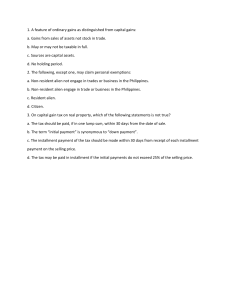

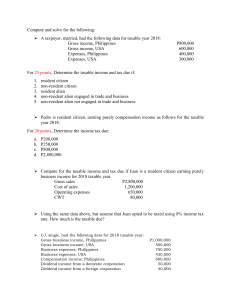

CHAPTER 3: INTRODUCTION TO INCOME TAX ITEMS THAT ARE TAXABLE INCOME: 1. Return on Capital 2. Recovery of Lost Profits Proceeds of Crop or Livestock Insurance Guarantee Payments Indemnity received from Patent Infringement Suit 3. Bilateral/Onerous Transactions (Sale and Barter) 4. Gains/Income derived between relatives, corporations and between a partner and the partnership. 5. Income between affiliated companies such as between a holding or a parent company and its subsidiaries and between sister companies 6. Rendering of Services 7. Gains from Gamblings 8. Income received in Non-cash Properties 9. Embezzlement of Swindling *Any LOSS PROFITS that is recovered in any way is an income and therefore TAXABLE ITEMS THAT ARE INCOME TAX EXEMPT: 1. 2. 3. 4. 5. 6. 7. 8. 9. Life Health Human Reputation (Defame, alienation, breach) Return of Lost Capital Not Benefits Receipt of a Loan Discovery of Lost Properties Receipt of Money or Property Gratuitous/Unilateral Transactions (Succession,Donation, Transfer of Property) - *Only subject to TRANSFER TAX Sales of Home Office to its Branch Office Income of Proprietorship Business Unrealized Gains or Holding Gains CLASSIFICATION RULES FOR INDIVIDUALS 1. Intention Documents for Short Term (Tourist Visa) – shall not result in reclassification Documents for Long Term (Immigration Visa and Working Visa) – automatic reclassification INDIVIDUAL Alien Citizen Alien Citizen INTENTION Came to the Philippines with a Tourist Visa Went to abroad with Tourist Visa Came to the Philippines with an Immigration Visa Went to abroad with a 2-year Working Visa CLASSIFICATION/TAXPAYER Non-Resident Alien Resident Citizen Resident Alien (upon arrival) Non-resident Citizen (upon departure) 2. Length of Stay – (applicable if documents are absent) INDIVIDUAL LENGTH OF STAY Citizen Staying in the Philippines Citizen At least 183 days abroad CLASSIFICATION Resident Non-Resident TAXPAYER Resident Citizen Non-Resident Citizen Alien Alien Alien More than 1 year in the Philippines as to the Resident Resident Alien end of the taxable year. Not more than 1 year but more than 180 days Non-Resident Alien Non-Resident Engaged in in the Philippines Engaged in Trade or Trade or Business (NRABusiness NETB) Not more than 180 days in the Philippines Non-Resident Alien Not Non-Resident Not Engaged Engaged in Trade or in Trade or Business (NRABusiness NETB) TAXABLE ESTATES AND TRUST 1. ESTATES Under Judicial Settlement – taxable on the income of the properties Under Extrajudicial Settlement – tax exempt entities - *only taxable to the heirs* 2. TRUST Revocably Designated – taxable to the trust Irrevocably Designated – tax exempt entities - *only taxable to the grantor/trustor* CORPOARATE INCOME TAXPAYERS Partnerships (no matter how created or organized) Joint Stock Companies Joint Associations Joint Account Insurance Companies *However, the term doe NOT included General Professional Partnerships and a Joint Venture or Consortium formed for the purpose of undertaking construction projects or engaging in petroleum, coal, geothermal and other energy operations pursuant to an operating consortium agreement under a service contract with the government* 1. Domestic Corporation – organized in accordance with Philippine Laws 2. Foreign Corporations – is one organized under a foreign law Resident Foreign Corporations (RFC) – operates in the PH Non-Resident Foreign Corporations (RFC) – does not operate in PH OTHER CORPOARATE INCOME TAXPAYERS 1. One-Person Corporation (OPC) – with a single stockholder who may be a natural person 2. Partnership General Professional Partnership (GPP) – tax exempt from corporate income - *partners are tax individually based share in income of the partnership. Business Partnership – taxable as a corporation 3. Joint Venture Joint Venture or Consortium formed for the purpose of undertaking construction projects or engaging in petroleum, coal, geothermal and other energy operations pursuant to an operating consortium agreement under a service contract with the government - – tax exempt from corporate income - *venturers are tax individually based share in income of the venture All other joint ventures - taxable as a corporation 4. Co-ownership Limited to property preservation or income collection - – tax exempt from corporate income - *co-owners are tax individually based share in income of the co-owned property* Reinvests the income of the co-owned property to other income producing properties or ventures taxable as a corporation IMPORTANT NOTE!!! *Resident Citizen and Domestic Corporation are taxable on all income within and without the Philippines* OTHER INCOME SITUS RULES A. GAIN ON SALE ON PROPERTIES 1. Personal Property Domestic Securities – presumed earned within the Philippines Other Personal Properties – earned in the place where the property is sold. 2. Real Property – earned where the property is located. B. DIVIDEND INCOME 1. Domestic Corporation -presumed earned within 2. Foreign Corporation Resident Corporation – depends on the pre-dominance test. o At least 50% - earned within o Less than 50% - earned abroad Non-Resident Corporation – earned abroad C. MERCHANDISING INCOME – earned where the property is sold D. MANUFACTURING INCOME – earned where the goods are manufactured and sold PRODUCTION DISTRIBUTION Within Within Earned within PH Without Without Earned without PH Within Without P. Income – within PH Without Within P. Income – without PH D. Income – without PH D. Income – within PH CHAPTER 4: INCOME TAX SCHEMES, ACCOUNTING PERIODS, METHODS AND REPORTING INCOME TAX SCHEMES 1. Final Income Taxation – final taxes wherein full taxes are withheld by the income payor at source; not all items of passive income are subject to final tax, only certain that is listed by the law 2. Capital Gains Tax – imposed on the gain realized on the sale, exchanged and other dispositions of certain capital assets a. Capital Asset – not used in business, trade or profession b. Ordinary Asset – used in business like inventory and PPE 3. Regular Income Tax – general rule in income taxation ACCOUNTING PERIOD 1. Calendar Year – starts from January 1 to December 31 2. Fiscal Year – any 12-month periods that ends on any day other than December 31; not allowed to individual Tax Payers IMPORTANT NOTE!!! *the return is due for filing on the 15th day of the fourth month (Ex: January 1 to Dec 31; the filing is April 15)* FILING OF INCOME TAX RETURN IN SHORT ACCOUNTING PERIOD 1. Newly Commenced Business = start of the business – designated year-end business 2. Dissolution of the Business = start of the current year – date of dissolution 3. Change of Accounting Period = start of the previous accounting period – designated year end of the new accounting period. 4. Death of the Taxpayer = start of the calendar year – death of the taxpayer; should be filed on the usual deadline April 15. 5. Termination of the Accounting Period = start of the current year – termination date; payable immediately TYPES OF ACCOUNTING METHODS 1. General Methods a. Cash Basis – income is recognized when received b. Accrual Basis – income is recognized when earned regardless of when paid 2. Installment and Deferred Payment Method 3. Percentage of Completion Method 4. Outright and Spread out Method 5. Crop Year Basis PENALTIES FOR LATE FILING OR PAYMENT OF TAX 1. Surcharge a. 25% - basic tax for failure to file or pay deficiency tax on time b. 50% - for willful neglect to file and pay taxes; when an individual receives a notice before filing 2. Interest a. January 2018 – 12% interest penalty b. During 2017 – 20% penalty IMPORTANT NOTE!!! *leap year is 366 days. A year divisible by 4 without decimal is a leap year* January - 31 February – 28 or 29 March - 31 April - 30 May - 31 June - 30 July - 31 August - 31 September - 30 October - 31 November - 30 December - 31

![-----Original Message----- From: K.Audette [ ]](http://s2.studylib.net/store/data/015587928_1-66e3b3936af11bf9c348b9a1cff2a224-300x300.png)