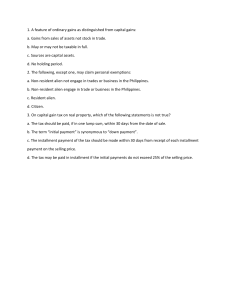

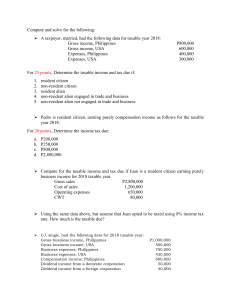

Income Taxation Reviewer (CHAPTER 2) INCOME TAXES FOR INDIVIDUALS Individual Taxpayers – natural persons with income derived from within the territorial jurisdiction of the taxing authority. Classification of Individual Taxpayer Resident Citizen (RC) Non-resident Citizen (NRC) Resident Alien (RA) Non-Resident Alien (NRA) o NRA Engaged in Trade/Business (ETB) o NRA Not Engaged in Trade/Business (NETB) Classification of Taxpayers Resident Citizen – a Filipino citizen residing within the Philippines Section I, Article III of Philippine Constitution A Filipino Citizen is a natural person who is/has: 1. Born (by birth) with father and/or mother as Filipino citizens 2. Born before January 17, 1973 of Filipino mother who elects Philippine citizenship upon reaching age of majority a. The 1973 Constitution gives different meaning of “citizens” b. The 1973 Constitution favor men over women therefore a child born by a Filipino mother and a father of different race must elect citizenship upon reaching age of majority. 3. Acquired Philippine citizenship after birth (naturalized) in accordance with Philippine Laws Non-Resident Citizens 1. Definite Intention to reside abroad 2. Leaves the Philippines during taxable year to reside abroad as: a. An Immigrant b. For employment on permanent basis c. Derives income from abroad and employment requires physical appearance abroad during taxable year 3. A Filipino citizen who shall have stayed outside the Philippine for 183 days or more aggregately. a. Meaning that the days a person stay outside the Philippines is aggregated. 4. A non-resident citizen coming back to Philippines for good at any time of the taxable year shall only be considered non-resident on the taxable year wherein his/her income is derived from abroad until his arrival on the Philippines. a. This means that non-resident lang ang isang tao dun sa part ng taxable year na kumikita pa siya sa ibang bansa. b. Example: Mr. A arrived in the Philippines on July 01, 2018 for good i. January-June 2018 – Nonresident ii. July 01, 2018 onwards – resident c. The same principle applies for those who decided to migrate abroad for good anytime of the taxable year. 5. OFW’s are considered as non-resident Resident Alien It is an individual who resides within the Philippines, but is not considered as a citizen. If an alien actually present in the Philippines are not mere “transients”, he/she is considered as a resident alien If the intention to stay of an alien in the Philippines is clear or not clear, he/she is considered a resident alien. Non-resident Alien – ETB If aggregated residence is equivalent to 180 or more days AND the intention not to stay is definite, but has an intention to earn by running a business in the Philippines, then he/she is considered as NRA-ETB. KIRA Income Taxation Reviewer (CHAPTER 2) *FIRST LOOK ON THE INTENTION TO EARN AND NOT TO STAY BEFORE LOOKING ON THE AGGREGATED STAY IN THE PHIL.* Non-Resident Alien – NETB NRA-NETB is subject to a consistent 25% tax rate to gross income from all sources within the premises of the Philippines. HAS NO INTENTION TO EARN, BUT EARNED ANYWAYS, THESE EARNINGS WILL BE SUBJECT TO 25% TAX BASED ON GROSS. CITIZENS NONRESIDENT INTENTION NOT TO STAY CLEAR TAXPAYER TAX BASE RC NRC, NRAETB NRA-NETB NET INCOME NET INCOME GROSS INCOME SOURCE OF TAXABLE INCOME Within & Without Phil. Within Philippines Only Within Phil. Only As discussed, OFW’s income from abroad are exempted to income tax, However, OFW’s income from Philippines through an existing business venture is subject to income tax in Philippines. SUMMATIVE EXAMPLE: TAXPAYER RESIDENT Sources of Income Business Income Philippines Business Income Thailand Business Expenses Philippines Business Expenses Thailand ALIENS Resident Citizen: Taxable Income = 5M+7.5M-2.1M-3.4M = 7,000,000 NONRESIDENT RESIDENT Php 5,000,000 Php 7,500,000 Php 2,100,000 Php 3,400,000 Non-resident Citizen: Taxable income = 5M-2.1M = 2,900,000 INTENTION TO STAY CLEAR/NOT CLEAR Resident Alien: Taxable income = 5M-2.1M = 2,900,000 ETB INTENTION NOT TO STAY CLEAR INTENTION TO EARN BY OWNING BUSINESS IS CLEAR NETB INTENTION NOT TO STAY CLEAR NO INTENTION TO EARN ALL UNINTENTIONAL GROSS INCOME SUBJECT TO 25% Applicable Taxes and Tax Rates Classification of Taxpayers Taxpayers classified as NRA-NETB are taxed 25% based on their gross income, while other classifications of taxpayers are taxed based on their net income. Some of these taxpayers may be taxed on their income within or outside the Philippines and some may be taxed on their income only within the Philippines Non-Resident Alien ETB Taxable income = 5M-2.1M = 2,900,000 Non-Resident Alien NETB Taxable income = 5,000,000 A Filipino citizen with duly processed papers in POEA headed Qatar last May 01, 2019 Business Income January – April Business Income May – December Business Expenses January – April Business Expenses May – December Php 400,000 Php 350,000 Php 210,000 Php 140,000 NOTE: OFW’s are considered as non-resident citizens Taxable Income: 400,000 – 210,000 = 190,000 Types of Income For purposes of income taxation there are three types of income subject to income tax. KIRA Income Taxation Reviewer (CHAPTER 2) 1. Ordinary/Regular Income – these incomes are taxed based on the graduated tax rates. Such incomes includes: compensation income, business income, income from practice of profession, income from sale of property and miscellaneous income. Further, passive income other than those that are subject to final withholding tax are also considered as ordinary income. IF PURELY SEP - 250K < Gross Receipts <3M 3M< Gross Receipts 3. Capital gains subject to CGT – these are income that arises from sale of capital assets that are subject to capital gains tax a. Capital gains from sale of shares of stocks of a domestic corporation that is not traded in local stock exchange b. Capital gains from sales of real property that is inside the Philippines. 8% in excess of 250,000 Basic tax / Graduated Tax IF MIXED INCOME EARNER - 2. Passive Income – these are income sourced within the Philippines that are subject to final withholding tax and tax rates for such income are enumerated under Section 24(B) of the Tax Code These are taxpayers that are either SelfEmployed or earning Professional Income These are taxpayers that are employed at the same time earns Professional/Business Income COMPENSATION 250K < Gross Gross Receipts + INCOME Receipt < 3M < 3M Basic Tax OR Basic Basic + 8% on Gross Tax/Graduated Tax/Graduated Receipts Tax Tax NOTE: The problem must say if the taxpayer elected the 8% option if the problem becomes silent assumed that it is based on basic tax rates. NOTE: The election of 8% must be made on the 1st Quarter otherwise income will be taxed based on graduated tax/basic tax rates EXAMPLE: GRADUATED TAX % for ORDINARY INCOME INCOME TAX% Not over 250,000 Exempt 250,000< X <400,000 20% in excess of 250,000 30,000 + 25% in excess of 400,000< X <800,000 400,000 130,000 + 30% in excess of 800,000< X <2M 800,000 2M< X <8M 490,000 + 32% in excess of 2M 2,410,000 + 35% in excess of 8M < X 8M Self-employed / Professionals (SEP) Upon the effectivity of TRAIN Law, self-employed or professionals may choose to elect that their ordinary/regular income may be taxed based on 8% of gross receipts (GROSS SALES not gross income) if their income is higher than Php 250,000 but not greater than 3,000,000 in every taxable year. Mr. A is classified as purely Self-employed taxpayer earning solely on his business. The following is the list of his quarterly gross income and expenses. QUARTERLY INCOME 1,000,000 500,000 1,000,000 800,000 3,300,000 QUARTERLY EXPENSES 320,000 125,000 350,000 375,000 1,170,000 NOTE: THE PROBLEM IS SILENT THEREFORE ASSUME THAT INCOME WILL BE BASED ON INCOME TAX TAXABLE INCOME = 3,300,000 – 1,170,000 = 2,130,000 Total Income Tax Payable = 490,000 + ((2.13M – 2M)(32%)) = 531,600 WHAT IF: Mr. A elected 8% on the 1ST Quarter of the Taxable year TAXABLE INCOME = 3,300,000 KIRA Income Taxation Reviewer (CHAPTER 2) Tax Payable = [490k + ((3.3M – 2M)(32%))] – [(1M+0.5M+1M)(8%)] = 706,000 OTHER WINNINGS REGARDLESS OF AMOUNT LOTTO WINNINGS X <= 10,000 X > 10,000 CASH/PROPERTY DIVIDENDS nd 2 Version 8%: If the given values are accumulating QUARTERLY INCOME 1,000,000 1,500,000 2,500,000 3,300,000 QUARTERLY EXPENSES 320,000 445,000 795,000 1,170,000 NOTE: THAT THE 4TH QUARTER IS THE TOTAL ALREADY 20% 25% 20% - 25% 25% 10% 20% 25% Passive income are subject to Final Withholding Tax, thus it is not included in the computation for the income tax payable of an individual. Tax Payable per quarter: 1st Quarter = 1,000,000 x 8% = 80,000 These taxes from the aforementioned passive incomes are analogous as an advance tax payment of an individual because it is the bank, publishing, PCSO or etc that would remit these taxes to BIR not the individual. 2nd Quarter = 1,500,000 x 8% = 120,000 120,000 – 80,000 = 40,000 3rd Quarter = 2,500,000 x 8% = 200,000 EXAMPLE: 200,000 – 80,000 – 40,000 = 80,000 or 200,000 – 120,000 = 80,000 4th Quarter = [490k + ((3.3M – 2M)(32%))] – 200,000 = 706,000 PASSIVE INCOME WITHIN PHILIPPINES RC & NRANRC ETB INTEREST INCOME From: Bank Deposits; any 20% 20% currency Deposit substitutes 20% 20% Trust Funds 20% 20% Depository Banks under RC = FCDU/FCDS 15% Long Term Deposits (above 5yrs) PRETERMINATED 4 yrs to less than 5yrs 5% 5% 3 yrs to less than 4yrs 12% 12% Less than 3yrs 20% 20% ROYALTIES In General 20% 20% on Books, literary works 10% 10% and compositions PRIZES More than 10,000 20% 20% Less than 10,000 - 20% NRANETB 25% 25% 25% - 25% 25% 25% 25% 25% 25% - Interest Income from personal loans Interest Income from bank deposits Interest Income from FCDU bank Interest Income from Pre-terminated Long term deposit held for 4.5 years out of 8yrs Int. Income from a 6 year Time deposit Royalty income Raffle draw winning Dividend income ABROAD PHILIPPINES 1,000 2,000 3,500 3,000 11,000 10,000 - 5,000 7,0000 9,000 9,500 5,000 2,000 10,500 9,500 10,200 NOTE: PASSIVE INCOME subject to Final Withholding are those income that only came from Philippines Interest Income from personal loans is subject to basic tax because wala naming intermediary na siya na mismo magbibigay ng income tax other than yourself. RC Passive Income Tax Payable (FWT) = (3,000 + 10,500 + 9,500)20% = 4,600 (10,000)(15%) = 1,500 (5,000)(5%) = 250 (10,200)(10%) = 1,020 TOTAL: 7,370 KIRA Income Taxation Reviewer (CHAPTER 2) NRC CAPITAL GAINS TAX (3,000 + 10,500 + 9,500)20% = 4,600 (5,000)(5%) = 250 (10,200)(10%) = 1,020 TOTAL: 5,870 ORDINARY ASSETS REAL P. 6% of Selling Price or Fair MV (whichever is higher) NRA-ETB (3,000 + 10,500 + 9,500 + 10,200)20% = 6,640 (5,000)(5%) = 250 TOTAL: 6,890 Deposit Substitutes – alternative form of obtaining funds from public, other than deposits, through the issuance, endorsements, or acceptance of debt instruments for the purpose of re-lending or purchasing receivables or other obligations or financing their own needs. BASIC TAX Requisites for Tax Exemption o The depositor is a RC, NRC, RA, NRA-ETB o Deposit must be under the name of a “natural person” o Deposits/Investments must be in the form of savings, individual trust funds, deposit substitutes, investments management accounts or other investments evidenced by certs prescribed by BSP o Deposits must be issued by a BANK o Not less than 5yrs maturity o In denominations of 10,000 and other denominations prescribed by BSP o Must be terminated or held by the depositor for not less than 5yrs o Gains from trading, foreign exchange is not covered by the exemption. Non-resident foreign corporations’ interest income from long-term deposit is subject to 30% Final Withholding Tax (FWT) READ INFORMER’S REWARD on page 85-86 Maybe exempt if sale of principal residence 6% or basic tax if it is sold to gov’t Long-term deposits – deposits or investments in the form of savings with maturity value of not less than 5 years. CAPITAL ASSETS Basic tax if situated abroad SHARES OF STOCKS 15% of Capital gain from sale of shares of stock by a closely held corporation if sales of stock that is publicly listed/traded it is not CGT but Stock Transaction Tax OTHER ASSETS BASIC TAX Basic tax is shares of a foreign corporation NOTE: The Fair MV includes the FMV given by the City/Municipal or Provincial Assessors AND the Zonal Value given by CIR If both given, whichever is higher will be used. Capital Assets vs Ordinary Assets Capital Assets – these are assets that are not intended to be sold, for a business, these assets are not used in trade or ordinary course of business. (BASTA HINDI GINAGAMIT FOR BUSINESS PURPOSES) Ordinary Assets – assets that are being used for business purposes. Tax Exemption for Sale of Principal Residence Requisites: - Proceeds must be “fully utilized” in acquiring or constructing new principal home o If not fully utilized, the unutilized part would be subject to CGTax. The formula for the taxable amount is as follows Taxable Amount = (Unutilized/Gross KIRA Income Taxation Reviewer (CHAPTER 2) - Selling Price) x (Gross Selling Price or FMValue whichever is higher) Historical Cost of the sold property will be carried over to new principal residence BIR must be duly notified for tax exemption within 30 days after sale of property Can only be availed once in every 10 years. EXAMPLE: The table below shows the summary of Mr. A’s sale of properties 1.Sale of Shares of Stock from a closely held Corporation 2.Sale from Shares of Stock from a Corporation listed on SEC 3.Sale of land used in the operations of the business abroad No. of Stocks – 1,000 Acquisition Value – 100/stock Selling Price – 130/stock No. of Stocks – 1,200 Acquisition Value – 50/stock Selling Price – 70/stock Acquired @ – 1,000,000 Selling Price – 1,650,000 Market Value – 1,500,000 Zonal Value – 1,300,000 Acquired @ – 2,000,000 Selling Price – 2,550,000 Market Value – 2,800,000 Zonal Value – 2,700,000 Acquired @ – 3,000,000 Selling Price – 3,250,000 Market Value – 3,500,000 Zonal Value – 3,300,000 4.Sale of a house located at Pasig City deemed as capital asset 5.Sales of a house deemed as ordinary asset (Meaning it is the principal residence) Additional Information: a. The proceeds from sale of principal residence were not fully utilized only 2,000,000 What is the CGT of Mr. A? 1.) [(1000 Stocks x 130) – (1000 x 100)] x 15% = 4,500 4.) (2,800,000 x 6%) = 168,000 5.) [(3,250,000-2,000,000)/3,250,000)] x 3,500,000 = 1,346,154* 1,346,154 x 6% = 80, 769 TOTAL: 253,269 Final Tax vs Creditable Tax Final Withholding Taxes – basta ito yung mga passive income within the Philippines subject to tax that are under Section 24B of the Tax Code. Hindi kasama or nileless sa income tax payable/tax due of an individual Creditable Withholding Tax – nileless sa income tax payable/tax due of an individual. Purchase/Payment Professional Fees Individual Payee - Gross income <= 3M - Gross income > 3M Non-individual Payee - Gross income <= 720k - Gross income > 720k Rentals Goods Services Income payments to beneficiaries of trusts Income payments to partners of GPP’s - Gross income <= 720k - Gross income > 720k Income made by Credit Card Companies CWT 5% 10 10% 15% 5% 1% 2% 15% 10% 15% 1% Income Tax Due of Married Taxpayers - - Income Tax shall be computed separately provided that the income exclusive earned by either of the couple If in any case an income is attributed to both, the income is divided equally between the spouses. Minimum Wage Earners (MWE) Taxpayer Purely MWE MWE w/additional benefits exceeding 90k MWE w/business income (B.I.) Income Tax EXEMPT EXEMPT CWT EXEMPT EXEMPT Wage = Exempt B.I = Basic Tax W= Ex B.I= CWT Payment Under RA 10963 (TRAIN Law), when tax due exceed 2,000 the taxpayer my elect to pay tax in 2 equal installments: (1) at the time of filing at BIR, (2) on or before October 15 of the same year. Quarterly Payments Income Tax Returns from income derived from business and/or profession are required to be filed on a quarterly basis. KIRA