of 6 years. What should be the depreciation amount and the journal entry for year 20X3 and onwards? 6) XYZ corporation has an IBM computer costing $40000 with an allowance for depreciation of $12000 using straightline depreciation rate of $4000 per year. On 4|1|20X4 a) Sold the computer for $25000 cash b)Traded in this computer for another new computer with price tag of $ 50000 receiving trade in allowance of I) $20000 II) $ 30000. Make journal entry to record the above three independent transactions.(In b do the journal on assumption i) no commercial substance ii) there is commercial substance) 7) A company acquires on 20X1 a tract of land for iron ore mining for $ 2,000,000. It is estimated to contain 180000 tons of iron ore and a salvage value of $200,000.In 20X1 the company excavates 10000 tons of iron ore and sells 8000 tons @ $30 a ton. Record required journal entries for purchase of the asset and the operation for 20X1. 8) Z company purchased a patent from Y company for $ 10000 on 1|1|20X1. On this day the useful life of the patent is estimated to be 5 years and the legal life is 9 years. Record the journal entry for the purchase of the patent and its amortisation for the year 20X1. 9) Mr. B purchased a corner grocery store for $150000.On examining the balance sheet its total assets are $140000 and total liabilities are $ 20000.Make the journal entry for the purchase of the store on 1|1|20X1.Do you make any journal entry on 12|31|20X1 in connection with this transaction?