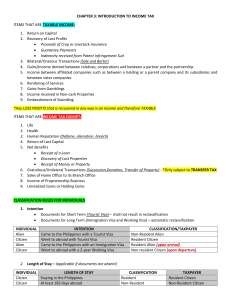

1. A feature of ordinary gains as distinguished from capital gains: a. Gains from sales of assets not stock in trade. b. May or may not be taxable in full. c. Sources are capital assets. d. No holding period. 2. The following, except one, may claim personal exemptions: a. Non-resident alien not engage in trades or business in the Philippines. b. Non-resident alien engage in trade or business in the Philippines. c. Resident alien. d. Citizen. 3. On capital gain tax on real property, which of the following statements is not true? a. The tax should be paid, if in one lump sum, within 30 days from the date of sale. b. The term “initial payment” is synonymous to “down payment”. c. The installment payment of the tax should be made within 30 days from receipt of each installment payment on the selling price. d. The tax may be paid in installment if the initial payments do not exceed 25% of the selling price.