Estate Tax Filing Guide for Non-Residents & Residents

advertisement

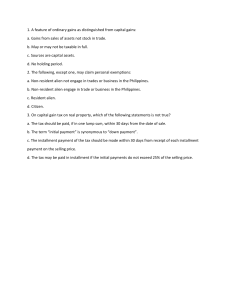

Non-resident alien AAB of RDO of the executor/ administrator Tax credit? Family home deduction? What to le? Not allowed Not allowed BIR form 1801 ( version July 2003) Allowed Allowed AAB of RDO 39- south- Quezon City (if w/ no executor or administrator) Resident citizen RDO where decedent resides Table 2 When to le? How much? When to pay? Who to pay? statutory within 1 year after death Estate tax due within 1 year after death Extension by the commissioner Not exceeding 30 days If paid after statutory date but within the extension, estate tax due plus interest but no surcharge not to exceed 5 years (if settled thru courts) Executor or administrator (if there are 2 or more executors/ administrators, all are severelly liable ) If by installment: no civil penalty and interest If by installment: not to exceed 2 years from the date of ling Tax amnesty Not later than June 14, 2023 not to exceed 2 years (if settled extra judicially) minimum of 5.000 pesos fi fi 1 fi fi where to le? Non-resident alien Resident citizen 2 Table 1 Formalities Oral or in writing If personal property exceeds 5,000 pesos the donation and acceptance must be inwriting 1