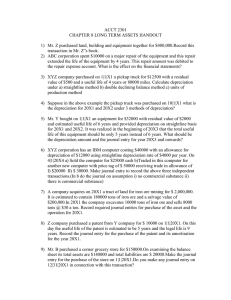

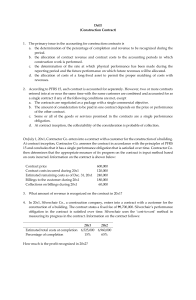

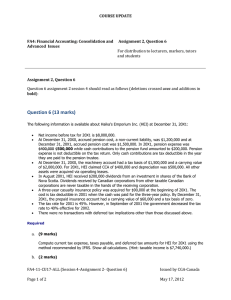

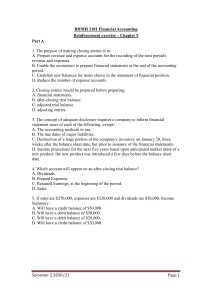

PRE-FINALS QUIZ MULTIPLE CHOICE: On your answer sheet, write the corresponding letter of the best answer. Provide solutions for problems solving questions. Write the letter of your choice in the CAPITAL letters. 1. RFC provides 3-year warranty for the products it sells. RFC estimates that warranty costs ₱400 per unit sold. As of January 1, 20x1, the liability for warranty has a balance of ₱800,000 for units sold in 20x0. During the year RISIBLE sold 5,000 units and actual warranty costs incurred were ₱1,240,000. How much is the warranty expense to be recognized in 20x1? (nfl,p,c) a. 2,000,000 b. 1,240,000 c. 3,240,000 d. 4,240,000 2. PFC launched a sales promotion in 20x1. For every ten empty packs returned to PFC plus ₱200, customers will receive a set of kitchen knives. PFC estimates that 40% of the packs sold will be redeemed. Information on transactions during the year is as follows: Units Sales Sets of kitchen knives purchased (₱800 per set) Number of packs redeemed 500,000 300,000 45,000 Amount 3B 240M How much is the premium expense in 20x1? (nfl,p,c) a. 8,000,000 b. 12,000,000 c. 14,000,000 d. 16,000,000 3. In December 20x1, Mill Co. began including one coupon in each package of candy that it sells and offering a toy in exchange for 50 centavos and five coupons. The toys cost Mill 80 centavos each. Eventually, 60% of the coupons will be redeemed. During December, Mill sold 110,000 packages of candy and no coupons were redeemed. In its December 31, 20x1, balance sheet, what amount should Mill report as estimated liability for coupons? a. 3,960 b. 10,560 c. 19,800 d. 52,800 4. In May 20x6, Caso Co. filed suit against Wayne, Inc. seeking ₱1,900,000 damages for patent infringement. A court verdict in November 20x9 awarded Caso ₱1,5000,000 in damages, but Wayne’s appeal is not expected to be decided before 2x10. Caso’s counsel believes it is probable that Caso will be successful against Wayne for an estimated amount in the range between ₱800,000 and ₱1,100,000, with ₱1,000,000 considered the most likely amount. What amount should Caso record as income from the lawsuit in the year ended December 31, 20x9? a. 0 b. 800,000 c. 1,000,000 d. 1,500,000 5. National Appliance Center sells washing machines that carry a three-year warranty against manufacturer’s defects. Based on company experience, warranty costs are estimated at ₱60 per machine. During the year, National sold 48,000 washing machines and paid warranty costs of ₱340,000. In its income statement for the year ended December 31, National should report warranty expense of: a. 680,000 b. 960,000 c. 2,200,000 d. 2,880,000 6. During January 20x9, Haze Corp. won a litigation award for ₱15,000 which was tripled to ₱45,000 to include punitive damages. The defendant, who is financially stable, has appealed only the ₱30,000 punitive damages. Haze was awarded ₱50,000 in an unrelated suit it filed, which is being appealed by the defendant. Counsel is unable to estimate the outcome of these appeals. In its 20x9 financial statements, Haze should report what amount of pretax gain? a. 15,000 b. 45,000 c. 50,000 d. 95,000 7. Taken from the records of ABC Co. as of December 31, 20x1 is the following information: Computer software cost Machinery Accrued liability - health care Carrying amount Tax base Difference 500,000 1,000,000 200,000 600,000 - 500,000 400,000 200,000 Additional information: Software development costs after technological feasibility was established were capitalized for financial reporting. The costs were recognized as outright deductions for tax purposes. Straight line method is used in depreciating the machinery while sum-of-the-years’ digits method is used for tax purposes. Health care benefits are accrued as incurred but are tax deductible only when cash is actually paid. Pretax profit for 20x1 is ₱1,000,000. Income tax rate is 30%. There were no temporary differences as of January 1, 20x1. How much is the deferred tax liability on December 31, 20x1? (it) a. 400,000 b. 900,000 c. 320,000 d. 270,000 8. Information on an entity’s operating segments is shown below: Operating segments Total revenue Profit Identifiable assets A B C D E F 1,000,000 500,000 300,000 500,000 200,000 900,000 200,000 120,000 30,000 50,000 60,000 400,000 4,000,000 1,000,000 800,000 1,700,000 800,000 1,000,000 860,000 9,300,000 Totals The reportable segments are a. A, B and F b. A, B, D and F 3,400,000 c. A, B, C, D and F d. All segments 9. Stiggins Corporation had the following account balances for 20x2: Accounts Payable Prepaid Rent Expense Accounts Receivable (net) 31-Dec 67,200 24,600 84,000 1-Jan 58,200 37,200 66,600 Stiggins' 2002 profit is ₱450,000. What amount should Stiggins include as net cash provided by operating activities in its 20x2 statement of cash flows? a. 436,200 b. 445,200 c. 453,600 d. 454,200 10. Chow Company's 20x2 income statement reported the cost of goods sold as ₱135,000. Additional information is as follows: Inventory Accounts Payable 31-Dec-02 30,000 13,000 31-Dec-01 22,500 19,500 If Chow uses the direct method, what amount should Chow report as cash paid to suppliers in its 2002 statement of cash flows? a. 121,000 b. 134,000 c. 136,000 d. 149,000 Use the following for the next three questions: Frye Company uses the direct method to prepare its statement of cash flows. The company had the following cash flows in 2002: Cash receipts from the issuance of ordinary shares Cash receipts from customers Cash receipts from dividends on long-term investments Cash receipts from repayment of loan made to another entity Cash payments for wages and other operating expenses Cash payments for insurance Cash payments for dividends Cash payments for taxes Cash payment to purchase land 400,000 200,000 30,000 220,000 120,000 10,000 20,000 40,000 80,000 11. The net cash provided by (used in) operating activities is a. 60,000 b. 40,000 c. 30,000 d. (20,000) 12. The net cash provided by (used in) investing activities is a. 220,000 b. 140,000 c. 60,000 d. (80,000) 13. The net cash provided by (used in) all activities is a. 580,000 b. 410,000 c. 380,000 d. (60,000) 14. Entity Co. uses the cash basis of accounting and reported income of ₱87,000 in 20x1. The following items were considered in the computation of the cash basis net income. Inventory, beginning Inventory, ending Receivables, beginning Receivables, ending Payables, beginning Payables, ending The accrual basis income is a. 97,000 b. 73,000 12,000 18,000 40,000 38,000 19,000 25,000 c. 89,000 d. 85,000 15. Entity A reported profit of ₱340,000 for the year ended December 31, 20x1. Depreciation expense for the year was ₱100,000. The following are the changes in the operating assets and liabilities of Entity A during 20x1: Accounts receivable Accounts payable 20x1 20x0 560,000 240,000 300,000 120,000 How much is the net cash from operating activities? a. 820,000 b. 580,000 c. 300,000 d. 100,00 The following were the cash transactions of Entity A during the period: Cash receipts from sale of goods Cash paid for purchases of inventory Cash receipts on loans taken from a bank Cash paid for interest expense Cash payment for the acquisition of property, plant and equipment 650,000 340,000 200,000 20,000 180,000 16. How much is the net cash from (used in) operating activities? a. 155,000 b. (155,000) c. 290,000 d. (290,000) 17. How much is the net cash from (used in) investing activities? a. 180,000 b. (180,000) c. 20,000 d. 0 18. Under the indirect method, the cash flow from operating activities is determined by adjusting the reported profit by (choose the incorrect statement) a. adding back non-cash expenses b. adding back decreases in operating assets c. deducting decreases in operating liabilities d. adding back increases in operating assets 19. Under the indirect method, the cash flow from operating activities is determined by adjusting the reported profit by (choose the incorrect statement) a. deducting non-cash income b. deducting increases in operating assets c. deducting decreases in nonoperating liabilities d. deducting gains on sale of nonoperating assets 20. When preparing a statement of cash flows using the direct method, amortization of patent is a. shown as an increase in cash flows from operating activities. b. shown as a reduction in cash flows from operating activities. c. included with supplemental disclosures of noncash transactions. d. not reported in the statement of cash flows or related disclosures. The movements in the cash account of DEADLOCK STANDSTILL Co. during 20x2 are shown below. Cash beg. 400 Sales 12,000 7,600 Purchases Interest income 40 2,400 Operating expenses Rent income 540 60 Interest expense Dividend income 80 140 Income taxes Sale of held for trading securities 1,600 200 Investment in FVOCI Sale of old building 1,040 2,200 Purchase of equipment Collection of non-trade note 120 260 Loan granted to employee Proceeds from loan with a bank 3,200 480 Payment of loan borrowed Issuance of shares 1,940 400 Reacquisition of shares 180 Dividends 7,040 end. 21. How much is the cash flows from operating activities? a. 4,600 b. 4,840 c. 5,040 d. 4,060 22. How much is the cash flows from investing activities? a. (1,500) b. 1,500 c. 1,240 d. (1,240) 23. How much is the cash flows from financing activities? a. 4,800 b. (4,800) c. 4,240 d. 4,080 24. DEMENTED INSANE Co. is preparing its year-end financial statements and has identified the following operating segments: Segments Revenues Profit (loss) Assets A 4,000,000 800,000 56,000,000 B 4,800,000 560,000 72,000,000 C 1,080,000 (280,000) 48,000,000 D 960,000 (2,800,000) 4,000,000 E 1,160,000 200,000 5,600,000 12,000,000 (1,520,000) 185,600,000 Totals What are the reportable segments? a. A, B and D b. A, B, C and D c. A and B d. A, B, C, D and E 25. EMBOSOM CHERISH Co. engages in five diversified operations namely, operations A, B, C, D, and E. Information on these segments are shown below: Segments Revenues Profit (loss) Assets A 3,200 800 40,000 B 3,200 400 8,000 C 200 40 4,000 D 600 80 8,000 E 800 280 24,000 8,000 1,600 84,000 Totals Additional information: a. For internal reporting purposes, segments A and B are considered as one operating segment. b. Segment E is considered as an operating segment for internal decision making purposes. c. Segments C and D have similar economic characteristics and share a majority of the aggregation criteria. What are the reportable segments? a. A, B, C, D and E b. A, B and E c. A and B as one segment and E d. A and B as one segment, E, and C and D as one segment 26. SORDID DIRTY Co. is preparing its year-end financial statements and has identified the following operating segments: InterExternal segment Total Segments revenues revenues revenues Profit Assets A 4,800,000 2,400,000 7,200,000 2,800,000 48,000,000 B 1,600,000 400,000 2,000,000 1,600,000 28,000,000 C 1,000,000 1,000,000 400,000 4,000,000 D 800,000 800,000 320,000 3,200,000 E 600,000 600,000 280,000 2,800,000 F 400,000 400,000 200,000 2,000,000 9,200,000 2,800,000 12,000,000 5,600,000 88,000,000 Totals Management believes that between segments C, D, E and F, segment C is most relevant to external users of financial statements. What are the reportable segments? a. A and B b. A, B, C and D c. A, B and C d. A, B, C, D, E and F 27. The ledger of PERNICIOUS DEADLY Co. as of December 31, 20x1 includes the following: Liabilities Bank overdraft Trade accounts payable (net of ₱10,000 debit balance in accounts) Notes payable (due in 20 semi-annual payments of ₱4,000) Interest payable Bonds payable (due on March 31, 20x2) Discount on bonds payable Dividends payable Share dividends payable Deferred tax liability (expected to reverse in 20x2) Income tax payable Contingent liability Reserve for contingencies Totals 10,000 40,000 80,000 30,000 70,000 (30,000) 10,000 12,000 36,000 44,000 100,000 28,000 430,000 How much is the total current liabilities? a. 192,000 b. 186,000 c. 212,000 d. 178,000 28. On January 1, 20x1, ABC signed a 3-year, non-cancellable purchase contract which allows ABC to purchase up to 12,000 units of Buko annually from XYZ at P15 per unit and guarantees a minimum purchase of 3,000 units. At year-end, it was found out that the goods become unique in the market. ABC had 4,000 units of this inventory at December 31, 20x1, and believes these can be sold for P25 per unit. How much is the gain on purchase commitment to be recognized on December 31, 20x1? a. 70,000 b. 100,000 c. 60,000 d. 0 29. ABC Co. has the following information relating to its income tax on December 31, 20x1: Provision for probable loss on litigation of ₱300,000 is recognized for financial reporting. This amount is tax deductible only when actually paid. ABC expects to pay for the accrued loss in 20x2. Revenue for financial reporting is recognized based on percentage of completion while revenue for taxation purposes is recognized based on collections on progress billings. Total revenue recognized for financial reporting is ₱1,000,000 while revenue recognized for taxation purposes is ₱800,000. Pretax income for the year is ₱1,000,000. Income tax rate for 20x1 is 30%. However, an enacted tax law that will take effect starting January 1, 20x2 requires a tax rate of 32%. There are no temporary differences on January 1, 20x1. How much is the income tax expense? a. 320,000 b. 300,000 c. 298,000 d. 289,000 30. ABC Co. is determining the amount of its pretax accounting income for the year by making adjustment to taxable income from the company's year-end income tax return. The tax return indicates taxable income of ₱100,000, on which a tax liability of ₱30,000 has been recognized (₱100,000 x 30% = ₱30,000). Additional information is shown below: Goodwill impairment loss not included as a deduction in the tax return but may be deducted for financial reporting Interest income on savings and time deposits with private banks Revenues from installment sales are recognized as goods are sold but are taxed only when installment payments are collected. Excess of depreciation recognized for financial reporting over depreciation recognized for taxation purposes due to shorter depreciation period used for financial reporting Bad debt expense recognized using the allowance method How much is the pretax income? a. 115,000 b. 100,000 c. 96,000 d. 86,000 -END OF QUIZ- 35,000 6,000 40,000 10,000 15,000