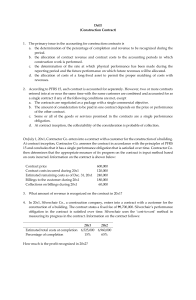

1. 2. 3. 4. The standard that addresses the accounting for revenues is a. PFRS 16. b. PFRS 18. c. PFRS 5. d. PFRS 15. The objective of PAS 1 Presentation of Financial Statements is a. to provide the basic principles in the presentation of general purpose financial statements to improve comparability. b. to provide the basic principles in the presentation of general and special purpose financial statements to improve comparability. c. to provide the basic principles in the presentation of general purpose financial statements to improve consistency. d. all of these The heading of a financial statement most likely will not include a. the name of the reporting entity. b. the title of the financial statement. c. the date of the financial statement. d. the name(s) of the business owner(s). According to PAS 1, an asset shall be classified as current when it satisfies any of the following criteria, except a. it is expected to be realized in, or is intended for sale or consumption in, the entity’s normal operating cycle b. it is held primarily for the purpose of being traded c. it is expected to be realized within twelve months after the balance sheet date d. it is cash or a cash equivalent that is restricted 5. A liability shall be classified as current when it satisfies any of the following criteria, except a. it is expected to be settled in the entity’s normal operating cycle b. it is held primarily for the purpose of being traded c. it is due to be settled within twelve months after the balance sheet date d. the entity has an unconditional right to defer settlement of the liability for at least twelve months after the balance sheet date. 6. If an entity expects, and has the discretion, to refinance or roll over an obligation for at least twelve months after the balance sheet date under an existing loan facility, it classifies the obligation as non-current, a. even if it would otherwise be due within a shorter period. b. even if the original term was for a period longer than twelve months c. even if an agreement to refinance, or to reschedule payments, on a long-term basis is completed after the reporting period and before the financial statements are authorized for issue d. choices b and c 7. When an entity breaches an undertaking under a long-term loan agreement on or before the end of the reporting period with the effect that the liability becomes payable on demand, (choose the incorrect statement) a. The liability is classified as current, even if the lender has agreed, after the balance sheet date and before the authorization of the financial statements for issue, not to demand payment as a consequence of the breach. b. The liability is classified as current because, at the balance sheet date, the entity does not have an unconditional right to defer its settlement for at least twelve months after that date. c. The liability is classified as non-current, even if the lender has agreed, after the balance sheet date and before the authorization of the financial statements for issue, not to demand payment as a consequence of the breach . d. The liability is normally classified as current; however, the liability is classified as non- current if the lender agreed by the balance sheet date to provide a period of grace ending at least twelve months after the balance sheet date, within which the entity can rectify the breach and during that period the lender cannot demand immediate repayment. 8. Material Omissions or misstatements of items are material if they could, individually or collectively; influence the economic decisions of users taken on the basis of the financial statements. Materiality depends on a. the peso amount and degree of financial consequence of the omission or misstatement judged in the surrounding circumstances b. the size and peso amount of the omission or misstatement judged in the surrounding circumstances c. the peso amount and nature of the omission but not the misstatement judged in the surrounding circumstances d. the size and nature of the omission or misstatement judged in the surrounding circumstances 9. In the extremely rare circumstances in which management concludes that compliance with a requirement in a Standard or an Interpretation would be so misleading that it would conflict with the objective of financial statements set out in the Framework, the entity shall depart from that requirement in the manner set under PAS 1. When an entity departs from a requirement of a Standard or an Interpretation, it shall disclose: (choose the incorrect statement) a. that management has concluded that the financial statements present fairly the entity’s financial position, financial performance and cash flows; b. that it has complied with applicable Standards and Interpretations, except that it has departed from a particular requirement to achieve a fair presentation; c. that it has complied with other applicable standards other than those issued by FRSC or IASB and the description of those accounting standards which the entity has complied to. d. the title of the Standard or Interpretation from which the entity has departed, the nature of e. the departure, including the treatment that the Standard or Interpretation would require, the reason why that treatment would be so misleading in the circumstances that it would conflict with the objective of financial statements set out in the Framework, and the treatment adopted; and for each period presented, the financial impact of the departure on each item in the financial statements that would have been reported in complying with the requirement. 10. Identify the incorrect statement. a. b. c. When an entity has departed from a requirement of a Standard or an Interpretation in a prior period, and that departure affects the amounts recognized in the financial statements for the current period, it shall disclose the (a) title of the Standard or Interpretation from which the entity has departed and the (b) impact of such departure. In the extremely rare circumstances in which management concludes that compliance with a requirement in a Standard or an Interpretation would be so misleading that it would conflict with the objective of financial statements set out in the Framework, but the relevant regulatory framework prohibits departure from the requirement, the entity shall, to the maximum extent possible, reduce the perceived misleading aspects of compliance by disclosing:(a) the title of the Standard or Interpretation in question and (b) for each period presented, the adjustments to each item in the financial statements that management has concluded would be necessary to achieve a fair presentation. Financial statements shall be prepared on a going concern basis unless management either intends to liquidate the entity or to cease trading, or has no realistic alternative but to do so. d. PAS 1 requires an entity preparing financial statements, to make an assessment of the entity’s ability to continue as a going concern. In assessing whether the going concern assumption is appropriate, management takes into account all available information about the future, which is at least, but is not limited to, five years from the balance sheet date. 11. Identify the incorrect statement. a. b. c. The final stage in the process of aggregation and classification is the presentation of condensed and classified data, which form line items on the face of the financial statements. PAS 1 sometimes uses the term ‘disclosure’ in a broad sense, encompassing items presented on the face of the balance sheet, statement of profit or loss and other comprehensive income, statement of changes in equity and cash flow statement, as well as in the notes. Applying the concept of materiality means that a specific disclosure requirement in a Standard or an Interpretation need not be satisfied if the information is not material. d. An entity shall prepare its financial statements, including cash flow information, using the . accrual basis of accounting e. PAS 1 requires an entity presenting its current year financial statements to also present its financial statements for the previous year. 12. The ledger of SCHOLIAST COMMENTATOR Co. as of December 31, 20x1 includes the following: Assets Cash Trade accounts receivable (net of ₱10,000 credit balance in accounts) Held for trading securities Financial assets designated at FVPL Investment in equity securities at FVOCI Investment in bonds measured at amortized cost (due in 3 years) Prepaid assets Deferred tax asset (expected to reverse in 20x2) Investment in Associate 10,000 40,000 80,000 30,000 70,000 60,000 10,000 12,000 36,000 Investment property Sinking fund Property, plant, and equipment Goodwill Totals 46,000 38,000 100,000 28,000 560,000 How much is the total current assets? a. 220,000 b. 180,000 c. 340,000 d. 164,000 Solution: Current assets 10,000 Cash 50,000 Trade accounts receivable (40,000 + 10,000) 80,000 Held for trading securities 30,000 Financial assets designated at FVPL Prepaid assets 10,000 180,000 Total current assets 13. The ledger of PERNICIOUS DEADLY Co. as of December 31, 20x1 includes the following: Liabilities Bank overdraft Trade accounts payable (net of ₱10,000 debit balance in accounts) Notes payable (due in 20 semi-annual payments of ₱4,000) Interest payable Bonds payable (due on March 31, 20x2) Discount on bonds payable Dividends payable Share dividends payable Deferred tax liability (expected to reverse in 20x2) Income tax payable Contingent liability Reserve for contingencies Totals How much is the total current liabilities? a. 192,000 b. 186,000 c. 212,000 10,000 40,000 80,000 30,000 70,000 (30,000) 10,000 12,000 36,000 44,000 100,000 28,000 430,000 d. 178,000 Solution: Current liabilities Bank overdraft Trade accounts payable (P20,000 + P5,000) Notes payable (P2,000 semi-annual instalment x 2) Interest payable Bonds payable (due on March 31, 20x2) Discount on bonds payable Dividends payable Income tax payable Total current liabilities 10,000 50,000 8,000 30,000 70,000 (30,000) 10,000 44,000 192,000 14. The ledger of CALLOW IMMATURE Co. in 20x1 includes the following: Share capital Share premium Retained earnings, appropriated Retained earnings, unappropriated Revaluation surplus Remeasurements of the net defined benefit liability (asset) - gain Cumulative net unrealized gain on fair value changes of investment in FVOCI Effective portion of losses on hedging instruments in a cash flow hedge Cumulative translation loss on foreign operation Treasury shares, at cost 200,000 40,000 36,000 84,000 60,000 30,000 46,000 20,000 10,000 26,000 How much is the total shareholders’ equity? a. b. c. d. 460,000 440,000 420,000 390,000 Solution: Share capital Share premium Retained earnings, appropriated Retained earnings, unappropriated Revaluation surplus Remeasurements of the net defined benefit liability (asset) - gain Cumulative net unrealized gain on fair value changes of investment in FVOCI Effective portion of losses on hedging instruments in a cash flow hedge Cumulative translation loss on foreign operation Treasury shares, at cost 200,000 40,000 36,000 84,000 60,000 30,000 46,000 (20,000) (10,000) (26,000) Total shareholders' equity 440,000 Use the following information for the next two questions: 15. GUILE DECEITFULNESS Co. was incorporated on January 1, 20x1. The following were the transactions during the year: - Total consideration from share issuances amounted to ₱2,000,000. - A land and building were acquired through a lump sum payment of ₱400,000. A mortgage amounting to ₱100,000 was assumed on the land and building. - Total payments of ₱80,000 were made during the year on the mortgage assumed on the land and building, The payments are inclusive of interest amounting to ₱10,000. - Additional capital of ₱200,000 was obtained through bank loans. None of the bank loans were paid during the year. Half of the bank loans required a secondary mortgage on the land and building. - There is no accrued interest as of year-end. - Dividends declared during the year but remained unpaid amounted to ₱60,000. - No other transactions during the year affected liabilities. - Retained earnings as of December 31, 20x1 is ₱120,000. 16. How much is the profit for the year? a. b. c. d. 120,000 160,000 180,000 220,000 Retained earnings Dividends Dec. 31, 20x1 60,000 120,000 180,000 Jan. 1, 20x1 Profit for the year (squeeze) 17. How much is the total assets as of December 31, 20x1? a. b. c. d. 2,410,000 2,520,000 2,380,000 2,420,000 Asset = Liabilities + Equity Mortgage assumed on land and building Principal payment on the mortgage (80K – 10K interest) Bank loans Dividends payable Liabilities, Dec. 31, 20x1 100,000 ( 70,000) 200,000 60,000 290,000 Share issuances 2,000,000 Retained earnings – Dec. 31, 20x1 Equity, Dec. 31, 20x1 120,000 2,120,000 Total assets, Dec. 31, 20x1 (liabilities + equity) 2,410,000 18. The ledger of DEROGATORY DEGRADING Co. in 20x1 includes the following: Cash Accounts receivable Inventory Accounts payable Note payable 200,000 400,000 1,000,00 0 300,000 100,000 During the audit of DEROGATORY’s 20x1 financial statements, the following were noted by the auditor: - Cash sales in 20x2 amounting to ₱20,000 were inadvertently included as sales in 20x1. DEROGATORY recognized gross profit of ₱6,000 on the sales. - A collection of a ₱40,000 accounts receivable in 20x2 was recorded as collection in 20x1. A cash discount of ₱2,000 was given to the customer. - During January 20x2, a short-term bank loan of ₱50,000 obtained in 20x1 was paid together with ₱5,000 interest accruing in January 20x2. The payment transaction in 20x2 was inadvertently included as 20x1 transaction. How much is the adjusted working capital as of December 31, 20x1? a. 1,651,000 b. 1,014,000 c. 1,450,000 d. 1,201,000 Solution: The adjusted balance of cash is computed as follows: Cash (unadjusted) Cash sales in 20x2 recorded as 20x1 sale 200,000 (20,000) Collection of account in 20x2 recorded as 20x1 collection (40,000 account less 2,000 cash discount) (38,000) Loan payment in 20x2 recorded as 20x1 transaction Interest payment in 20x2 recorded as 20x1 transaction 50,000 5,000 Adjusted cash balance, Dec. 31, 20x1 The adjusted balance of accounts receivable is computed as follows: Accounts receivable (unadjusted) Collection of account in 20x2 recorded as 20x1 collection Adjusted accounts receivable balance, Dec. 31, 20x1 The adjusted balance of inventory is computed as follows: Inventory (unadjusted) Cost of cash sale in 20x2 recorded as 20x1 sale 197,000 400,000 40,000 440,000 1,000,000 (20,000 sale - 6,000 gross profit) Adjusted inventory balance, Dec. 31, 20x1 14,000 1,014,000 Adjusted current assets, Dec. 31, 20x1: (197K + 440K + 1,014K) = 1,651,000 The adjusted current liabilities are computed as follows: Accounts payable Note payable Loan payable Adjusted current liabilities, Dec. 31, 20x1 300,000 100,000 50,000 450,000 Working capital, Dec. 31, 20x1 = Current assets – Current liabilities Working capital, Dec. 31, 20x1 = (1,651,000 – 450,000) = 1,201,000 19. According to PAS 1 Presentation of Financial Statements, expenses are presented using a. Nature of expense method b. Function of expense method c. a or b d. Classified and Unclassified Use the following information for the next two questions: Anne Jeng Inc.’s accounts show the following balances: Cost of goods sold Insurance expense Advertising expense Freight-out Loss on sale of equipment Rent expense (one-half pertains sales department) Salaries expense (1/4 pertains to non-sales personnel) Sales commission expense Bad debts expense Interest expense ₱320,000 75,000 25,000 30,000 7,000 80,000 150,000 10,000 5,000 5,000 20. How much is the total distribution costs (selling expenses)? a. 198,000 b. 210,500 c. 217,500 d. 221,500 Advertising expense 25,000 Freight-out 30,000 Rent expense (80K x 1/2) 40,000 Salaries expense (150K x 3/4) 112,500 Sales commission expense Distribution costs 10,000 217,500 21. How much is the total administrative expenses? a. 157,500 b. 156,500 c. 147,500 d. 175,500 Insurance expense Rent expense (80K x 1/2) 75,000 40000 Salaries expense (150K x 1/4) 37500 Bad debts expense Administrative expenses 5,000 157,500 22. Entity A has the following information: Inventory, beg. 80,000 Inventory, end. Purchases Freight-in Purchase returns Purchase discounts 128,000 320,000 16,000 8,000 11,200 How much is Entity A’s cost of sales? a. 286,800 b. 292,800 c. 288,600 d. 268,800 Inventory, beg. Net purchases: 80,000 Purchases 320,000 Freight-in 16,000 Purchase returns Purchase discounts (8,000) (11,200) Total goods available for sale Less: Inventory, end. 316,800 396,800 (128,000) Cost of goods sold 268,800 23. A correct dating of financial statements is Statement of financial position a. as of a point in time b. for a period of time c. for a period of time Statement of comprehensive income for a period of time as of a point in time for a period of time d. time after time time and time again 24. Which of the following is considered revenue? a. c. d. gain on sale of equipment b. service fees other income other comprehensive income 25. Which of the following items is likely to be presented in the statement of comprehensive income of a merchandising business but not of a service business? a. Service fees b. Salaries expense c. Cost of sales d. Income tax expense 26. A statement of comprehensive income that presents cost of sales separately from other expenses is prepared under the a. b. single-step method. single-presentation. c. multi-step method. d. two-statement presentation. 27. In a two-statement presentation, information on profit or loss and other comprehensive income is shown a. b. c. d. in two separate statements, a statement of profit or loss and a statement showing other comprehensive income. in two separate statements, a statement of profit or loss and an income statement. in two separate statements, a single-step statement and a multi-step statement. in a single statement called “statement of comprehensive income.” 28. Expenses are presented in the statement of comprehensive income using a. b. c. nature of expense method. function of expense method. single or two-statement method. d. a or b 29. Under this presentation method, expenses are presented in the statement of comprehensive income without distinctions as to their functions within the entity. a. nature of expense method b. function of expense method c. single-statement presentation d. two-statement presentation 30. Under this presentation, expenses are classified as either operating or non-operating item. At a minimum, cost of sales is presented separately. a. nature of expense method b. function of expense method c. single-statement presentation d. two-statement presentation 31. In a statement of comprehensive income showing expenses according to their function, which of the following is included in the line item “Distribution costs” or “Selling costs?” a. Insurance expense c. Freight-in b. Legal and accounting fees d. Advertising expense 32. In a statement of comprehensive income showing expenses according to their function, which of the following is included in the line item “Administrative expenses?” a. Salaries of sales personnel b. Cost of sales c. Freight-out d. Legal and accounting fees Use the following information for the next five questions: The nominal accounts of Rommel SP Corp. on December 31, 20x1 have the following balances: Accounts Sales Interest income Gains Inventory, beg. Purchases Freight-in Purchase returns Purchase discounts Freight-out Sales commission Advertising expense Salaries expense Rent expense Depreciation expense Utilities expense Supplies expense Transportation and travel expense Insurance expense Taxes and licenses Interest expense Miscellaneous expense Loss on the sale of equipment Dr. Cr. ₱739,000 45,000 15,000 ₱65,000 180,000 10,000 5,000 9,000 30,000 45,000 25,000 240,000 30,000 50,000 25,000 15,000 15,000 10,000 60,000 5,000 3,000 5,000 Additional information: a. Ending inventory is ₱90,000. b. One-fourth of the salaries, rent, and depreciation expenses pertain to the non-sales department. The sales department does not share in the other expenses. 33. How much is the net purchases? a. ₱185,000 c. ₱194,000 b. ₱176,000 d. ₱192,000 Purchases 180,000 Freight-in 10,000 Purchase returns (5,000) Purchase discounts (9,000) Net purchases 176,000 34. How much is the “change in inventory” in 20x1? a. ₱90,000 increase c. ₱25,000 decrease b. ₱65,000 decrease d. ₱25,000 increase Inventory, beg. Inventory, end. 65,000 90,000 Change in inventory – increase (25,000) 35. How much is the cost of goods sold? a. ₱151,000 b. ₱95,000 c. ₱169,000 d. ₱127,000 Net purchases 176,000 Less: Net increase in inventory Cost of sales (25,000) 151,000 36. How much is the total selling expense? a. ₱420,000 c. ₱180,000 b. ₱260,000 d. ₱340,000 Freight-out Sales commission 30,000 45,000 Advertising expense 25,000 Salaries expense (240K x 3/4) 180,000 Rent expense (30K x 3/4) 22,500 Depreciation expense (50K x 3/4) Selling expenses/Distribution costs 37,500 340,000 37. How much is the total general and administrative expense? a. 330,000 b. 320,000 d. 208,000 Salaries expense (240K x 1/4) Rent expense (30,000 x 1/4) 60,000 7,500 Depreciation expense (50K x 1/4) 12,500 Utilities expense 25,000 280,000 c. Supplies expense Transportation and travel expense 15,000 15,000 Insurance expense 10,000 Taxes and licenses 60,000 Miscellaneous expense Administrative expenses 3,000 208,000 38. One of the conditions that must be satisfied in order to recognize revenue in a transaction involving the rendering of services over a contractual period is that the stage of completion of the transaction at the end of the reporting period can be measured reliably. Which of the following methods for determining the stage of completion of a contract involving the rendering of services are specifically referred to in PFRS 15 as being acceptable? I. Costs incurred to date as a percentage of the estimated total costs of the transaction II. Advances received to date as a percentage of the total amount receivable III. Surveys of work performed IV. Revenue to date divided by total contract revenue a. I, III, IV b. I, III c. I, II, IV d. I, II, III 39. The Grand Company placed an order with The Little Company for new specialist machinery. The order was non-cancellable once signed and Grand agreed to pay for the machinery at the time the order was signed on 1 February 20X7. Little held the machinery to Grand's order from 1 June 20X7, the date on which it was completed. Grand commenced using the machinery on 1 August 20X7 when Little completed the installation process. The installation is not distinct. Little had staff on standby to deal with any operating problems until the warranty period ended on 1 November 20X7. The warranty does not provide service in addition to assurance that the machinery complies with agreed-upon specifications. Under PFRS15 Revenue, Little should recognize the revenue from the sale of this specialist machinery on a. 1 February 20X7 c. 1 August 20X7 b. 1 June 20X7 d. 1 November 20X7 40. Which is incorrect concerning recognition of revenue? a. b. c. d. Revenue from rendering of services over an extended contractual period shall be recognized by reference to the stage of completion of the transaction at balance sheet date. Interest revenue shall be recognized on a time proportion basis that does not take into account the effective yield on the asset. Royalty revenue shall be recognized on an accrual basis in accordance with the substance of the relevant agreement, Dividend revenue shall be recognized when the stockholder’s right to receive payment is established. 41. In a normal sale, generally the most uncertain factor in the revenue recognition process is a. the seller's fulfillment of its responsibility in the transaction b. the measurability of the resource or item received by the seller c. of the resource or item received by the seller d. the relevance of the resource or item received by the seller the realizability 42. Which of the following methods of service revenue recognition usually would be most appropriate for a business engaged in packing, loading, transporting and delivering freight (where each of the processes is an input to a combined output specified by the customer)? a. Proportional performance method (i.e., over time as the entity progresses towards the complete satisfaction of the performance obligation) b. Completed performance method (i.e., at a point in time when the entity completes the output specified in the contract) c. Specific performance method (i.e., when the customer pays for the completion of a single specific activity) d. Collection method (i.e., when cash is collected) 43. An entity is a large manufacturer of machines. A major customer has placed an order for a special machine for which it has given a deposit to the entity. The parties have agreed on a price for the machine. As per the terms of the sale agreement, it is FOB (tree on board) contract and the title passes to the buyer when goods are loaded into the ship at the port. When should the revenue be recognized by the entity? a. When the customer orders the machine. b. When the deposit is received. c. When the machine is loaded on the port. d. When the machine has been received by the customer. 44. A company manufacturing and selling consumable products has come out with an offer to refund the cost of purchase within one month of sale if the customer is not satisfied with the product. When should the company recognize the revenue? a. When goods are sold to the customers. b. After one month of sale. c. Only if goods are not returned by the customers after the period of one month. d. At the time of sale along with an offset to revenue for the refund liability for the products expected to be returned. 45. A computer chip manufacturing company sells its products to its distributors for onward sales to the ultimate customers. Due to frequent fluctuations in the market prices for these goods, the company has a “price protection” clause in the distributor agreement that entitles it to raise additional billings in case of upward price movement, Another clause in the distributor’s agreement is that the company can at any lime reduce its inventory by buying back goods at the cost at which it sold the goods to the distributors. Distributors pay for the goods within 60 days from the sale of goods to them. When should the company recognize revenue on sale of goods to the distributors? a. When the goods are sold to the distributors. b. When the distributors pay to the company the cost of the goods. c. When goods are sold to the distributors provided estimated additional revenue is also booked under the “protection clause” based on past experience, d. When the distributors sell goods to the ultimate customers and there is no uncertainty with respect to the “price protection” clause or the buyback of goods. 46. An entity manufactures and sells standard machinery. One of the conditions in the sale contract is that installation of machinery will be undertaken by the entity. During December of the current year, the entity received a special onetime contract from a customer to manufacture, install and maintain customized machinery. It is the first time the entity will be producing this kind of machinery, and it is expecting numerous changes that would need to be made to the machine after the installation is completed, which one period is described in the contract of sale as the “maintenance period.” The maintenance services are an input to a combined output specified in the contract. The total cost of making the changes during the maintenance period cannot be reasonably estimated at the time of the installation. Costs incurred are not recoverable if, during the maintenance period, the machinery is discovered as non-compliant with agreed- upon specifications and the non-compliance is beyond remediation. The customer shall signify its acceptance of the machinery at the end of the maintenance period. When should revenue from the sale of the special machine most likely be recognized? a. When the machinery is produced. b. When the machinery is produced and delivered. c. When the installation is complete d. When the maintenance period as per the contract of sale expires. 47. Revenue is recognized at the time of sale under the: a. b. c. d. cost recovery method (i.e., the outcome of a performance obligation cannot be reasonably measured but the entity expects to recover the costs incurred in satisfying the performance obligation) collection method (i.e., when cash is collected) percentage-of-completion method (i.e., the performance obligation is satisfied over time) sales method when goods are sold on credit (i.e., the performance obligation is satisfied when the goods are transferred to the customer). The next three items are based on the following information: Lake Corporation’s accounting records showed the following investments at January 1, 20x3: Ordinary shares: Kar Corp. (1,000 shares) Aub Corp. (5,000 shares) 10,000 100,000 Real estate: Parking lot (leased to Day Co.) 300,000 Other: Trademark (at Total investments cost, less accumulated amortization) 25,000 435,00 0 Lake owns 1% of Kar and 30% of Aub. The Day lease, which commenced on January 1, 20x1, is for ten years, at an annual rental of ₱48,000. In addition, on January 1, 20x1, Day paid a nonrefundable deposit of ₱50,000, as well as a security deposit of ₱8,000 to be refunded upon expiration of the lease. The trademark was licensed to Barr Co. for royalties of 10% of sales of the trademarked items. Royalties are payable semiannually on March 1 (for sales in July through December of the prior year), and on September 1 (for sales in January through June of the same year). During the year ended December 31, 20x3, Lake received cash dividends of ₱1,000 from Kar, and ₱15,000 from Aub, whose 20x3 net incomes were ₱75,000 and ₱150,000, respectively. Lake also received ₱48,000 rent from Day in 20x3 and the following royalties from Barr: 20x2 20x3 March 1 3,000 4,000 September 1 5,000 7,000 Barr estimated that sales of the trademarked items would total ₱20,000 for the last half of 20x3. 48. In Lake’s 20x3 income statement, how much should be reported for dividend revenue? a. 16,000 b. 2,400 c. 1,000 d. 150 C 1,000 – the dividend from the 1% investment. The dividend from the 30% investment is not dividend income but rather a deduction to the carrying amount of the investment in associate (significant influence is presumed to exist). 49. In Lake’s 20x3 income statement, how much should be reported for royalty revenue? a. 14,000 b. 13,000 c. 11,000 d. 9,000 D Solution: Royalty revenue for Jan. to June, 20x3 (received on Sept. 20x3) Royalty revenue for July to Dec., 20x3 (20,000 x 10%) Total royalty revenue 7,000 2,000 9,000 50. In Lake’s 20x3 income statement, how much should be reported for rental revenue? a. 43,000 b. 48,000 c. 53,000 d. 53,800 C Solution: Annual rental Amortization of nonrefundable deposit (50K ÷ 10 yrs.) Total rental revenue 48,000 5,000 53,000 Use the following information for the next two questions: DECORTICATE PEEL, Inc. is committed to a plan to sell a manufacturing facility and has initiated actions to locate a buyer. As of this date, the building has a carrying amount of ₱6,000,000, a fair value of ₱5,000,000 and estimated costs to sell of ₱200,000. At the plan commitment date, there is a backlog of uncompleted customer orders. 51. DECORTICATE, Inc. intends to sell the manufacturing facility with its operations. Any uncompleted customer orders at the sale date will be transferred to the buyer. The transfer of uncompleted customer orders at the sale date will not affect the timing of the transfer of the facility. How should DECORTICATE Co. classify the manufacturing facility? a. Included under property, plant and equipment at ₱6,000,000. b. Included under property, plant and equipment at ₱4,800,000. c. Classified as held for sale at ₱6,000,000 d. Classified as held for sale at ₱4,800,000 D (5,000,000 fair value – 200,000 costs to sell) = 4,800,000 52. DECORTICATE, Inc. intends to sell the manufacturing facility, but without its operations. The entity does not intend to transfer the facility to a buyer until after it ceases all operations of the facility and eliminates the backlog of uncompleted customer orders. How should DECORTICATE Co. classify the manufacturing facility? a. Included under property, plant and equipment at ₱6,000,000. b. Included under property, plant and equipment at ₱4,800,000. c. Classified as held for sale at ₱6,000,000 d. Classified as held for sale at ₱4,800,000 B – not available for immediate sale in its present condition; PPE at 4.8M (5M – 200K) because the manufacturing facility is impaired. 53. An entity in the power generating industry is committed to a plan to sell a disposal group that represents a significant portion of its regulated operations. The sale requires regulatory approval, which could extend the period required to complete the sale beyond one year. Actions necessary to obtain that approval cannot be initiated until after a buyer is known and a firm purchase commitment is obtained. However, a firm purchase commitment is highly probable within one year. The disposal group has a carrying amount of ₱10,000,000 and fair value less costs to sell of ₱10,600,000. How should the entity classify the disposal group? a. Held for sale, ₱10.6M c. Under previous classifications, ₱10M b. Held for sale, ₱10M d. Under previous classifications, ₱10.6M B – The exceptions to the “1-yr. requirement” are met. Use the following information for the next two questions: In 20x1, FORGETIVE CREATIVE Co. classified a property as held for sale. The carrying amount prior to classification is ₱400,000 while fair value less cost to sell is ₱360,000. The property is being sold at ₱360,000. During 20x1, the market conditions that existed at the date the asset was classified initially as held for sale deteriorate and, as a result, the asset is not sold by the end of that period. During that period, FORGETIVE actively solicited but did not receive any reasonable offers to purchase the asset and, in response, FORGETIVE reduced the price from ₱360,000 to ₱320,000. The fair value less costs to sell on December 31, 20x1 is ₱340,000. 54. How should FORGETIVE Co. classify the property in its 20x1 annual financial statements? a. Held for sale, ₱320,000 b. Held for sale, ₱340,000 c. PPE, ₱340,000 d. PPE, ₱400,000 B 340,000, the fair value less costs to sell, which is lower than the carrying amount of P360,000. 55. During 20x2, the market conditions deteriorate further, and the asset is not sold by December 31, 20x2. FORGETIVE Co. believes that the market conditions will improve and has not further reduced the price of the asset. The fair value less costs to sell on December 31, 20x2 is ₱300,000. If the property was not classified as held for sale in 20x1, its carrying amount by this time would have been ₱350,000. a. Held for sale, ₱300,000 c. PPE, ₱300,000 b. Held for sale, ₱320,000 d. PPE, ₱350,000 C – The asset is reclassified back to PPE at the lower of recoverable amount (i.e., 300,000) and the carrying amount adjusted for depreciation not recognized during the asset was classified as held for sale (i.e., 350,000). 56. WAYFARER TRAVELER Co. is preparing its December 31, 20x1, current year financial statements. A land included in WAYFARER’s property, plant and equipment that did not qualify as held for sale as of December 31, 20x1 was actually sold on January 5, 20x2. The financial statements were authorized for issue on March 1, 20x2. On December 31, 20x1, WAYFARER has total current assets of ₱9,000,000. Not included in this amount is the fair value less costs to sell of the land amounting to ₱1,000,000. How much is the total current assets current in WAYFARER’s December 31, 20x1 financial statements? a. ₱8,000,000 c. ₱10,000,000 b. ₱9,000,000 d. ₱11,000,000 B – The event is disclosed only as a non-adjusting event after the reporting period. 57. On December 31, 20x1, STRIDENT HARSH-SOUNDING Co. classified its building with a historical cost of ₱4,000,000 and accumulated depreciation of ₱2,400,000 as held for sale. All of the criteria under PFRS 5 are complied with. On that date, the land has a fair value of ₱1,400,000 and cost to sell of ₱80,000. The entry on December 31, 20x1 includes a. a debit to building for ₱1,320,000 b. a credit to accumulated depreciation for ₱2,400,000 c. a debit to impairment loss for ₱280,000 d. No reclassification entry will be made on December 31, 20x1 C Jan. 1, 20x1 Held for sale asset (1.4M – 80K) Accumulated depreciation Impairment loss 1,320,000 2,400,000 280,000 Building 4,000,000 58. On December 31, 20x1, OBSTINACY STUBBORNESS Co. classified its building with a carrying amount of ₱1,600,000 and fair value less cost to sell of ₱1,320,000 as held for sale. The building was not sold in 20x2. However, the exception to the one-year requirement was met. On December 31, 20x2, the fair value less cost to sell of building is ₱1,240,000. The building was not sold in 20x3. However, the exception to the one-year requirement was still met. On December 31, 20x3, the fair value less cost to sell of building increased to ₱1,680,000. How much is the gain on reversal of impairment to be recognized on December 31, 20x3? a. 440,000 b. 360,000 c. 280,000 d. 0 B 360,000, limited to the total impairment losses recognized in previous years (1,240,000 - 1,600,000 original carrying amount) Use the following information for the next four questions: On December 31, 20x1, INSOUCIANT CAREFREE Co. plans to dispose of a group of its assets. Information on these assets is shown below: Carrying amount on Dec. 31, Carrying amount as remeasured 20x1 before classification as immediately before classification as held for sale held for sale Inventory Investment in FVOCI Investment property (at cost model) PPE (at cost model) Goodwill 9,600,000 7,200,000 22,800,000 18,400,000 6,000,000 8,800,000 6,000,000 22,800,000 16,000,000 6,000,000 Total 64,000,000 59,600,000 INSOUCIANT Co. entity estimates that the fair value less costs to sell of the disposal group amounts to ₱52,000,000. 59. How would the reduction in the value of the assets on classification as held for sale be treated in the financial statements? a. b. c. d. The entity recognizes a loss of ₱4.4M immediately before classification as held for sale and then recognizes an impairment loss of ₱7.6M. The entity recognizes an impairment loss of ₱12 million. The entity recognizes an impairment loss of ₱7.6M. The entity recognizes a loss of ₱12M immediately before classifying the disposal group as held for sale. A Step #1: 59.6M – 64M = 4.4M Impairment loss; Step #2: 52M – 59.6M = 7.6 Additional impairment loss 60. How much is the carrying amount of the inventory after classification of the disposal group as held for sale? a. 8,800,000 b. 7,950,576 c. 7,899,324 d. 7,765,391 A 8,800,000 - Carrying amount as remeasured immediately before classification as held for sale. (See also solutions below) 61. How much is the carrying amount of the Investment property (at cost model) after classification of the disposal group as held for sale? a. 22,800,000 b. 21,859,794 c. 21,786,665 d. 20,766,298 B (Refer to solutions below) 62. How much is the carrying amount of the PPE (at cost model) after classification of the disposal group as held for sale? a. 16,000,000 b. 15,780,740 c. 15,340,206 d. 15,211,612 C Fair value less costs to sell Carrying amount as remeasured immediately before classification as held for sale Additional impairment loss on initial classification under PFRS 5 Allocation to goodwill Impairment loss to be allocated to the other assets The excess is allocated to the other assets pro rata based on their carrying amounts as follows: Allocation of Assets Carrying amt. Fraction Impairment Loss Inventory N/A N/ N/A A Investment in FVOCI N/A N/ N/A A IP – cost 22,800,000 22.8/38.8 (940,206) PPE – cost model 16,000,000 16/38.8 (659,794) 38,800,000 (1,600,000) 52,000,000 59,600,000 (7,600,000) 6,000,000 1,600,000 The carrying amount after allocation of impairment loss is: Inventory Investment in FVOCI Investment property (at cost model) (22.8M – 940,206) PPE (at cost model) (16M – 659,794) Goodwill Total 8,800,000 6,000,000 21,859,794 15,340,206 52,000,000 63. On December 31, 20x1, INGENIOUS NATURAL Co. classified its building with a carrying amount of ₱1,600,000 and fair value less costs to sell of ₱1,320,000 as held for sale. Impairment loss of ₱280,000 was recognized on that date. The building has a remaining useful life of 4 years and it was depreciated using the straight-line method. As of December 31, 20x2, the building was not yet sold and management decided not to sell the building anymore. The fair value less cost to sell of the building on December 31, 20x2 is ₱1,240,000 while the value in use is ₱1,220,000. How much is the carrying amount of the building upon reclassification back to property, plant and equipment? a. 1,220,000 b. 1,320,000 c. 1,240,000 d. 1,200,000 D a. Carrying amount adjusted for depreciation not recognized (1.6M x ¾) = 1.2M; b. Recoverable amount = 1.240M the higher of FVLCS and VIN Measurement = 1.2M - the lower of a and b above 64. On December 31, 20x1, INIMICAL UNFRIENDLY Co. entered into an agreement to sell a component. On that date, INIMICAL estimated the gain from the disposal to be made in 20x2 at ₱2,000,000 and the operating losses prior to the date of sale to be ₱1,200,000. As a result of the sale, the component’s operations and cash flows will be eliminated from the entity’s operations and the entity will not have any significant continuing post-sale involvement in the component’s operations. Accordingly, the component was classified as held for sale and discontinued operations. The component’s actual operating losses in 20x1 and 20x2 were ₱2,800,000 and ₱2,600,000, respectively, and the actual gain on disposal of the component in 20x2 was ₱1,600,000. INIMICAL’s income tax rate is 30%. Any income tax benefit is expected to be realizable. There were no other temporary differences during the year. What single, post-tax amounts should be reported for discontinued operations in INIMICAL’s comparative 20x2 and 20x1 income statements, respectively? a. (1,960,000), (700,000) b. (560,000), (1,960,000) c. (650,000), (1,950,000) d. (700,000), (1,960,000) D 20x2: (1,600,000 – 2,600,000) x 70% = (700,000) 20x1: (-2,800,000 x 70%) = (1,960,000) 65. On April 30, 20x1, ABROGATE ABOLISH Co. approved a plan to dispose of a component of its operations. The disposal meets the requirements for classification as discontinued operations. From January 1 to April 30, 20x1, the component earned operating profit of ₱400,000 and from May 1 to December 31, 20x1, the segment suffered operating losses of ₱200,000. The net assets of the component has a carrying amount of ₱32,000,000 as of April 30, 20x1. The fair value less costs to sell of the component is ₱26,000,000. Additional estimated disposal loss includes severance pay of ₱220,000 and employee relocation costs of ₱100,000, both of which are directly associated with the decision to dispose of the segment. ABROGATE’s income tax rate is 30%. Any income tax benefit is expected to be realizable. There were no other temporary differences during the year. How much is the profit (loss) from discontinued operations to be reported in ABROGATE's statement of profit or loss and other comprehensive income for the year ended December 31, 20x1? a. 4,564,000 b. 4,060,000 c. 4,340,000 d. 4,284,000 D Solution: Operating profit – January 1 to April 30, 20x1 Operating loss – May 1 to December 31, 20x1 Impairment loss (32M – 26M) Severance pay Employee relocation costs Total Multiply by: 1 minus Tax rate Loss for the period from discontinued operations 400,000 (200,000) (6,000,000) (220,000) (100,000) (6,120,000) 70% (4,284,000) 66. You are a CPA. Your client asked you for an advice regarding the items that are presented as other comprehensive income. You will tell your client to refer to which of the following standards? a. PAS 1 b. PFRS 1 c. PFRS 15 d. PAS 8 67. Non-current assets held for sale and discontinued operations are accounted for under a. b. PFRS 4. PAS 41. c. d. PFRS 5. PFRS 8. 68. When measuring the fair value of an asset or a liability, an entity refers to a. PFRS 13. b. PAS 28. c. PAS 1. d. PAS 33. 69. This standard deals with the recognition and measurement of financial instruments. a. PAS 1 b. PAS 7 c. PFRS 9 d. PFRS 5 70. As used in accounting parlance, PFRS stands for a. Philippine Accounting Standards. b. Philippine Financial Accounting Standards. c. Philippine Financial Reporting Standards. d. Palabok, Friedchicken, Rice and Sprite. e. All of the above “give thanks in all circumstances; for this is God’s will for you in Christ Jesus.” - (1 Thessalonians 5:18) - END -