Accounting Exam Questions: Financial Statements & Liabilities

advertisement

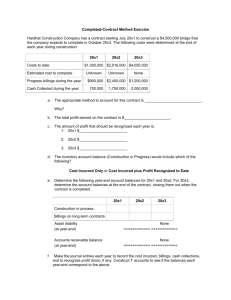

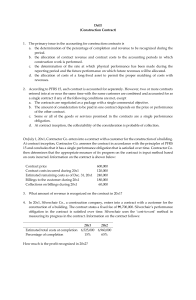

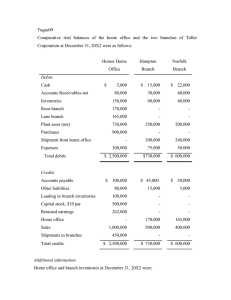

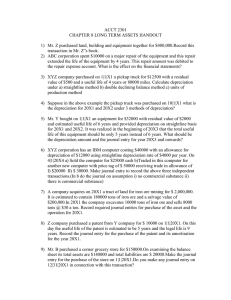

1. The objective of PAS 1 Presentation of Financial Statements is to prescribe the basis for presentation of general purpose financial statements, to ensure a. intra-comparability c. faithful representation b. inter-comparability d. a and b 2. General purpose financial statements cater to what type of needs of users? a. common needs c. a and b b. specific needs d. loving and caring needs 3. The ledger of COPIOUS RICH Co. as of December 31, 20x1 includes the following: 15% Note payable 16% Bonds payable 18% Serial bonds Interest payable 50,000 100,000 200,000 - Additional information: COPIOUS Co.’s financial statements were authorized for issue on April 15, 20x2. - The 15% note payable was issued on January 1, 20x1 and is due on January 1, 20x5. The note pays annual interest every year-end. The agreement with the lender provides that COPIOUS Co. shall maintain an average current ratio of 2:1. If at any time the current ratio falls below the agreement, the note payable will become due on demand. As of the 3 rd quarter in 20x1, COPIOUS’s average current ratio is 0.50:1. Immediately, COPIOUS informed the lender of the breach of the agreement. On December 31, 20x1, the lender gave COPIOUS a grace period ending on December 31, 20x2 to rectify the deficiency in the current ratio. COPIOUS promised the creditor to liquidate some of its long-term investments in 20x2 to increase its current ratio. - The 16% bonds are 10-year bonds issued on December 31, 1992. The bonds pay annual interest every year-end. - The 18% serial bonds are issued at face amount and are due in semi-annual installments of ₱20,000 every April 1 and September 30. Interests on the bonds are also due semi-annually. The last installment on the bonds is due on September 30, 20x7. How much is the total current liabilities? a. 9,000 b. 100,000 c. 109,000 d. 120,000 Solution: 16% Bonds payable Interest payable on the serial bonds (200K x 18% x 3/12) Current liabilities 100,000 9,000 109,000 4. Entity B has the following information: Inventory, beg. Inventory, end. Purchases Freight-in Purchase returns Purchase discounts 120,000 192,000 480,000 24,000 12,000 16,800 How much is Entity B’s the cost of sales? a. 402,300 b. 416,300 c. 420,300 d. 422,300 Inventory, beg. Net purchases: Purchases Freight-in Purchase returns Purchase discounts 120,000 480,000 24,000 (12,000) (16,800) Total goods available for sale Less: Inventory, end. 475,200 595,200 (192,000) Cost of goods sold 403,200 Use the following information for the next four questions: The nominal accounts of Hazel Lee Co. on December 31, 20x1 have the following balances: Accounts Sales Interest income Gains Inventory, beg. Purchases Freight-in Purchase returns Purchase discounts Freight-out Sales commission Advertising expense Salaries expense Rent expense Depreciation expense Utilities expense Supplies expense Transportation and travel expense Dr. Cr. ₱1,045,000 80,000 30,000 ₱80,000 300,000 30,000 15,000 27,000 25,000 60,000 35,000 350,000 60,000 80,000 40,000 30,000 25,000 Insurance expense Taxes and licenses Interest expense Miscellaneous expense Loss on the sale of equipment 10,000 50,000 5,000 2,000 15,000 Additional information: a. Ending inventory is ₱100,000. b. Three-fourths of the salaries, rent, and depreciation expenses pertain to the sales department. The sales department does not share in the other expenses. 5. In a statement of comprehensive income prepared using the single-step approach (nature of expense method), how much is presented as ‘change in inventory’? (increase)/decrease a. (288,000) b. 288,000 c. (20,000) d. 20,000 Single-step approach Hazel Lee Co. Statement of Comprehensive Income For the period ended December 31, 20x1 INCOME Sales Interest income Gains TOTAL INCOME EXPENSES Net purchases (a) Change in inventory (b) Freight-out Sales commission Advertising expense Salaries expense Rent expense Depreciation expense Utilities expense Supplies expense Transportation and travel expense Insurance expense Taxes and licenses ₱1,045,00 0 80,000 30,000 1,155,000 288,000 (20,000) 25,000 60,000 35,000 350,000 60,000 80,000 40,000 30,000 25,000 10,000 50,000 Interest expense Miscellaneous expense Loss on sale of equipment TOTAL EXPENSES 5,000 2,000 15,000 1,055,000 PROFIT FOR THE YEAR Other comprehensive income COMPREHENSIVE INCOME FOR THE YEAR 100,000 ₱100,000 (a) “Net purchases” is computed as follows: Purchases Freight-in ₱300,000 30,000 Purchase returns (15,000) Purchase discounts (27,000) ₱288,000 Net Purchases (b) “Change in inventory” is computed as follows: Inventory, beg. ₱80,000 Inventory, end 100,000 (₱20,000 Change in inventory – increase ) 6. In a statement of comprehensive income prepared using the single-step approach (nature of expense method), how much is presented as total expenses? a. 1,055,000 b. 1,075,000 c. 787,000 d. 772,000 7. In a statement of comprehensive income prepared using the multi-step approach (function of expense method), how much is presented as distribution costs? a. 398,500 b. 487,500 c. 467,500 d. 512,500 Multi-step approach Hazel Lee Co. Statement of Comprehensive Income For the period ended December 31, 20x1 Notes Sales ₱1,045,000 Cost of sales GROSS PROFIT Other income Distribution costs Administrative expenses Other expenses Interest expense PROFIT FOR THE YEAR Other comprehensive income COMPREHENSIVE INCOME FOR THE YR. Note 1: Cost of sales Inventory, beg. Purchases Freight-in 1 2 3 4 5 ₱80,000 300,000 30,000 Purchase returns (15,000) Purchase discounts (27,000) Total goods available for sale 368,000 Inventory, end (100,000) Cost of sales ₱268,000 Note 2: Other income Interest income Gains Other income Note 3: Distribution costs Freight-out ₱80,000 30,000 ₱110,000 ₱25,000 Sales commission 60,000 Advertising expense 35,000 Salaries expense (350,000 x 3/4) 262,500 Rent expense (60,000 x 3/4) 45,000 Depreciation expense (80,000 x 3/4) 60,000 Distribution costs ₱487,500 Note 4: Administrative expenses Salaries expense (350,000 x 1/4) ₱87,500 Rent expense (60,000 x 1/4) 15,000 Depreciation expense (80,000 x 1/4) 20,000 Utilities expense 40,000 Supplies expense 30,000 Transportation and travel expense 25,000 (268,000) 777,000 110,000 (487,500) (279,500) (15,000) (5,000) 100,000 ₱100,000 Insurance expense 10,000 Taxes and licenses 50,000 Miscellaneous expense Administrative expenses 2,000 ₱279,500 Note 5: Other expenses Loss incurred on the sale of equipment – 15,000 8. In a statement of comprehensive income prepared using the multi-step approach (function of expense method), how much is presented as administrative expenses? a. 297,500 b. 302,500 c. 287,500 d. 279,500 Use the following information for the next two questions: DEMOTIC POPULAR Co. acquires through foreclosure a property comprising land and buildings that it intends to sell. The fair value of the land and buildings is ₱6,000,000 and costs to sell are ₱200,000. The related defaulted receivables have a carrying amount of ₱5,000,000. 9. The entity does not intend to transfer the property to a buyer until after it completes renovations to increase the property’s sales value. How should DEMOTIC Co. classify the land and buildings? a. Included under property, plant and equipment at ₱5,000,000. b. Included under investment property at ₱5,000,000. c. Included under investment property at ₱5,800,000. d. Classified as held for sale at ₱5,800,000 C (6M – 200K) = 5.8M investment property because the property is not available for sale in its present condition 10. After the renovations are completed and the property is classified as held for sale but before a firm purchase commitment is obtained, the entity becomes aware of environmental damage requiring remediation. The entity still intends to sell the property. However, the entity does not have the ability to transfer the property to a buyer until after the remediation is completed. The costs of renovations made totaled ₱200,000. The estimated costs of remediation are ₱100,000. How should DEMOTIC Co. classify the land and buildings? a. Included under property, plant and equipment at ₱5,700,000. b. Included under investment property at ₱6,000,000. c. Included under investment property at ₱5,700,000. d. Classified as held for sale at ₱5,700,000 B (5.8M (see no. 5) + 200K costs of renovations = 6M. The land and buildings are classified as investment property and not as held for sale assets because they are not available for immediate sale in their present condition. 11. An entity is committed to a plan to sell a manufacturing facility in its present condition and classifies the facility as held for sale at that date. After a firm purchase commitment is obtained, the buyer’s inspection of the property identifies environmental damage not previously known to exist. The entity is required by the buyer to make good the damage, which will extend the period required to complete the sale beyond one year. However, the entity has initiated actions to make good the damage, and satisfactory rectification of the damage is highly probable. The manufacturing facility has a carrying amount of ₱10,000,000 and fair value less costs to sell of ₱10,600,000. How should the entity classify the manufacturing facility? a. Held for sale, ₱10.6M c. PPE, ₱10M b. Held for sale, ₱10M d. PPE, ₱10.6M B – The exception to the “1-yr. requirement” is met. 12. Under the indirect method, the cash flow from operating activities is determined by adjusting the reported profit by (choose the incorrect statement) a. adding back non-cash expenses b. adding back decreases in operating assets c. deducting decreases in operating liabilities d. adding back increases in operating assets 13. Under the indirect method, the cash flow from operating activities is determined by adjusting the reported profit by (choose the incorrect statement) a. deducting non-cash income b. deducting increases in operating assets c. deducting decreases in nonoperating liabilities d. deducting gains on sale of nonoperating assets 14. When preparing a statement of cash flows using the direct method, amortization of patent is a. shown as an increase in cash flows from operating activities. b. shown as a reduction in cash flows from operating activities. c. included with supplemental disclosures of noncash transactions. d. not reported in the statement of cash flows or related disclosures. 15. Which of the following statements regarding cash equivalents is correct? a. A one-year Treasury note could not qualify as a cash equivalent. b. All investments meeting the PFRS 9 Financial Instruments criteria must be reported as cash equivalents. c. The date a security is purchased determines its "original maturity" for cash equivalent classification purposes. d. Once established, management's policy for classifying items as cash equivalents cannot be changed. 16. Using the indirect method, cash flows from operating activities would be increased by which of the following? a. Gain on sale of investments b. Increase in prepaid expenses c. Decrease in accounts payable d. Decrease in accounts receivable Use the following information for the next three questions: The movements in the cash account of DEADLOCK STANDSTILL Co. during 20x2 are shown below. beg. Sales Cash 400 12,000 Interest income Rent income Dividend income Sale of held for trading securities 40 540 80 1,600 Sale of old building Collection of non-trade note Proceeds from loan with a bank Issuance of shares 1,040 120 3,200 1,940 7,60 0 2,40 0 60 140 200 2,20 0 260 480 400 180 7,04 0 Purchases Operating expenses Interest expense Income taxes Investment in FVOCI Purchase of equipment Loan granted to employee Payment of loan borrowed Reacquisition of shares Dividends end. 17. How much is the cash flows from operating activities? a. 4,600 b. 4,840 c. 5,040 d. 4,060 D (Refer to solutions below) 18. How much is the cash flows from investing activities? a. (1,500) b. 1,500 c. 1,240 d. (1,240) A (Refer to solutions below) 19. How much is the cash flows from financing activities? a. 4,800 b. (4,800) c. 4,240 d. 4,080 D Solutions: DEADLOCK STANDSTILL Co. Statement of cash flows For the year ended December 31, 20x2 Cash flows from operating activities Cash receipts from customers Cash receipts for interest income Cash receipts for rent income Cash receipts for dividend income Cash paid to suppliers Cash paid for operating expenses Cash generated from operations Interest paid Income taxes paid Cash receipt from sale of held for trading securities Net cash from operating activities 12,000 40 540 80 (7,600) (2,400) 2,660 (60) (140) 1,600 4,060 Cash flows from investing activities Cash payment for acquisition of investment in FVOCI Cash receipt from sale of old building Cash payment for acquisition of equipment Cash receipt from collection of loan granted Cash payment for loan granted Net cash used in investing activities (200) 1,040 (2,200) 120 (260) (1,500) Cash flows from financing activities Cash proceeds from loan borrowed Cash payment for loan borrowed Cash proceeds from issuance of share capital Cash payment for acquisition of treasury shares Cash payment for dividends Net cash from financing activities 3,200 (480) 1,940 (400) (180) 4,080 6,640 Net increase in cash and cash equivalents 400 Cash and cash equivalents, beginning 7,040 Cash and cash equivalents, end Use the following information for the next four questions: BLITHE JOYFUL Co. had the following information during 20x2: Accounts receivable, January 1, 20x2 2,400 Accounts receivable, December 31, 20x2 1,600 Sales on account and cash sales 32,000 Bad debts expense 800 Accounts payable, January 1, 20x2 1,400 Accounts payable, December 31, 20x2 800 Cost of sales 16,000 Increase in inventory 3,600 Operating expenses on accrual basis Increase in accrued payables for operating expenses Decrease in prepaid operating expenses 4,880 1,640 1,560 Property, plant, and equipment, January 1, 20x2 Property, plant, and equipment, December 31, 20x2 7,200 10,800 Additional information: There were no write-offs of accounts receivable during the year. Equipment with an accumulated depreciation of ₱800 was sold during the year for ₱480 resulting to a gain on sale of ₱60. 20. How much is the cash receipts from customers? a. 38,200 b. 37,400 c. 35,400 d. 32,800 D Solution: Accounts receivable Jan. 1, 20x2 Sales 2,400 32,000 32,800 1,600 21. How much is the cash payments to suppliers? a. 19,000 Write-offs Collections of accounts receivables (squeeze) Dec. 31, 20x2 b. 20,200 c. 22,000 d. 23,400 B Solution: Jan. 1, 20x2 Net purchases (squeeze) Inventory 19,600 16,000 3,600 Cost of sales Dec. 31, 20x2 Accounts payable 1,400 Payments for purchases on account (squeeze) Dec. 31, 20x2 20,200 800 19,600 Jan. 1, 20x2 Net purchases (accrual) 22. How much is the cash payments for operating expenses? a. 1,680 b. 4,800 c. 4,960 d. 8,080 A Solution: Prepaid expense / Accrued expense Prepaid expense, beginning 1,560 Accrued expense, beg. Cash paid for operating expenses (squeeze) 1,680 4,880 Operating expense (accrual basis) Accrued expense, end 1,640 Prepaid expense, end 23. How much is the cash payments for acquisition of property, plant, and equipment? a. 3,600 b. 4,820 c. 4,080 d. 4,940 B Solution: The entry for the sale of equipment is re-constructed as follows: 20x2 Cash on hand (given) Accumulated depreciation (given) Equipment (squeeze) Gain on sale (given) 480 800 1,220 60 Property, plant and equipment 7,200 Jan. 1, 20x2 Acquisition of PPE (squeeze) 4,820 1,220 10,800 Historical cost of equipment sold (see journal entry above) Dec. 31, 20x2 24. ABC Co. has the following information as of December 31, 20x1: Jan. 1 Dec. 31 Accounts receivable 100,000 250,000 Allowance for bad 15,000 debts 20,000 Net credit sales 850,000 Bad debt expense 60,000 Recoveries 20,000 How much is the total cash receipts from customers during the period? a. 970,000 b. 879,000 c. 907,000 d. 897,000 C Solution: beg. Net credit sales Accounts receivable 90,000 1,200,000 Recoveries 10,000 73,000 907,000 320,000 Write-offs a Collections from customers (including recoveries) - (squeeze) end. a The amount of write-offs is computed as follows: Allowance for doubtful accounts 26,000 Write-offs (squeeze) 73,000 10,000 80,000 end. 43,000 beg. Recoveries Bad debt expense 25. BLUFF DECEIVE Co. has the following information as of December 31, 20x2: Accounts receivable Allowance for bad debts Prepaid rent Accounts payable Jan. 1 16,000 (400) 3,840 6,800 Dec. 31 20,000 (1,000) 3,200 8,800 BLUFF reported profit of ₱8,800 for the year, after depreciation expense of ₱200, gain on sale of equipment of ₱240, and restructuring and other provisions of ₱400. None of the provisions recognized during the period affected cash. How much is the cash flows from operating activities? a. 4,800 b. 5,600 c. 8,800 d. 8,400 D Solution: Cash flows from operating activities Profit Adjustments for: Depreciation expense Gain on sale of building Restructuring and other provisions 8,800 200 (240) 400 9,160 Increase in accounts receivable, net (3,400) 640 2,000 8,400 [(20,000 – 1,000) – (16,000 – 400)] Decrease in prepaid rent Increase in accounts payable Net cash from operating activities Use the following information for the next two questions: INORDINATE EXCESSIVE Co. had the following information for 20x2: Acquired 3-month treasury bills for ₱200,000. Acquired equipment with a purchase price of ₱4,000,000 by paying 20% in cash and issuing a note payable for the balance. There were no payments made on the note during the year. Acquired land with fair value of ₱3,200,000 by issuing shares with aggregate par value of ₱2,400,000. The excess is credited to share premium. Extended a ₱1,600,000 loan to a director. Borrowed ₱1,280,000 from a bank. Used the cash proceeds as follows: ₱800,000 for additional working capital and ₱480,000 to settle scrip dividends declared in 20x1. Settled an outstanding note payable by issuing shares with aggregate par value of ₱800,000. Share premium resulted from the transaction amounted to ₱280,000. 26. How much is the net cash flows from (used in) investing activities? a. (2,400,000) b. 2,400,000 c. 800,000 d. (800,000) A Cash flows from investing activities Cash payment for acquisition of equipment Cash proceeds of loan granted to officer (4M x 20%) (800,000) (1,600,000) Net cash used in investing activities (2,400,000) 27. How much is the net cash flows from (used in) financing activities? a. (800,000) b. 800,000 c. (2,400,000) d. 2,400,000 B Cash flows from financing activities Cash receipt from borrowings Cash payment for dividends Net cash used in financing activities 1,280,000 (480,000) 800,000 Use the following information for the next three questions: Information on LA-DI-DA SHOWY Co.'s financial position and performance as of December 31, 20x2 and 20x1 are presented below. LA-DI-DA SHOWY Company Statement of financial position As of December 31, 20x2 20x2 20x1 1,000,000 480,000 1,520,000 100,000 2,000,000 200,000 5,300,000 600,000 1,240,000 40,000 3,600,000 160,000 5,640,000 360,000 10,000,000 (800,000) 360,000 9,920,000 15,220,000 340,000 4,000,000 (800,000) 400,000 3,940,000 9,580,000 480,000 80,000 240,000 920,000 60,000 - 320,000 120,000 180,000 480,000 140,000 200,000 ASSETS Current assets Cash and cash equivalents Held for trading securities Accounts receivable – net Rent receivable Inventory Prepaid insurance Total current assets Noncurrent assets Investment in bonds Buildings Accumulated depreciation Goodwill Total noncurrent assets TOTAL ASSETS LIABILITIES AND EQUITY Current liabilities Accounts payable Unearned rent Insurance payable Dividends payable Income tax payable Short-term loan payable Total current liabilities Noncurrent liabilities Bonds payable Discount on bonds Deferred tax liability Total noncurrent liabilities TOTAL LIABILITIES Equity Share capital Retained earnings TOTAL EQUITY TOTAL LIABILITIES AND EQUITY 1,780,000 1,440,000 4,000,000 (380,000) 60,000 3,680,000 5,460,000 4,000,000 (400,000) 40,000 3,640,000 5,080,000 8,000,000 1,760,000 9,760,000 4,000,000 500,000 4,500,000 15,220,000 9,580,000 LA-DI-DA SHOWY Company Statement of profit or loss For the year ended December 31, 20x2 Sales 20,000,000 Cost of sales (12,000,000) Gross income 8,000,000 Rent income 1,800,000 Interest income 80,000 Insurance expense (400,000) Bad debts expense (60,000) Interest expense (400,000) Loss on sale of building (160,000) Unrealized gain on investment 80,000 Other expenses (4,800,000) Profit before tax 4,140,000 Income tax expense (1,200,000) Profit for the year 2,940,000 Additional information: During 20x2, LA-DI-DA purchased held for trading securities for ₱400,000. The fair value of the shares on December 31, 20x2 is ₱480,000. The allowance for doubtful accounts has balances of ₱80,000 and ₱40,000 as of December 31, 20x2 and 20x1, respectively. During 20x2, LA-DI-DA sold an old building with historical cost of ₱3,200,000 for ₱1,040,000. LA-DI-DA inadvertently included depreciation expense in the “Other expenses” line item. There were no acquisitions or disposals of investment in bonds during the period. During 20x2, LA-DI-DA issued shares with an aggregate par value of ₱4,000,000 for ₱4,000,000 cash. 28. How much is the net cash flows from (used in) operating activities? a. (6,000,000) b. 6,000,000 c. 6,600,000 d. (7,600,000) B Solution: Cash flows from operating activities Profit for the year 2,940,000 Adjustments for: Depreciation expense Impairment loss on goodwill Loss on sale of building Unrealized gain on held for trading securities Amortization of discount on investment in bonds Amortization of discount on bonds payable 2,000,000 40,000 160,000 (80,000) (20,000) 20,000 5,060,000 Increase in accounts receivable, net Increase in rent receivable Decrease in inventory Increase in prepaid insurance Increase in accounts payable Decrease in unearned rent Increase in insurance payable Decrease in income tax payable Increase in deferred tax liability (280,000) (60,000) 1,600,000 (40,000) 160,000 (40,000) 60,000 (80,000) 20,000 6,400,000 Cash paid for the acquisition of held for trading securities Net cash from operating activities (400,000) 6,000,000 29. How much is the net cash flows from (used in) investing activities? a. (8,160,000) b. 8,460,000 c. (9,200,000) d. 8,160,000 A Solution: Cash flows from investing activities Cash receipt from sale of old building Cash payment for acquisition of building Net cash used in investing activities 1,040,000 (9,200,000) (8,160,000) 30. How much is the net cash flows from (used in) financing activities? a. (2,560,000) b. 2,560,000 c. (2,960,000) d. 2,960,000 B Solution: Cash flows from financing activities Cash proceeds from issuance of share capital Cash payment for short-term loan Cash payment for dividends Net cash from financing activities 4,000,000 (200,000) (1,240,000) 2,560,000 31. REMNANT REMAINDER Co.’s cash balances as of December 31, 20x2 and 20x1 were ₱7,040,000 and ₱400,000 respectively. REMNANT’s December 31, 20x2 statement of cash flows reported net cash used in investing activities of ₱1,500,000 and net cash from financing activities of ₱4,080,000. How much is the net cash flows from (used in) operating activities? a. (4,060,000) b. 4,060,000 c. 4,600,000 d. (4,600,000) B Solution: Net cash from operating activities Net cash from investing activities Net cash used in financing activities Net increase in cash during the period Cash, beginning balance Cash, ending balance 4,060,000 squeeze (1,500,000) 4,080,000 6,640,000 400,000 7,040,000 start 32. During 20x1, ALBEIT ALTHOUGH Company decided to change from the Average cost formula for inventory valuation to the FIFO cost formula. Inventory balances under each method were as follows: Average FIFO January 1 4,000,000 4,800,000 December 31 8,000,000 8,400,000 Income tax rate is 30%. What is the net cumulative effect of the accounting change in ALBEIT’s opening retained earnings balance? a. 400,000 increase c. 280,000 increase b. 560,000 decrease d. 560,000 increase D (4,800,000 – 4,000,000) x 70% = 560,000 increase 33. On January 1, 20x1, PRISTINE UNCORRUPTED Co. acquired an equipment for ₱4,000,000. The equipment will be depreciated using the straight-line method over 20 years. The estimated residual value is ₱400,000. In 20x6, following a reassessment of the realization of the expected economic benefits from the equipment, PRISTINE Co. changed its depreciation method to sum-of-the-years digits (SYD). The remaining useful life of the asset is estimated to be 4 years and the residual value is changed to ₱200,000. How much is the depreciation expense in 20x6? a. 1,160,000 b. 1,140,000 c. 1,233,560 d. 1,110,669 A [(4M – 400K) x 15/20 + 400K] – 200K x 4/10 = 1,160,000 Use the following information for the next two questions: On January 10, 20x2, prior to the authorization of LIBERTINE IMMORAL Co.’s December 31, 20x1 financial statements for issue, the accountant of LIBERTINE Co. received a bill for an advertisement made in the month of December 20x1 amounting to ₱1,600,000. This expense was not accrued as of December 31, 20x1. 34. The correcting entry, if the books are still open, includes a. a debit to advertising expense for ₱1,600,000 b. a credit to advertising income for ₱1,600,000 c. a debit to retained earnings for ₱1,600,000 d. a credit to retained earnings for ₱1,600,000 A (Dr.) Advertising expense 1.6M; (Cr.) Advertising payable 1.6M 35. The correcting entry, if the books are already closed, includes a. a debit to advertising expense for ₱1,600,000 b. a credit to advertising income for ₱1,600,000 c. a debit to retained earnings for ₱1,600,000 d. a credit to retained earnings for ₱1,600,000 C (Dr.) Retained earnings 1.6M; (Cr.) Advertising payable 1.6M 36. On January 15, 20x3 while finalizing its 20x2 financial statements, DIAPHANOUS TRANSPARENT Co. discovered that depreciation expense recognized in 20x1 is overstated by ₱1,600,000. Ignoring income tax, the entry to correct the prior period error includes a. a debit to depreciation expense for ₱1,600,000 b. a debit to retained earnings for ₱1,600,000 c. a credit to depreciation expense for ₱1,600,000 d. a debit to accumulated depreciation for ₱1,600,000 D (Dr.) Accum. Dep’n. 1.6M; (Cr.) Retained earnings 1.6M Use the following information for the next four questions: GULOSITY GREEDINESS Co. reported profits of ₱4,000,000 and ₱8,000,000 in 20x1 and 20x2, respectively. In 20x3, the following prior period errors were discovered: The inventory on December 31, 20x1 was understated by ₱200,000. An equipment with an acquisition cost of ₱1,200,000 was erroneously charged as expense in 20x1. The equipment has an estimated useful life of 5 years with no residual value. GULOSITY Co. provides full year depreciation in the year of acquisition. The unadjusted balances of retained earnings are ₱8,800,000 and ₱16,800,000 as of December 31, 20x1 and 20x2, respectively. 37. How much is the correct profit in 20x1? a. 7,560,000 b. 5,610,000 c. 4,760,000 d. 5,160,000 D (Refer to solutions below) 38. How much is the correct profit in 20x2? a. 7,560,000 b. 5,160,000 c. 5,720,000 d. 5,610,000 A Unadjusted profits Corrections - (over) understatement: 20x1 4,000,000 20x2 8,000,000 (a) Understatement of Dec. 31, 20x1 inventory (b.1) Capitalizable costs charged as expense (b.2) Depreciation expense not recognized Net adjustment to profit Correct profits 200,000 1,200,000 (240,000) 1,160,000 5,160,000 (200,000) (240,000) (440,000) 7,560,000 39. How much is the correct retained earnings in 20x1? a. 9,960,000 b. 17,520,000 c. 9,860,000 d. 18,420,000 A (Refer to solutions below) 40. How much is the correct retained earnings in 20x2? a. 9,960,000 b. 17,520,000 c. 9,860,000 d. 18,420,000 B Unadjusted retained earnings Net effect of errors on retained earnings: 20x1: 1,160,000* 20x2: (440,000) + 1,160,000* Adjusted retained earnings 20x1 8,800,000 20x2 16,800,000 1,160,000 9,960,000 720,000 17,520,000 *Amounts represent the net effect of errors in profits (refer to previous solution). Use the following information for the next four questions: HELICAL SPIRAL Co. reported profits of ₱1,600,000 and ₱2,400,000 in 20x1 and 20x2, respectively. In 20x3, the following prior period errors were discovered: Prepaid supplies in 20x1 were overstated by ₱80,000. Accrued salaries payable in 20x1 were understated by ₱160,000. Repairs and maintenance expenses in 20x1 amounting to ₱400,000 were erroneously capitalized and being depreciated over a period of 4 years. The unadjusted balances of retained earnings are ₱6,400,000 and ₱8,800,000 as of December 31, 20x1 and 20x2, respectively. 41. How much is the correct profit in 20x1? a. 1,006,000 b. 1,610,000 c. 1,720,000 d. 1,060,000 D (Refer to solutions below) 42. How much is the correct profit in 20x2? a. 2,704,000 b. 2,160,000 c. 2,740,000 d. 2,610,000 C Solutions: Unadjusted profits Corrections - (over) understatement: (a) Overstatement of 20x1 prepaid assets (b) Understatement of 20x1 accrued salaries (c.1) Expenses erroneously capitalized (c.2) Depreciation recognized on repair costs (400,000 ÷ 4) Net adjustment to profit Correct profits 20x1 1,600,000 20x2 2,400,000 (80,000) (160,000) (400,000) 80,000 160,000 - 100,000 (540,000) 1,060,000 100,000 340,000 2,740,000 43. How much is the correct retained earnings in 20x1? a. 5,806,000 b. 5,520,000 c. 5,860,000 d. 5,420,000 C (Refer to solutions below) 44. How much is the correct retained earnings in 20x2? a. 8,960,000 b. 8,600,000 c. 8,860,000 d. 8,420,000 B (Refer to solutions below) Solutions: 20x1 Unadjusted retained earnings 6,400,000 Net effect of errors on retained earnings: 20x1: (540,000)* (540,000) 20x2: 340,000 + (540,000)* Adjusted retained earnings 5,860,000 *Amounts represent the net effect of errors in profits (refer to previous solution). Use the following information for the next fifteen questions: 20x2 8,800,000 (200,000) 8,600,000 THRALL SLAVE Company made the following errors: a. December 31, 20x1 inventory was understated by ₱100,000. b. December 31, 20x2 inventory was overstated by ₱160,000. c. Purchases on account in 20x1 were understated by ₱400,000 (not included in physical count). d. Advances to suppliers in 20x2 totaling ₱520,000 were inappropriately charged as purchases. e. December 31, 20x1 prepaid insurance was overstated by ₱20,000. f. December 31, 20x1 unearned rent income was overstated by ₱104,000. g. December 31, 20x2 interest receivable was understated by ₱68,000. h. December 31, 20x2 accrued salaries payable was understated by ₱120,000. i. Advances from customers in 20x2 totaling ₱240,000 were inappropriately recognized as sales but the goods were delivered in 20x3. j. Depreciation expense in 20x1 was overstated by ₱28,800 k. In 20x2, the acquisition cost of a delivery truck amounting to ₱360,000 was inappropriately charged as expense. The delivery truck has a useful life of five years. THRALL’s policy is to provide a full year’s straight line depreciation in the year of acquisition and none in the year of disposal. l. A fully depreciated equipment with no residual value was sold in 20x3 for ₱200,000 but the sale was recorded in the following year. Profits before correction of errors were ₱492,000, ₱624,000, and ₱840,000 in 20x1, 20x2, and 20x3, respectively. Retained earnings before correction of errors were ₱4,492,000, ₱5,116,000 and ₱5,956,000 in 20x1, 20x2, and 20x3, respectively. 45. What is the net effect of the errors on the 20x1 profit? (over) understatement a. (187,200) b. 187,200 c. (164,200) d. 164,200 A (Refer to solutions below) 46. What is the net effect of the errors on the 20x2 profit? (over) understatement a. (572,000) b. 572,000 c. 563,400 d. (563,400) B (Refer to solutions below) 47. What is the net effect of the errors on the 20x3 profit? (over) understatement a. (78,000) b. 78,000 c. (60,000) d. 60,000 D (Refer to solutions below) 48. How much is the correct profit (loss) in 20x1? a. (348,000) b. 348,000 c. 324,800 d. 304,800 D (Refer to solutions below) 49. How much is the correct profit (loss) in 20x2? a. 1,196,000 b. 1,296,000 c. 1,684,800 d. 1,286,000 A (Refer to solutions below) 50. How much is the correct profit (loss) in 20x3? a. 900,000 b. 926,000 c. 968,400 d. 986,000 A (Refer to solutions below) Solutions: Unadjusted profits Corrections - (over)/understatement a. Understatement of 20x1 inventory b. Overstatement of 20x2 inventory c. Understatement of 20x1 purchases d. Overstatement of 20x2 purchases e. Overstatement of 20x1 prepaid insurance f. Overstatement of 20x1 unearned rent g. Understatement of 20x2 interest income h. Understatement of 20x2 accrued salaries i. Overstatement of 20x2 advances/ sales j. Overstatement of 20x1 depreciation expense 20x1 492,000 20x2 624,000 20x3 840,000 100,000 (100,000) (160,000) 400,000 520,000 160,000 (520,000) (20,000) 20,000 - 104,000 (104,000) - 68,000 (68,000) (120,000) 120,000 (240,000) 240,000 - - (400,000) 28,800 k. Acquisition cost of delivery truck in 20x2 k.1 Depreciation on delivery truck l. Gain on sale in 20x3 not recorded* Net correction on profits (over) / under Corrected profits 360,000 (72,000) (187,200) 304,800 572,000 1,196,000 (72,000) 200,000 60,000 900,000 *Since the equipment sold is fully depreciated and it has no residual value, the proceeds represents the gain on sale. 51. What is the net effect of the errors on the 20x1 retained earnings? (over) understatement a. (182,700) b. 182,700 c. (165,200) d. (187,200) D (Refer to solutions below) 52. What is the net effect of the errors on the 20x2 retained earnings? (over) understatement a. 348,800 b. (348,800) c. (384,800) d. 384,800 D (Refer to solutions below) 53. What is the net effect of the errors on the 20x3 retained earnings? (over) understatement a. 444,800 b. (444,800) c. 524,800 d. (524,800) A (Refer to solutions below) 54. How much is the correct retained earnings in 20x1? a. 4,304,800 b. 4,404,800 c. 4,524,400 d. 4,340,800 A (Refer to solutions below) 55. How much is the correct retained earnings in 20x2? a. 5,500,800 b. 5,756,800 c. 5,246,400 d. 5,340,400 A (Refer to solutions below) 56. How much is the correct retained earnings in 20x3? a. 6,340,800 b. 6,400,800 c. 6,479,800 d. 7,004,400 B Solutions: Unadjusted retained earnings Net effect of errors on profits in: 20x1 20x2 20x3 Net effect of errors on retained earnings (over) / under Adjusted retained earnings 20x1 4,492,000 20x2 5,116,000 20x3 5,956,000 (187,200) (187,200) 572,000 (187,200) 572,000 60,000 (187,200) 4,304,800 384,800 5,500,800 444,800 6,400,800 57. What is the net effect of the errors on the 20x1 working capital? (over) understatement a. (216,000) b. 216,000 c. 80,000 d. (80,000) A 58. What is the net effect of the errors on the 20x2 working capital? (over) understatement a. 228,000 b. (228,000) c. (68,000) d. 68,000 D 59. What is the net effect of the errors on the 20x3 working capital? (over) understatement a. No effect b. 132,000 c. 200,000 d. (200,000) C Solutions: 20x1 Effect of errors on working capital (over)/under a. Understatement of 20x1 inventory b. Overstatement of 20x2 inventory c. Understatement of 20x1 accounts payable a d. Understatement of 20x2 advances to suppliers b e. Overstatement of 20x1 prepaid insurance f. Overstatement of 20x1 unearned rent g. Understatement of 20x2 interest receivable h. Understatement of 20x2 accrued salaries i. Understatement of 20x2 advances to customers c 20x2 100,000 (160,000) (400,000) 520,000 (20,000) 104,000 68,000 (120,000) (240,000) l. Understatement of cash due to the sale of equipment not recorded in 20x3 Net effect of errors on working capital (over)/under 20x3 200,000 (216,000) 68,000 200,000 a If purchases on account is understated, accounts payable is also understated. Understatement in current liabilities overstates working capital. b Advances to suppliers are normally classified as current receivables. Understatement in current assets understates working capital. c Advances from customers are normally classified as current liabilities. Understatement in current liabilities overstates working capital. 60. TRIBULATION GREAT DISTRESS Co.’s current reporting period ends on December 31, 20x1. The following transactions occurred after the end of reporting period: On January 5, 20x2, TRIBULATION declared ₱8,000,000 dividends. On January 15, 20x2, TRIBULATION issued 1,000 shares with par value per share of ₱400 for ₱2,400 per share. On January 20, 20x2, TRIBULATION installed an oil rig. Current legislation requires that the oil rig be uninstalled at the end of its useful life and the site where it was installed be restored. TRIBULATION estimates the present value of the decommissioning and restoration cost at ₱4,000,000. On February 1, 20x2, a building with a carrying amount as of December 31, 20x1 of ₱2,000,000 was totally razed by fire. On February 10, 20x2, TRIBULATION received notice of a litigation in relation to an accident that happened on December 31, 20x1. TRIBULATION estimates a probable loss of ₱800,000. On March 5, 20x2, TRIBULATION purchased a subsidiary for ₱40,000,000 in a business combination accounted for using the acquisition method. Goodwill of ₱10,000,000 was recognized on the business combination. The financial statements were authorized for issue on March 1, 20x2. What is the total amount of the adjusting events? a. 6,800,000 b. 800,000 c. 4,800,000 d. 30,000,000 B 800,000 probable loss on litigation 61. UNCORK RELEASE Co.’s current reporting period ends on December 31, 20x1. The following transactions occurred after the end of reporting period: On January 20, 20x2, a pending litigation was resolved requiring a settlement amount of ₱400,000. The 20x1 year-end financial statements included a provision for loss on litigation of ₱480,000. Inventories costing ₱4,000,000 were recognized at their net realizable value of ₱3,600,000 in the 20x1 year-end financial statements. During January 20x2, the inventories were sold for ₱3,520,000. Actual selling costs amounted to ₱120,000. The year-end accounts receivable include a ₱400,000 receivable from RELINQUISH, Inc. No allowance for doubtful accounts was recognized on this receivable as of December 31, 20x1. On February 3, 20x2, RELINQUISH filed for bankruptcy. It was estimated that the receivable will not be collected. The fair value of financial assets measured at fair value through profit or loss significantly declined to ₱320,000 on February 28, 20x2. The financial assets are recognized in the 20x1 yearend financial statements at ₱1,200,000 which is their fair value as of December 31, 20x1. On March 5, 20x2, a case was resolved requiring a settlement amount of ₱800,000. The 20x1 yearend financial statements included a provision for loss on litigation of ₱600,000. UNCORK Co.’s profit for the year ended December 31, 20x1 before consideration of the above transactions is ₱8,800,000. The financial statements were authorized for issue on March 1, 20x2. How much is the adjusted profit? a. 8,820,000 b. 9,020,000 c. 10,820,000 d. 8,280,000 D Solution: Unadjusted profit, December 31, 20x1 (a) Reduction in provision for loss on pending litigation (480K – 400K) (b) Reduction in NRV of inventories [3.6M - (3.52M –120K)] (c) Impairment loss on receivables Adjusted profit, December 31, 20x1 Use the following information for the next two questions: The following relates to the transactions of GRIMACE FROWN Co. during 20x1: 8,800,000 80,000 (200,000) (400,000) 8,280,000 Directors' and officers' remuneration Post-employment benefits of officers Fringe benefits in the form of housing assistance to directors and officers Share options granted to officers Officers' expenses on travels, representation and entertainment subject to liquidation and reimbursement Loans to directors and officers Sales to related entities 8,000,000 800,000 20,000,000 1,200,000 400,000 12,000,000 40,000,000 62. How much is the amount of related party disclosures on GRIMACE’s separate financial statements? a. 30,000,000 b. 52,000,000 c. 82,000,000 d. 42,000,000 C Key management personnel compensation (8M + 800K + 20M + 1.2M) + Related party transactions (12M + 40M) = 82M 63. How much is the amount of related party disclosures on GRIMACE’s statements? a. 12,000,000 b. 30,000,000 c. 82,000,000 d. 42,000,000 consolidated financial D Key management personnel compensation (8M + 800K + 20M + 1.2M) + Related party transactions (12M) = 42M 64. DEMENTED INSANE Co. is preparing its year-end financial statements and has identified the following operating segments: Segment s Revenues Profit (loss) Assets A 4,000,000 800,000 56,000,000 B 4,800,000 560,000 72,000,000 C 1,080,000 (280,000) 48,000,000 D 960,000 (2,800,000) 4,000,000 E 1,160,000 200,000 5,600,000 Totals 12,000,000 (1,520,000) 185,600,000 What are the reportable segments? a. A, B and D b. A, B, C and D c. A and B d. A, B, C, D and E B Revenue test: Threshold = 1,200,000 (12,000,000 x 10%). Reportable segments are A and B. Profit or loss test: Total profits (800,000 + 560,000 + 200,000 = 1,560,000); Total losses (280,000 + 2,800,000 = 3,080,000). Threshold = 308,000 (3,080,000 (higher) x 10%). Reportable segments are A, B and D. Asset test: Threshold = 18,560,000 (185,600,000 x 10%). Reportable segments are A, B and C. The reportable segments are A, B, C and D. 65. EMBOSOM CHERISH Co. engages in five diversified operations namely, operations A, B, C, D, and E. Information on these segments are shown below: Segment s Revenues Profit (loss) Assets A 3,200 800 40,000 B 3,200 400 8,000 C 200 40 4,000 D 600 80 8,000 E 800 280 24,000 1,600 84,000 Totals 8,000 Additional information: a. For internal reporting purposes, segments A and B are considered as one operating segment. b. Segment E is considered as an operating segment for internal decision making purposes. c. Segments C and D have similar economic characteristics and share a majority of the aggregation criteria. What are the reportable segments? a. A, B, C, D and E b. A, B and E c. A and B as one segment and E d. A and B as one segment, E, and C and D as one segment D Management approach: Reportable segments are A and B aggregated as a single reportable segment and E. Quantitative tests: C and D aggregated as a single reportable segment. 66. SORDID DIRTY Co. is preparing its year-end financial statements and has identified the following operating segments: InterExternal segment Total Segments revenues revenues revenues Profit Assets A 4,800,000 2,400,000 7,200,000 2,800,000 48,000,000 B 1,600,000 400,000 2,000,000 1,600,000 28,000,000 C 1,000,000 1,000,000 400,000 4,000,000 D 800,000 800,000 320,000 3,200,000 E 600,000 600,000 280,000 2,800,000 F 400,000 400,000 200,000 2,000,000 Totals 9,200,000 2,800,000 12,000,000 5,600,000 88,000,000 Management believes that between segments C, D, E and F, segment C is most relevant to external users of financial statements. What are the reportable segments? a. A and B b. A, B, C and D c. A, B and C d. A, B, C, D, E and F C Quantitative tests: A and B. However, their total external revenues is less than the 75% limit. Therefore, C is included as reportable in order to meet the 75% limit, even if segment C does not qualify in any of the quantitative tests. 67. RUSTIC RURAL Co. has the following information on its operating segments. InterExternal segment Total Segments revenues revenues revenues Profit A 4,800,000 2,400,000 7,200,000 2,800,000 B 1,600,000 400,000 2,000,000 1,600,000 C 1,000,000 1,000,000 400,000 D 800,000 800,000 320,000 E 600,000 600,000 280,000 F 400,000 400,000 200,000 Totals 9,200,000 2,800,000 12,000,000 5,600,000 Assets 48,000,000 28,000,000 4,000,000 3,200,000 2,800,000 2,000,000 88,000,000 RUSTIC Co. shall provide disclosure for major customers if revenues from transactions with a single external customer amount to how much? a. 920,000 b. 280,000 c. 1,200,000 d. 560,000 A (9,200,000 x 10%) = 920,000 68. You are the accountant of Entity X. The board of directors asked you for an advice because they feel like the company’s financial statements do not properly reflect the company’s financial position. The board noted out that the company’s properties (i.e., land) are absurdly stated at their historical cost. The properties were acquired 50 years ago and the market prices of the properties have more than tripled since then. In providing your professional advice, you will most certainly quote the provisions of which of the following standards? a. PAS 7 b. PAS 1 c. PAS 16 d. PAS 8 69. PFRS 8 relates to which of the following? a. Disclosure of operating segments b. Disclosure of related party relationships and transactions c. Disclosure of events after the reporting period d. Interim financial reporting 70. "Aanhin mo pa ang damo kung patay na ang kabayo.” a. Relevance b. Timeliness c. Biological asset - Horse d. PFRH – Philippine Financial Reporting Horse e. b and c B – choice (c) is wrong. A dead animal cannot qualify as a biological asset. Stocks of grass used for feeding horses are considered “Supplies” rather than biological assets. “Bio” means life. “I press on toward the goal to win the prize for which God has called me heavenward in Christ Jesus.” – (Philippians 3:14) - END -