Financial Accounting 4 Exam Questions

advertisement

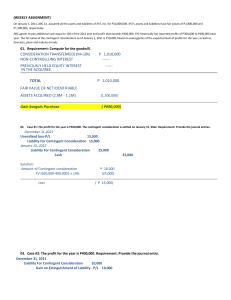

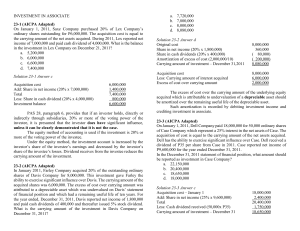

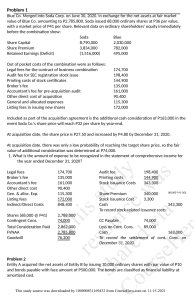

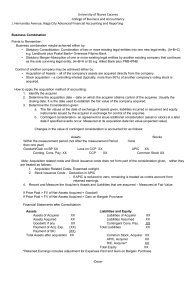

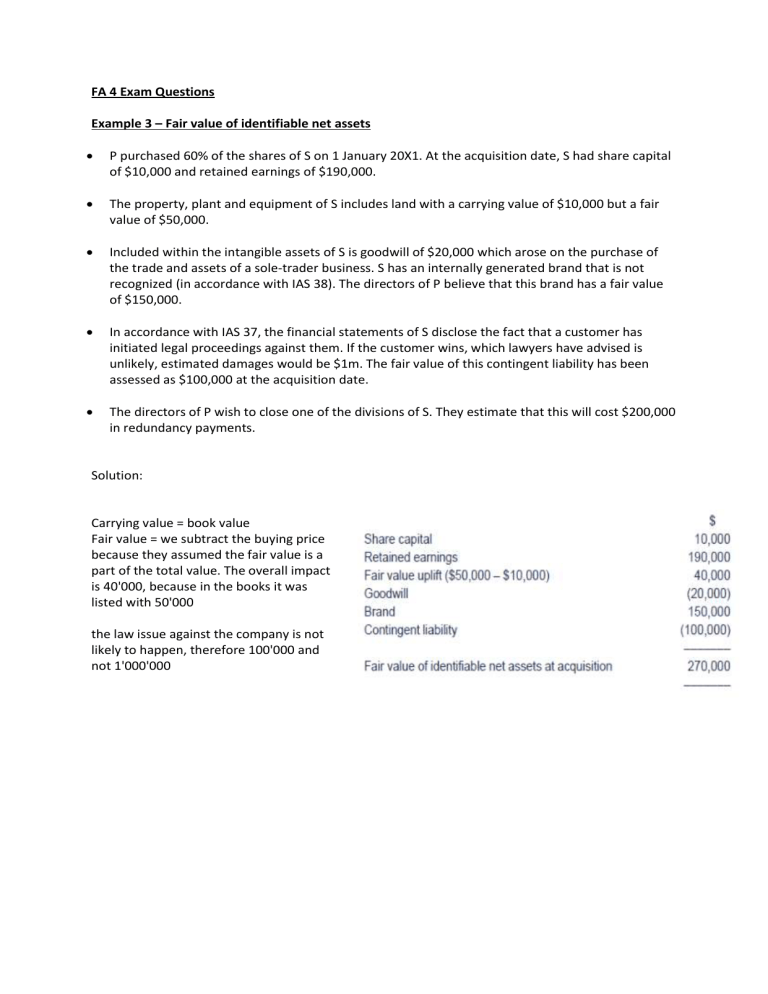

FA 4 Exam Questions Example 3 – Fair value of identifiable net assets P purchased 60% of the shares of S on 1 January 20X1. At the acquisition date, S had share capital of $10,000 and retained earnings of $190,000. The property, plant and equipment of S includes land with a carrying value of $10,000 but a fair value of $50,000. Included within the intangible assets of S is goodwill of $20,000 which arose on the purchase of the trade and assets of a sole-trader business. S has an internally generated brand that is not recognized (in accordance with IAS 38). The directors of P believe that this brand has a fair value of $150,000. In accordance with IAS 37, the financial statements of S disclose the fact that a customer has initiated legal proceedings against them. If the customer wins, which lawyers have advised is unlikely, estimated damages would be $1m. The fair value of this contingent liability has been assessed as $100,000 at the acquisition date. The directors of P wish to close one of the divisions of S. They estimate that this will cost $200,000 in redundancy payments. Solution: Carrying value = book value Fair value = we subtract the buying price because they assumed the fair value is a part of the total value. The overall impact is 40'000, because in the books it was listed with 50'000 the law issue against the company is not likely to happen, therefore 100'000 and not 1'000'000 4) Purchase consideration Following on from Example 3, the purchase consideration transferred by P in exchange for the shares in S was as follows: 1. Cash paid of $300,000 2. Cash to be paid in one year's time of $200,000 3. 10,000 shares in P. These had a nominal value of $1 and a fair value at 1 January 20X1 of $3 each 4. $250,000 to be paid in one year's time if S makes a profit before tax of more than $2m. There is a 50% chance of this happening. The fair value of this contingent consideration can be measured as the present value of the expected value. 5. Legal fees associated with the acquisition were $10,000. Where required, a discount rate of 10% should be used. (nominal value = nennwert) ((fair value = market value)