Income Taxation for Individuals: Taxpayer Classification & Types

advertisement

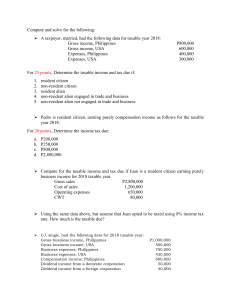

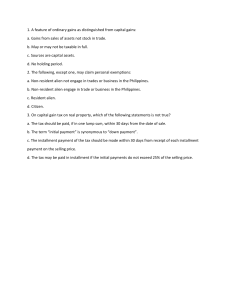

Income Taxation for Individuals Module 2 Classification of Individual Income Taxpayers Citizen – Resident – Non-resident Alien – Resident – Non-Resident • Engaged in trade or business in the Philippines. • Not engaged in trade or business in the Philippines Citizen Those who are citizens of the Philippines at the time of the adoption of the Feb. 2, 1987 Constitution. Those whose fathers or mothers are citizens of the Philippines. Those who born before January 17, 1973. Those who are naturalized in accordance with the law. Resident Citizen Is a Filipino citizen who permanently resides in the Philippines. Non-resident Citizen Physical presence abroad with a definite intention to reside therein. Who leaves the Phils. to reside abroad either as an immigrant or for employment on a permanent basis. Presence abroad for at least 183 days during the taxable year. Resident Alien An individual whose residence is within the Phils. and who is not a citizen thereof. Actually present in the Phils. and not a mere transient or sojourner. Depending on his intention with regard to the length and nature of his stay. Non-resident Alien An individual whose residence is not within the Phils. and who is not a citizen thereof. Non-resident Alien Engaged in Trade and Business – Who comes to the Philippines and stay for an aggregate period of more than 180 days Not Engaged in Trade and Business – Who comes to the Philippines and stay for an aggregate period of 180 days or less Individual Resident Citizen Non-resident Citizen Resident Alien Non-resident Alien Sources of Income Within the Phils. Without the Phils. Yes Yes Yes No Yes Yes No No Sample Situation A British computer expert was hired by a Philippine Corporation to assists in its computer system installation for which he had to stay in the Philippines for 6 months. Is he a resident alien? Sample Situation A British cultural performer was engaged to perform in the Philippines for 2 weeks after which he returned to his country. Is he a resident alien? Sample Situation A resident alien left the Philippines and abandoned his residency thereof without any intention of returning. May he still be considered a resident alien? Types of Income Taxes Final Withholding Tax on passive income derived from Philippine source Capital Gains Tax on Sale of Shares of Stock of unlisted domestic corporations Capital Gains Tax on Sale of Real Properties located in the Philippines Basic Income Tax on regular or ordinary income Final Withholding Tax (FWT) On Passive Income It is subject to a separate and final tax Applicable only to passive income from sources within the Philippines. It is a tax deducted from the income to be paid to the payee or seller. Tax Rates for Passive Income Sample Problems Identify the tax rate and compute the tax due of the following: 1. Royalties from an invention by a resident alien, P50,000. 2. Lotto winnings of a resident alien, P100 million. 3. Interest from a BPI savings deposit of a resident citizen, P75,000. Exercise 1 Identify the tax rate and compute the tax due of the following: 1. Royalties as a musical composer received by a non-resident citizen, P200,000. 2. Bingo winnings at Robinson’s Place-Manila of a NRC, P200,000. 3. PCSO winnings for P5,000. 4. Cash dividend from a domestic corporation received by a RC, P5million. 5. Interest from BDO savings deposit of a RC, P75,000. Exercise 2 Helena Dela Cruz, single and a resident citizen has the following passive income for the year 2021: Interest from BPI savings P75,000 Royalty from invention P80,000 Prize in a painting competition P50,000 Dividends received from a domestic corporation P30,000 Compute for the total final tax. Capital Gains from Sale of Shares of Stock, Not Traded trough the Local Stock Exchange Taxed at 15% of the capital gains Formula for Capital Gains (CG): Selling Price Less Cost = CG Sample Problem Ester, a resident citizen owns shares of stocks of ABC Company costing P20,000. She sold it for P80,000. Compute for the capital gains tax. Exercise 3 In 2022, Alexis, a resident citizen, holds a shares of stocks of XYZ company, a domestic corporation for P40,000. He sold all shares directly to Imee for P160,000. How much final tax must be paid? Capital Gains from Sale of Real Property Taxed at 6% final tax on the gross selling price or current fair market value at the time of the sale, whichever is higher. Sample Problem In 2021, Nicos Luna, a resident citizen, sold his residential house and lot in Singalong, Manila for P2,500,000. The cost of the house and lot three years ago when he acquired the property was P1,500,000 and the fair market value at the time of sale is P2,300,000. How much is the capital gains from sale? Basic Income Tax Individuals Earning Purely Compensation Income Shall be taxed based in the income tax rates prescribed under the graduated income tax rates. Total Compensation Income xxx Less: Mandatory Contributions/ Non-taxable benefits xxx Net Taxable Income xxx Minimum Wage Earners Shall be exempt from the payment of income tax based on their statutory minimum wage rates. The holiday pay, overtime pay, night shift differential and hazard pay received by such earner are likewise exempt. 13th Month Pay and Other Benefits Shall not exceed P90,000. The excess amount is included in the taxable income. Sample Problem 1 Mr. CSO, a minimum wage earner, works for ABC Company. He is not engaged in business nor has any other source of income other than his employment. Mr. CSO earned a total compensation income of P135,000. The taxpayer contributed to the SSS, PHIC and HDMF amounting to P5,000 and has received 13th month pay of P11,000. Compute for the tax due of Mr. CSO. Exercise 1 Employee A, above minimum wage earner, received the following: Total Basic Salary 650,000 13th month pay 50,000 SSS, PHIC and HDMF Contri. (20,000) Total Net Compensation 680,000 a. If the taxable year is 2022, how much is the tax due? b. If the taxable year is 2023, how much is the tax due Self-Employed and/or Professionals (SEP) Taxable Income (If Graduated Rates) Gross Sales/Receipts xxx Less: Cost of Sales xxx Gross Income xxx Less: Operating Expenses xxx Taxable Income xxx Taxable Income (8% tax on Gross sales/Receipts and Other Non-Operating Income Total Gross Sales/Receipts Less: Amount allowed as deduction under Sec. 24(A)(2)(b) Taxable Income xxx 250,000 xxx Sample Problem 2 Ms. EBQ operates a convenience store while she offers bookkeeping services to her clients, In 2018, her gross sales amounted to P800,000, in addition to her receipts from bookkeeping services of P300,000. She already signified her intention to be taxed at 8% income tax rate in her 1stQ income tax return. Compute for the tax due. Sample Problem 3 If Ms. EOQ failed to signify her intention to be taxed at 8% income tax on gross sales in her initial Quarterly Income Tax Return, and she incurred cost of sales and operating expenses amounting to P600,000 and P200,000 respectively. Compute for the tax due. Exercise 2 Engr. Cala offers professional consultancy services. For taxable year 2018, her records show a total gross receipts of P3,850,000, cost of services amounting to P1,900,000 and operating expenses of P800,000. Compute for Engr. Cala’s income tax liability for 2018. Exercise 3 Dr. Adrina is a medical practitioner. In 2023, her medical practice’s gross receipts amounted to P5,700,000. Her cost of services and operating expenses were P2,200,000 and P750,000. What is Dr. Adrina’s tax liability for 2023? Individuals Earning Income Both from Compensation and from SelfEmployment Sample Problem 4 Mr. MAG, a financial comptroller of JAB Company. Earned annual compensation in 2018 of P1,500,000 inclusive of 13th month pay and other benefits of P120,000. Aside from employment, he owns a convenience store, with gross sales of P2,400,000. His cost of sales and operating expenses are P1,000,000 and P600,000, respectively, and with non-operating income of P100,000. a. What is his tax due if he opted to use the 8% income tax rate? b. What is his tax due if he did opted to use the graduated income tax rate? In 2018, Mr. Boris, Sales Manager of ABC Co., earned an annual compensation of P1,380,000, inclusive of 13th month pay and other benefits of P135,000. He is also a proprietor with gross sales of P3,750,000 and non-operating income of P175,000. Cost of sales and opex of 1,250,000 and 675,000, respectively. Compute for the total tax due. Sample Problem 5 In 2018, Mr. Bonaro, Senior Manager of DEF Company, earned an annual compensation of P1,800,000, inclusive of 13th month pay and other benefits amounting to P130,000 but net of mandatory contributions to SSS, PHIC and HDMF. Aside from being employed, he is also into the business of selling travel accessories. His gross sales for the year was P2,700,000. His cost of sales and operating expenses were P1,200,000 and P700,000 respectively, while non-operating income was P250,000. Sample Problem 6 Sample Problem 7